The past few years have witnessed a significant rise in economic uncertainty amid global developments such as the Covid-19 pandemic, trade tensions among major economies, and military conflicts (Bloom et al. 2022). Whereas the pathways through which economic uncertainty influences the behaviour of economic agents and policy are well understood (Bloom 2014, Husted et al. 2020), less emphasis has been placed on how financial intermediaries shape the effects of uncertainty on the economy (Buch et al. 2023). The question of how bank credit provision responds to uncertainty is particularly relevant when uncertainty shocks affect only certain sectors of the economy, as banks can transmit such shocks to other sectors and impact the broader economy.

To explore this question, in a recent paper (Correa et al. 2023), we exploit the US credit register and the 2018-2019 trade tensions to study the impact of trade uncertainty on US domestic credit supply. We ask the following questions: What is the effect of a sudden and sustained increase in trade uncertainty on the supply of bank loans? What are the mechanisms by which trade uncertainty shapes banks’ lending decisions? How are the investment activities of bank-dependent borrowers affected by uncertainty?

Uncertainty and economic outcomes

The study of uncertainty and its consequences for economic decisions is not new. A large literature links uncertainty to firm investment and hiring decisions through the so-called ‘real options’ channel (Pindyck 1991). Real options theory advances that uncertainty leads firms to postpone irreversible lumpy investment in machinery, equipment, or physical structures. Additionally, uncertainty is often associated with higher borrowing costs as lenders become more reluctant to lend and require higher compensation for taking risk. In the presence of financial frictions, uncertainty shocks can have material aggregate economic effects (Caldara et al. 2016).

Whereas this literature sheds light on the effects of uncertainty on firms and households, only a handful of studies examine its influence on the banking sector. Indeed, some of the channels that are important for firms may also apply to banks. As aggregate uncertainty increases, banks may adopt ‘wait and see’ attitudes and become more cautious in the allocation of their capital, especially if they are worried about balance sheet losses. They may increase the rejection rate on loan applications and take longer to disburse funds (Alessandri and Bottero 2020), or they may adjust the terms of existing loan contracts. Some banks may internalise the disruptions in their core borrowers’ activities caused by uncertainty and continue lending to them. Uncertainty shocks can also have a bright side insofar as they generate new business opportunities to which banks may respond with more credit.

Studying how uncertainty influences bank lending is important as the impact of uncertainty may differ relative to the effect of first-moment shocks. Such shocks may include economic, financial, or policy events that affect realised and expected returns to lending. Uncertainty can affect economic decisions by increasing the dispersion of returns to lending (a second-moment effect) and raising the prospect of future balance sheet gains or losses without those gains or losses ever materialising.

