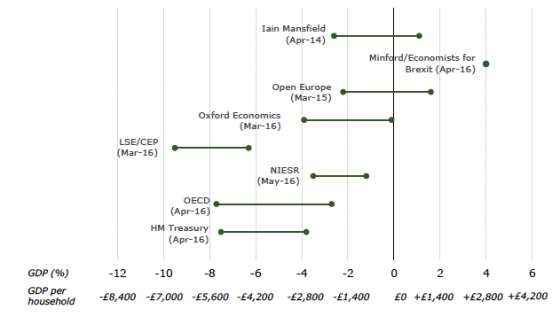

We are quite accustomed to the entertaining spectator sport of economists disagreeing, often in very strong terms, but the lead up to the UK referendum vote on EU membership has introduced to the public the rather strange sight of economists coming together nearly as one. The consensus is rather clear: the measurable economic risks from a UK exit from the EU are significantly negative and the balance of those risks are skewed to the downside. Figure 1, from the recent Treasury Committee report, makes the point fairly clearly, where all except one analyst thinks, as a central case, that reorienting trade and capital flows away from our largest trading partners in the EU will tend to reduce output in the long and short run (for a summary of some of these issues, see NIESR 2016).

Figure 1 Recent estimates of the long-term impact of leaving the EU on UK GDP

Like many contrary-minded people, I am often wary of the consensus as it may turn out to be misleading. Experts may tend to offer advice that favours the status quo because there is little substantive evidence in favour of an altered state of nature. They may also herd around one opinion because they do not want to be seen as outliers with their professional colleagues or because they have not been able to develop a truly independent view. Either of these possibilities may lead to what economists call an informational cascade in which information that may be valuable is lost. Or all or some of the experts may also all be lying to us in order to gain some advantage later.1 We shall though put the lying possibility to one side.

So might we dismiss the economic consensus that leaving the EU is likely to be costly on at least one of three grounds that experts are too risk averse, or short-sighted, or have formed a mendacious conspiracy? In the face of such possible biases, can yet more economic analysis help us again? Even if the signal from the experts is clear, the problem then is how should we consume it. As members of the public, we may have pretty much one answer or signal – “Do not leave the EU” – but before acting on it we have to decide on how to treat any biases. Assuming that the all the economists who have provided various analysis want their advice to be heeded, they may also have tailored their advice so as to maximise the probability that the advice will be used by amplifying the signal, thinking that it is better to exaggerate the impact on the up or downside so that people will understand the qualitative stance on ‘good’ or ‘bad’ more easily.

If economists wished to influence opinion in this manner, the set of published views on either side would then actually become more dispersed as economists would exaggerate their claims in order to get more attention. And if this happened there is further, more subtle impact. The increased polarisation of opinion on the impact of Leave or Remain will then lead to increased uncertainty over the future, as rational agents will today attach some possibility to either extreme state. Accordingly we can (almost) certainly observe an increase in uncertainty as these two regimes tussle out the consequences for the UK. The uncertainty itself then leads to some delay in both consumption and investment, which may not be completely resolved if the vote is very narrow.

Figure 2 NIESR Uncertainty Index

The disinterested yet rational economist then has another choice. Let us suppose that whatever advice she wishes to give, she wants the output consequences to be minimised. She will know that her advice may not be followed and that the other side may win the day. So she may have to change her advice in order to militate against the costs of her advice being ignored. How does she do this? She forecasts away from the extreme and so reduces the range of possible outcomes. Our sensible economist wants to reduce uncertainty because she does not want to impart a shock on the economy as rational agents respond first to uncertainty and then to the expectation of a large change in circumstance. The public then might be best choosing the consensus when accepting advice – if the economists were truly disinterested in the results of the referendum one way or other, they would not wish to exaggerate the consequences because that would by itself negatively impact on the economy. And so we as the public should, in the absence of an ability to referee or replicate the analysis produced, be most wary of the outliers or extremes on either side, so perhaps the truly contrary thing on in terms of the economics and the referendum is to agree with the remaining ‘trimmed’ consensus. Discard the extremes and place weight on the central view, which still says that leaving is likely to be bad for the economy.

Editors’ note: The author’s Gresham lecture on this subject was given on 2 June 2016.

References

Basu, S. M. S. Kimball, N. G.Mankiw and D. N. Weil (1990), "Optimal Advice for Monetary Policy", Journal of Money, Credit and Banking 22(1), 19-36.

Chadha, J. S. (2016), "Assessing the Economic Risks from Brexit", Gresham College Lecture, 2 June.

NIESR (2016), National Institute Economic Review, no. 236, May.

Park, A. and H. Sabourian (2011), "Herding and Contrarian Behavior in Financial Markets", Econometrica 79(4), 973-1026.

Treasury Committee (2016), "The economic and financial costs and benefits of the UK's EU membership", First Report of Session 2016-17.

Endnotes

[1] Some of these issues are discussed in Park and Sabourian (2011).