What does GDP really mean? Is it a measure of material welfare or simply a measure of output? A recent wave of critical publications (Coyle 2014, Masood 2016, Philipsen 2015, among others) reject any pretence that GDP captures anything other than production, which it captures incompletely. They have heightened scrutiny that goes back to the inception of national accounts (Engerman 1997, Nordhaus and Tobin 1972).

This is not a new claim. Economists have long viewed GDP as a crude measure of economic progress and an even poorer measure of welfare (Beckerman 1968, Syrquin 2016).

Those who claim that GDP is a flawed measure of economic welfare nevertheless accept that GDP per capita is highly correlated with non-monetary dimensions of well-being (Oulton 2012, Jones and Klenow 2016).

Can we, then, rely on historical estimates of GDP to assess output and material welfare in the long run? In the early days of modern economic quantification, Kuznets (1952: 16-17), noticed the “tendency to shrink from long-term estimates” on the grounds of “the increasing inadequacy of the data as one goes back in time and to the increasing discontinuity in social and economic conditions”. Cautious historians recommend we restrict the use of GDP to societies that had efficient recording mechanisms, relatively centralised economic activities, and a small subsistence sector (Hudson 2016, Deng and O’Brien 2016). But should the adequacy of data be “judged in terms of the uses of the results” (Kuznets, 1952: 17)?

A new dataset

In this context, I present a new set of historical national accounts for Spain, with GDP estimates from the demand and supply side, to investigate its modern economic growth (Prados de la Escosura 2016b).

I have reconstructed historical output and expenditure series for the century prior to the introduction of modern national accounts. The new series are built from painstaking research using highly disaggregated data.

Available national accounts have been spliced through interpolation, as an alternative to conventional retropolation, to derive new continuous series for 1958-2015 (Prados de la Escosura 2014 and 2016a). The series for the ‘pre-statistical era’ have been linked to the spliced national accounts, providing yearly series for GDP and its components from 1850 until 2015. Finally, based on new population and labour force estimates, I calculated GDP per capita and labour productivity. You can access the dataset at http://espacioinvestiga.org/bbdd-chne/?lang=en)

What do the data show?

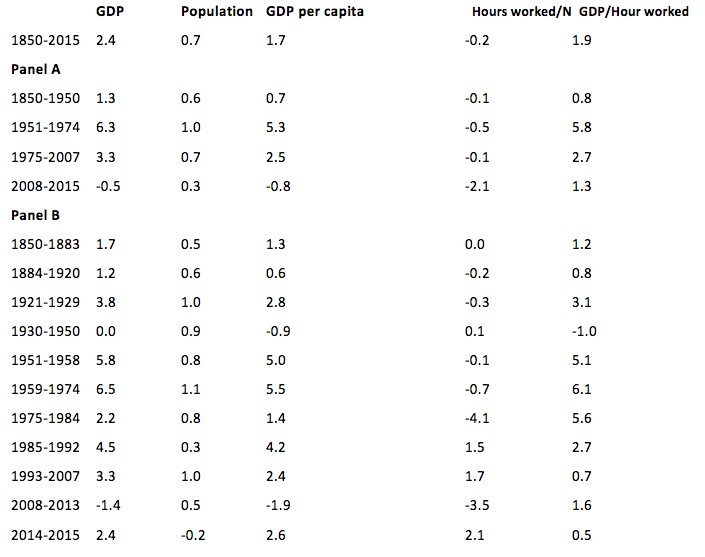

Aggregate economic activity multiplied 50 times between 1850 and 2015, at an average cumulative growth rate of 2.4% per year (Table 1). This happened in four main phases: 1850-1950 (with a shift to a lower level during the Civil War, 1936-1939), 1951-1974, 1975-2007, and 2008-2015, in which the growth trend varied significantly (Figure 1).

Table 1. GDP Growth and its Components, 1850-2015 (%) (average yearly logarithmic rates)

Source: Prados de la Escosura (2016b)

But to what extent did more goods and services affect the living conditions of individuals? Since population trebled, real GDP per capita experienced nearly a 16-fold increase, growing at an annual rate of 1.7%. This improvement took place at an uneven pace. Per-capita GDP grew at 0.7% between 1850 and 1950, doubling its initial level. During the next quarter of a century, the ‘Golden Age’, growth was seven times as fast, so by 1974 income per capita was 3.6 times higher than in 1950. Although economic progress slowed down from 1975 onwards, and the rate of GDP per capita growth shrank to one-half that of the Golden Age, the level of GDP per capita more than doubled between 1974 and 2007. The Great Recession (2008-13) shrank per capita income by 11% but, by 2015, its level was still 83% higher than at the time of Spain’s EU accession (1985).

