Over the past century, humanity has experienced dramatic urbanisation. Today, more than half of the world’s population lives in cities, and this figure will keep rising in the coming decades (World Bank 2022). Alongside this urbanisation has been the rise of tall buildings. Dramatic skylines in Chicago, Hong Kong, and Dubai, for example, are visible manifestations of each city’s growth (Ahlfeldt and Barr 2020).

Despite the increasing role of tall buildings for local and national economies (Ahlfeldt and Jedwab 2022), little is known about how tall building stocks vary globally and what drives international differences (Ahlfeldt and Barr 2022). This is true even though real estate is one of the largest asset classes in the world. Given the durable nature of real estate, policies and preferences regarding different types of structures can have long-run effects on the wellbeing of cities and their residents (Barr et al. 2021).

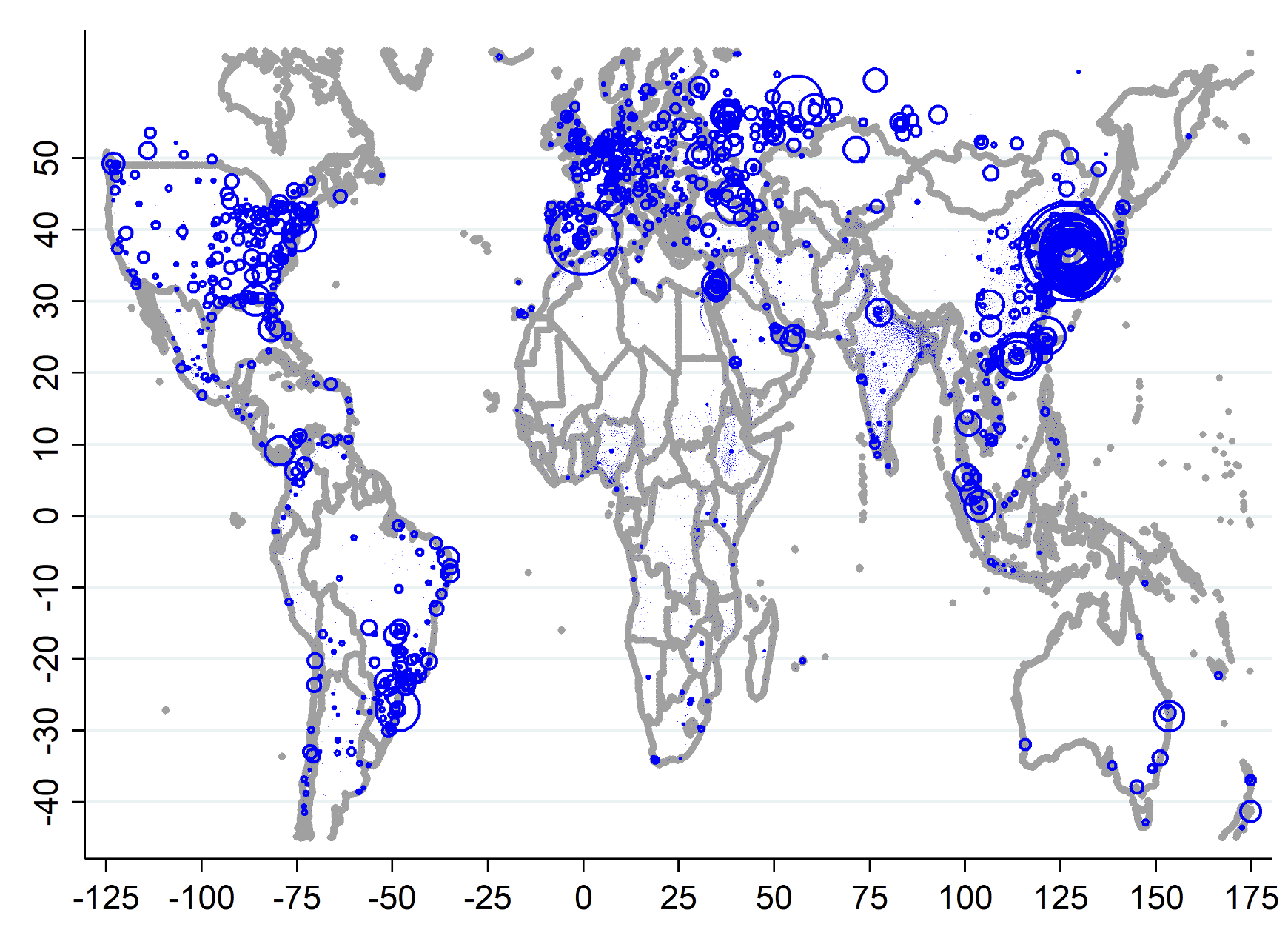

While cities can physically grow via land expansion – by building out – they can also grow by becoming more vertical – by building up (Jedwab et al. forthcoming). Our research adds to our understanding of why there is so much global variation in tall building stocks (Barr and Jedwab 2022). We analyse tall building completions using a novel dataset from Emporis – a global provider of tall buildings data – on the location, year of construction, heights, and uses of nearly all tall buildings in the world. For this study, we include all completed, occupiable structures above 55 meters (about 14 floors). Figure 1 shows tall building heights per capita in cities around world.

Figure 1 Map of tall builidng stocks per capita

Source: Barr and Jedwab (2022).

