‘Mafia’-type criminality represents, much to the country’s dismay, an Italian symbol. Italy is often identified as a country with pervasive organised crime. From its places of origin – Sicily, Campania, Calabria, and Apulia – mafia-type activities have spread to many other parts of the country (Buonanno and Pazzona 2014). But how does organised criminality affect the performance of firms? To what extent does it undermine the productivity of Italian firms?

Organised criminality and productivity in Italy

A widespread presence of criminality in considered to weaken the performance of individual firms. Criminal organisations reduce the level of legality and security in the places where they operate (La Spina and Lo Forte 2006), undermining both the socioeconomic environment and local firms' performance. Organised crime makes the business environment less secure and dynamic, and increases uncertainty, reducing trust and reciprocity among agents. Criminal organisations function in the market through controlled ‘illicit’ firms, altering competition and market rules. Overall, organised crime acts as a tax on the local economic system (Detotto and Otranto 2010) – it increases the costs and reduces the returns of economic activity, damaging firms' efficiency (Albanese and Marinelli 2013).

There is no shortage of research focusing on how organised crime affects the overall economic performance of Italian firms. Research has focused on issues such as local institutional quality (Lasagni et al. 2015), financial development (Moretti 2014), the presence of innovative milieu (Belussi et al. 2010), or industrial agglomeration (Cainelli et al. 2016). Most of this literature points towards the idea that, as firms interact with local actors (e.g. neighbouring firms, banks, local institutions, research centres), their capacity to get and assimilate knowledge, their competitiveness, and their economic performance are positively or negatively affected by the socioeconomic context in which they are located. Firms operating in different environments are likely to gain from both tangible (e.g. local availability of inputs and intermediate goods, reduction of transportation costs) and intangible (e.g. the reduction of transaction costs favoured by repeated interactions and increasing trust among local actors) agglomeration externalities that lessen the costs of the economic activity, thus fostering their efficiency and growth (Baldwin et al. 2010, Martin et al. 2011).

Yet the extent to which mafia-type criminality damages the productivity of Italian firms, and especially of small and medium-sized firms, has attracted less attention. This is the question we address in our recent work (Ganau and Rodríguez-Pose 2017), examining how the benefits derived from agglomeration and industrial clustering are erased by the presence of organised crime in local areas.

Organised crime’s biggest losers

Who loses most from organised crime? To answer this question the empirical analysis covers a total of 26,812 SMEs (up to 250 employees) scattered across 103 Italian provinces during the period 2009-13. The analysis is conducted using an Instrumental Variables (IV), two-stage least squares (TSLS) estimator.

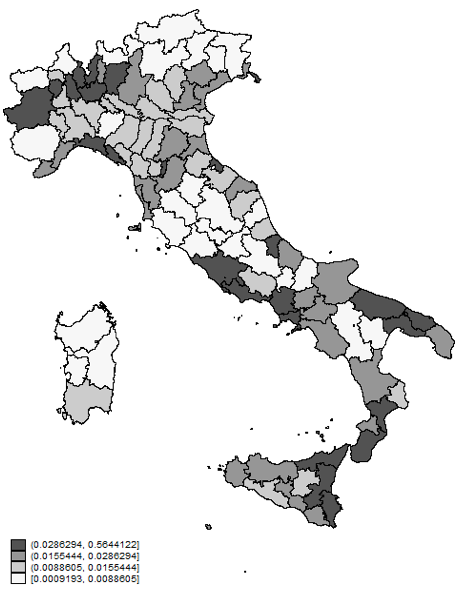

The results of the analysis first reveal that the geography of organised crime in Italy is more variegated than that suggested by the stereotypical dichotomy of a mafia-ravaged south of the country versus a much cleaner north. As Figure 1 – which displays the quartile map of organised crime by province in Italy – indicates, the panorama is much more complex. While there is, as expected, a concentration of reported organised crime in the south of Italy (the Mezzogiorno) – and particularly in the regions of Apulia, Calabria, Campania, and Sicily – many parts of the centre and the north of the country suffer from the same phenomenon as well. Mafia-type activities are widespread in some northern and central Italian provinces (such as Milan, Prato, Rome, Trieste, Varese, Rimini or Biella), whereas certain parts of the Mezzogiorno (such as Sardinia) are relatively free of organised crime.

