Despite a public rhetoric about taxation that can be shockingly simplistic – good versus bad! – the relationship between taxation and economic growth is very complex. A short list of important factors includes disincentives of taxation for effort; the provision of education, infrastructure, and other public goods; redistribution effects and financing constraints; and so on. Moreover, the impact of taxation certainly depends on the quality of the hands that handle it – the benevolent dictator of our economic models, or the real life Robert Mugabe. This moderating role of government efficiency and corruption can help explain why the efficient governments of Scandinavia are prosperous despite top marginal income tax rates of 60% to 70% (Kleven 2014).

We explore how the relationship between taxation and growth is governed by levels of corruption. We construct an endogenous growth model that builds upon Klette and Kortum (2004). These growth models have realistic firm dynamics and have been applied to many policy settings, and yet the relationship between taxation, corruption, and growth has yet to be systematically examined. On the other hand, much of the public finance literature takes growth rates as predetermined for optimal tax models. We model that the innovation production function for entrants and incumbents depends on infrastructure quality, which is provided by the government through taxation. Tax revenues can support the accumulation of public goods to the extent that governments can effectively use this source of revenue.

For a given level of government efficiency, our model predicts an inverted U-shape relationship for taxation and growth, which arises from the competing effects of disincentives for effort with the positive provision of public infrastructure. Higher corruption dampens the positive growth effects of taxes by taking away available resources that could have been utilised for growth-enhancing infrastructure, but leaving in place the disincentives. Our work characterises the marginal effects implied by the model through a state-level analysis of the US taxation-corruption distribution. A calibrated version of the model also affords a micro-founded assessment of optimal taxation levels given these trade-offs. We hope this framework is useful to other researchers approaching this important policy choice.

Empirical analysis

We build a 25-year panel to test our model. We consider state- and county-level variation in growth from the Longitudinal Business Database (LBD) of the US Census Bureau alongside data on tax revenues and state-wide corruption instances, measured through federal convictions of public officials. The panel nature of our data allows us to better isolate our taxation and corruption interests from other potentially endogenous characteristics. We complement our model’s growth in GDP per worker with additional metrics, including economic growth in GDP, workers, and establishment counts and drivers related to growth like firm entry and exit, patenting, etc.

We measure how changes in corruption and taxation levels in a given state affect economic growth outcomes. A key focal point is the negative interaction between taxation and corruption, for which we find our strongest evidence in our empirical work. The marginal effect of taxation on growth for a state at the 10th or 25th percentile of corruption is quite positive and robust, and its economic and statistical importance only begins to taper at the upper end of US tax ranges, if at all. By contrast, the marginal growth effects of taxation for a state at the 90th percentile of corruption are much lower across the board, and its values are rarely statistically distinguishable from zero except at the very lowest initial taxation levels. Even within the limited range of US state income taxes, we see evidence for negative growth effects of increased taxes for states with very high levels of corruption and taxes. By contrast, we find it more difficult to establish direct effects of corruption on growth beyond this link with taxes in the US context, which coincides with mixed results found in the literature (Glaeser and Saks 2006).

We make progress towards establishing causal relationships in several ways (e.g. pseudo Granger tests). Most important, we draw on the ‘border effects’ techniques from Holmes (1998) and Rohlin et al. (2010) to test whether these effects hold for periphery counties in states. The core idea can be visualised in the Florida panhandle, where northern counties in Florida are substantially influenced by the functioning of bordering counties in Alabama and Georgia, compared to what happens near Miami. Our identifying assumption is that the corruption levels in neighbouring state capitals are being made without strong reference to these border counties, but that they can still matter (e.g. due to misappropriation of highway funds that impact roads throughout the state). In practice, a ring is drawn around a given county to create a 100-mile localised estimate of taxation and corruption by taking the weighted average of these metrics for states within this radius. We find the stronger and more precise estimates for our key interaction in these border estimations to be an important step towards establishing causality in our results.