Notes: Cities that have at least one building above 55 meters and have a population greater than 50,000.

Guided by predictions from the standard land-use model in urban economics (Brueckner 1986), we perform country-level econometric analyses for 163 countries every five years (from 1950 to 2020) and city-level econometric analyses for 12,877 cities every five years (from 1975 to 2020). Urban economic theory holds that a country’s or city’s heights should be positively related to its income and population, but negatively related to geographic and environmental features that increase costs, such as earthquake risk and poor geological conditions for anchoring building foundations.

Our regression results show that though income, population, and supply conditions explain a large fraction of the global variation in heights, considerable differences remain. For example, even in our most comprehensive specification, the explanatory power (as measured by R2) is still only about 64%. We thus delve deeper into the nature of the regression residuals to better understand the patterns of global tall-building construction.

Measuring the gaps

To simplify the analysis, we performed regional comparisons, grouping countries by geographic areas with similar income levels and/or cultures. More precisely, we used the 19 United Nations subregions (UN 2022), each of which we call simply a ‘region.’

Our aim is to identify regions that grow taller than expected given their economic and demographic conditions. To this end, we reviewed the rankings based on average residuals within each region. A positive average means that a region tends to build more than the urban model would predict, while a negative average means the region ‘underbuilds’ relative to its economic fundamentals.