Figure 1. Real GDP and GDP per Head, 1850-2015 (2010=100) (logs).

Source: Prados de la Escosura (2016b)

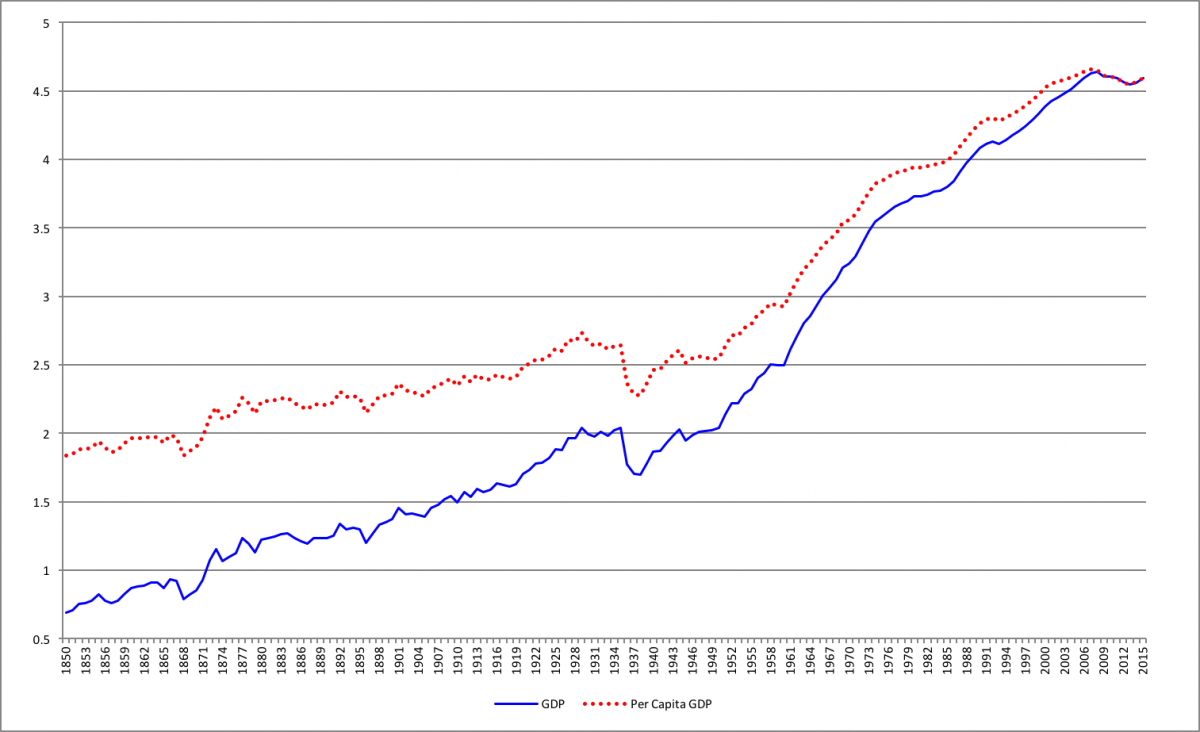

What created such a remarkable rise? GDP per capita depends on the amount of work per capita, and how productive this effort is. GDP per capita and labour productivity (measured as GDP per hour worked) evolved together over 1850-2015. Although the amount of hours worked per capita shrank, labour productivity grew at a faster pace –it increased 23-fold against 16-fold for GDP per capita (Figure 2). The decline in hours worked per capita was driven by a reduction in hours worked per fully occupied worker, which fell from 2,800 hours per year in mid-19th century to less than 1,900 in the early 21st century. So long-run gains in output per capita are entirely attributable to productivity gains, with phases of accelerating GDP per capita, such as the 1920s or the Golden Age (1950-1974), matching those of faster labour productivity growth.

Figure 2. Per Capita GDP and its Components, 1850-2015 (2010=100) (logs).

