The euro’s four phases

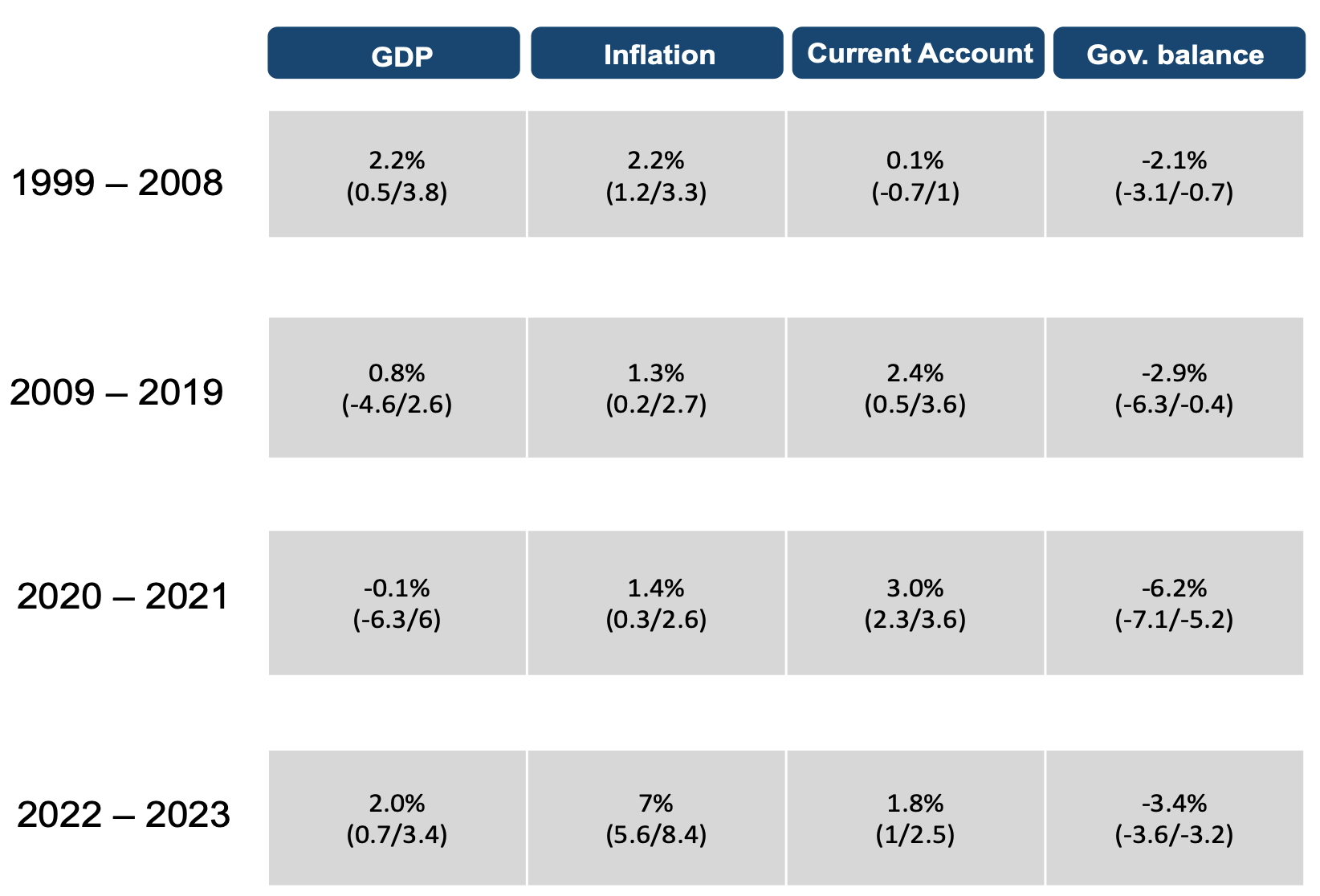

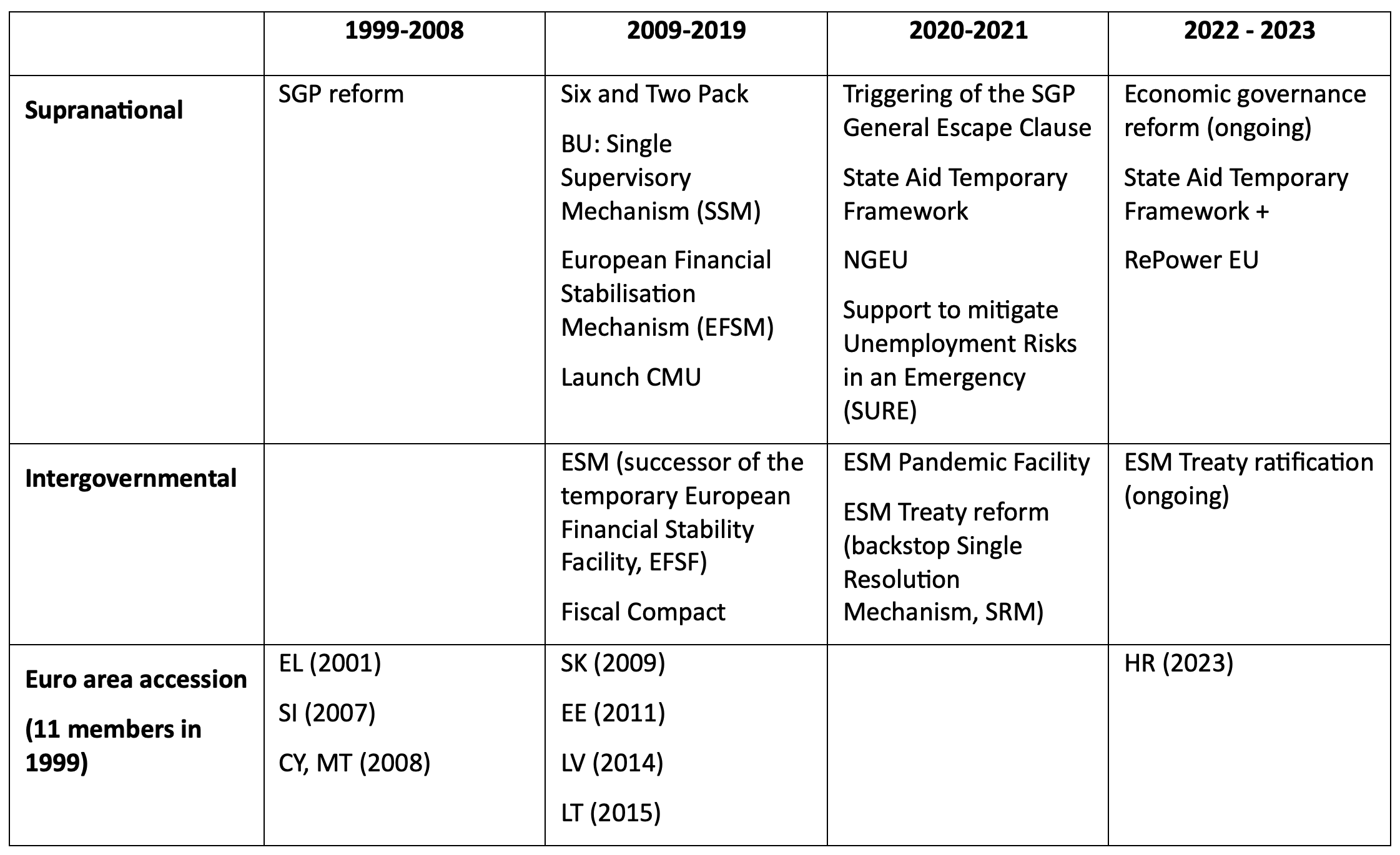

To see what an incomplete architecture has meant for the euro area, in a new CEPR Policy Insight (Buti and Corsetti 2024) we review the past 25 years distinguishing four phases: the first decade of (over-)optimism and resource misallocation (1999 to 2008); the decade of home-bred crises and fragmentation (2008 to 2019); the progressive response to the pandemic (2020 to 2021); and the return of policy trade-offs in the battle against inflation (from 2022 to the present day). The main economic indicators and the institutional developments characterising these four phases are summarised in Tables 1 and 2.

Table 1 Main macroeconomic indicators

Source: European Commission.

Note: Columns refer to the year-on-year growth of real Gross Domestic Product, yearly HICP, current account balance (as % of Euro Area GDP) and government balance (as % of Euro Area GDP). Numbers in parenthesis refer to the minimum and maximum registered value for the period.

Table 2 EU and euro area institutional reforms

Source: Authors’ elaboration based on European Commission sources.