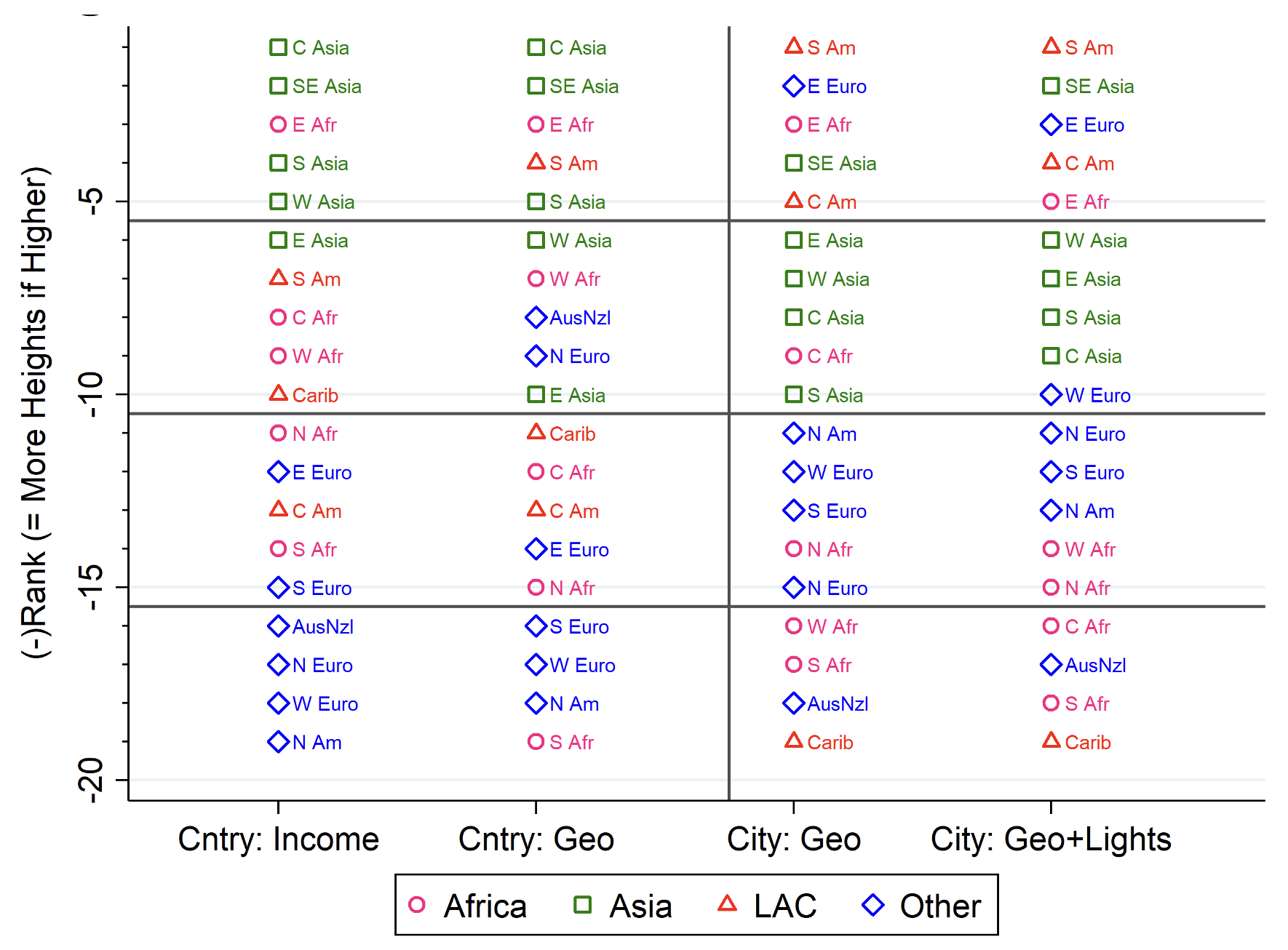

Figure 2 shows the rankings based on the residuals. We performed a stepwise regression analysis, beginning with two basic controls – population and income – and then adding more supply- and demand-related variables to see how the ‘controlling for’ nature of the regressions alters the residuals. This method gives us clues as to which specific elements, such as geological conditions or access to technology, impact the growth of each region’s skyline.

Figure 2 Ranking of regional residuals

Source: Barr and Jedwab (2022).

Notes: “Cntry: Income” = Country-level analysis controlling for national per capita GDP. “Cntry: Geo” = Country-level analysis with more controls including geological variables. “City: Geo” = City-level analysis with the full specification with all country- and city-level controls. “City: Geo+Lights” = City-level analysis with the full specification, also includes the night lights controls.

Focusing on the residuals from the regression with the most controls using city-level data (the right-most column) shows some interesting results. We find that South America, Eastern Europe, and Western Europe (which includes the UK and France) are highly ranked in their tall building construction. Ironically, some important Asian regions and North America are not that well ranked. Within Asia, the leading region is Southeast Asia (which includes India), not East Asia (which includes China). West Asia, which includes the Gulf nations, is also not that well-ranked. Additionally, two African regions – East Africa and Southern Africa – are relatively well-ranked.

While cities like New York, Shanghai, and Tokyo have impressive skylines, they also have enormous populations. Likewise, some skyline-oriented cities – such as Dubai, Hong Kong, and Singapore – are among the wealthiest in the world. Thus, once we control for income and population, they are not as impressive.

Exciting or boring skylines

Next, we repeated the same analyses but used different subsamples. Specifically, we looked at the average residuals for large versus small cities, central versus peripheral city areas, high-rises between 55 and 100 metres versus skyscrapers above 100 metres, and residential versus commercial buildings.