Figure 1. Spatial distribution of organised crime in Italy by province

Notes: Quartile distribution of organised crime (number of reported mafia-type crimes per square kilometre).

Second, the results show that the presence of organised crime in any given Italian province has a negative (direct) effect on firm-level productivity growth. But this negative effect is enhanced through a number of indirect channels – mafia-type associations, extortions, and murders create local conditions that undermine the positive effect of industrial clustering on productivity growth. Moreover, the negative moderation effect is far stronger for smaller than for larger firms. The positive impact of industrial clustering and agglomeration externalities decreases, as the level of organised crime at the local level increases, to the extent that it becomes negative in those areas with both particularly high levels of criminality and a strong presence of small firms.

The mechanism through which organised criminality undermines the productivity of Italian firms is twofold. On the one hand, criminal organisations gain from the direct economic control of specific forms of production and, therefore, influence their dynamics. On the other hand, the presence of criminal organisations reduces confidence, trust, and reciprocity among individuals and firms, increasing transaction costs and contributing to making the local business environment less competitive. This produces negative externalities on local market-based relationships among firms – market transactions become more expensive, in particular if the criminal organisation imposes (as is normally the case) protection rackets and other illegal payments on local firms. Hence, high levels of organised crime destabilise traditional cluster-like competition and cooperation relationships among firms located in a given place. Smaller firms and businesses are the greatest victims. These aspects contribute to determine the negative (indirect) effect that can be ascribed to the presence of criminal organisations. They influence firms' performance, by increasing the costs of the economic activity, as well as altering the mechanisms that determine the positive effect of industrial agglomeration on firm-level growth.

These results further underline the importance of the local context on firm-level performance, beyond the traditional firm-specific characteristics (Fitjar and Rodríguez-Pose 2015). In particular, they highlight the relevance of accounting for different dimensions of the local environment where firms operate, as well as how these local-level factors interact with one another in order to determine the economic behaviour of firms. The presence of organised criminal activity in the local context alters the way in which firms behave, innovate, perform, and benefit from spatial agglomeration. Organised crime thus represents an important bottleneck for firms to prosper, and tackling it would be a significant boost to productivity, and consequently, to the economic dynamism of many firms, cities, and territories in Italy and, possibly, in the rest of the world.

References

Albanese, G, and G Marinelli (2013), “Organized crime and productivity: Evidence from firm-level data”, Rivista Italiana degli Economisti, 18, 367−394.

Baldwin, J R, W M Brown, and D L Rigby (2010), “Agglomeration economies: Microdata panel estimates from Canadian manufacturing”, Journal of Regional Science, 50, 915−934.

Belussi, F, A Sammarra, and S R Sedita (2010), “Learning at the boundaries in an "Open Regional Innovation System": A focus on firms' innovation strategies in the Emilia Romagna life science industry”, Research Policy, 39, 710−721.

Buonanno, P, D Montolio, and P Vanin (2009), “Does social capital reduce crime?”, Journal of Law and Economics, 52, 145−170.

Cainelli, G, R Ganau, and D Iacobucci (2016), “Do geographic concentration and vertically-related variety foster firm productivity? Micro-evidence from Italy”, Growth and Change, 47, 197−217.

Detotto, C, and E Otranto (2010), “Does crime affect economic growth?”, Kyklos, 63, 330−345.

Fitjar, R D, and A Rodríguez-Pose (2015), “Networking, context and firm-level innovation: Cooperation through the regional filter in Norway”, Geoforum, 63, 25−35.

Ganau, R and A Rodríguez-Pose (2017), “Industrial clusters, organized crime and productivity growth in Italian SMEs”, Journal of Regional Science, forthcoming.

La Spina, A, and G Lo Forte (2006), “I costi dell'illegalità”, Rivista Economica del Mezzogiorno, 3−4, 509−570.

Lasagni, A, A Nifo, and G Vecchione (2015), “Firm productivity and institutional quality: Evidence from Italian industry”, Journal of Regional Science, 55, 774−800.

Martin, P, T Mayer, and F Mayneris (2011), “Spatial concentration and plant-level productivity in France”, Journal of Urban Economics, 69, 182−195.

Moretti, L (2014), “Local financial development, socio-institutional environment, and firm productivity: Evidence from Italy”, European Journal of Political Economy, 35, 38−51.