In recent decades, there has been a growing appreciation among policymakers that communication is a useful tool for managing expectations. Forward guidance is now an established part of the monetary policy toolkit (Reichlin et al. 2021). Central banks have become more transparent, communicating more frequently and in different formats. Central banks also evaluate their own communications (Phelan et al. 2022). It remains an open question, however, what an optimal central bank communication strategy would look like (Blinder et al. 2008). A broader question relates to what, if anything, a central bank knows that informed market participants do not. If central banks have an information advantage, what is the nature of it?

A burgeoning literature (e.g. Gürkaynak et al. 2005) uses high-frequency movements in the prices of financial assets around monetary policy communication events to show that central banks can influence market expectations. This evidence shows that markets must have some ‘information deficit’ relative to the central bank – they cannot fully anticipate what the central bank will communicate and so the communication leads them to update their views. It is less clear what in the central bank communication markets find valuable. The central bank may reveal valuable information about the state of the economy (e.g. Nakamura and Steinsson 2018, Altavilla et al. 2019), but as markets also have access to most of the underlying data that central banks have, some are sceptical of this channel (Bauer and Swanson 2022). In many models used for the analysis of monetary policy,

the usefulness of central bank communication is limited to describing the reaction function and any planned deviations from it (often termed ‘forward guidance’).

In reality, central banks communicate about more than their reaction function and any private data they might have (which they often don’t communicate explicitly anyway). In particular, they devote significant time to their assessments of the state of the economy. They often discuss what they believe about the current state, how the economy got to that point, and where they see it going over some future projection period. They discuss how incoming data affect these beliefs and how they might have changed their minds about what the data mean about the economy. While not private information in the strictest sense, these assessments are typically not publicly known until the communication. A recent example comes from the analysis of inflation dynamics during and after the COVID-19 pandemic. Central banks have had to devote a lot of time to describing how their evaluations of the inflation process, and their projections for inflation, were changing in the face of the incoming data.

In our recent paper (Byrne et al. 2023a), we highlight the importance of central bank communication of their economic assessments in explaining market surprises. To do this, we present a monetary policy decision-making framework in which the central bank’s preferences may vary from meeting to meeting (as in McMahon and Munday 2022) but there is also an explicit role for the central bank’s assessment of current conditions.

The assessment function is also time-varying and comprises evaluation of the state based on past data, and projection of the current state to the future. We show through a novel decomposition that when there is a market surprise following a communication event, it can be attributed to updated preferences, a new evaluation or projection, or the release of new private information.