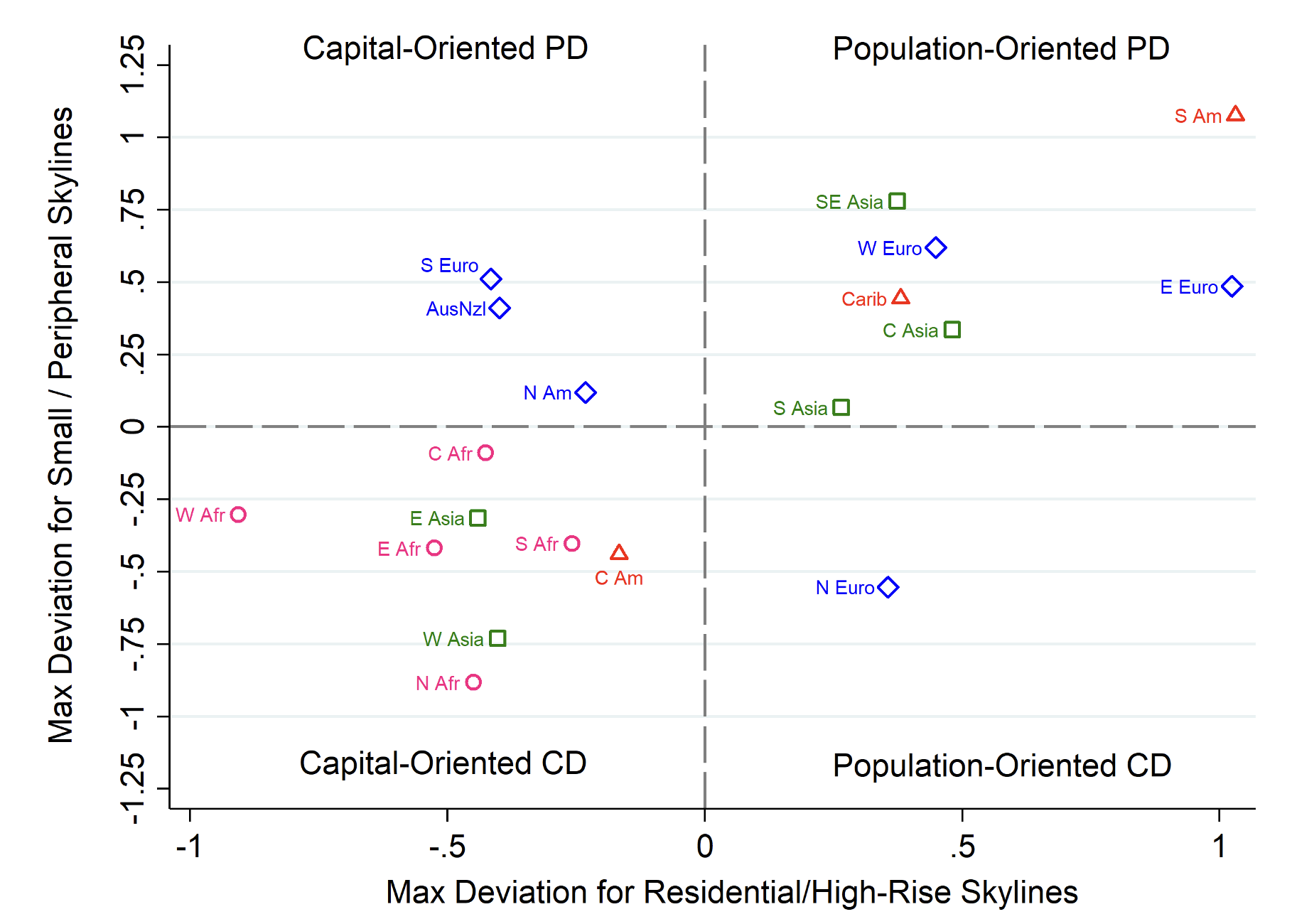

Based on the magnitudes of the respective residuals, we classified the subregions into four groups: population-oriented central districts (CDs), capital-oriented CDs, population-oriented peripheral districts (PDs), and capital-oriented PDs. The categorisation depends on whether the region’s skyline is specialised into central districts or peripheral districts and is serving people (residential structures) or capital (office towers and/or luxury residential skyscrapers).

Figure 3 shows where each region falls within the quadrants. Additionally, the further distance a region is from the origin, the higher its ranking (as discussed above). Overall, we find that the capital-oriented CDs and population-oriented PDs contain the majority of regions. And most regions that rank highly overall have skylines specialised in residential high-rises, i.e. flatter skylines. Regions with capital-oriented CDs – those with the gleaming corporate or ‘vanity’ towers – that rank well in terms of skyscrapers and/or office towers are not the world’s leaders.

