Modern finance has increasingly been characterised by higher financial concentration. Federal Reserve data show that in 2010 the three largest US institutions – Bank of America, JP Morgan, and Citigroup – held 49% of all banking assets. In Japan, the three largest ‘megabanks’ (SMBC, Mizuho, and MUFG) account for just over half of all lending to listed corporations, and evidence from Buch and Neugebauer (2011) for Europe suggests that these examples are not exceptions – they are the rule. We are living in a world in which banks are large relative to the economies they serve.

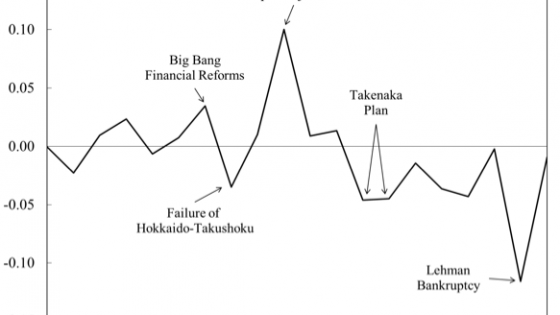

A series of policy changes has promoted greater bank concentration. For example, in the late 1990s Japan abolished restrictions on holding companies that had been central to the dissolution of Japan’s pre-war corporate groups (‘zaibatsu’). This policy change, coupled with aggressive policies to merge insolvent institutions with healthy ones as a means of cleaning up the country’s bad loans problem, led to a dramatic increase in concentration. Figure 1 portrays this increase for Japan. The figure plots the individual loan shares of every bank with a loan share exceeding 1% of aggregate lending to listed companies, where we group those with a market share of less than 1% into the shaded region. As one can see from the figure, there has been a remarkable increase in concentration over the period.

Figure 1 Rising bank concentration in Japan

Note: bars depict individual loan shares of every bank with a loan share exceeding 1% of aggregate lending to listed companies. Banks with a market share of less than 1% are grouped into the shaded region.

Sources: Nikkei NEEDS Financial QUEST, author’s calculations

Implications of rising bank concentration for understanding aggregate economic fluctuations

The first point to realise is that the law of large numbers breaks down when there are only a few players in a market. In markets comprised of a large number of essentially infinitesimal firms, the success or failure of any individual enterprise is irrelevant for understanding aggregate performance because these idiosyncratic behaviours cancel out on average. However, when players are large, idiosyncratic behaviours can matter because they do not necessarily cancel out overall. If an institution that provides 20% of loans suddenly stops lending, there is no law-of-large-numbers result that suggests that some other big institution will take up the slack. In technical terms, we say that large banks are not infinitesimal, they are ‘granular’. In contrast to shocks to infinitesimally sized firms, shocks to large, granular firms can matter. In other words, while Humphrey Bogart’s character was correct to note in Casablanca that “it doesn't take much to see that the problems of three little people don't amount to a hill of beans in this crazy world”, it also doesn’t take much to see that the problems of three big banks can amount to a whole heap of trouble.

Of course, in order to believe that the fates of individual banks matter for aggregate behaviour, we need to also believe that idiosyncratic bank shocks are large. For example, if all banks became troubled at the same time, that might well cause a downturn, but this would not be due to a particular idiosyncratic problem in a given institution. Trying to identify these idiosyncratic shocks has proved challenging in past research in this area. Researchers have gone to great lengths to identify ‘natural experiments’ in which one bank or set of institutions were adversely affected relative to others, to study the implications for real activity of individual firms. While these studies are important for understanding individual firm behaviour, they provide no guidance for how to identify idiosyncratic bank shocks in general, and how to estimate their effect on aggregate variables.

In a forthcoming paper, we explore this rigorously using data on all loans extended by each bank to every listed firm in Japan (Amiti and Weinstein 2017). By saturating the model with firm-time and bank-time fixed effects, we can identify how much of every loan movement is explainable by factors affecting the firm or the bank in that time period. For example, if a bank starts lending less to a set of firms that other banks lend more to, that is indicative of a negative idiosyncratic shock to the first bank. Similarly, if a firm starts borrowing more from a given set of banks than other firms, this suggests that the firm’s demand for credit has risen idiosyncratically. We develop a new methodology for an estimation procedure that delivers parameters that exactly aggregate to match total firm and bank lending.

With these estimates in hand, we can then exactly decompose loan movements into four forces. First, there are common shocks, which capture macro forces that affect all lending. Second, there are industry shocks, that affect borrowing demand of all firms in a particular industry. Finally, we identify idiosyncratic firm-demand and bank-supply shocks, which tell us how much the borrowing of a particular firm or the lending of a particular bank deviates from what one might expect, given the behaviour of other banks and firms. Consistent with standard stories about the existence of a credit crunch, we observe that banks that are either insufficiently capitalised, suffer large declines in their share price, or run into legal trouble are the ones to typically experience large negative lending shocks. On the flip side, banks that receive capital injections start lending much more than banks that do not, which demonstrates the salutary impact of government bailouts in troubled times.

