The Bank of England hiked interest rates by a half point to 5% in its June Monetary Policy Committee (MPC) meeting. This marked the 13th consecutive interest rate hike by the MPC, raising rates to the highest level since 2008. This was in response to persistently high inflation rates, with headline inflation remaining unchanged at 8.7% (year-on-year) in May as compared to the previous month and core inflation rising to 7.1%. While interest hikes are seen as critical to pull inflation levels down to the 2% target, opinions are divided on whether this target can be achieved without forcing the UK into a recession. The IMF takes an optimistic stance on the issue, stating that while interest rates may have to remain high for longer to bring down inflation more assuredly, “resilient demand in the context of declining energy prices” would allow the UK to avoid a recession and maintain positive growth in 2023 (IMF 2023). Vanguard forecasts that the Bank of England will bring inflation down to 2% by the end of 2024, with the UK marginally avoiding a recession. KPMG also expressed a similar view in its June 2023 UK Economic Outlook, suggesting that the UK economy will likely escape a recession due to “a better outlook for energy prices, a more resilient global environment, and continued tightness in the labour market” (KPMG 2023). The Confederation of British Industry (CBI) and the British Chambers of Commerce (BCC) echoed these sentiments, suggesting that a combination of the aforementioned factors would lead let the UK steer clear of a recession (CBI 2023, BCC, 2023). A Bloomberg survey of UK economists also shows consensus that growth is strengthening, further easing fears of a looming recession.

Yet not all experts express such a positive outlook regarding the UK’s economic prospects. Luke Bartholomew, a senior economist asset management firm Abrdn, indicated that it may be impossible for the Bank of England to reduce inflation without inducing a recession in the process. Karen Ward, chief market strategist EMEA at JP Morgan Asset Management and a member of Chancellor Hunt’s economic advisory team, expressed support for such a move, suggesting that the Bank of England had to create a recession in order to prevent the emerging wage-price spiral from increasing inflation beyond control. Jagjit Chadha (National Institute of Economic and Social Research) has also stated that there is a “strong possibility of monetary policy having to induce a recession to attain price stability” if the UK is to avoid persistent inflation (Chadha 2023). The government has also expressed its support for the Bank of England’s tough stance on inflation, with Chancellor Hunt stating that he is comfortable with Britain being plunged into recession if that's what it takes to bring down inflation (Conway 2023).

UK money markets predict the UK will do what it takes to rein in inflation and that interest rates will reach 6% by February 2024. Schroders’ analysis yielded a similar forecast, predicting interest rates to peak at 6.5% by the end of 2023 (Zangana 2023). Analysis by Bloomberg Economics suggests that Britain could tip into a shallow recession if investor expectations would come to fruition (Atkinson, 2023). Market predictions imply roughly even odds that interest rates will remain at 6% or decline by roughly 0.25 percentage points in the first half of 2024.

The July 2023 CfM-CEPR survey asked the members of its panel to predict whether bringing inflation down to its 2% target will require a recession and whether a recession is a price worth paying for the Bank of England to achieve its target. The survey contained two questions. The first asked the panellists if inflation could be brought down to its 2% target by the end of 2024 without generating a recession in the next 18 months. The second asked them to comment on whether the Bank of England should do whatever it takes (including inducing a mild recession) to combat the current inflationary crisis.