Source: Prados de la Escosura (2016b)

A closer look at the last four decades reveals significant discrepancies, with phases of acceleration in labour productivity at the same time as GDP per capita slowdown, and vice versa (Table 1, Panel B). Thus, periods of sluggish (1975-84) or negative (2008-13) GDP per capita growth paralleled episodes of vigorous or recovering productivity growth, although in the first case, the ‘transition to democracy’ decade, labour productivity offset the sharp contraction in hours worked – largely resulting from unemployment – and prevented a decline in GDP per capita. Conversely, in the years between Spain’s accession to the European Union (1985) and the Great Recession (2007), there were substantial GDP per capita gains while labour productivity slowed down. Thus, during the three decades after Spain’s accession to the EU, in which grew at 3 per cent per year, doubling its GDP per capita, the increase in hours worked per capita contributed more than half of it. It can, then, be concluded that since the mid-1970s the Spanish economy has been unable to combine employment creation and productivity growth, with the implication that sectors that expanded and created jobs (mostly construction and services) were less successful in attracting investment and technological innovation.

Falling behind, catching up … and falling back again?

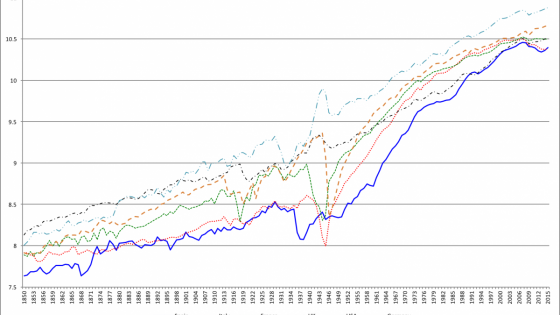

Spanish long-run growth has been like that of western nations, though Spain’s level of GDP per capita appears systematically lower (Figure 3).

Figure 3. Spain’s Comparative Real Per Capita GDP (2011 EKS $) (logs)

Source: Prados de la Escosura (2016b)

The pace of growth before 1950 was comparatively slow in Spain. Sluggish performance over 1883-1913, followed by a failure take advantage of its neutrality in World War I to catch up, partly account for it. Furthermore, the progress achieved in the 1920s was outweighed by Spain’s short-lived recovery from the Depression, which was brought to a halt by Civil War (1936-39), and by a longer and weaker post-war reconstruction than in other western European countries after 1945. Thus, Spain fell behind between 1850 and 1950.

The situation improved between 1950 and 2007. The Golden Age, especially since 1960, stands out as a period of outstanding performance and catch-up to the advanced nations. Steady, although slower, growth after the transition to democracy years (1975-84), allowed Spain to keep catching up until 2007. The Great Recession reversed the trend, although it is too soon to determine whether we are in a new phase of falling behind.

So Spain’s relative position to western countries has evolved along a wide-U shape, deteriorating to 1950 (except for the 1870s and 1920s) and recovering thereafter (except for the episodes of the transition to democracy and the Great Recession). Thus, at the beginning of the 21st century Spanish real GDP per capita represented a proportion of US and Germany’s income similar to what it was in the mid-19th century, and to that of the 1870s with regard to France and Italy, although it had significantly improved with respect to the UK.

But does GDP per capita capture welfare?