Rising trade uncertainty and banks

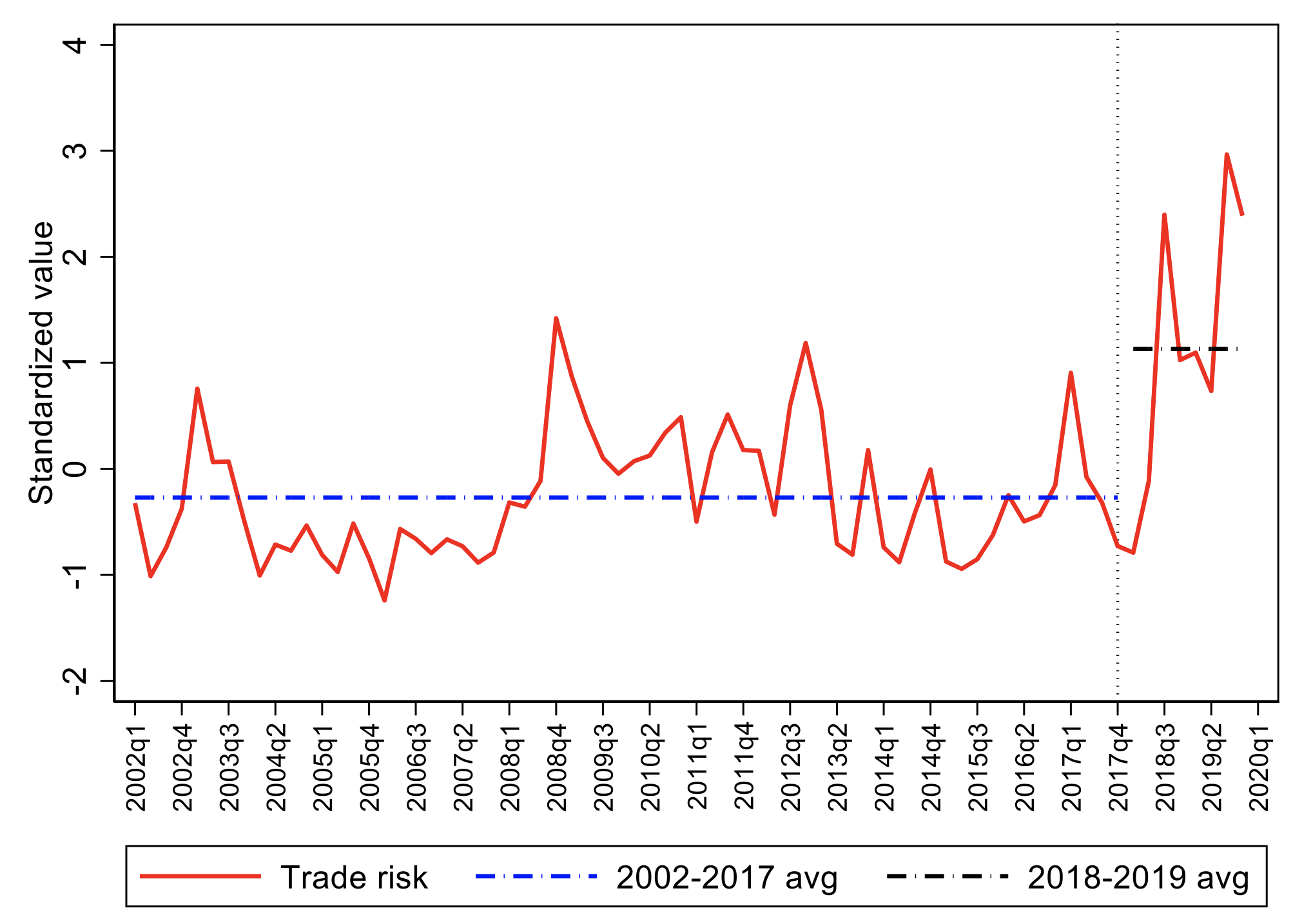

In recent years, trade uncertainty has been a significant driver of overall global uncertainty amid rising trade tensions between China and the US and the renegotiation of standing trade agreements (Bloom et al. 2019). In Figure 1, we plot a trade uncertainty index based on the mentions of words related to trade uncertainty in earnings calls of US listed firms. According to this index, trade uncertainty was relatively low between 2002 and 2007, but started rising and became more volatile after 2008, and in 2018 and 2019, this index spiked to levels not seen since the beginning of its measurement in 2002.

Figure 1 Trade uncertainty index, 2002-2019

Notes: The chart plots the standardised value of the trade uncertainty (risk) index, a topic-specific risk index from Hassan et al. (2019). This index is based on the frequency of mentions of synonyms for trade-related risk or uncertainty in earnings calls transcripts of US publicly listed firms, normalised by transcript length. The quarterly index represents the average of the firm-level indexes across US firms. The figure also plots the average of the index over 2002-2017 and 2018-2019.

Source: Authors’ calculations using data from Hassan et al. (2019) and https://www.firmlevelrisk.com/.

This spike in trade uncertainty is in part attributed to the sudden changes in US trade policy vis-à-vis its major trading partners, including China. Starting in February 2018, trade tariffs on a wide variety of products, mostly intermediate inputs and capital goods, were announced and enacted in several waves. Given these developments, we designate 2018-2019 as a period of ‘high trade uncertainty’ and examine the lending decisions of US banks in this period compared to 2016-2017.

Trade uncertainty reduces bank lending and firm investment

We empirically investigate the effects of trade uncertainty on bank lending using data on the individual bank loans to nonfinancial firms. We classify firms and banks into ‘high-uncertainty firms’ and ‘exposed banks’ depending on their exposure to trade uncertainty. High-uncertainty firms are those firms in industrial sectors that experience a large increase in trade uncertainty between 2016-2017 and 2018-2019. Such sectors include textile and textile product mills, transit/ground/rail transportation, primary metals, and machinery manufacturing. By contrast, ‘low-uncertainty firms’ are those firms in sectors that experienced either a small increase in uncertainty or a decrease in uncertainty. Exposed banks are those banks with large loan exposure to sectors affected by trade uncertainty.

