Natural disasters have long-lasting consequences (Noy 2012). Two and a half years have passed since the Great East Japan Earthquake, and although many issues have yet to be resolved – including that of the evacuees – many lessons concerning economic activities have been learned from the unexpected disaster. Companies’ resilience was tested, and the introduction of business continuity management was accelerated. Supply chains have also been overhauled to surmount companies’ vulnerability.

It is important to understand the essence of companies’ vulnerability by carrying out an assessment of the Great East Japan Earthquake in preparation for future major earthquakes and other unanticipated disasters. Accordingly, I have analysed the process in which the damage suffered by companies within the affected areas spilled over to those outside of the affected areas via supply chains, as well as the ways in which these companies responded.

Linkages of companies outside of the affected areas

Even outside of the affected areas, companies reported suffering considerable damage via their supply chains as a consequence of the Great East Japan Earthquake. Vigorous research has been conducted on the damage to the companies, and numerous research findings also have been produced through projects at the Research Institute of Economy, Trade and Industry.

In the course of researching supply chains and the damage to the companies, it has been found that many companies outside of the affected areas are connected via indirect business relationships with those within the affected areas (Saito 2012). The number of companies connected to those in the affected areas depends on the network structure and geographical proximity of the supply chain. Small world structures were found in supply-chain networks, which suggests a large number of connected companies (see Albert and Barabási 2002 and Ohnishi et al. 2010).

Although half of these relations occur within just 40km (Nakajima et al. 2012), and only 3% of companies have direct transaction partners in the affected areas, this figure rises to 50%-60% when indirect transaction partners (partners of partners) are included. In spite of the localisation of direct transactions, hub companies play an important role in the geographical spread of transaction networks (Saito 2013).

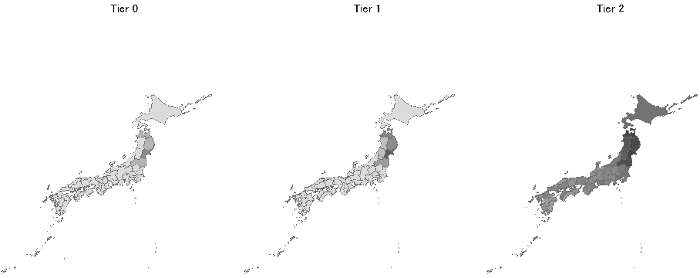

Figure 1 below shows prefectural data on the percentages of companies in the affected areas (Tier0), the transaction partners of companies in the affected areas (Tier1), and the transaction partners’ partners of companies in the affected areas (Tier2), which enables us to visualise the geographical spread of these transactions.

Figure 1. Companies affected by the Great East Japan Earthquake

Size of the spillover effects from companies in the affected areas

How did the spillover effects spread to companies outside of the affected areas via supply chains? Here, I will introduce the new research findings of the project at the Research Institute of Economy, Trade and Industry by Carvalho et al. (2013). Data taken from a database created by Tokyo Shoko Research on approximately one million companies were used to understand the inter-firm transactions. The same data were used in the aforementioned research as well, but this project used new data from before and after the earthquake to analyse changes in corporate performance and transactions.

First, companies in the affected areas were defined as those companies in the flooded areas. On the basis of this definition, it was confirmed that there was a statistically significant increase in the probability of exit and a lower growth rate of sales among companies in the affected areas.1 It should be noted, however, that there were tremendous differences in the degrees of damage suffered by companies in the affected areas, with some even enjoying considerable growth – perhaps as a result of reconstruction assistance. As such, we focused on the hardest-hit companies (i.e. those that exited).

Next, we focused on transactions with the aforementioned companies in the affected areas. We examined the relationship between these transactions and the sales growth rate after the disaster for the companies outside the affected areas.2 It was confirmed that the spillover effect was not significant but was negative in companies whose suppliers are located in the affected areas, and it was significantly negative in companies whose customers are located in the affected areas. It was found that the effect of reductions in sales tends to spill over from customers.

On the other hand, a significant spillover effect from both suppliers and customers was confirmed with those exiting companies which suffered major damage. More interestingly, the spillover effect from exiting companies was larger from suppliers than from customers, and a significant spillover effect from suppliers was confirmed not only on direct transaction partners but also on indirect partners (partners’ partners and partners’ partners’ partners).

Coping with the spillover effects from companies in the affected areas

How did companies outside of the affected areas cope with the spillover effects from companies in the affected areas? We focused on their building of new transaction partners. First, if the company outside of the affected areas had business partners – either suppliers or customers – in the affected areas, it was confirmed that there was a significant increase in the probability of building new business partners. Thus, new business transactions have been flexibly established to substitute for damaged transactions. However, if the company outside of the affected areas had transactions with exiting companies in the affected areas, no significant change in the probability of building new business partners was found. It appears that these companies were unable to establish flexibly new business partners, which in turn led to lower sales.

The results from the above analysis imply that companies can cope with relatively small shocks by flexibly building new business partners and adjusting inventory, but that they are unable to deal flexibly with major shocks and thus face potential spillover effects even down to their business partners’ partners.3 A localised shock can thus have a macro-level impact.

Given the vulnerability of company supply chains, these results suggest that prioritising reconstruction assistance after major disasters toward companies experiencing major shocks would be preferable to uniform across-the-board assistance. In preparing for the mega-quake forecast for the Tokyo Metropolitan Area or a large-scale volcanic eruption, insurance systems, disaster recovery legislation, and other measures capable of addressing major shocks should be considered based on the empirical evidence.

References

Albert, R, and A-L Barabási (2002), “Statistical mechanics of complex networks”, Reviews of Modern Physics, 74: 47–97.

Ohnishi, T, H Takayasu, and M Takayasu (2010), “Network Motifs in an Inter-firm Network”, Journal of Economic Interaction and Coordination, 5(2): 171–180.

Carvalho, V, M Nirei and Y-U Saito (2013), “Supply Chain Disruptions: Evidence from the Great East Japan Earthquake”, mimeo.

Nakajima, K, Y-U Saito and I Uesugi (2012), "The Localization of Interfirm Transaction Relationships and Industry Agglomeration", RIETI Discussion Paper Series, 12-E-023, April.

Noy, Ilan (2012), “The enduring economic aftermath of natural catastrophes”, VoxEU.org, 5 September.

Saito, Y-U (2013) , “Role of Hub Firms in Geographical Transaction Network”, RIETI Discussion Paper 13-E-080 , September.

Saito, Y-U (2012), “The Impact of the Great East Japan Earthquake on Companies in the Non-affected Areas: Structure of the inter-company network of supply chains and its implication”, RIETI Discussion Paper 12-J-020, June.

1 These estimates control for pre-disaster sales growth rates and the number of business relationships. The subsequent regression analysis, too, controls for these same two variables.

2 In order to observe the differences before and after the disaster, this analysis was limited to companies that posted financial results in December 2010 prior to the disaster and in December 2011 after the disaster. To factor out the direct damage, companies in Aomori, Iwate, Miyagi, and Fukushima prefectures were excluded in the regressions.

3 This research did not analyse inventory fluctuations, but such an analysis can and will be performed in the future using the data from the basic survey of corporate activities.