Figure 3 Classification of subregions based on their skyline characteristics, c. 2020

Source: Barr and Jedwab (2022).

Notes: CD vs. PD = ‘central’ districts vs. ‘peripheral’ districts, i.e. whether it is larger cities and/or central city areas OR smaller cities and/or peripheral city areas that disproportionately have tall buildings within the subregion. Capital-Oriented vs. Population-Oriented = whether it is skyscrapers and/or office towers or high-rises and/or residential towers that are disproportionately tall in the subregion.

Our results also demonstrate a key point: the most impressive skylines are not necessarily the ones with the densest tall-building stocks. For example, regions like South America and Eastern Europe make up in high-rise volume what they lose in supertall skyscrapers. Thus, focusing on exciting skylines and famous skyscrapers can be a misleading way to characterise cities.

About 70% and 80% of tall building heights in the world come from high-rises below 100 metres (not skyscrapers) and residential towers (not office supertall towers), respectively. Many skylines may appear more prominent internationally than they are once one includes all tall buildings and core controls. Boring skylines of residential high-rises are more common than we would expect.

Drivers of global differences

What’s driving the types of skylines that regions embrace? There are a handful of possibilities. The first is land-use regulation. Height restrictions may be imposed in hopes of reducing shadows and congestion. A region with many restrictions will have a lower ranking.

Similarly, countries with historical cities may impose relatively strict preservation measures. Since the central areas of cities tend to be more historical, preservation may disproportionately impact central areas, where tall buildings are more likely to be skyscrapers and office buildings. Relatedly, and particularly in regions where property rights are not strong, land assembly might hinder tall building construction because ownership claims are vague and diffused.

Finally, due to various socio-historical factors, preferences for different types of urban living may vary. In some nations, residents have an intrinsic preference for living in high-rise apartments because of their centrality, views, and amenities; in other countries, citizens prefer low-rise living with larger private yards.

Why a society has specific preferences in favour of or against high-rise apartments is difficult to say. Preferences and land-use regulations reinforce each other. In societies where high-rise apartments are preferred less, height restrictions are more likely to be imposed. But in contexts where stringent height restrictions exist, exceptions are often made for social housing. High-rise apartments may then be associated with poverty and crime, reinforcing the societies’ overall preference against high-rise apartments.

Reviewing both the residual rankings and types of skylines can give clues to what is driving global variations. We conclude that land-use regulations and preferences, not historical preservation or dispersed ownership, likely account for differences across the world. For example, Brazilian cities like Sao Paulo have restrictions on very tall buildings, which may explain South America’s disproportionately ‘flat’ skylines. Yet, in South and Central American cities, living in residential high-rises is seen as more modern. It is the combination of preferences and regulations that drive residential high-rises to spread throughout their respective urban areas.

Despite the glamour of the Empire State Building, the Burj Khalifa, and the Shanghai Tower, our research shows the more mundane residential buildings are the real towering achievements.

References

Ahlfeldt, G and J Barr (2020), “The economics of skyscrapers: A synthesis”, VoxEU.org, 20 August.

Ahlfeldt, G and J Barr (2022), “The economics of skyscrapers: A synthesis”, Journal of Urban Economics 5(129).

Ahlfeldt, G and R Jedwab (2022), “The Skyscraper Revolution: Global Economic Development and Land Savings”, Mimeo.

Barr, J M, J K Brueckner and R Jedwab (2021), “Cities without skylines: Worldwide building-height gaps, their determinants, and their implications”, VoxEU.org, 28 February.

Barr, J and R Jedwab (2022), “Exciting, Boring, and Non-Existent Skylines: Vertical Building Gaps in Global Perspective”, George Washington University Working Paper.

Brueckner, J (1986), “The Structure of Urban Equilibria: A Unified Treatment of the Muth-Mills Model”, Handbook of Regional and Urban Economics 2: 821.

Jedwab, R, J Barr and J Brueckner (forthcoming), “Cities without Skylines: Worldwide Building-height Gaps and their Implications”, Journal of Urban Economics.

United Nations (2022), “Methodology: Standard Country or Area Codes for Statistical Use (M49)”, accessed 4 October.

World Bank (2022), “Urban population (% of total population)”, accessed September.