Climate change is rapidly being recognised as a potential source of financial risk by regulators and supervisors (Claessens et al. 2022, FSB 2022, ESRB 2021a, 2022, ECB 2021a, BIS 2021a, 2021b).

Climate-related financial risks have two main dimensions. The first is physical risks: these stem from extreme weather (storms, floods, droughts, heatwaves etc.) or changes in climate patterns that affect firms, households and their physical assets, increasing their probability of default.

The second dimension is transition risk. This stems from the need to shift to a low-carbon economy (Pisu et al. 2022), causing some activities to be reduced or abandoned and leading the corresponding assets to lose value and become ‘stranded’.

The importance of addressing transition-related financial risk

These risks are of particular importance for bank supervisors and regulators as some financial institutions could be particularly exposed to affected geographies or economic sectors, and depending which financial institutions get in trouble, the consequences could be potentially systemic. Moreover, we argue that investors, being forward-looking, could anticipate transition dynamics and start shedding high-carbon financial assets already before the underlying physical assets become stranded. Recent research shows that so far, banks have been undervaluing stranded assets risks by continuing to finance fossil fuel firms (Ongena et al. 2021) while restricting credit to green innovators (Roukny et el. 2022), but this may not last forever.

Over the last few years, proposals have been put forth regarding policy options to reflect climate-related prudential considerations in bank capital requirements. An increasing number of papers have tried to assess the impacts of these measures on banks and financial stability. Thoma and Gibhardt (2019) compare the effects of a ‘green supporting factor’ versus a ‘brown penalising factor’, concluding that the latter seems more effective in restricting capital to environmentally harmful activities. Dunz et al. (2021) find that the former would support green investment only in the short term and potentially increase risks for financial stability, while Diluiso et al. (2021) argue that the introduction of climate-related buffers may greatly reduce the severity of financial shock to fossil fuel-related assets (at the cost of a slower recovery). To our knowledge, until now there have been no studies estimating bank-specific capital add-ons to address climate change transition risk, which is the focus of our recent paper (Alessi et al. 2022).

Following these premises, we explore the potential impact of transition risk on banks’ balance sheets and estimate the additional bank-specific capital add-on that would effectively protect banks from the materialisation of transition-related financial risk. Building on relevant literature and using publicly available data on bank balance sheets and exposures, we build a data set of climate-transition risks at the individual bank level for a large sample of European banks.

We then proceed to analyse the potential impact of transition risk by using a simulation model to generate counterfactual scenarios for the realisation of transition risks with and without capital adjustments.

In the first simulation, we analyse the additional negative impacts of transition risk in terms of aggregate bank losses in the case of a large financial crisis originating in a macroeconomic shock. In a second set of simulations, we study the case of a crisis that is triggered by climate transition risk. In particular, we develop a fire-sale model, where defaults in a small number of banks particularly exposed to transition risk are assumed to trigger a sell-off of high-carbon assets by other institutions in an otherwise business-as-usual scenario. Finally, we calibrate the additional capital that would prevent the default of the small number of highly-exposed banks and hence the assumed start of a fire sale of carbon-intensive assets, both under current bank balance sheets and also assuming greener balance sheets.

Transition risk might push a limited number of highly-exposed banks into default

In order to build our data set, we use individual balance sheet data from Moody’s Analytics Bankfocus for 462 banks located in the EU, accounting for about 89% of all assets in the EU banking system. To obtain the shares of equity, bonds, mortgages and corporate loans exposed to climate risk, we resort to country-level statistics from the ECB on the shares of loans to households and non-financial corporates, as well as on the sectoral disaggregation of the banks’ counterparts. We then couple these data with estimates of shares of high-carbon activities by sector from Alessi and Battiston (2022). We finally adjust the calculation of risk-weighted-assets (RWA) by assuming, in line with existing studies, an increased riskiness of 15% for mortgages financing energy-inefficient buildings and an increased riskiness of 25% for assets financing high-carbon and fossil-fuel-related activities (e.g. Chamberlin and Evain 2021).