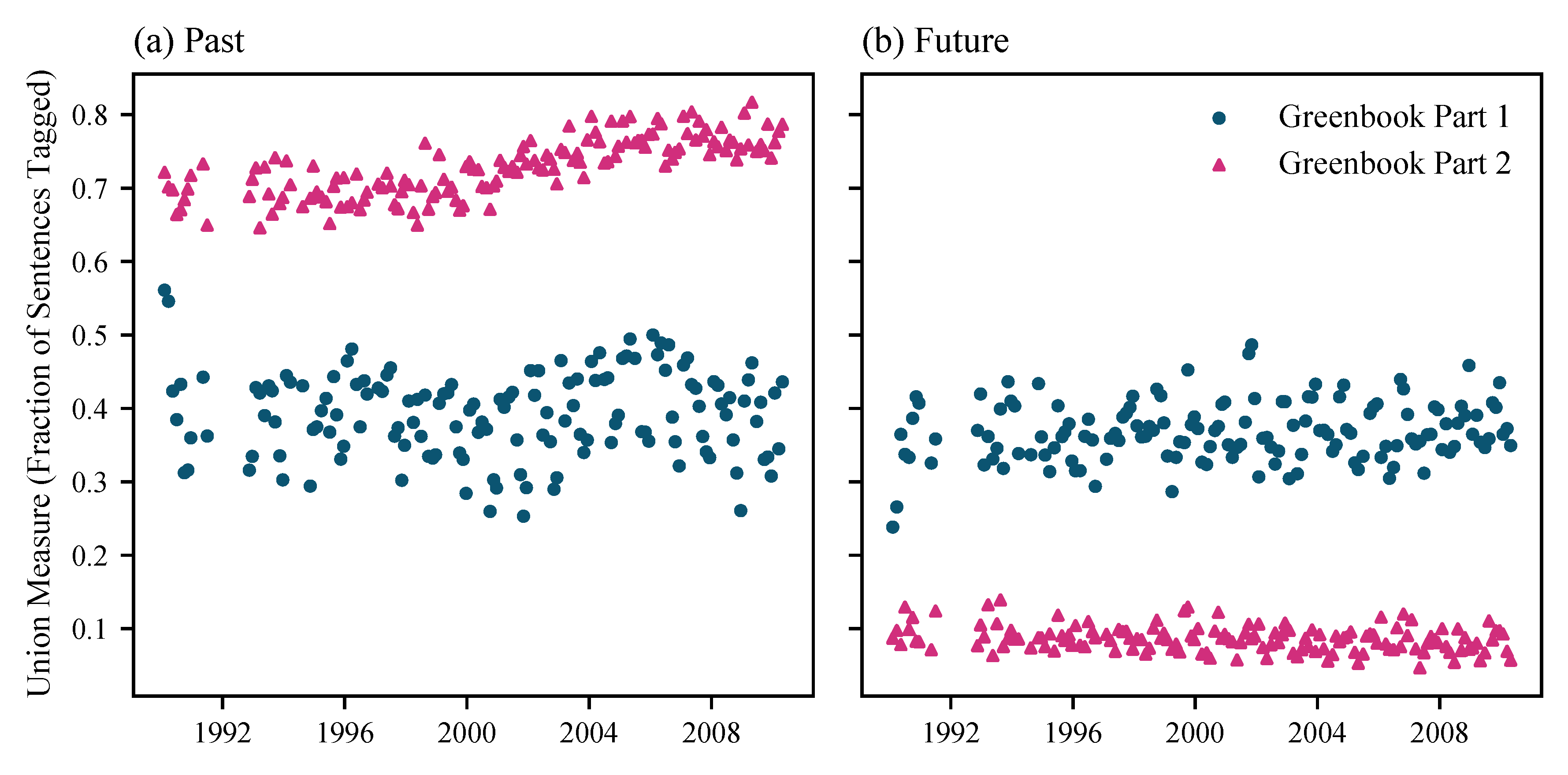

Figure 1 Applying the NLP algorithm to the Fed’s Tealbooks

Notes: The figure shows the output of an algorithm using NLP techniques to analyse numerical and verbal references to time in central bank communication. The algorithm is here applied to the Fed’s Tealbooks (formerly known as Greenbooks) and summarises the shares of the text spent discussing the past or future.

Source: Byrne et al. (2023a).

To explore the role of the different elements of the assessment function, we exploit their differences in the time dimension: one looks backward to understand the current state, one looks forward from there. We show that temporal information in text can be used to distinguish evaluation and projection. To extract temporal information, we use a set of natural language processing (NLP) techniques to develop an algorithm that measures the time dimension of text, whether from the words or numbers within.

Figure 1 shows that our algorithm accurately recovers the time dimension in the Fed Tealbooks, in which Part 1 (“Summary and outlook”) should include a mixture of past/evaluation and future/projection, while Part 2 (“Recent developments”) should be heavily weighted towards the past.

We then apply this algorithm to a large corpus of text from the Fed and the ECB, including their monetary policy statements, speeches, and press conferences. Our econometric strategy is to use these measurements of evaluation and projection to explain market surprises, in the form of high frequency movements in market interest rates and bond yields, around the central bank communication events.

For both the US and euro area, we examine the effects of different types of communication on bond price surprises as a measure of market participants’ updated beliefs. We use a range of maturities and instruments for each area; for example, we use the Eurodollar contracts up to the 10-Year Treasury yield for the US, for the euro area we use the Overnight Index Swap (OIS) rates up to the 10-Year German Bund yield. The surprises are measured at high frequency in a window around the communication event.

Our results show that using the time dimension of text considerably improves our ability to explain surprises compared with what is achievable by controlling for lagged financial data (Bauer and Swanson 2022) or the topic of the text (Hansen et al. 2019). This is true for both Fed and ECB communication and for surprises to both short- and long-term yields. In the paper, we also show this for different kinds of identified monetary policy surprises from the literature. Our evidence shows that central bank communication of past information, which we interpret as related to how they assess the economy, is a meaningful source of market reactions.