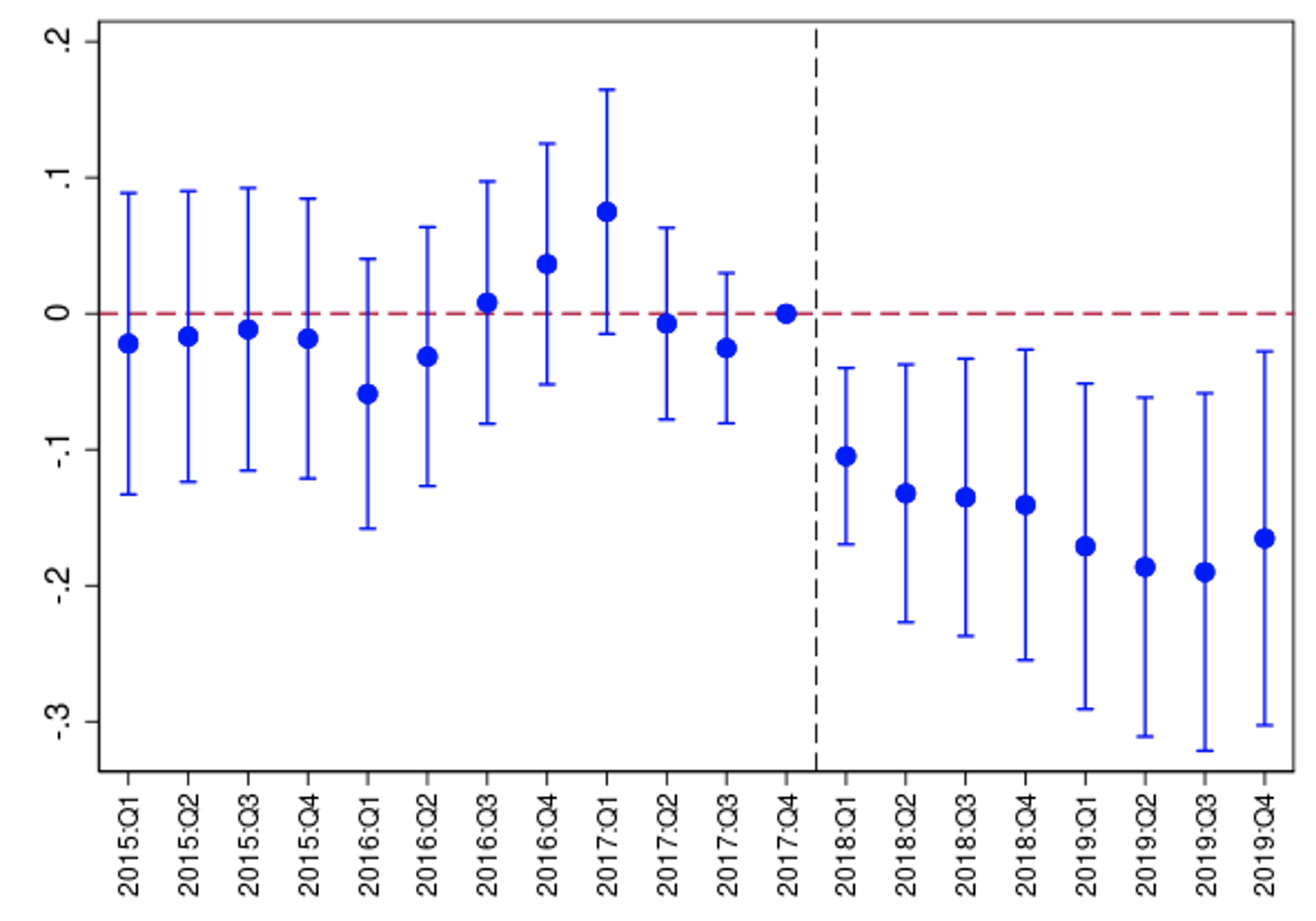

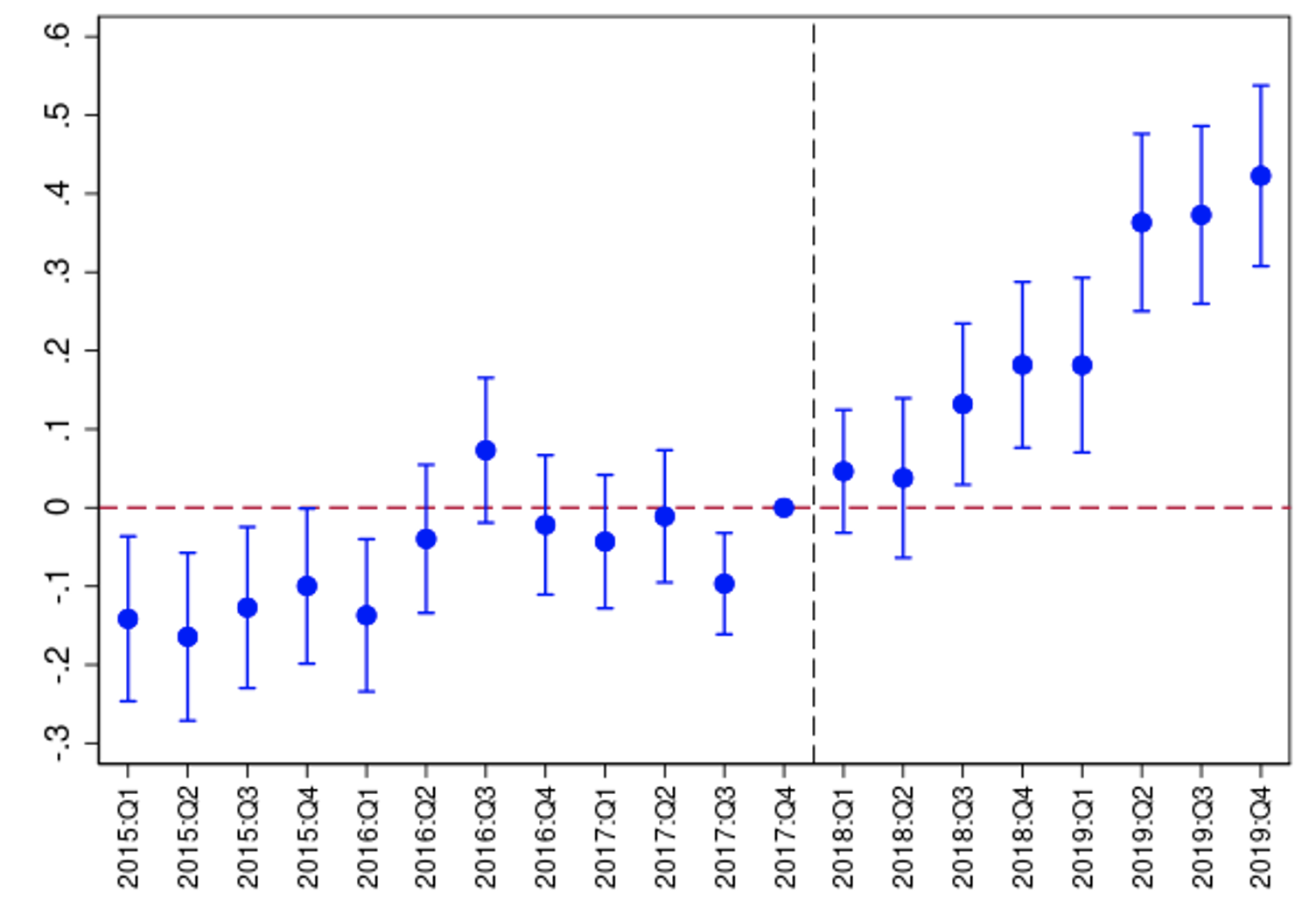

Our main results are as follows. First, we find that exposed banks cut bank lending to both high and low-uncertainty firms. The lending pullback manifests itself in depressed loan growth rates and higher loan spreads, pointing to a loan supply behaviour offsetting concurrent changes in loan demand. Thus, developments originating in certain sectors of the economy have adverse spillover effects on bank credit supply to other sectors of the economy. The effect of trade uncertainty on loan outcomes is shown in Figure 2, which depicts the time-evolution of differential effects in loan outcomes between exposed and nonexposed banks pre/post the period of high trade uncertainty.