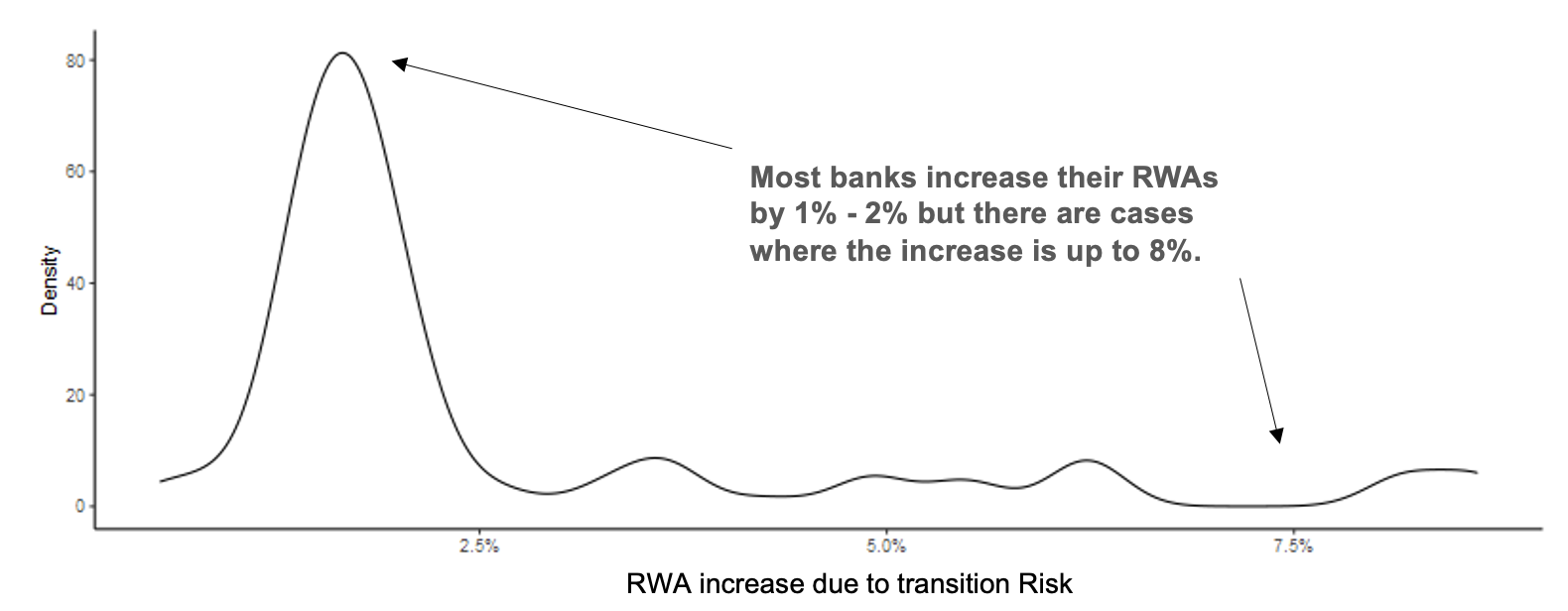

Based on these calculations, banks do not seem to be, on average, highly exposed to transition-related financial risk, with RWA increasing in the vast majority of banks by only 1%-2% for most of the banks (see Figure 1). The distribution of risk is, however, very skewed, with RWA increasing in a small number of banks up to 8%.

Figure 1 Distribution of increases in RWA due to exposure to transition risk

We use a simulation model to calculate the losses of the banking sector in case of a financial crisis triggered by a recession, both with and without the additional risk due to climate and in the absence of any climate-related adjustment to capital. We find that losses in the EU would increase by up to 8% in case of a financial crisis where transition risks also materialise, leading to a larger number of bank failures. This result is admittedly not breathtaking, as in the case of a banking crisis due to a recession, the problem is the recession, not climate risk. However, we also find that climate-related financial losses are highly concentrated, with some banks showing higher losses by over 20%.