Calibration

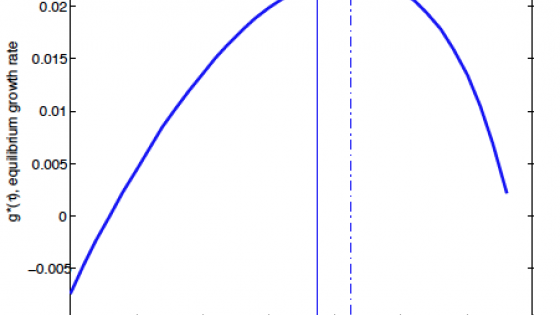

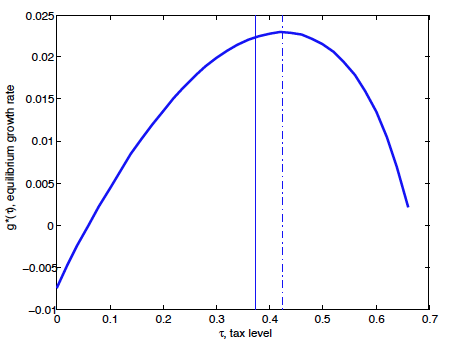

We also calibrate our model to quantify the effects of corruption and taxation on growth and evaluate gains from policy interventions. Figure 1 plots the equilibrium growth rate as a function of the corporate tax rate. The relationship between taxation and growth exhibits the inverted U-shaped pattern – while improved provision of public goods makes firms more productive, disincentives to investment and effort counteract this force and beyond a certain tax rate become too large. Our calibrated tax rate of 37% is quite close to the growth maximising level for the current level of US corruption, occurring around 42% (marked by the dashed line).

Figure 1. Growth as a function of the tax rate

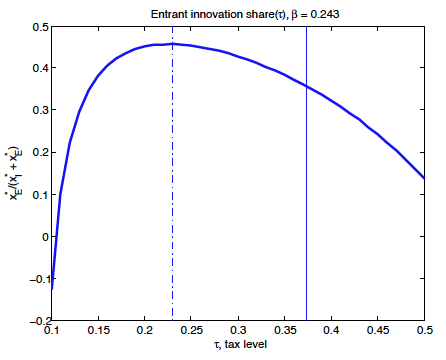

We also characterise the relative innovation rates of entrants vs. incumbents in Figure 2 below. Initial increases in taxes from low levels benefit entrants more than incumbents, as entrants depend upon public infrastructure, and the growth prospects of incumbents become more limited due to the resulting increase in competition. However, past a certain threshold, the negative effects of taxation discourage entry due to smaller returns, benefitting incumbents. The tax rate that maximises the entrant share is lower than the growth maximising rate, because the incumbents’ innovation rate per product line is higher than the success rate of outsiders for acquiring their first product in our calibrated framework.

Figure 2. Entrant share of innovation as a function of the tax rate

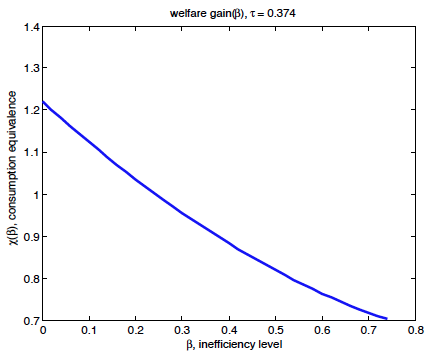

These results have considerable implications for policy, but our concluding and most important message is a simple one. Figure 3 shows that the boost to welfare in consumption equivalence terms from reducing corruption or increasing government efficiency are substantially larger than the marginal gains from further optimising the tax rate for the existing level of government efficiency. This is true within the US, and the growth enhancements from better government handling of public funds would hold true for many countries around the world.

Figure 3. Consumption equivalence as a function of the corruption rate

References

Aghion, P, U Akcigit, J Cagé, and W Kerr (2016), “Taxation, Corruption, and Growth”, NBER Working Paper No. 21928, published in European Economic Review (2016), 86: 24–51.

Glaeser, E, and R Saks (2006), "Corruption in America", Journal of Public Economics 90: 6-7, 1053-1072.

Holmes, T (1998), "The Effects of State Policies on the Location of Manufacturing: Evidence from State Borders", Journal of Political Economy, 106, 667-705.

Klette, T-J, and S Kortum (2004), "Innovating Firms and Aggregate Innovation", Journal of Political Economy, 112: 5, 986-1018.

Kleven, H J (2014), “How Can Scandinavians Tax So Much?”, Journal of Economic Perspectives, 28: 4, 78-98.

Rohlin, S, S Rosenthal, and A Ross (2010), "State Tax Effects and Entrepreneurship: Estimates from a Border Model With Agglomeration Economies", Working Paper, Syracuse University.