The remarkable rise in cross-border capital flows, and their frequent boom-bust cycles, have raised doubts about the degree to which flexible exchange rates can insulate economies from global financial shocks. Rey (2013), for example, argues that there is a global financial cycle in capital flows, asset prices, and credit growth, which co-moves with global uncertainty and risk aversion, and “constrains national monetary policies regardless of the exchange rate regime” when capital is freely mobile; the international monetary trilemma, under which exchange-rate flexibility supposedly confers monetary policy autonomy, thus becomes a “dilemma.” Rey (2015) provides evidence that US monetary policy shocks affect financial conditions in inflation-targeting advanced economies, while Passari and Rey (2015) show—in a mixed sample of advanced and emerging market economies—that global financial shocks (proxied by the VIX index) affect domestic credit and equity returns regardless of the exchange rate regime.

Indeed, it is quite plausible for the effectiveness of domestic monetary policy to be more limited in financially integrated economies. Borrowers, for example, may be able to substitute between domestic and external financing sources, limiting the impact of changes in domestic interest rates on credit and asset price dynamics. Moreover, even if policy interest rates can be set independently by central banks under flexible exchange rates (as has been documented in several studies, including Klein and Shambaugh 2015, Caceres et al. 2016, and Bekaert and Mehl 2017), long-term rates—which can exert a powerful influence on domestic real variables—tend to be strongly influenced by global forces (Obstfeld 2015). Another transmission mechanism could be the flexible exchange rate itself which, instead of acting as a shock absorber, could amplify the boom-bust cycle through leverage dynamics (Bruno and Shin, 2015).

In a recent paper, we revisit the claim that exchange rates are of little relevance in the transmission of global financial shocks by systematically analysing the response of a range of domestic financial and real variables—credit, prices of risky assets (housing and equities), banking system leverage, and economic activity—to global financial conditions (proxied by the VXO index) in a sample of about 40 emerging market economies (EMEs) over 1986–2013 (Obstfeld et al. 2017). Because financial conditions in EMEs are strongly associated with cross-border capital flows, we also investigate if the sensitivity of private capital flows—both net and gross flows—to global financial shocks varies across exchange rate regimes.

Why do we focus our analysis only on EMEs? First, we do so to tie in with the policy debates concerning the transmission of global financial shocks from the centre to the periphery, which relate mainly to the experience of EMEs. A related point is that several advanced economies experience the global financial cycle differently from EMEs, given their tendency to receive safe-haven flows during risk-off periods (i.e. they will be contending with inflows during risk-off episodes even as EMEs are contending with outflows). Second, the hypothesis being investigated is the extent to which exchange rate regime variation affects cross-border transmission: for the data to speak on this issue, there needs to be genuine cross-country variation in regimes. For the advanced economies, however, this is problematic since the majority typically classified as fixed exchange rate regimes among them are in the Eurozone—whose currencies float internationally. For these reasons, inferences and policy implications drawn from a sample comprising advanced economies (or indeed a pooled sample) could be misleading.

To exploit fully the cross-country variation in exchange rate regimes in our emerging markets dataset, we use the usual aggregate regime categorisation (fixed, intermediate, and float) together with a finer classification that distinguishes within these broad buckets. The latter is important, as EMEs have been moving away from the bipolar prescription and increasingly embracing ‘managed’ floating (Ghosh et al. 2015) Thus, to the degree that the exchange rate regime is salient, it is essential to analyse how far its benefits extend to managed floats as well as to pure floats.

Does the exchange rate regime matter?

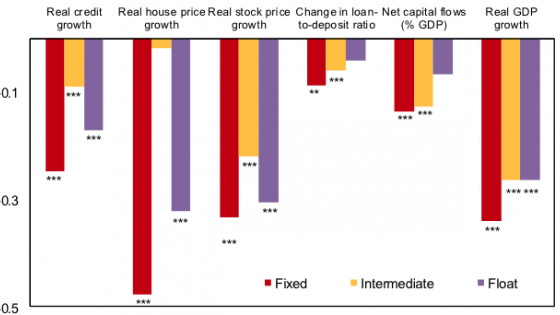

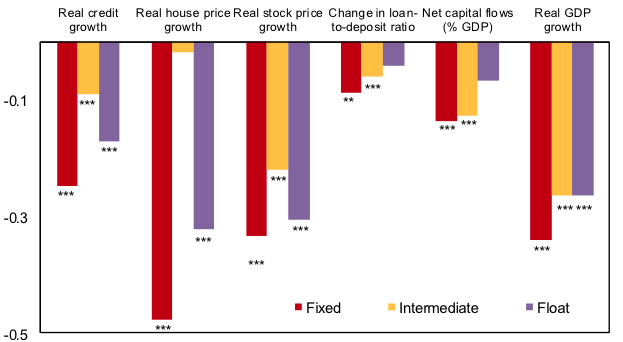

Yes. A simple snapshot of the data suggests that the (unconditional) negative correlation between the VXO index and net capital flows, domestic credit growth, asset prices (house and stocks), and leverage growth (proxied by the change in the banking sector’s loan-to-deposit ratio) is negative across exchange rate regimes, but it tends to be higher (in absolute terms) for fixed exchange rate regimes as compared with intermediate regimes and free floats (Figure 1). Notably, the negative association of real GDP growth with the VXO is also stronger in fixed exchange rate regimes, suggesting that such regimes are more prone to economic boom-bust cycles, perhaps because they are subject to more limited policy autonomy and face external adjustment difficulties.