The first phase is the ‘2% decade’: growth, inflation, and budget deficits are on average close to 2%. It was the period of ‘Great Moderation’ and excess optimism, associated with a systematic underestimation of macro and micro risks, in the European economy as in the world economy. It was in these years that, in a context of perceived stability, the imbalances that will haunt the euro area in the years to come accumulated. The bonus of interest rate convergence across member states, with minimal spreads, embellished public accounts and led to a reduction in overall deficits in vulnerable countries; accommodating fiscal and monetary conditions favoured growth, reducing the pressure to adopt structural reforms and removing the urgency to strengthen the banking system. Nominal convergence, however, concealed structural divergence: capital within the euro area flew in the right direction, from the richest towards the less wealthy countries, but ended up in the wrong sectors (real estate and non-tradable services) through the wrong instrument (short-term bank loans). While the current account was in balance for the euro area as a whole, large imbalances opened inside the area, reflecting the increasing specialisation of the ‘periphery’ in non-tradeables and dependency of its banking system on the core countries’ banks, in turn heavily exposed overseas. These structural divergences translated also into a divarication of social preferences between euro area members.

The Great Financial Crisis brought these imbalances to light. Relative to the magnitude of financial problems in the European banking system, the Greek fiscal crisis that ignited the crisis was actually a relatively contained issue. But because the crisis originated from it, with discovery that the official Greek accounts were far from the truth, trust among member countries quickly evaporated, preventing a prompt and effective response to the crisis in all its fiscal and financial dimensions. The political narrative became one of fiscal laxity and moral hazard, implicitly seeing the costs of the crisis as necessary to discipline profligate governments. The overarching principle was ‘putting your own house in order’. Therefore, the EU intervened only as ‘ultima ratio’, after all means at national level had been exhausted. In this context, a euro area-level response, with the creation of the European Stability Mechanism, the launch of the Banking Union project, the introduction of the Outright Monetary Transactions, and the scaling up of the ECB balance sheet programmes, came substantially late. The focus on fiscal policy delayed the measures needed to put the banking system on a sounder footing. It was only after Mario Draghi's “whatever it takes” speech in July 2012 that the risks of a euro area breakup receded and the area could return to a path of growth, but with large disparities between countries. With monetary policy long being the ‘only game in town’ (much more in the euro area than in other regions), the economic and financial space of the euro area remained fragmented, and the macro stance insufficiently weak. Reflecting the strong fiscal correction and recession in the crisis countries, the external balance of the euro area moved into a persistent surplus of 2% of GDP or more. Remarkably, in spite of the perceived sense of existential crisis, the euro area continued to expand – an indication of the huge amount of political capital invested in the euro that markets tended to belittle.

Remarkably, the response to the pandemic crisis of early 2020 was totally different. The lessons from the mismanagement of the sovereign debt crisis were at least in part learned, but more importantly, the ambitious policy response benefitted from a ‘benign coincidence’ of circumstances: the exogenous nature of the crisis and the absence of electoral appointments on the horizon allowed EU leaders to act with fewer internal constraints, and embrace a narrative of solidarity free of moral hazard concerns. The result was the suspension of the Stability and Growth Pact, the SURE programme to support the labour markets, NextGenerationEU to foster the double transition, both with common borrowing, and the ECB's Pandemic Emergency Purchase Programme. Policies moved in the same direction, ensuring a congruent mix across policies (fiscal and monetary) and space (EU and member countries). Evidence of strong collective leadership reassured markets, the risks of fragmentation receded, and the economy rebounded strongly.

This virtuous scenario, however, did not last. The surge in inflation, ignited worldwide by strong macroeconomic stimulus and the imbalances due to the disruption of value chains during the lockdown, was exacerbated in Europe by the energy crisis following Russia's war of aggression. Europeans manage to coordinate policies to reduce the region dependence on Russian gas, but failed to deliver a common and forward-looking response in the spirit of NextGenerationEU. Monetary and fiscal policy moved in opposite directions. With rising debt and deficits, the strongest monetary tightening since the 1980s marked the return of policy trade-offs. This new phase – still ongoing – did not remove the deadlocks in the debate on EMU reforms. The huge political capital spent to maintain unity on the sanctions against Russia and the overriding domestic political concerns probably hindered other common endeavours.

