Financial institutions play an important role in international commerce. They provide financing to importers and exporters, offer trade credit insurance and factoring services, and sell specific trade finance products. But just how important these banking services are for international trade remains an open question, because of a lack of data. Existing evidence comes from datasets that are based on either a limited number of firms or a single country. Antras and Foley (2015), for example, report payment choices from one large US exporter.1 Reliable numbers that provide a worldwide view have been lacking so far.2

Since the 2007–08 crisis, policymakers have been worried that world trade could be harmed by a shortage of trade finance. As a result of such concerns, institutions like the World Bank and the Asian Development Bank have been running large trade finance programmes focused on the issuance and confirmation of letters of credit.3 Improving our knowledge about trade finance around the world is therefore not only of academic interest, but is also central for policymakers who want to grasp the extent and importance of the business.

Our recent work examines the prevalence of bank intermediation in global trade (Niepmann and Schmidt-Eisenlohr 2014). It exploits unique data from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) on letter-of-credit and documentary-collection messages that banks exchange worldwide. Because practically all bank communication runs through this platform, our data capture about 90% of total world letter-of-credit bank-to-bank flows, according to SWIFT.4

How letters of credit and documentary collections work

Letters of credit (LC) and documentary collections (DC) allow firms to manage the risks inherent in international trade. Although LCs reduce risk by more than DCs, they are costlier.5

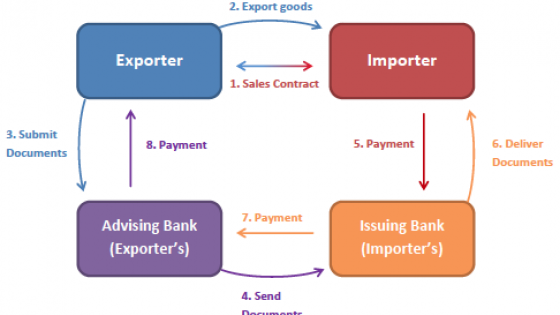

How an LC works

The importer asks its bank to issue an LC. The LC guarantees that the issuing bank will pay the agreed amount to the exporter upon proof of delivery. To cover the risk that the issuing bank will not pay, an exporter may have a bank in its own country confirm the LC.

Figure 1. How an LC works

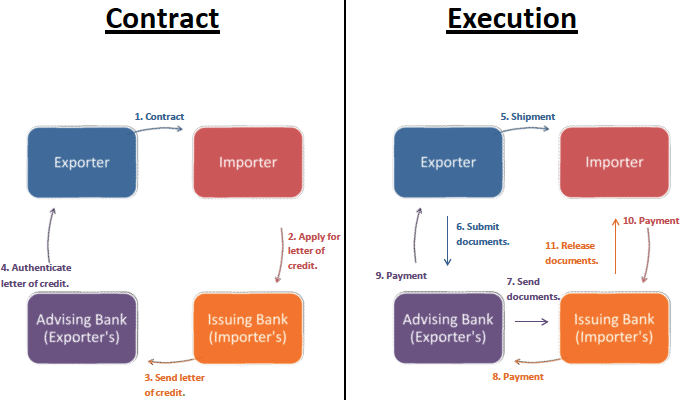

How a DC works

A DC does not involve a payment guarantee, but the exporter's bank forwards ownership documents to the importer’s bank; the documents are handed to the importer upon payment for the goods. Although less secure than an LC, a DC still increases the incentives for the importer to pay.

Figure 2. How a DC works

The use of LCs in the world

Worldwide, LCs (DCs) in 2011 backed about $2.3 trillion ($310 billion) of international trade, which corresponds to 12.5% (1.7%) of world trade in goods. These instruments are employed disproportionally for larger transactions. For US exports, which had an overall average value of $40,000, the average value of a shipment was $670,000 with an LC and $120,000 with a DC.