Figure 1 Correlation with global risk aversion in EMEs

Note: Figure shows the unconditional correlation across countries between the (log) VXO index and three-quarter moving average of real domestic private sector credit growth, real house price growth, real stock price growth, change in loan-to-deposit ratio, net capital flows to GDP, and real GDP growth. *,**, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively.

Source: Authors’ calculations.

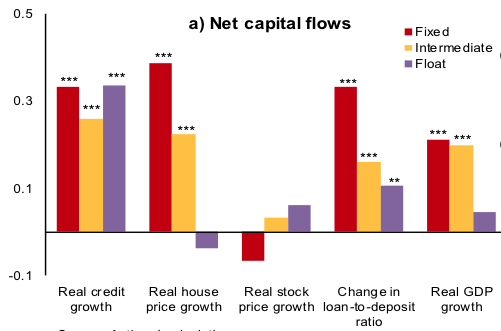

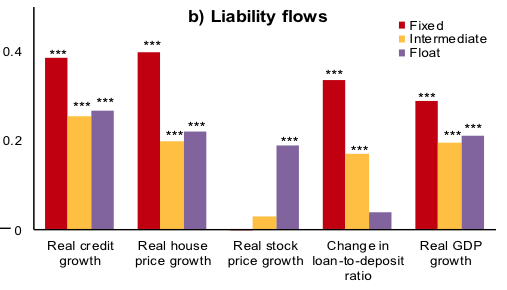

A similar pattern emerges looking at the correlation between capital flows and domestic financial and macroeconomic conditions in EMEs (Figure 2). Capital flows—both net and liability (nonresident) flows—are positively correlated with financial variables (except for stock prices) and real GDP growth across regimes, but the correlation is generally higher for fixed exchange rate regimes than for the other regimes. This suggests that capital flows are a more potent transmission channel of global conditions in pegs as compared with more flexible regimes in EMEs.

Figure 2 Correlation with capital flows in EMEs

a) Net capital flows

b) Liability flows

Note: Figures show the unconditional correlation between three-quarter moving average of net and liability flows, and real domestic private sector credit growth, real house price growth, real stock price growth, change in loan-to-deposit ratio, net capital flows to GDP, and real GDP growth. *,**, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively.

Source: Authors’ calculations.

Impact on domestic financial conditions

The initial observations are supported by formal regression analysis, where we examine the differential impact of the VXO index on domestic financial variables, while controlling for other relevant factors (such as real GDP growth, the level of financial development, capital flows, country-specific effects, and quarter-year effects). Specifically, our results show that a one standard deviation shock to the VXO implies:

- About 1 percentage point lower quarterly real credit growth in fixed exchange rate regimes as compared with more flexible ones, this difference being statistically significant at the 5% level.

- About 1½2 percentage points larger reduction in quarterly real house-price growth in fixed exchange rate regimes relative to intermediate regimes and floats, the difference being statistically significant at the 1% level.

- A decrease in domestic banking system leverage growth of about 1 percentage point in fixed rate regimes compared with floats, the difference being statistically significant at the 5% level.

- No statistically significant difference across exchange rate regimes in the response of real equity returns, though these returns are generally strongly negatively related to the VXO index. (A possible reason why stock prices in fixed exchange rate regimes do not react more to the VXO than in other regimes could be that they are not significantly associated with domestic credit growth, which, as mentioned above, is particularly sensitive to the VXO in fixed exchange rate regimes.)

Looking at the disaggregated exchange rate regime classification, the negative reaction of domestic credit, house prices, and leverage to the VXO is significantly greater for both hard pegs and conventional single currency pegs—which forgo monetary policy autonomy by more rigidly pegging their exchange rates. For other types of soft pegs (basket pegs, bands, and crawling arrangements), as well as for managed floats, there is no meaningful difference as compared to free floats in the sensitivity of domestic financial conditions to global financial shocks.

Transmission of shocks through capital flows

A key channel through which global financial conditions are transmitted to financially open emerging markets is cross-border capital flows. Our results show that EMEs with fixed and intermediate regimes attract more net flows (in percent of GDP) than floats, but they also react more when the global financial cycle turns. A one standard deviation shock to the VXO thus implies about 2% and 0.5% of GDP lower net flows in fixed and intermediate regimes, respectively, as compared with floats (against mean quarterly net flows of about 4% of GDP in fixed and intermediate regimes).