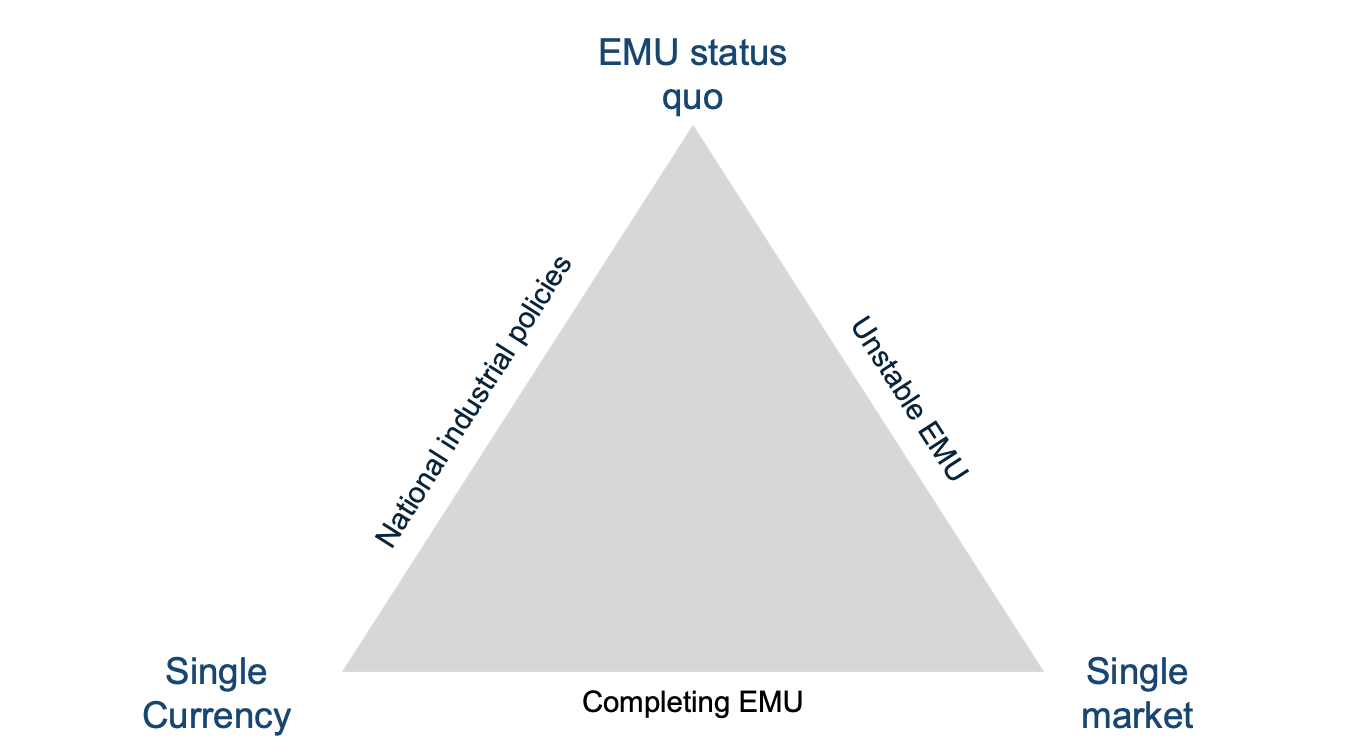

Back to the future: From the ‘inconsistent quartet’ to the ‘euro trilemma’

Based on the assessment above, how should the reform of EMU’s architecture be approached? In light of the experience of the first 25 years in the life of the euro, it seems appropriate to go back to the initial inspiration for the project of a single currency as a keystone of the Single Market project. Indeed, Tommaso Padoa-Schioppa proposed the ‘inconsistent quartet’, a European version of the open economy ‘trilemma’, adding free trade (essentially, the Single Market) among EU members as the fourth corner: a single currency would prevent the competitive devaluations that were incompatible with preserving a level playing field and that created political acrimony in the 1980s (Padoa-Schioppa 1987).

The quartet clarifies that a deficit in macroeconomic stabilisation at EA/EU level would create strong political and economic incentives for national governments to respond to shocks (domestic and external) resorting to national industrial policy, tax and regulatory initiatives and stealth subsidies, de jure or de facto incompatible with the Single Market. The experience during the energy crisis and the response to the American Inflation Reduction Act (IRA) is telling. A resilient euro area, with enough stabilisation tools in place, is essential to prevent Member States from going down a route that would lead to ‘real’ fragmentation, up to creating risks for the integrity, let alone the performance, of the Single Market.