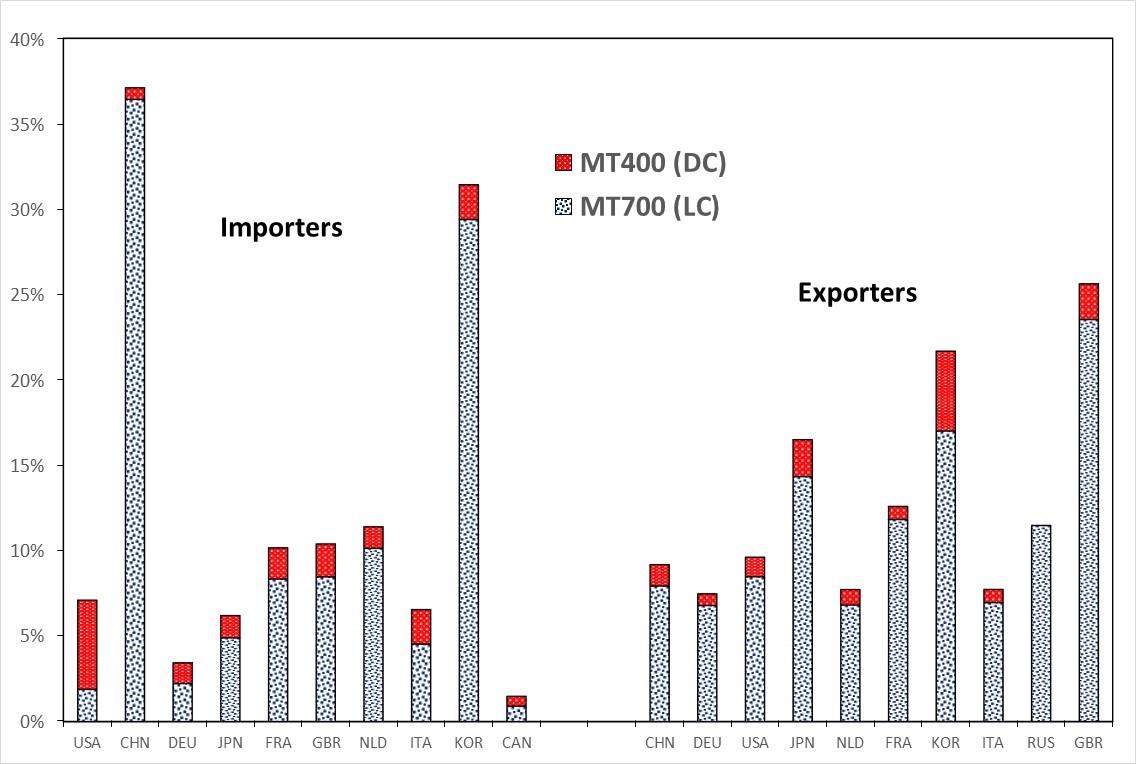

Trade finance use of the world’s top exporters and importers

The aggregate numbers mask the fact that the use of trade finance instruments is very heterogeneous across trading countries. Figure 3 shows the LC and DC intensities of imports (exports) for the world’s top 10 importers (exporters), measured as the fraction of trade covered by each instrument. More than one-third of China’s imports are paid with LCs. In contrast, less than 2% of US imports are based on this instrument. Among the top exporting countries, the UK requires the most LCs from its buyers. DCs are particularly important for US imports and South Korean exports.

Figure 3. The use of LCs and DCs by the top 10 world exporters and importers

Note: The figure shows the top ten world importers on the left and the top ten world exporters on the right. For each of these countries, the figure displays the share of international shipments that is settled with LCs or DCs in 2011, based on SWIFT message values and export values in that year.

Data source: Swift Institute and IMF Directions of Trade Statistics.