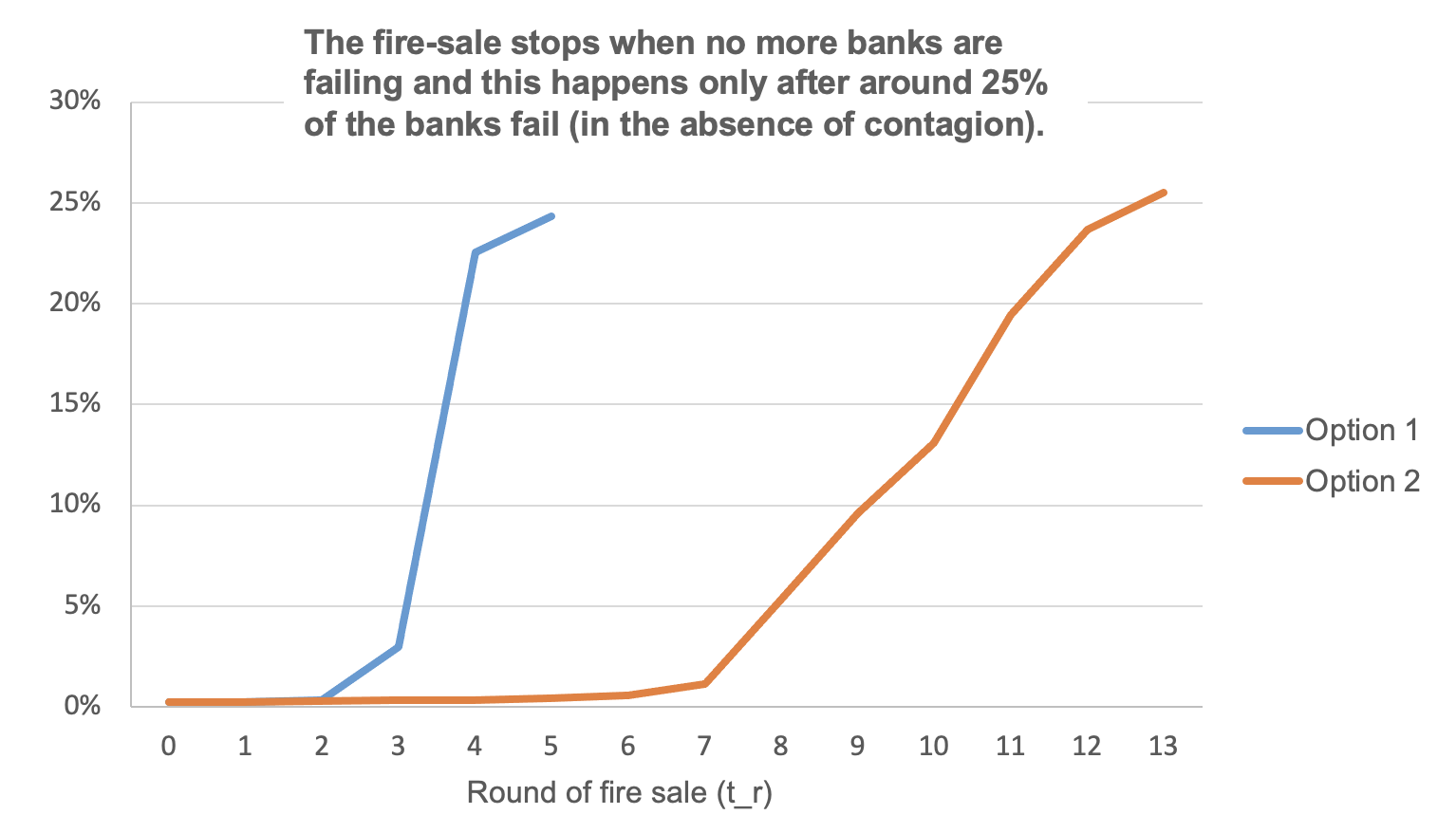

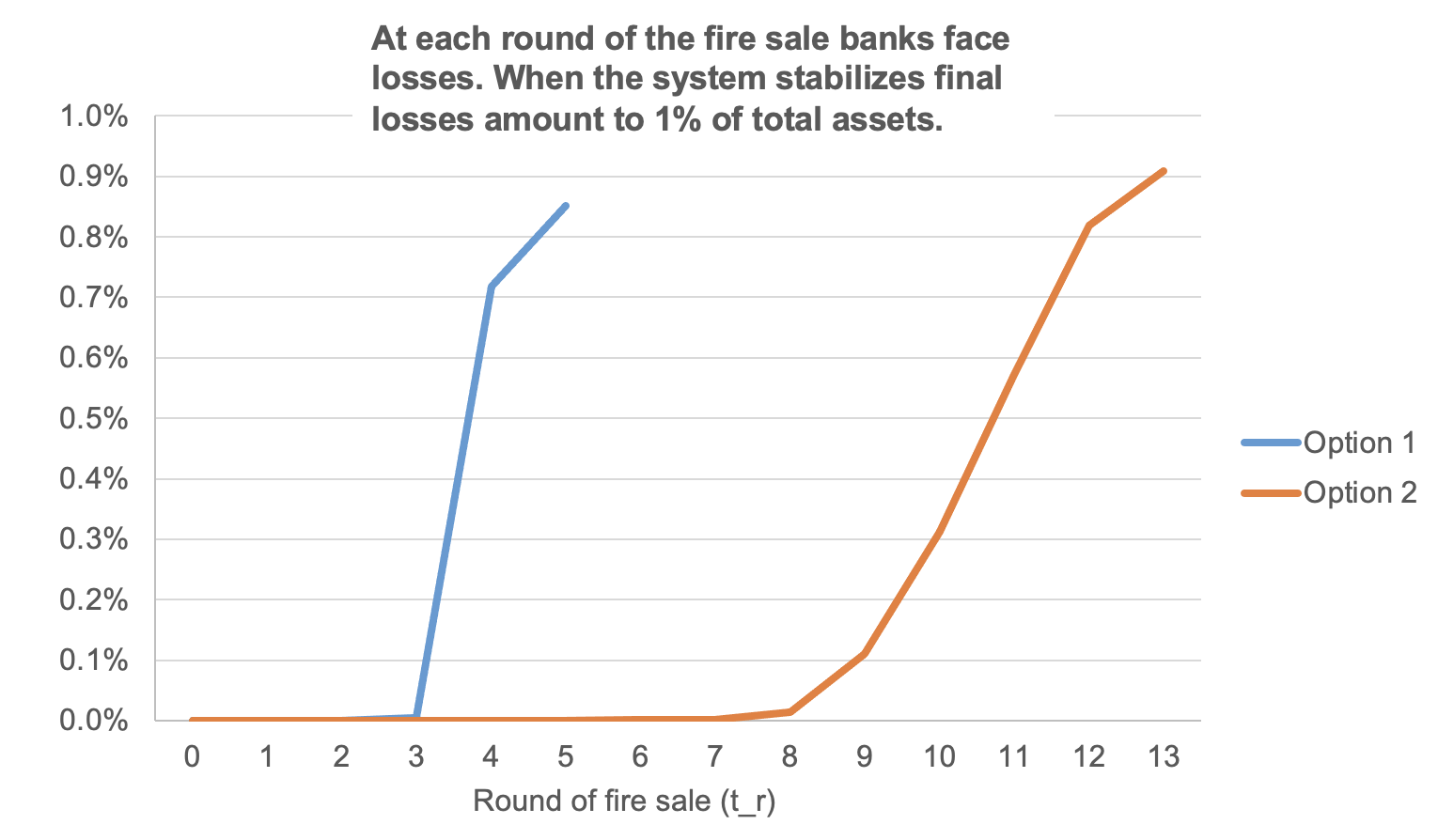

In a second exercise, we investigate what could happen if transition risks materialise in a business-as-usual scenario. We estimate that losses due to unaccounted transition risks could be sufficient to push a limited number of banks into default also in non-crisis times. We furthermore assume that these transition-risk-related defaults subsequently trigger panic in the market with a sell-off of high-carbon assets, which would initially only result in a very limited reduction in their value. However, we calculate that a 0.3% depreciation involving high-carbon assets would be enough to cause additional bank defaults. At this point, a fire sale of high-carbon assets is assumed to start, with additional rounds of depreciations and defaults. No matter the particular underlying functional forms and parametrisations in our simulations, once the negative spiral stops, the losses for the banking system due to banks’ defaults amount to around 1% of total assets, which is comparable to the losses recorded with the global financial crisis (see Figure 2). Of course, this is an extreme and stylised outcome that would, in reality, never occur under these conditions, as we have regulations and policy frameworks in place that would be enacted to avoid the failures of individual banks would turn into systemic events.

Figure 2 Evolution of fire-sale in terms of cumulative share of banks at default (top panel) and cumulative share of bank losses as a share of TA (bottom panel) under two alternative depreciation paths

However, the results of this stylised model show that transition-related financial risk is material for European banks, in line with the results from climate stress tests, analyses and exercises carried out by other European Institutions. In particular, we also find that risks are highly concentrated in a fraction of banks highly exposed to particular economic sectors (ECB 2021b, EBA 2021), that large banks are also exposed to some extent (ECB 2022), and that climate risks could spread throughout the financial system (ESRB 2021b). With respect to the magnitude of estimated losses, the analysis presented in this column assumes the most severe scenario among all existing exercises, as it assumes second-round effects and financial system-wide amplifiers, and it admits potential bank defaults.

