Pinpointing the right level of generosity of an unemployment insurance system is a delicate exercise. The main objective of the unemployment system is to provide insurance for workers who lose their jobs. The system should be generous enough to smooth income shocks and allow workers to look for a job without too much financial stress. However, high replacement rates and long benefit durations may have two kinds of effects. First, they may discourage workers from trying to search for a job. And second, they may increase workers’ reservation wages, or the lowest wage employees are ready to accept.

The debate

A vast empirical literature has documented that a more generous insurance system increases the time job seekers spend in non-employment (see the review by Schmieder and von Wachter 2016). However, this empirical fact is, in theory, compatible with the two channels mentioned above. Return to employment can be slower because job seekers put less effort when searching for a job, or because they are ‘pickier’. Distinguishing between these two channels is important for both the government and the taxpayer. If job seekers put in less effort, we shouldn’t expect the job they ultimately find to be of higher quality than their last job. If, on the contrary, job seekers are more selective, longer unemployment duration may cost more initially but taxes on the subsequent higher wages may alleviate the cost of such a policy.

While the empirical literature on the impact of unemployment insurance generosity on reemployment wages documents modest effects (Nekoei and Weber 2017), there is surprisingly little evidence on how unemployment insurance affects reservation wages (Krueger and Mueller 2016). Reemployment wages are the equilibrium outcome of the wages offered by employers and of the job seekers’ preferences. As we explained, more generous unemployment insurance prompts job seekers to stay out of work longer, which tends to decrease their job prospects and the wage they are offered. At the same time, job seekers could become more selective when it comes to the wages they accept because staying unemployed is less costly when the system is more generous. These two offsetting effects would be consistent with modest effects of unemployment insurance generosity on reemployment wages despite a strong effect on job seekers’ preferences. To make progress on this question, we need direct data on reservation wages.

The generosity of unemployment insurance has no effect on reservation wages

In recent work, we provide empirical evidence that the elasticity of the reservation wage with respect to potential benefit duration – the maximum number of days of benefits – is very close to zero (Le Barbanchon et al. 2017). While we find that job seekers spend more time in unemployment when they face more generous benefit durations, there is no significant impact on their reservation wage.

Our study relies on French data collected by the Public Employment Service (Pôle Emploi), covering the universe of unemployed job seekers registered at Pôle Emploi between 2006 and 2012. These French data are unique in that a question relating to the reservation wage is asked to every job seeker at the time of registration. Indeed, during registration, each job seeker is asked about the type of job she is looking for and her reservation wage for this job (as well as the maximum commute accepted and other characteristics). The question is worded as follows: “What minimum gross wage do you ask for?”. We checked that the distribution of this self-reported reservation wage measure makes sense and is correlated with the respondent’s socio-demographic characteristics in a meaningful manner, for a given pre-unemployment wage. Restricting the analysis to individuals for whom we observe several unemployment spells, we see that that they tend to stay unemployed longer during periods for which they stated a higher reservation wage, which is consistent with the reservation wage definition.

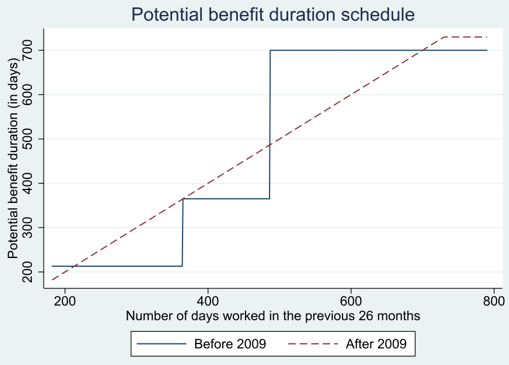

To identify a causal effect of an increase in the duration of potential benefits, we rely on a natural experiment. Every three years, French unions and employers’ representatives renegotiate unemployment insurance rules. Following the 2009 negotiation, the number of days claimants are entitled to benefits, which is a function of the number of days worked in the past two years, changed from a step function to a perfectly linear function (Figure 1). The overall generosity was not affected but some groups of people gained while others lost a few weeks (or months), compared to the pre-reform situation. We use this exogenous variation in a differences-in-differences estimation to compare the reservation wage (and the actual duration of benefit claims) of individuals who faced a more generous schedule than others.

Figure 1 Schedule of potential benefit duration, before and after the 2009 reform

We find that job seekers who benefited from a longer benefit duration following the reform remained claimants for a longer time, which is consistent with the literature. Our main result is that job seekers’ reservation wages did not change. Because we work with a very large sample of job seekers, we can rule out elasticities larger than 0.006 – a 10% increase in potential benefit duration cannot trigger an increase of the reservation wage of more than 0.06%, which is a very low figure.

We also test whether job seekers react to other dimensions of job quality. We find no effect of longer benefit duration on the desired number of hours, duration of the labour contract and commuting time/distance.

What this means for policy

The Great Recession has revived a debate about how unemployment insurance should react to an increase in the unemployment rate. Increasing potential benefit duration improves the insurance provided to workers facing more instability but bears the cost of lengthening non-employment duration. These benefits and costs may weigh differently in good and bad times. Part of the literature argues that unemployment insurance should be countercyclical, that is, more generous in crisis times (Landais et al. 2015, Marinescu 2017). Others show that increasing unemployment generosity in bad times amplifies crises by pushing job seekers to be more selective, which means that the cost of labour increases and the number of jobs shrinks further (Hagedorn et al. 2013).

The evidence we bring does not support this last argument. If job seekers are not ‘pickier’ when they are more protected, increasing the generosity of unemployment insurance during crises should not lead to any substantial loss of jobs.

References

Hagedorn, M, F Karahan, I Manovskii and K Mitman (2013), “Unemployment benefits and unemployment in the Great Recession: The role of macro effects”, NBER Working Paper 19499.

Krueger, A and A Mueller (2016), “A contribution to the empirics of reservation wages”, American Economic Journal: Economic Policy 8(1): 142-179.

Landais C, P Michaillat and E Saez (2017), “A macroeconomic approach to optimal unemployment insurance: Theory”, American Economic Journal: Economic Policy, forthcoming.

Le Barbanchon, T, R Rathelot and A Roulet (2017), “Unemployment insurance and reservation wages: Evidence from administrative data”, Journal of Public Economics, forthcoming.

Marinescu, I (2017), “The general equilibrium impacts of unemployment insurance: Evidence from a large online job board”, Journal of Public Economics 150: 14-29.

Nekoei, A and A Weber (2017), “Does extending unemployment benefits improve job quality?”, American Economic Review 107: 527-61.

Schmieder, J F and T von Wachter (2016), “The effects of unemployment insurance: New evidence and interpretation”, Annual Review of Economics 8: 547-81.