Trade finance use and institutional quality

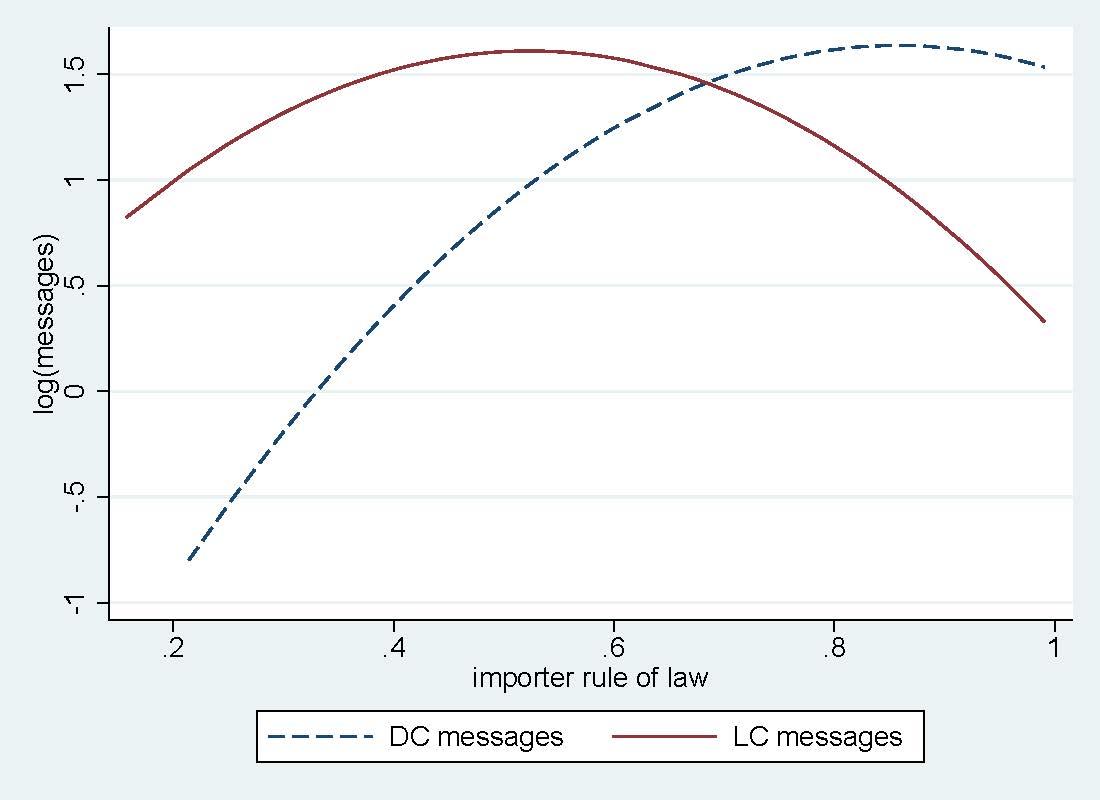

One key factor that determines whether an LC or a DC is used in a trade transaction is the risk of the destination country. Figure 4 illustrates results from regression analysis. The plot shows the log number of LC and DC messages on the y-axis and a country’s rule of law, an inverse measure of country risk, on the x-axis.

Figure 4. Trade finance and importer rule of law

Note: The figure illustrates how the use of letters of credit and documentary collections varies with the rule of law of the importer. The solid line shows the log number of LC messages. The dashed line depicts the log number of DC messages.

Two patterns emerge. First, LCs are used most frequently for destination countries with intermediate levels of rule of law. Second, DCs tend to be used for countries with better rule of law than LCs. Both findings can be explained by the optimal choice of firms. On the one hand, LCs imply substantial costs, so they are not employed for the destinations with the lowest risk (strongest rule of law) – instead, firms prefer to trade on open account terms with these countries.6 On the other hand, when countries become very risky, banks demand large premiums for the LCs, so firms prefer to demand cash-in-advance payments.7 DCs are cheaper than LCs but also reduce risk by less. They are hence used for safer destinations (higher rule of law).