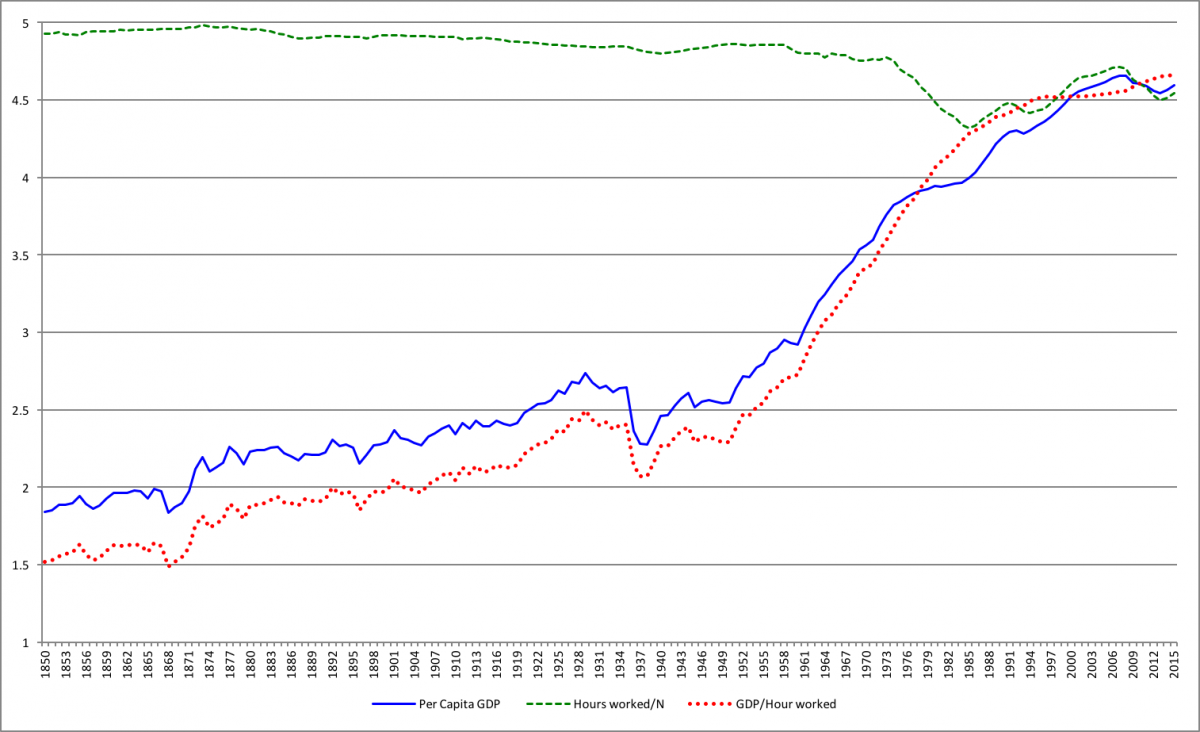

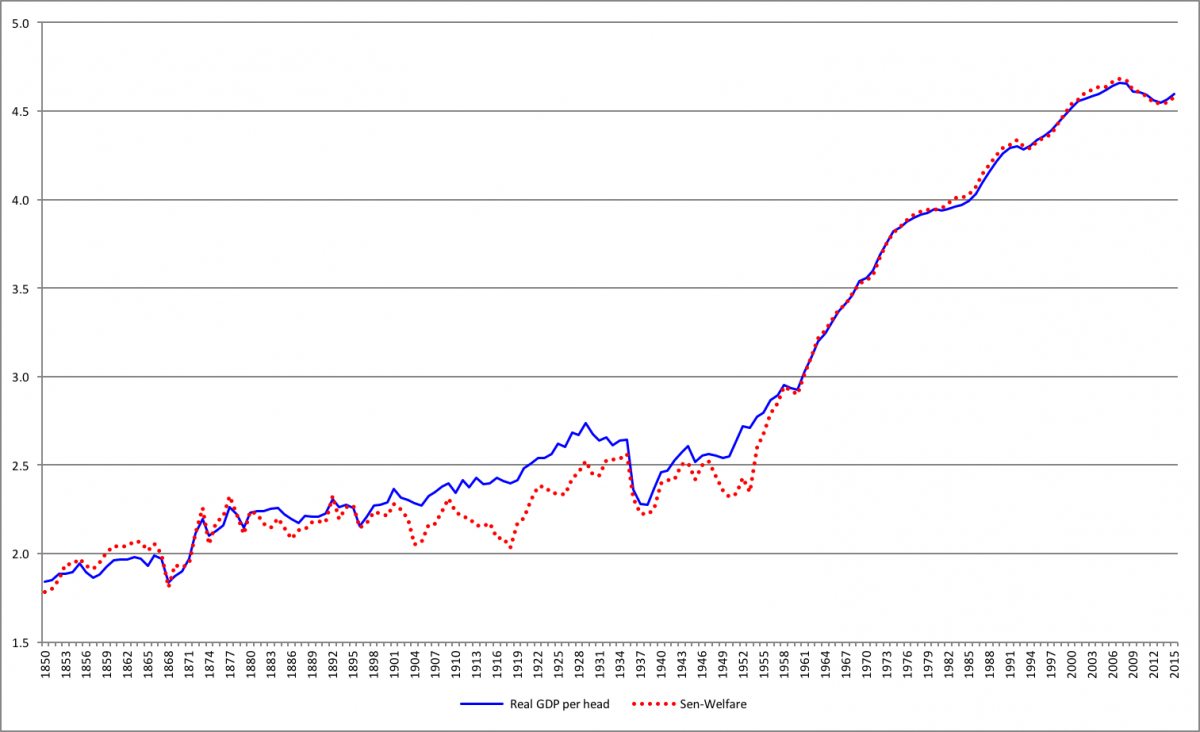

A major objection to GDP per capita is that it takes no account of income distribution. Figure 4 compares GDP per capita with the Sen welfare measure, namely, inequality-adjusted income per capita (GDP per capita, multiplied by 1 minus the Gini). Except for the early 20th century – especially the 1910s and 1920s and in the late 1940s and early mid-1950s, when the Sen welfare level fell behind GDP per capita – both measures exhibit similar long-run performance.