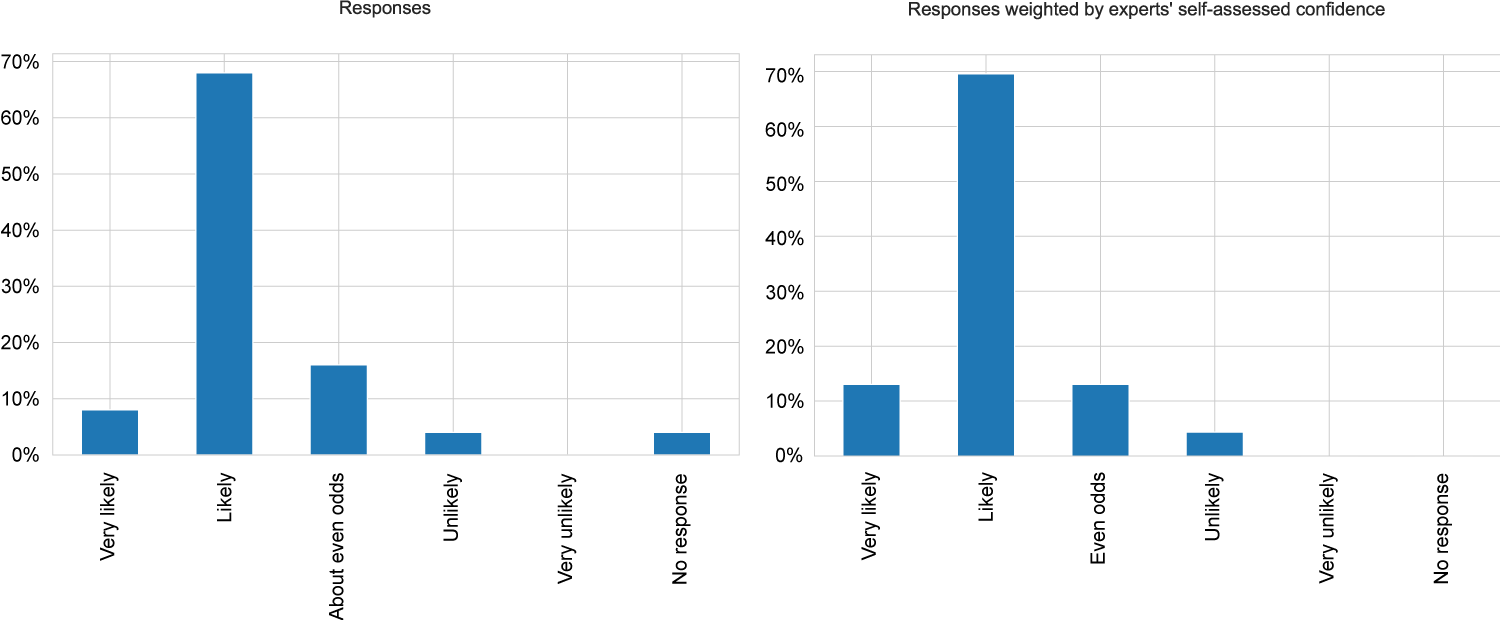

Question 1: How likely is a UK recession in the upcoming 18 months if the Bank of England took actions to bring inflation to its 2% target by the end of 2024?

Twenty-five panel members responded to this question. The majority of the panel (74%) believes that the UK is either likely or very likely to face a recession in the next 18 months as the Bank of England raises interest rates to combat inflation. A minority of 16% of the panel believe the odds of a recession are about 50% and only a single panellist believes that a recession is unlikely.

Around three-quarters of the panel expect the UK to suffer a recession in the short/medium term as the Bank of England struggles to tackle high inflation rates. Jumana Saleheen (Vanguard Asset Management) summarises this view: “My view is [that] additional rate rises will finally push the real interest rate into positive territory. That will tip the UK into a mild recession at some point over the next 18 months.” Patrick Minford (Cardiff Business School) expresses similar sentiments, stating that there are “long and fairly unpredictable lags in the response of annual inflation to this extreme tightening [by the Bank]” which suggests that there is a “serious danger of overkill.” However, unless the Bank of England chooses to increase interest rates further (which he deems as unnecessary), he argues that a recession can be avoided.

Lukasz Rachel (University College London) offers an alternate explanation for the UK’s impending recession, claiming that with “trend growth so close to zero, even relatively small changes in growth rates can push the economy into a technical recession.” Martin Ellison (University of Oxford) goes one step further and suggests that “a recession is likely irrespective of what monetary policy does” as the UK’s near-zero growth rate could result in a simple measurement error tipping the UK economy into a recession. He warns that declaring a recession using arbitrary definitions (such as media outlets declaring a recession after two consecutive quarters of negative GDP growth) could have further negative implications for the economy, as explained in Eggers et al. (2021).