Trade finance gaps

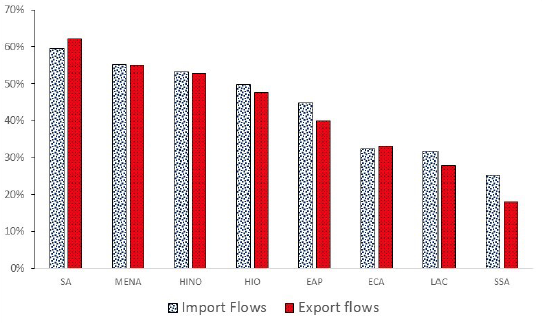

As illustrated in Figure 5, the extensive margin of the data provides evidence for a lack of supply of LCs.

Figure 5. Positive letter of credit flows by region

Note: The chart shows the fraction of unidirectional country pairs for which we observe positive LC flows by geographic region in 2010 conditional on positive trade flows. For example, the first (second) bar shows the share of country pairs with South Asian countries as importers (exporters) that had positive LC traffic in that year. The acronyms stand for the following: SA, South Asia; MENA, Middle East and North Africa; HINO, high-income non-OECD; HIO, high-income OECD; EAP, East Asia and Pacific; ECA, Eastern Europe and Central Asia; LAC, Latin America and Caribbean; SSA, Sub-Saharan Africa.

More than 70% of country pairs that have a sub-Saharan African country as either importer or exporter and had positive trade flows in 2010 had zero LC flows. These ‘missing’ LC messages indicate a gap in the supply of trade finance, in particular because these risky and poor countries might benefit substantially from LCs for their trade.8 Latin America and the Caribbean (LAC) and Europe and Central Asia (ECA) also appear to have limited access to LCs.

Why are LCs not available for some country pairs? Providing LCs is a relationship-intensive business. The smooth processing of an LC typically requires an established relationship between a bank in the source and in the destination country. As building and maintaining such interbank links is costly, banks might not have an incentive to do so if trade flows are too small. It is likely that technological advances will make setting up these links less costly and, thus, may improve the availability of LCs in the future. At the same time, new regulations, in particular ‘know your customer’ rules, increase the cost of LC issuance.9