Figure 4. Real Per Capita GDP and Sen Welfare, 1850-2015 (2010=100) (logs)

Source: Prados de la Escosura (2017)

Another objection to GDP per capita is that it fails to incorporate non-income dimensions of well-being. Critics of GDP as a measure of welfare claim the Human Development Index as a better alternative (Coyle 2014). Similar long-run trends are observed in GDP per capita and Human Development (Figure 5), although improvements in the Historical Index of Human Development were more intense between 1880 and 1950 and slower thereafter. There is a large discrepancy between the two measures in the 1930s and 1940s, when human development thrived, driven by life expectancy gains – a result of the epidemiological transition and broadening primary education, while GDP per capita contracted as consequence of the Depression and the Civil War, and its autarchic aftermath.

Figure 5. Real Per Capita GDP (2010=100) (logs) and Historical Index of Human Development (excluding income dimension) (multiplied by 1000 and transformed into logs), 1850-2007

Source: Prados de la Escosura (2015, 2016b).

We can conclude on this evidence that that GDP per capita captures long-run trends in welfare in Spain, but not the short and medium run trends.

References

Beckerman, W. (1968), An Introduction to National Income Analysis, London: Weidenfeld and Nicolson.

Coyle, D. (2014), GDP: A Brief But Affectionate History, Princeton: Princeton University Press.

Deng, K. and P. O’Brien (2016), “China’s GDP Per Capita from the Han Dynasty to Communist Times”, World Economics 17, 2: 79-123.

Engerman, S.L. (1997). “The Standard of Living Debate in International Perspective: Measure and Indicators”, in R.H. Steckel and R. Floud (eds.), Health and Welfare during Industrialization, University of Chicago Press/NBER, pp. 17-45.

Hudson, P. (2016), GDP per capita: from measurement tool to ideological construct, LSE Business Review (10 May 2016).

Jones, C.I. and P.J. Klenow (2016), “Beyond GDP? Welfare across Countries and Time”, American Economic Review 106, 9: 2426-2457.

Kuznets, S. (1952), Income and Wealth of the United States. Trade and Structure, Income and Wealth Series II, Cambridge: Bowes and Bowes.

Masood, E. (2016), The Great Invention: The Story of GDP and the Making (and Unmaking) of the Modern World, Pegasus.

Nordhaus, W., and J. Tobin (1972), “Is Growth Obsolete?”, in National Bureau of Economic Research, Economic Growth: Fiftieth Anniversary Colloquium V, New York: Columbia University Press, pp. 1–80

Oulton, N. (2012), Hooray for GDP!, Centre for Economic Performance Occasional Paper 30 (August).

Prados de la Escosura, L. (2017), Spanish Economic Growth, 1850-2015, London: Palgrave-Macmillan.

Prados de la Escosura (2016a), “Mismeasuring Long Run Growth. The Bias from Spliced National Accounts: The Case of Spain”, Cliometrica 10, 3: 251-275

Prados de la Escosura, L. (2016b), Spain’s Historical National Accounts: Expenditure and Output, 1850-2015, CEPR Discussion Paper 11524. The dataset can be accessed at http://espacioinvestiga.org/bbdd-chne/?lang=en

Prados de la Escosura, L. (2015), “World Human Development, 1870-2007”, Review of Income and Wealth 61, 2: 220-247

Prados de la Escosura, L. (2014), Mismeasuring long-run growth: The bias from spliced national accounts, VoxEU.org (27 September).

Philipsen, D. (2015), The Little Big Number: How GDP Came to Rule the World and What to Do about It, Princeton: Princeton University Press.

Syrquin, M. (2016), “A Review Essay on GDP: A Brief but Affectionate History by Diane Coyle”, Journal of Economic Literature 254, 2: 573–588.