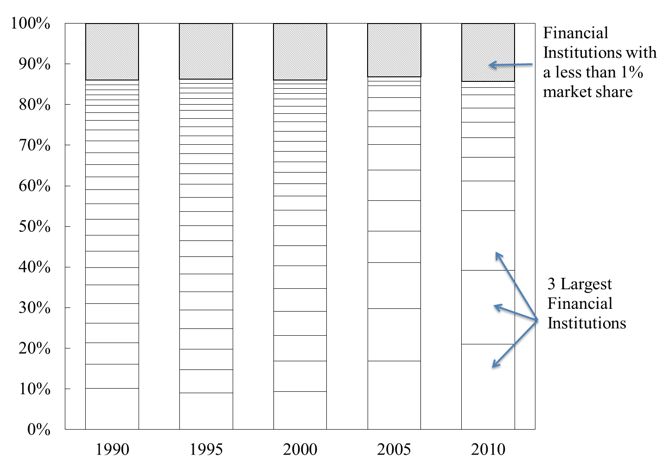

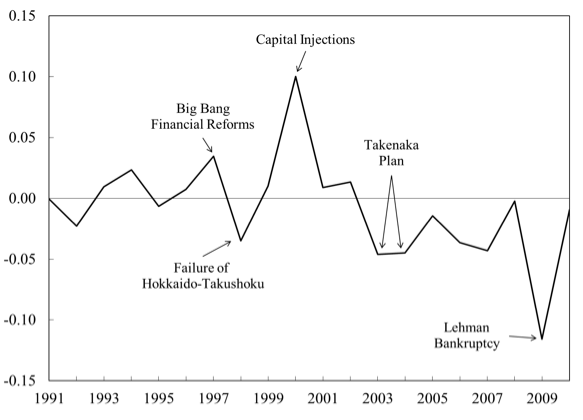

Figure 2 plots the weighted-average of the idiosyncratic bank shocks and the granular bank shock, over our sample period. If we could apply the law of large numbers to banks, these shocks would equal zero, but because a large shock to a large bank can affect average lending, they need not necessarily cancel out. The largest movements in the series correspond to major crises and policy interventions. In fiscal year 1997 (which roughly corresponds to calendar year 1996 because Japanese corporate fiscal years end in march), we see a big positive shock. This shock coincides Prime Minister Hashimoto's 1996 ‘Big Bang’ financial reforms, which paved the way for bank holding companies. We see a large negative bank shock in FY1998, which corresponds to the year in which the failure of Hokkaido-Takushoku Bank and a major wave of large-bank failures. In 1998 (FY1999), Japan’s largest banks were given capital injections. If these policy interventions induced more lending, we would expect to see that these large institutions lent more. This is precisely what we see in Figure 2, where we observe a big positive granular bank shock in 1999 (FY2000). The second largest granular bank shocks occur in FY2003 and FY2004 in the aftermath of the Takenaka Plan’s forced disclosure of banks’ nonperforming loans in 2002. The biggest negative granular bank shock is also easy to understand. It occurs in 2008 (FY2009), the same fiscal year as the Lehman bankruptcy. It is reasonable to suspect that the global financial meltdown in 2008 had a worse impact on large, global Japanese banks than on small ones who probably were much less exposed internationally. This helps explain why there is a large negative granular bank shock in FY2009. Overall, our method seems to correctly identify the major bank shocks in Japan.

Figure 2 Granular bank shocks

Note: Years refer to fiscal years, which roughly correspond to the calendar year plus one.

Armed with these idiosyncratic bank shocks, we can assess how much these shocks matter for investment. For obvious reasons, it is typically the case that firms tend to borrow more from larger banks than from smaller ones. As a result, when several of these large institutions register negative idiosyncratic loan shocks, reduction in lending is not offset by new lending from other institutions. Empirically, we show that the sales, employment, and investment of borrowing firms declines when their main banks cut back on lending.

The key empirical question is how much do these idiosyncratic bank loan supply shocks matter for aggregate Japanese lending. Fortunately, our methodology provides a simple way of assessing this. For each individual firm, we can estimate how much each firm’s investment was affected by the idiosyncratic loan shocks that struck each of its banks. By summing this impact across all firms, we can obtain an impact of the loan shocks on aggregate lending behaviour.

The results suggest that there was an extremely important impact of idiosyncratic bank shocks on aggregate investment. We estimate that 30% to 40% of Japan’s investment rate can be explained by these idiosyncratic bank shocks between 1990 and 2010. Since our definition of idiosyncratic shock nets out all macro variation and firm-demand effects, this number only represents the impact of a limited number of large banks suffering from idiosyncratic shocks. In other words, much of the fluctuation in Japanese aggregate investment appears to be driven by the idiosyncratic successes and failures of a limited number of institutions. At the very least, one implication of these results is that investment in the world’s third largest economy is very sensitive to idiosyncratic shocks affecting a very limited number of institutions.

Obviously, these results are dependent on the country and time period studied – Japan suffered through a major banking crisis in 1998 – but the parallels between what happened in Japan in the 1990s and what happened in the US and Europe following the Lehman bankruptcy give reason for pause. There is good reason to believe that the high level of financial concentration in many industrial countries has created conditions in which aggregate investment is very sensitive to the idiosyncratic successes and failures of large financial institutions.

Authors’ note: The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

References

Amiti, M, and D Weinstein (2017), “How Much do Idiosyncratic Bank Shocks Affect Investment? Evidence from Matched Bank-Firm Data”, Journal of Political Economy, forthcoming..

Federal Reserve Board of Governors (various), "BHCPR Peer Group Average Reports" , US Federal Reserve System National Information Center.

Buch, C M, and K Neugebauer (2011), “Bank-specific shocks and the real economy.” Journal of Banking & Finance, 35(8): 2179–2187.