LCs during the financial crisis

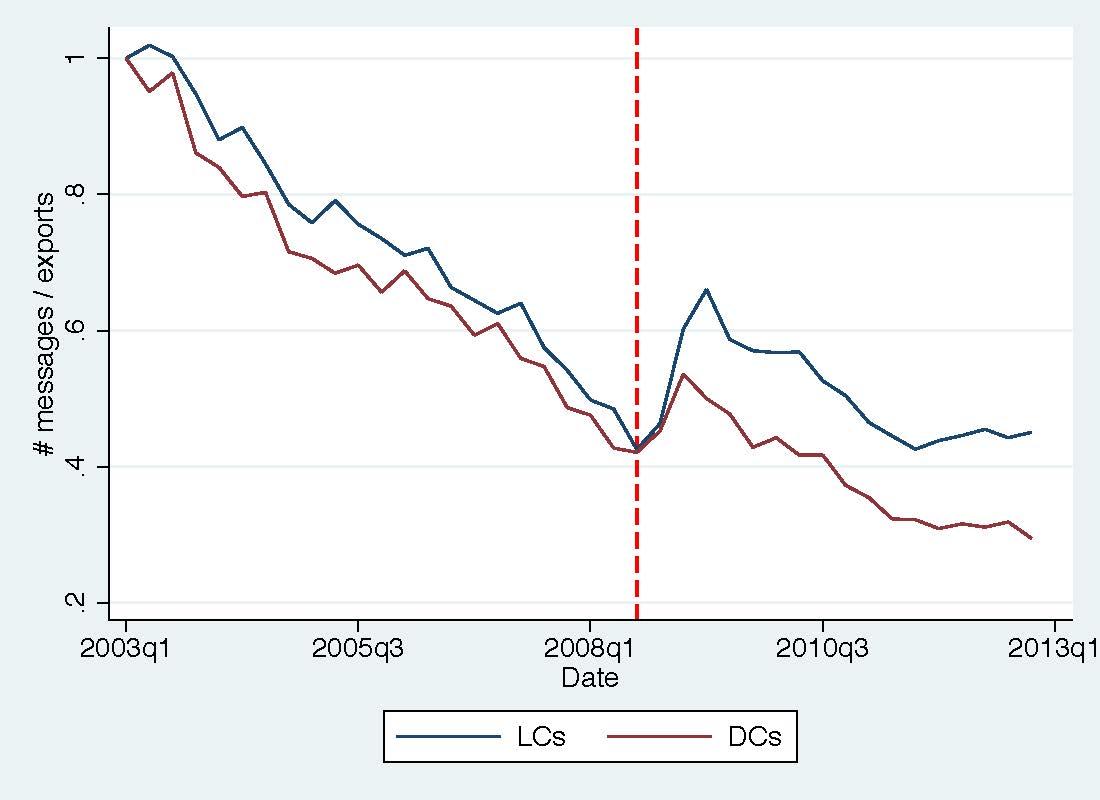

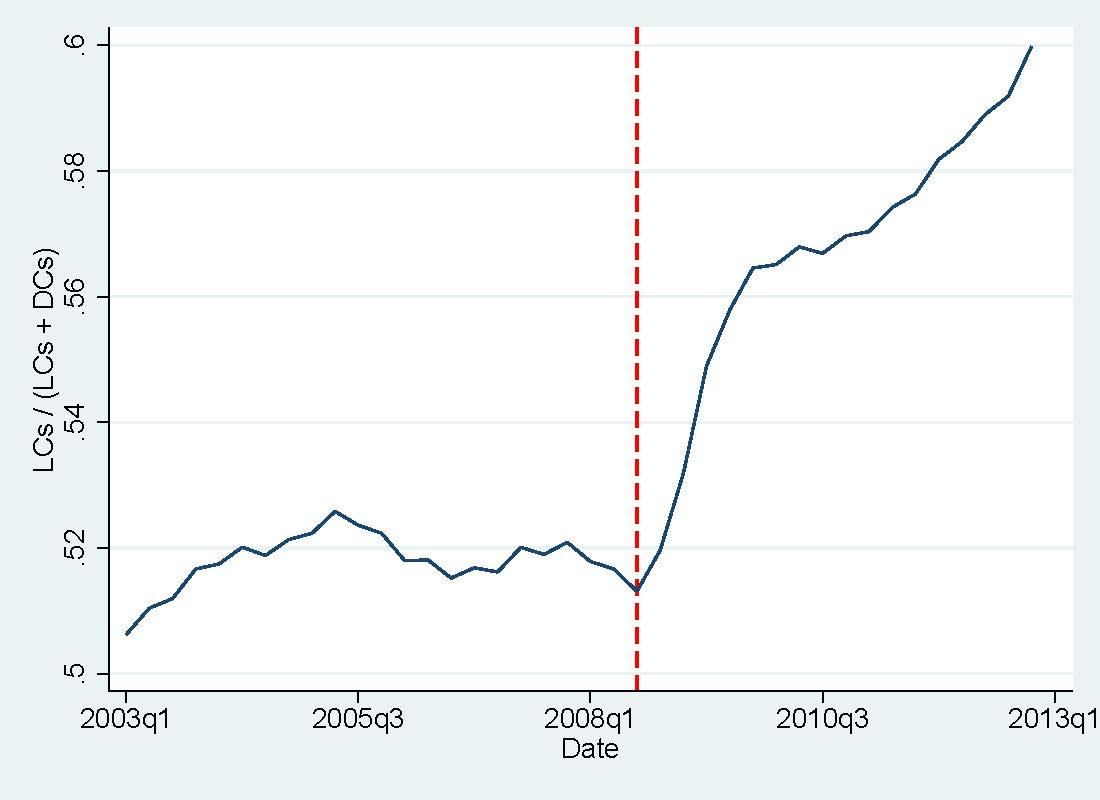

What happened to the use of LCs and DCs during the 2007–08 financial crisis? Although we expect trade finance supply to decline in a financial crisis, the demand for LCs and similar products should increase because firms become more risk-averse and because counterparty risk increases during crisis periods, making risk-reducing instruments more attractive. Which of the two effects dominates? Figure 6 shows the ratio of LC messages sent over world exports from 2003 to 2012. The red dashed line represents the third quarter of 2008, when Lehman Brothers collapsed. First, there is a downward trend, which suggests that LCs and DCs have become less popular over time. However, after the Lehman collapse, the use of LCs and DCs picked up. LCs, which reduce risk by more than DCs, gained in relative terms, as one might expect.