While the larger net private flows under fixed exchange rate regimes might be expected—since the exchange rate does not adjust to reduce the incentive for capital to flow and central bank intervention therefore must accommodate private portfolio shifts—our analysis suggests that more is at play. We find that liability (nonresident) flows differ markedly across exchange rate regimes, whereas asset flows do not. Thus, foreign investors are more likely to invest in pegged regimes than in more flexible rate regimes; but they are also more skittish under such regimes when global risk aversion rises. Looking at the disaggregated exchange rate regime classification suggests a differential impact of global financial conditions on liability flows for hard pegs, single currency pegs, and basket pegs. These relatively rigid exchange rate regimes, on average, experience larger inflows (presumably because of low currency risk), but also more pronounced fluctuations in capital flows with changes in global investor sentiment, than flexible regimes.

Relevance for real economic variables

financial conditions in EMEs react strongly to the global financial cycle, with the exchange rate regime playing an important role in determining the degree to which global shocks are transmitted. But does this finding have any macroeconomic relevance? Our results show that it does: real output growth in EMEs declines as the VXO rises, with a one standard deviation shock to the VXO implying a 0.2 percentage point decline in the quarterly growth rate (against a mean quarterly growth rate of 1% across exchange rate regimes). The decline in output is, however, twice as large for fixed exchange rate regimes compared with both intermediate regimes and floats—with a one standard deviation shock to the VXO lowering the growth rate by about 0.4 percentage points in fixed exchange rate regimes relative to the rest. These results hold if we consider year-on-year real output growth rates, or the volatility of quarterly growth rates, where we find that fixed rate regimes experience significantly greater output volatility than floats when the VXO rises.

Conclusion

With deepening financial integration, and the synchronous cross-border movement of capital, there is a temptation to conclude that national autonomy over exchange rate regime choice is no longer sufficient to counteract the influence of monetary and financial shocks from the epicentre. Evidence from advanced countries indeed seems to suggest that countries face a dilemma rather than a trilemma—restrict capital mobility or accept the consequences for domestic financial and real variables. Our analysis of emerging market economies suggests that the exchange rate regime does exert statistically and economically meaningful effects on the nature of the transmission of global financial shocks to domestic financial and real variables. Exchange rate flexibility dampens the magnitude of the transmission to domestic credit growth, real estate prices, financial sector leverage, and output. Moreover, regimes toward the flexible end of the spectrum (including, notably, managed floats) largely resemble pure floats from an insulation perspective, so that higher cross-border transmission of cross-border disturbances is mainly confined to the most inflexible end of the regime spectrum.

These results are robust to a range of sensitivity checks—including addressing relevant endogeneity concerns and using different exchange rate regime classifications. Exchange rate flexibility does not provide perfect insulation, but even in today’s highly integrated world, the choice of exchange rate regime—alongside choices for other elements of the policy toolkit, including capital controls and macroprudential policy (Ostry et al. 2011, Obstfeld 2015)—remains an important lever for managing domestic financial and macroeconomic outcomes in the face of volatile global financial conditions. The time to pronounce the irrelevance of the exchange rate regime has not arrived.

Authors’ note: The views expressed herein are those of the authors, and should not be attributed to the IMF, its Executive Board, or its management.

References

Bekaert, G and A Mehl (2017), “On the Global Financial Market Integration ‘Swoosh’ and the Trilemma,” NBER Working Paper 23124.

Bruno, V and H Shin (2015), “Capital Flows and the Risk-Taking Channel of Monetary Policy,” Journal of Monetary Economics 71: 119-132.

Caceres, C, Y Carrière-Swallow and B Gruss (2016), “Global Financial Conditions and Monetary Policy Autonomy,” IMF Working Paper WP/16/108.

Ghosh, A, J Ostry and M Qureshi (2015), “Exchange Rate Management and Crisis Susceptibility: A Reassessment,” IMF Economic Review 63(1): 238-276.

Klein, M and J Shambaugh (2015), “Rounding the Corners of the Policy Trilemma: Sources of Monetary Policy Autonomy,” American Economic Journal: Macroeconomics 7(4): 33-66.

Obstfeld, M (2015), “Trilemmas and Trade-offs: Living with Financial Globalization,” BIS Working Papers 480.

Obstfeld, M, J D Ostry and M S Qureshi (2017), “A Tie That Binds : Revisiting the Trilemma in Emerging Market Economies”, IMF Working Paper No. 17/130.

Ostry, J, A Ghosh, M Chamon and M Qureshi (2011), “Capital Controls: When and Why?” IMF Economic Review 59(3): 562-580.

Passari, E and H Rey (2015), “Financial Flows and the International Monetary System,” Economic Journal 125(584): 675–698.

Rey, H (2013), “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence,” Proceedings Federal Reserve Bank of Kansas City Economic Policy Symposium, Jackson Hole: 285-333.

Rey, H (2016), “International Channels of Transmission of Monetary Policy and the Mundellian Trilemma,” IMF Economic Review 64(1): 6-35.