These considerations can be synthesised via a modern reformulation of the inconsistent quartet, in terms of a euro trilemma (see Figure 1). Currently, the incomplete-union status quo (the upper corner of the triangle) is not simultaneously compatible with the Single Market (right lower corner) and a stable single currency (left corner). The need to maintain macro and financial stability conditional on the current architecture (along the left side of the triangle) creates strong incentives to resort to inward-looking national industrial policies and other measures undermining the foundations of the Single Market. Enforcing the Single Market rules without an adequate EMU architecture empowered with tools and competences to complement the Single Market (the right-hand side of the triangle) creates permanent risks of macro and financial instability, which we synthesise with the idea of an ‘unstable EMU’. The single market in an area of macro and financial stability (the bottom side of the triangle) is the constitutional goal of the reform of the euro area architecture.

Figure 1 The euro area trilemma

Source: Authors’ elaboration

The policy agenda looking forward: Back to Delors’ inspiration

In the light of the history of the first 25 years, how should we approach the reform of the euro area’s economic constitution to overcome the current status quo?

We stress two main points. First, it should now be crystal clear that leaving the euro area architecture incomplete, hoping for a ‘political leap forward’ in the next crisis, is both very costly and very risky. The response to the pandemic was possible because of favourable circumstances, but there is no guarantee that in the next crisis the EU will find comparable cohesion and deliver an effective common response (the suboptimal agreement on the reform of fiscal rules is there to demonstrate this). We do not need to wait for another crisis to complete the Banking Union with a credible resolution fund (here, the failure to ratify the new treaty of the European Stability Mechanism by Italy is serious) and a common deposit insurance. These are key reforms to enhance the stability, integration, and development of the European financial system overnight. The opposition of risk sharing to risk reduction can be overcome (reconciling the two strategies) if one considers the major benefits (economic and geopolitical) from integrated and stable financial markets – which in turn reinforces the case for removing the stalemate on the Capital Markets Union, given the challenge of financing the digital and green transitions.

Second, and most crucially, completing the euro area architecture is necessary to safeguard – and further develop – the most precious asset of European economic integration: the Single Market. Coupling the Single Market with a single currency, within an overall project addressing Europe’s growth bottlenecks and equity concerns, was the most prescient intuition and the enduring legacy of Jacques Delors as President of the European Commission in the 1980s and early 1990s.

In the past 25 years, the contribution of ‘one money’ to ‘one market’ has not been stellar. In the first decade, in the context of a half-baked architecture, the euro favoured the misallocation of resources and undesirable specialisation patterns; in the second decade, the deficiencies of the macro and financial governance in the area magnified instability and created fragmentation of the economic and political space. Thanks to a series of fortuitous circumstances, it did not prevent effective coordination in the response to the COVID-19 pandemic, minimising the risk of an economic meltdown, but this response has not raised the appetite for institutional development. As of today, Europe appears to be facing the risk of an inefficient multiplication of national industrial policies financed via state aid, undermining the very core of the Single Market project. This state of affairs has to be overcome. The most straightforward and economically sensible way is to step up transnational investment in European public goods in the double green and digital transition, in human capital and in the availability of critical materials – as the core of an industrial policy at European level that can truly relaunch the competitiveness of the EU economy.

This will require, again, crossing difficult political red lines. Kohl, Mitterand and Delors were able to do so after the fall of the Berlin Wall, and Macron, Merkel, and von der Leyen during the pandemic. Due to different circumstances, they all had a low ‘political discount rate’. A similar display of leadership will be required to make the euro future-proof.

Authors’ note: This column draws on CEPR Policy Insight No. 126, “The first 25 years of the euro. It was prepared under the auspices of the Economic and Monetary Union Laboratory (EMU Lab) that we launched at the EUI.

References

Buti, M and G Corsetti (2024), “The first 25 years of the euro”, CEPR Policy Insight No. 126.

Feldstein, M (1997), “The political economy of the European Economic and Monetary Union: political sources of an economic liability”, Journal of Economic Perspectives 11(4): 23-42.

Padoa-Schioppa, T (1987), Efficiency, Stability and Equity: A strategy for the evolution of the economic system of the European Community. A report, Oxford University Press.