Conclusions

Our model-based stress test exercise finds that transition risk could be the trigger of a financial crisis by illustrating that its materialisation could give rise to the failure of a small set of banks and a subsequent systemic crisis when these are assumed to trigger a broad-based sell-off of fossil-fuel-related assets. We calculate that transitions-related financial risks associated with high-carbon assets in banks’ portfolios could lead to substantial losses for most exposed banks and, under some assumptions, trigger a systemic event, in particular, if the markets panic and start a fire-sale of high-carbon assets.

To increase the resilience of the financial system, a bank-specific additional capital add-on is estimated to be effective in ensuring that no bank defaults due to transition risks, which in turn avoids the subsequent broad-based sell-off of fossil-fuel-related assets. Under the current exposures, the additional capital add-on would be zero or negligible for most EU banks. Still, a small number of banks that are highly exposed to transition risk would need up to 4.5% of RWA of additional capital. We also find that the system would become safer as exposures to high-carbon assets are reduced, in particular where they are more concentrated.

Authors’ note: The views expressed are purely those of the author and may not in any circumstances be regarded as stating an official position of the European Commission.

References

Alessi, L and S Battiston (2022), “Two sides of the same coin: Green Taxonomy alignment versus transition risk in financial portfolios”, International Review of Financial Analysis 84102319.

Alessi, L, F E Di Girolamo, A Pagano and M Petracco Giudici (2022), “Accounting for climate transition risk in banks’ capital requirements”, JRC Working papers in Economics and finance, 2022/8.

BIS – Bank for International Settlements (2021a), Climate-related financial risks – measurement methodologies.

BIS (2021b), Climate-related risk drivers and their transmission channels.

Chamberlin, B and J Evain (2021), “Indexing capital requirements on climate: What impacts can be expected?”, Institute for Climate Economics, Climate Report, 40(3):123–141.

Claessens, S, N Tarashev and C Borio (2022), “Finance and climate change risk: Managing expectations”, VoxEU.org, 7 June.

Diluiso F, B Annicchiarico, M Kalkuhl and J Minx (2021), "Climate actions and macro-financial stability: The role of central banks”, Journal of Environmental Economics and Management 110: 102548.

Dunz N., Naqvi A. and Monasterolo I. (2021), “Climate transition risk, climate sentiments, and financial stability in a stock-flow consistent model”, Journal of Financial Stability 54: 100872.

EBA – European Banking Authority (2021), Mapping climate risk: Main findings from the EU-wide pilot exercise.

ECB – European Central Bank (2021b), The challenge of capturing climate risks in the banking regulatory framework: is there a need for a macro prudential response?

ECB (2021b), ECB economy-wide climate stress.

ECB (2022), 2022 climate risk stress.

European Commission (2018), "Action plan: Financing sustainable growth", Communication from the Commission to the European Parliament, the European Council, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the regions.

ESRB – European Systemic Risk Board (2022), Review of the EU Macroprudential Framework for the Banking Sector, European System of Financial Supervision.

ESRB (2021a), Climate-related risk and financial stability, ECB/ESRB Project Team on climate risk monitoring.

ESRB (2021b), The macroprudential challenge of climate change, ECB/ESRB Project Team on climate risk monitoring.

FSB – Financial Stability Board (2022), Supervisory and Regulatory Approaches to Climate-related Risks.

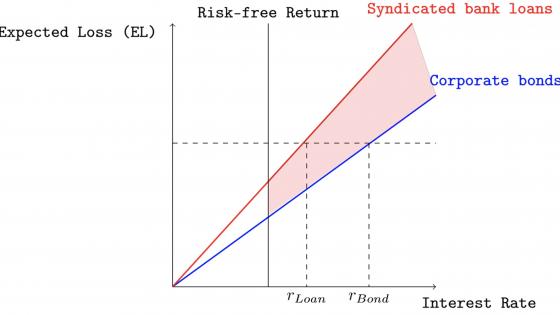

Ongena, S, K De Greiff, M Delis and W Beyene (2021), “Too-big-to-strand? Bond versus bank financing in the transition to a low carbon economy”, VoxEU.org, 4 December.

Pisu, M, A Johansson, I Levin and F M D’Arcangelo (2022), “A framework to decarbonise the economy”, VoxEU.org, 14 February.

Roukny, T, J Tielens and H Degryse (2022), “Asset overhang and technological change”, VoxEU.org, 24 August.

Thoma, J and K Gibhardt (2019), “Quantifying the potential impact of a green supporting factor or brown penalty on european banks and lending”, Journal of Financial Regulation and Compliance 27(3): 380-394.