To understand the information that contains meaningful information more fully, we turn to the ECB’s press conferences. For over 20 years, journalists have put questions to the president after Governing Council meetings, and it is in their business model to ask questions about which their readers would like more information. Over the same period, there have been over 2,000 speeches by Executive Board members. We can apply additional techniques to the speeches, the president’s introductory statements, and their answers to measure the similarity of each to the questions.

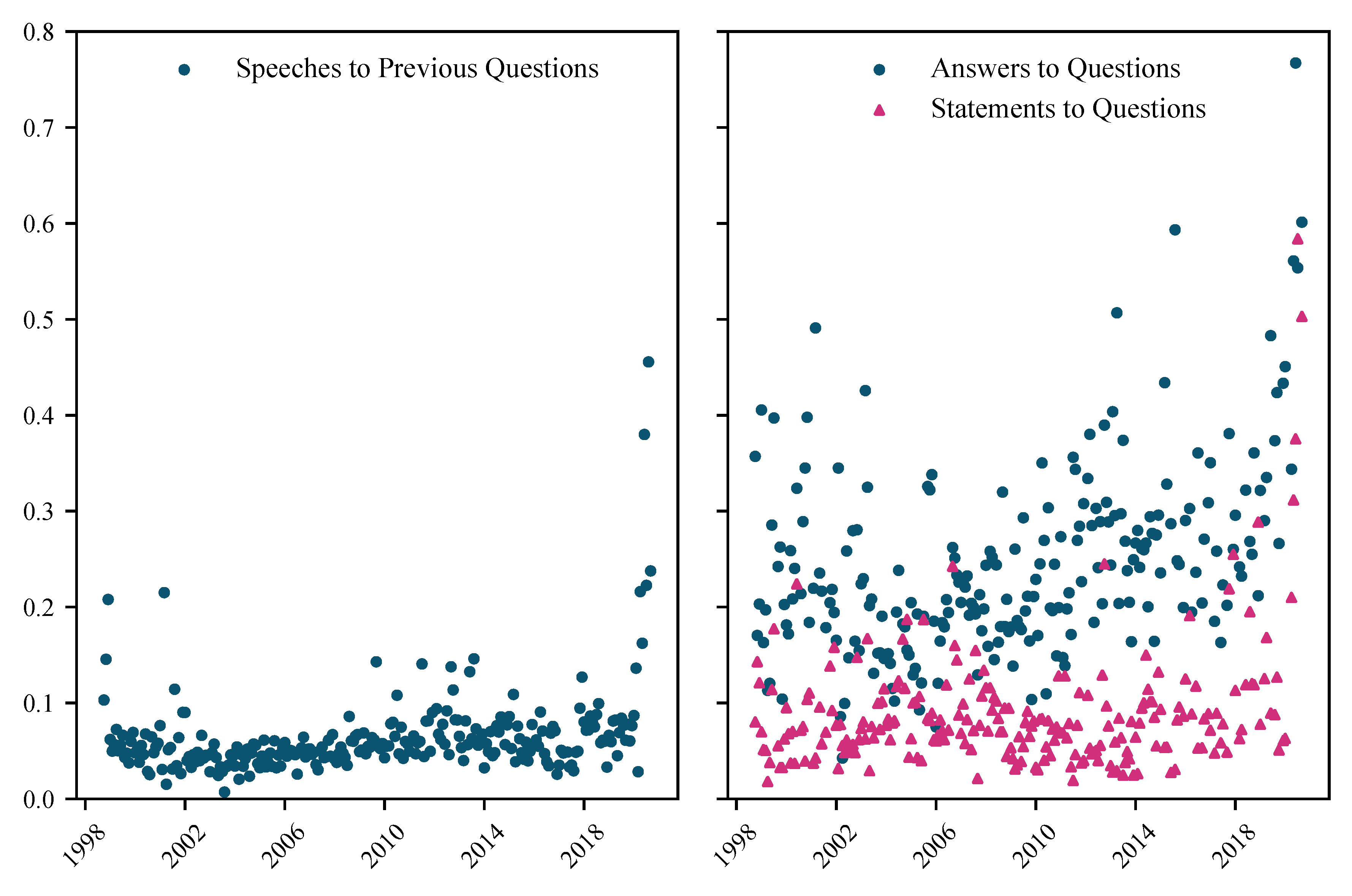

Figure 2 Measuring the similarity of types of ECB communications to journalists’ questions

Notes: The figure shows a measure of textual similarity between journalists’ questions and (i) speeches by ECB Executive Board Members, (ii) the answers the journalists received at the press conference, and (iii) the introductory statement given by the President. Similarity is defined by looking at the terms used, weighted by the TF-IDF score.

