What is the role of natural resources, such as land or minerals, in economic development? Historically, the conventional wisdom has been that resource endowments are a boon. In fact, in the past many colonial wars – and some more contemporary ones – were, at least partly, fought over control of natural resources. More recently, the literature has identified some of the adverse effects of natural resources. For example, Sachs and Warner (2001) found in their cross-sectional study that the economic growth of natural-resource exporters is slower than that of other countries. Thus, the concept of the ‘resource curse’ has emerged (for a survey of early empirical evidence in this regard, see van der Ploeg 2011).

The local resource curse

The recognition that cross-country analyses may contain confounding factors has led to the recent development of a literature on the ‘local resource curse’ (Allcott and Keniston 2014, Aragon and Rud 2013, Black et al. 2005, Caselli and Michaels 2011, Papyrakis and Gerlagh 2007). This new literature tends to focus on the effect of natural resource exploitation on regional development within a country. Some of the policy implications of this literature relate to the management of natural resources. Should their exploitation be subsidised or taxed? Should it be centralised or decentralised? Should it be regulated by the government or left to market forces?

Oil prices and economic activity in Brazil

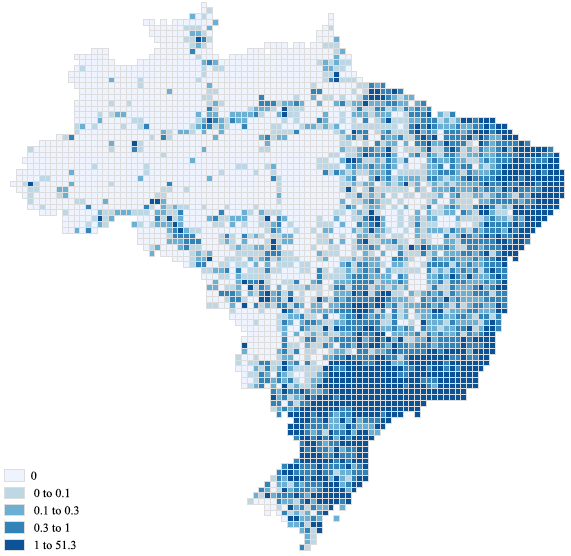

In this spirit, in a recent paper we explore the effect of oil prices on the intensity of economic activity in Brazil in recent decades (Gradstein and Klemp 2016). We exploit the fact that measures of oil access in Brazil are geographically varied, so that changes in international oil prices should have a differential effect in different locations within Brazil. For example, one measure of potential oil access is the distance between a given locality and the nearest oil field, whereby a locality is exogenously defined as a cell of a given size within Brazil. We relate a number of oil access measures, interacted with annual changes in the oil price, to annual changes in night-time light as a locality-specific measure of economic activity (see Chen and Nordhaus 2011 and Henderson et al. 2014 for evidence in favour of using this latter measure). Figure 1 illustrates the distribution of night-time light across Brazil in our sample.

Figure 1 Average luminosity per cell across Brazil’s grid (1992-2013)

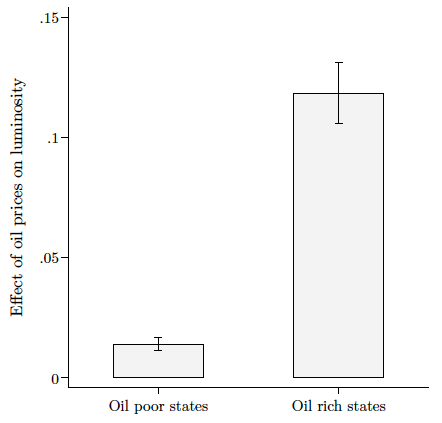

Our findings indicate that, compared to other areas, night-time light increases significantly more during periods of rising oil prices in localities with better access to oil. This is illustrated in Figure 2, which distinguishes oil price changes across oil-poor and oil-rich states in Brazil.

Figure 2 Estimated effect of an increase in oil prices on luminosity in Brazil, oil-poor versus oil-rich states, 1992-2013

Notes: The figure shows the estimated effect of an increase in oil prices of one standard deviation on the change in luminosity (in the number of standard deviations of the luminosity measure) in oil-poor versus oil-rich Brazilian states, 1992-2013. The 95% confidence intervals around the coefficient estimates are marked by the error bars.

The results hold true when controlling for a number of confounding factors. For example, our estimates indicate that a doubling of oil prices increases the luminosity measure by 50% more in oil-rich than in oil-poor states and by 30% more, on average, in localities located within 100 km of the nearest oil field relative to more remote localities. Therefore, our evidence suggests that a resource curse was not operating in the context of our study. We also find that the positive effect of oil prices on economic activity within Brazil is driven directly by oil revenue windfalls that accrue to oil-rich locations during oil booms, as well as via spillovers to adjacent locations. Taken together, these findings should help in estimating the effect of changes in international oil prices on Brazil’s economy and on its regional development.

References

Allcott, H and D Keniston (2014), “Dutch disease or agglomeration? The local economic effects of natural resource booms in modern America”, NBER Working Paper 20508.

Aragon, F and P Rud (2013), “Natural resources and local communities: Evidence from a Peruvian gold mine”, American Economic Journal: Economic Policy 5: 1-25.

Black, D, T McKinnish and S Sanders (2005), “The economic impact of the coal boom and bust”, Economic Journal 115(503): 449-476.

Caselli, F and G Michaels (2013), “Do oil windfalls improve living standards? Evidence from Brazil”, American Economic Journal: Applied Economics 5: 208-238.

Chen, X and W D Nordhaus (2011), “Using luminosity data as a proxy for economic statistics”, Proceedings of the National Academy of Sciences 108(21): 8589-94.

Gradstein, M and M P B Klemp (2016), “Can black gold shine? The effect of oil prices on nighttime light in Brazil”, CEPR discussion paper 11686.

Henderson, V, A Storeygard and D N Weil (2012), “Measuring economic growth from outer space,” American Economic Review 102(2): 994-1028.

Papyrakis, E and R Gerlagh (2007), “Resource abundance and economic growth in the United States”, European Economic Review 51 (4): 1011-1039.

Sachs, J D and A M Warner (2001), “The curse of natural resources”, European Economic Review 45(4-6): 827-838.

van der Ploeg, F (2011), “Natural resources: Curse or blessing?”, Journal of Economic Literature 49: 366-420.