In an attempt to slow down climate change, policies aiming at taxing carbon emissions are gradually being implemented all around the world. Pioneering in this field, the EU introduced an emission trading scheme (EU ETS) in 2005 which has been recognised as the first cross-border cap-and-trade scheme of its kind. The EU ETS now boasts one of the highest carbon prices in the world, with estimated allowance price nearing €100/tCO2 in 2022.

A high allowance price brings concern over the competitiveness of industry, as production costs are expected to rise. Industrial relocation, coupled with higher demand for relatively cheaper foreign products, may lead to emissions being relocated to countries with lower or no carbon pricing, a phenomenon economists refer to as ‘carbon leakage’. Ever since the implementation of the EU ETS, studies have tried to assess whether the introduction of the EU ETS has resulted in this phenomenon. Even now, there is no academic consensus regarding the existence of such leakage (Böhringer et al. 2022). However, as the EU ETS price has increased rapidly in recent years, this will increase the likelihood of carbon leakage occurring.

Carbon border adjustment: A solution to carbon leakage

In this context, in July 2021 the EU announced its plan to introduce a Carbon Border Adjustment Mechanism (CBAM) to tackle carbon leakage. This takes the form of an additional carbon pricing mechanism implemented at the EU border, whose value is determined based on the difference between the carbon price paid by EU producers and foreign producers, for a given product. By doing so, the EU aims to ensure a level-playing field for its industry. Carbon border adjustments are thought to be an effective instrument against carbon leakage, but many highlight that they may result in a decrease in exports, exacerbate regional inequalities between exporters, and be difficult to implement due to legal issues arising from WTO treaties (Böhringer et al. 2010, Böhringer et al. 2012, Fischer and Fox 2012, Monjon and Quirion 2011).

The EU’s is the first carbon border adjustment mechanism to be implemented, and thus, since its announcement, many studies have simulated its potential impact. A common trend emerging from their findings is that the CBAM would have a negligible effect on global welfare but a negative impact on exports (Korpar et al. 2023, Pyrka et al. 2020, Takeda and Arimura 2023). Most importantly, the CBAM is expected to have a small impact on emissions (Korpar et al. 2023, Zhong and Pei 2022), despite the policy’s main objective being to decrease global emissions.

Structural gravity focusing on Asia and the Pacific

Most studies that simulate the impact of the EU CBAM on emissions only incorporate its effect on emissions from production. However, the effect of trade policies on emissions are often more complex, as they include changes in emissions from shipping or indirect effects of the policy on the demand for downstream products. In our recent study (Mortha et al. 2023), we aim to include emissions from shipping activities in addition to emissions from production. We use a structural gravity model focused on trade to simulate the impact of the CBAM with data from 2014. In addition, we provide a case study of the policy’s effects on Asia and the Pacific (APAC) region, a region with many large, developing economies. This region does not yet possess widespread carbon pricing and is expected to be the most vulnerable to the introduction of the CBAM.

Overall, our analysis shows that the impact of the CBAM on welfare is small, regardless of the region. Still, the policy is expected to reduce exports, with global declines ranging from -0.29% (metal products) to -1.49% (steel products). South and Central Asia would see the largest declines in exports, estimated at -10.52% for crude steel products in South Asia and -7.03% for chemical products in Central Asia. This particular result suggests that the CBAM is a protectionist policy. However, it would tackle carbon leakage effectively, as it is expected to bring industrial production back inside the EU. In EU countries, production is simulated to experience a rebound of between 1.31% (nonferrous metals) and 5.24% (steel), and emissions from production will increase at a similar rate.