Figure 6. Trade finance during the financial crisis

Note: The figure shows the use of LCs and DCs over time. Panel (a) depicts the ratio of LCs and DCs over real exports (nominal exports deflated with the US GDP deflator). The ratio is indexed to 1 in 2003q1. Panel (b) shows the 5-quarter moving average of the ratio of LC messages over the sum of LC and DC messages. The vertical line in both panels indicates 2008q3.

Future work on trade finance

The data from the SWIFT Institute provide unprecedented details on LCs and DCs around the world. Information on trade credit insurance, factoring, and other payment forms remains limited, however, and much remains to be done. The collection of data on payment choices by firms can provide a much more complete picture and is an important next step. More data will help further clarify the role of trade finance for international trade and inform policymakers on how to best promote trade in the future.

References

Ahn, J (2014) “Understanding trade finance: Theory and evidence from transaction-level data”, International Monetary Fund, mimeo, May.

Antras, P and C F Foley (2015) “Poultry in motion: A study of international trade finance practices”, Journal of Political Economy, 123(4).

Bank for International Settlements (2014) “Trade finance: Developments and issues”, Technical Report, Bank for International Settlements.

Demir, B and B Javorcik (2014) “Grin and bear it: Producer-financed exports from an emerging market”, University of Oxford and Bilkent University, mimeo.

Hoefele, A, T Schmidt-Eisenlohr and Z Yu (2016) “Payment choice in international trade: Theory and evidence from cross-country firm level data”, Canadian Journal of Economics, forthcoming.

Niepmann, F and T Schmidt-Eisenlohr (2015) “International trade, risk, and the role of banks”, November.

Schmidt-Eisenlohr, T (2013) “Towards a theory of trade finance”, Journal of International Economics, 91(1): 96–112.

Endnotes

[1]See also Ahn (2013) and Demir and Javorcik (2013) who exploit data on payment forms used for Chilean and Colombian imports and Turkish exports, and Hoefele et al (forthcoming), who analyse World Bank Enterprise Survey data.

[2] The best summary of worldwide data to date is contained in a report by the Bank for International Settlements (2014) that combined different data sources on trade finance.

[3] Trade finance was also discussed in the context of the new Basel III regulations. There was a worry that larger capital weights could adversely affect the provision of letters of credit and thereby restrict international trade.

[4] Our letter-of-credit information comes from message type MT 700. Every time a letter of credit is issued, the issuing (importer’s) bank sends an MT 700 message to the receiving (exporter’s) bank. For documentary collections, we rely on message type MT 400 (advice of payment), sent by the collecting bank to the remitting bank.

[5] Firms can also decide to trade without an LC or DC and agree on pre-delivery payment (cash-in-advance) or post-delivery payment (open account). Open account can be combined with trade credit insurance, which transfers the risk of counterparty default to an insurance company. See Schmidt-Eisenlohr (2013) for details.

[6] Under open account, the exporter first delivers and then the importer pays. The key risk, hence, is that the importer may not pay. If the destination has a strong rule of law, this risk is low.

[7] Under cash-in-advance, the importer first pays and then the exporter delivers. This payment form thus avoids any risk that the importer may not pay and, hence, becomes optimal for the riskiest destinations.

[8] In some cases, it may be possible to organise the LC through third countries. However, such a detour comes at additional cost. In the extreme case, either an LC cannot be used or the actual goods need to be shipped through a third country.

[9] Know your customer rules, where banks or firms are required to better screen their counterparties, have become prominent in recent years in the context of anti-terrorism and anti-money laundering.