DP17707 The IMF's Journey on Capital Controls: What Is the Destination?

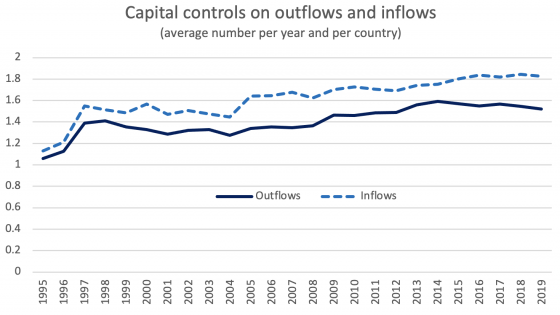

The International Monetary Fund’s Articles of Agreement give countries wide latitude to regulate cross-border capital movements, subject mainly to the proviso that such regulations not be used to manipulate the exchange rate for the purpose of gaining an unfair competitive advantage. Beginning from the 1990s, however, the IMF has seemed far more supportive of fully open capital accounts than its legal framework. This can be seen not only in the institutional push to amend the Articles to enshrine fully open capital accounts in the mid-1990s, but also in subsequent speeches by IMF managing directors impugning capital controls and recent attempts to codify a set of highly restrictive circumstances under which countries may avail themselves of external financial regulations. This history suggests that, institutionally, the IMF would be far more comfortable with an architecture in which countries (strive to) eliminate restrictions on cross-border capital movements than with the vision of capital controls enshrined in its constitution by the IMF’s founding fathers, Keynes and White.