Developing countries are expected to be more affected by the CBAM

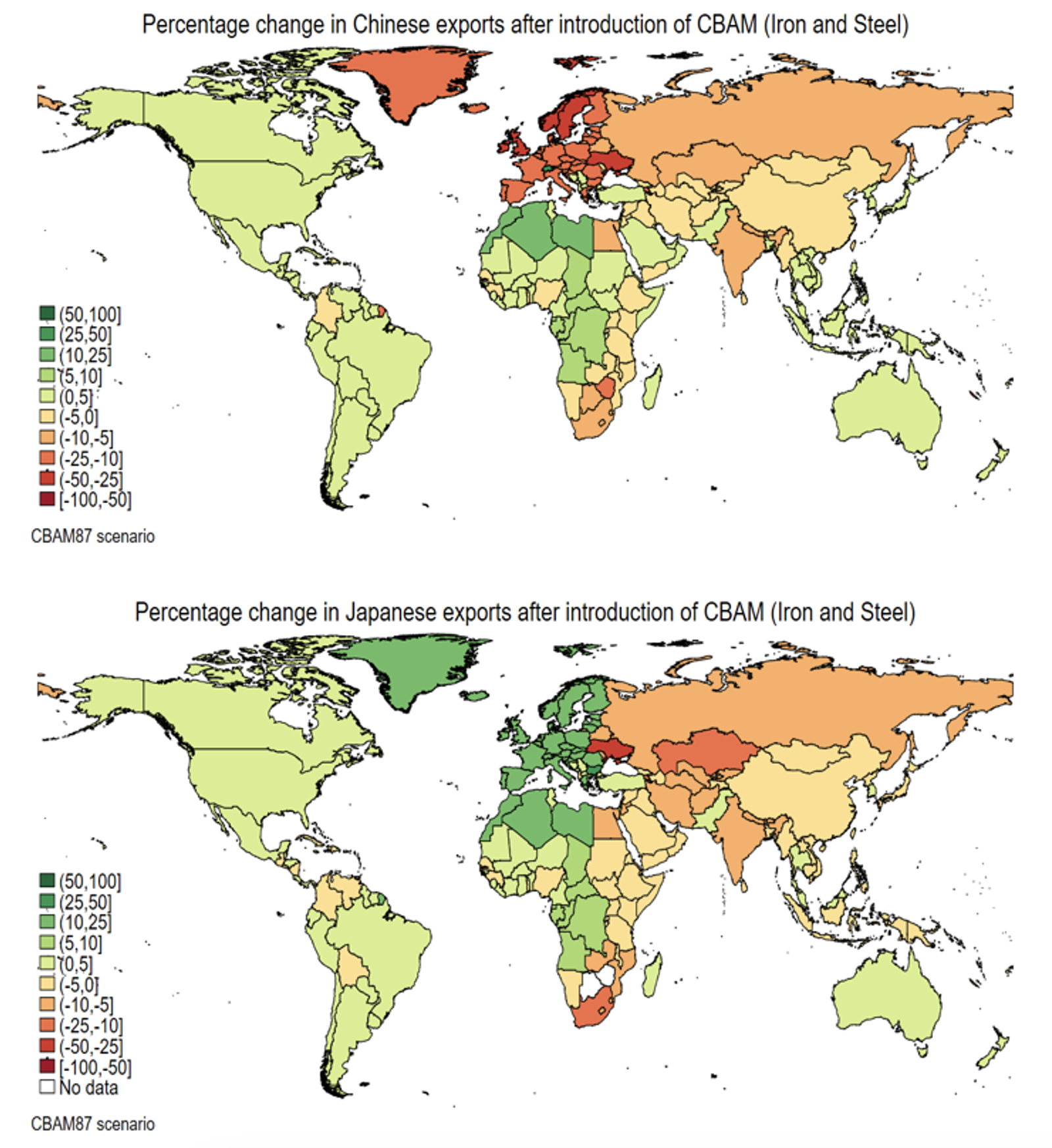

There are significant differences in vulnerability to the policy depending on level of development, which is exemplified by case studies from Asia and the Pacific. Middle-income economies are particularly affected by the CBAM, with significant declines in exports, production, and emissions. To illustrate this point, Figure 1 shows changes in steel exports from Japan and China. China, which is more emissions-intensive in its production and did not introduce carbon pricing in 2014, would face relatively higher CBAM prices. As a result, the simulation predicts a sharp decline in Chinese exports to the EU and a slight rebound effect on exports to Africa. In contrast, Japan is expected to face relatively low CBAM prices due to the high carbon efficiency of its energy-intensive products and the global warming tax. The simulation predicts that Japan and other high-income countries that gain a comparative advantage will increase their exports to the EU. Thus, our study suggests that this policy may contribute to the creation of a ‘Climate Club’ of developed nations trading between each other and may increase global inequality among nations.

Figure 1 Change in exports of iron and steel in China (top) and Japan (bottom)

Source: Mortha et al. (2023)