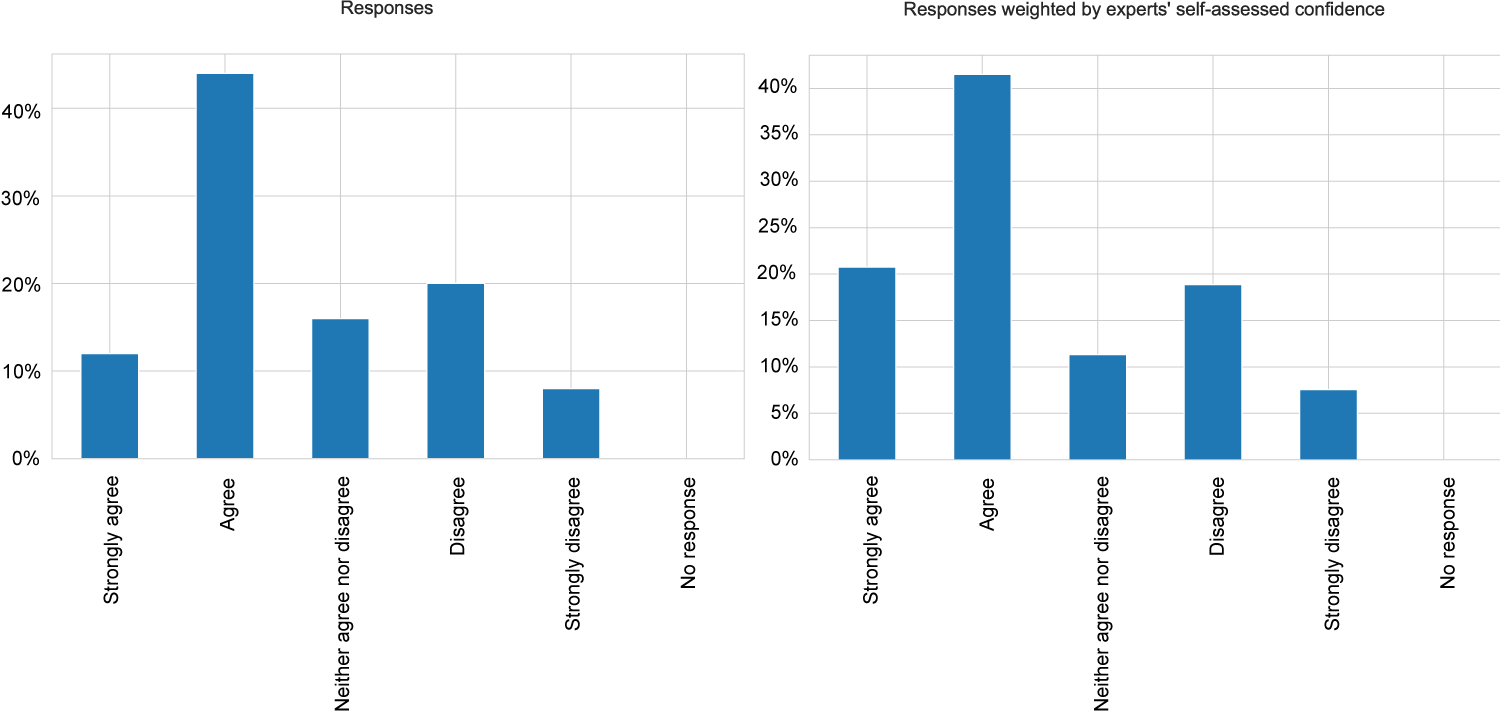

Question 2: How strongly do you (dis-)agree with the following statement? “The Bank of England should do what it takes to bring inflation down to 2% by the end of 2024, even if this leads to a mild recession.”

Twenty-five panel members responded to this question. A majority of the panel (56%) thinks that the Bank of England should continue its rate hikes to reduce inflation, even if this leads to a recession. A smaller portion of the panel (28%) believes that further monetary tightening would do more harm than good. The remainder of the panel (14%) is ambivalent on the issue of whether the Bank of England should do whatever it takes to bring inflation under control, even if it means inducing a recession.

Most panellists believe that bringing inflation down to the 2% target should be the Bank of England’s highest priority, even if it requires suffering through a few quarters of negative growth to achieve this objective. Ethan Ilzetzki (London School of Economics and Political Science) sums up this argument: “The Bank has a clear mandate [to reduce inflation]. The government can and should take fiscal actions (even without increasing deficits) that would mitigate the effects of higher interest rates on the most vulnerable.” Morten Ravn (University College London) stresses the importance of “anchor[ing] inflation expectations given the experiences over the last couple of years” and argues that the Bank must reduce inflation to “re-establish monetary credibility.” Nick Oulton (London School of Economics and Political Science) further adds that the Bank “risks a complete loss of credibility” if it fails to fulfil its mandate of curbing inflation “just when the going gets tough.”

Several panel members are apprehensive about the prospect of further rate hikes. Costas Milas (University of Liverpool) suggests that interest rate hikes may be the “wrong medicine” in the current context as estimates of standard macroeconomic models suggest that excess demand pressures add little to UK inflation. Patrick Minford echoes these views, stating that “the Bank needs to stop raising rates and let the tightness work through to inflation at its own pace.”

Jagjit Chadha (National Institute of Economic and Social Research) insists that further hikes would be unbearable as “many households will already be facing material falls in their standards of living, ” making further hikes unbearable. He argues that “at their current rates, inflation will fall” and as such, “policy would be better designed at containing demand in line with growth in incomes, rather than trying to engineer a faster disinflation.” Similar arguments are also put forth by James Smith (Resolution Foundation), who suggests that the “MPC has the leeway to bring inflation back to target more slowly, allowing it to avoid real-economy volatility,” which would ease the burden on households. Wouter den Haan (London School of Economics) suggests that the cost of reducing inflation by inducing a recession would be too high to justify, stating: “What matters are long-run inflation expectations and the credibility of the institution. Not actual inflation even if it lasts a couple years.”

References

Atkinson, A (2023), “BOE Set to Tip UK Into Recession by Year End, Economists Say”, Bloomberg.com, 27 June.

BCC – British Chambers of Commerce (2023), “BCC Economic Forecast: Upgrade to GDP but UK economy flatlining”, 8 June.

CBI – Confederation of British Industry (2023), “UK economy set to grow and business investment to rise following brush with recession – CBI Economic Forecast”, 12 June.

Chadha, J S (2023), “The Bank of England Needs to Improve its Communication on Inflation”, NIESR, 31 May.

Conway, E (2023), “Chancellor comfortable with recession if it brings down inflation”, Sky News, 26 May.

Eggers, A C, M Ellison and S S Lee (2021), “The economic impact of recession announcements”, Journal of Monetary Economics 120: 40-52.

IMF – International Monetary Fund (2023), “United Kingdom: Staff Concluding Statement of the 2023 Article IV Mission”, 22 May.

KPMG (2023), “UK economic update”, June.

Zangana, A (2023), “UK should brace for 6.5% interest rates: here’s why we’ve raised our forecast”, Schroders, 28 June.