Figure 2 Differential effects in loan outcomes vis-à-vis low-uncertainty firms

Panel A) Loan growth

Panel B) Loan spreads

Notes: This figure shows the effects of bank exposure to trade uncertainty on loan growth (panel A) and loan spreads (panel B) for low-uncertainty firms during 2015-2019. The charts plot the estimated difference-in-differences coefficients and the associated 99% confidence levels of our main empirical specification that interacts bank exposure to trade uncertainty with quarterly dummies and controls for bank size (log-total assets), capital (common equity/total assets), deposits (core deposits/liabilities), and bank specialisation, both in level and in interaction with 2018-2019 dummy.

Source: Correa et al. (2023).

Our second main result explores two potential mechanisms: ‘real options’ theory and financial constraints at banks that could limit their desire to lend. We find that both channels are at work. Exposed banks originate fewer new loans, reduce the maturity of their existing loans, grant more on-demand loans (which can be called back anytime), and revise up their assessments of default probabilities for individual borrowers. These behaviours are consistent with the ‘wait and see’ strategy nonfinancial firms adopt when making investment decisions under uncertainty.

Furthermore, exposed banks with lower capital buffers curtail lending by more than other banks, consistent with the presence of financial constraints. Nevertheless, this episode of trade uncertainty occurred against the backdrop of a well-capitalised banking system following the strengthening of bank capital regulation after the Global Crisis (GFC). To gauge the beneficial effect of sustaining the uncertainty shock with historically high capital levels, we can compare the loan growth of an exposed bank with a capital ratio of 8.5% (representative of pre-global crisis capital ratios) to a similar bank with a capital ratio of 11.6% (representative of pre-trade tensions capital ratios). This calculation indicates that differences in capital ratios would result in a seven percentage point lower loan growth rate for banks capitalised at pre-global crisis levels for the same trade uncertainty shock.

The third main result is that the contraction in bank loan supply matters for nonfinancial firms, especially for those firms with limited alternatives for external financing. Firms with more material lending relations with exposed banks have lower debt growth and investment in the years of high trade uncertainty. This effect is stronger for smaller and opaque privately held firms and for firms that are more reliant on bank debt.

Conclusions

Understanding how uncertainty shapes the flow of bank credit in a world facing increasing risks from trade fragmentation is critical for the design of appropriate policy responses. Our paper shows that banks retrench from lending across all sectors of the economy when uncertainty rises in a particular sector, with negative effects for bank-dependent firms. The financial sector therefore amplifies the uncertainty shock and transmits it back to the real economy. We also show that capital buffers mitigate the effects of uncertainty shocks on lending. Importantly, our findings emphasise that a complete accounting of the macroeconomic effects of trade disputes and other de-globalising events should consider the endogenous contractionary responses of the financial sector.

Authors’ note: The views expressed herein are those of the authors and do not necessarily represent those of the Federal Reserve Bank of New York, Federal Reserve Bank of Atlanta, the Board of Governors of the Federal Reserve, or the Federal Reserve System.

References

Alessandri, P and M Bottero (2020), “Bank lending in uncertain times”, European Economic Review 128.

Bloom, N (2014), “Fluctuations in uncertainty”, Journal of Economic Perspectives 28(2): 153-176.

Bloom, N, D Furceri and H Ahir (2019), “Caution: Trade uncertainty is rising and can harm the global economy”, VoxEU.org, 4 July.

Bloom, N, D Furceri, and H Ahir (2022), “Tracking uncertainty in a rapidly changing global economic outlook”, VoxEU.org, 17 December.

Buch, C, L S Goldberg and B Imbierowicz (2023), “Trade fragmentation matters for bank credit supply: New evidence from the International Banking Research Network”, VoxEU.org, 8 May.

Caldara, D, C Fuentes-Albero, S Gilchrist and E Zakrajšek (2016), “The macroeconomic impact of financial and uncertainty shocks”, European Economic Review 88: 185-207.

Correa, R, J di Giovanni, L S Goldberg and C Minoiu (2023), “Trade Uncertainty and U.S. Bank Lending”, CEPR Discussion Paper No. 18631.

Hassan, T A, S Hollander, L van Lent and A Tahoun (2019), “Firm-Level Political Risk: Measurement and Effects”, The Quarterly Journal of Economics 134(4): 2135-2202.

Husted, L, J Rogers and B Sun (2020), “Monetary policy uncertainty”, Journal of Monetary Economics 115: 20-36.

Pindyck, R S (1991), “Irreversibility, uncertainty, and investment”, Journal of Economic Literature 29(3): 1110-1148.