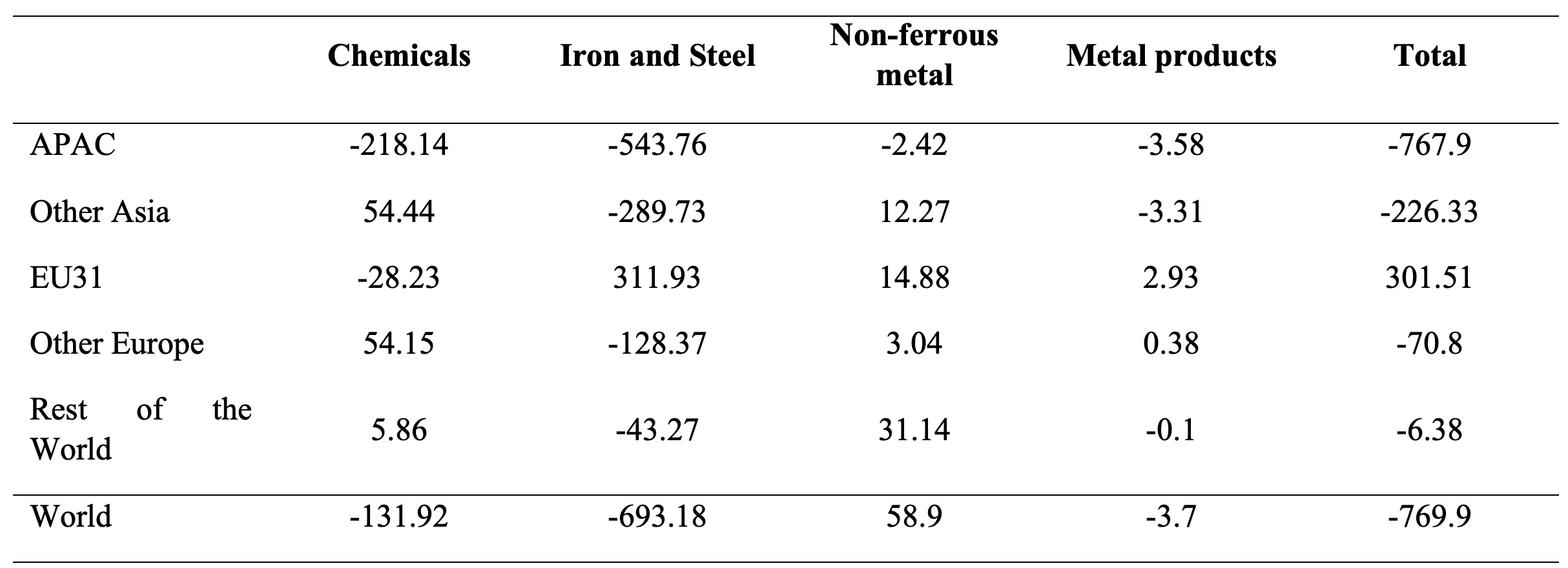

Comprehensive emission accounting, with emissions from shipping activities

Table 1 contains the emissions calculations from the CBAM. In addition to emissions from production, emissions from shipping activities are included. Globally, the CBAM is expected to reduce emissions, but the majority of this reduction will come from shipping activities. This reduction is estimated to have been approximately 770 mtCO2 if the policy had been implemented in 2014, with emissions from transportation activities and trade accounting for 73% of this reduction. There is a slight rebound effect on emissions from production activities (chemicals and non-ferrous metals), but this is generally offset by emissions from trade. The largest emission reductions by sector come from the steel sector (-693 MtCO2), followed by the chemical sector (-132 MtCO2). The largest reductions are in the Asia and Pacific region (-768 MtCO2). Perhaps due to approximations in the calculation of sea distances and the choice of emission factors, the emission reductions may be overestimated, but it can still be concluded that CBAM is an effective policy for reducing CO2 emissions globally.

Table 1 Expected effects of CBAM on emissions (Mt CO2)

Note: EU31 refers to the European countries that will be implementing the CBAM.

Source: Mortha et al. (2023).

Editor’s note: The main research on which this column is based (Morta et al.2023) first appeared as a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan.

References

Böhringer, C, C Fischer and K E Rosendahl (2010), “The Global Effects of Subglobal Climate Policies”, The B.E. Journal of Economic Analysis & Policy 10(2): 1–33.

Böhringer, C, J C Carbone and T F Rutherford (2012), “Unilateral climate policy design: Efficiency and equity implications of alternative instruments to reduce carbon leakage”, Energy Economics 34(Supplement): S208–S217.

Böhringer, C, C Fischer, K E Rosendahl and T F Rutherford (2022), “Potential impacts and challenges of border carbon adjustments”, Nature Climate Change 12(1): 22–29.

Fischer, C and A K Fox (2012), “Comparing policies to combat emissions leakage: Border carbon adjustments versus rebates”, Journal of Environmental Economics and Management 64(2): 199–216.

Korpar, N, M Larch and R Stöllinger (2023), “The European carbon border adjustment mechanism: a small step in the right direction”, International Economics and Economic Policy 20(1): 95–138.

Mortha, A, T H Arimura, S Takeda T Chesnokova (2023), “Effect of a European Carbon Border Adjustment Mechanism on the APAC Region: A structural gravity analysis”, Research Institute of Economy, Trade and Industry Discussion Paper August 2023 No. 23-E-058.

Monjon, S and P Quirion (2011), “Addressing leakage in the EU ETS: Border adjustment or output-based allocation?”, Ecological Economics 70(11): 1957–1971.

Pyrka, I, J M Boratinsky, I Tobiasz, R Jeszke and M Sekula (2020), “The effects of the implementation of BTA in the context of more stringent EU climate policy until 2030”, Institute of Environmental Protection – National Research Institute (IOŚ-PIB.

Takeda, S and T H Arimura (2023), “A Computable General Equilibrium Analysis of EU CBAM for the Japanese Economy”, Research Institute of Economy, Trade and Industry Discussion Paper No. 23-E-006.

Zhong, J and J Pei (2022), “Beggar thy neighbor? On the competitiveness and welfare impacts of the EU’s proposed carbon border adjustment mechanism”, Energy Policy 162: 112802.