Source: Byrne et al. (2023a)

Figure 2 shows the similarity scores over time; the panel on the right shows the similarity between the questions and (i) the preceding statement and (ii) the subsequent answer. The statements are not very similar to the questions; this supports our view that journalists are seeking relevant information that is not already available. Reassuringly, the greatest similarity is with the answers – these should address the topics raised by the journalists.

Figure 2 also shows the similarity score over time between the questions and speeches made in the intermeeting period that follows. Speeches’ similarity scores vary – some speeches are unrelated to the economy or monetary policy and so have little relation to the questions; other speeches, such as those given to the European Parliament, are more similar because they address the topic of the questions.

We hypothesise that speeches should generate greater market reaction when they address the questions, even more so when those questions were not already fully addressed by the president’s answers. Our econometric results support these hypotheses for interest rates of 6-month to 2-year maturity. Finally, we examine the time orientation of journalist questions and find that approximately one third relate to the past. This provides further evidence that the information deficit can relate to the central bank’s assessments of the economy.

An implication of having an important role for communication of evolving economic assessments is that the market will likely always have an information deficit because the mapping from economic data to the perceived state of the economy, to which the central bank must respond, changes over time. This means that the communication of a fixed monetary policy reaction function in terms of the recent outturns for inflation and output, even if desirable as in many models, is likely impossible in practice. This is true even if the central bank’s preferences are fixed, although they may be evolving too.

Our work indicates what is important to communicate. Even though markets may be solely interested in the outlook for future monetary policy, their interest will be in more than just forward guidance. Policymakers should try to communicate how they are assessing incoming data, and how this affects their thinking about both the current (evaluation) and future (projection) state of the economy. This goes beyond the recommendations from standard models used in the analysis of monetary policy.

Authors’ note: The views expressed in this column present the authors’ personal opinions and do not necessarily reflect the views of the Central bank of Ireland, the ECB, or the Eurosystem.

References

Altavilla, C, L Brugnolini, R Gürkaynak, R Motto and G Ragusa (2019), “The Euro Area Monetary Policy Event-Study Database”, VoxEU.org, 3 October.

Bauer, M and E Swanson (2022), “An Alternative Explanation for the 'Fed Information Effect'”, American Economic Review, forthcoming.

Blinder, A, M Ehrmann, M Fratzcher, J de Haan, and D Jansen (2008), “What we know and what we would like to know about central bank communication”, VoxEU.org, 15 May.

Byrne, D, R Goodhead, M McMahon and C Parle (2023a), “The Central Bank Crystal Ball: Temporal information in monetary policy communication”, CEPR Discussion Paper 17930

Byrne, D, R Goodhead, M McMahon and C Parle (2023b), “Measuring the Temporal Dimension of Text: An Application to Policymaker Speeches”, CEPR Discussion Paper 17931.

Eggertsson, G and M Woodford (2003), “The zero bound on interest rates and optimal monetary policy”, Brookings Papers on Economic Activity 2003(1): 139–211.

Gürkaynak, R, B Sack and E Swanson (2005), "Do Actions Speak Louder Than Words? The Response of Asset Prices to Monetary Policy Actions and Statements", International Journal of Central Banking 1(1): 55-93.

Hansen, S, M McMahon, and M Tong (2019), “The long-run information effect of central bank communication”, Journal of Monetary Economics 108: 185–202.

McMahon, M and T Munday (2022), “Uncertainty and time-varying monetary policy”, working paper.

Nakamura, E and J Steinsson (2018), “High Frequency Identification of Monetary Non-Neutrality: The Information Effect”, Quarterly Journal of Economics 133(3): 1283-1330.

Orphanides, A, “Monetary Policy Rules Based on Real-Time Data” (2001), American Economic Review 91(4): 964-985.

Phelan, G, S Holton, D Kedan and M Ehrmann (2022), “Views on monetary policy communication by former ECB policymakers”, VoxEU.org, 17 January.

Reichlin, L, K Adam, W J McKibbin, M McMahon, R Reis, G Ricco, and B Weder di Mauro (2021), The ECB strategy: The 2021 review and its future, CEPR Press.