In the last two years, as economies have recovered from the acute phase of the Covid-19 pandemic, Europe has faced a new set of macroeconomic challenges and, especially, high levels of inflation not seen in the last three decades. From the point of view of European fiscal and financial stability, an important open question is: what are the implications of this new inflationary environment for debt sustainability? The answer is ambiguous.

On the one hand, a relatively short-lived period of high inflation and high nominal GDP growth helps to reduce debt-to-GDP ratios, given that only a fraction of outstanding debt was indexed and that real rates are only gradually catching up. There are also immediate benefits of unexpected inflation on the primary balance, as various spending items are not indexed or partially indexed, while tax revenues tend to grow with nominal output.

On the other hand, the current inflationary environment may be a symptom that we have entered a new macroeconomic phase characterised by higher natural interest rates relative to the very low rates of the pre-pandemic years. A high natural rate regime affects debt sustainability calculations going forward and could reopen the possibility of self-fulfilling spirals in sovereign debt yields.

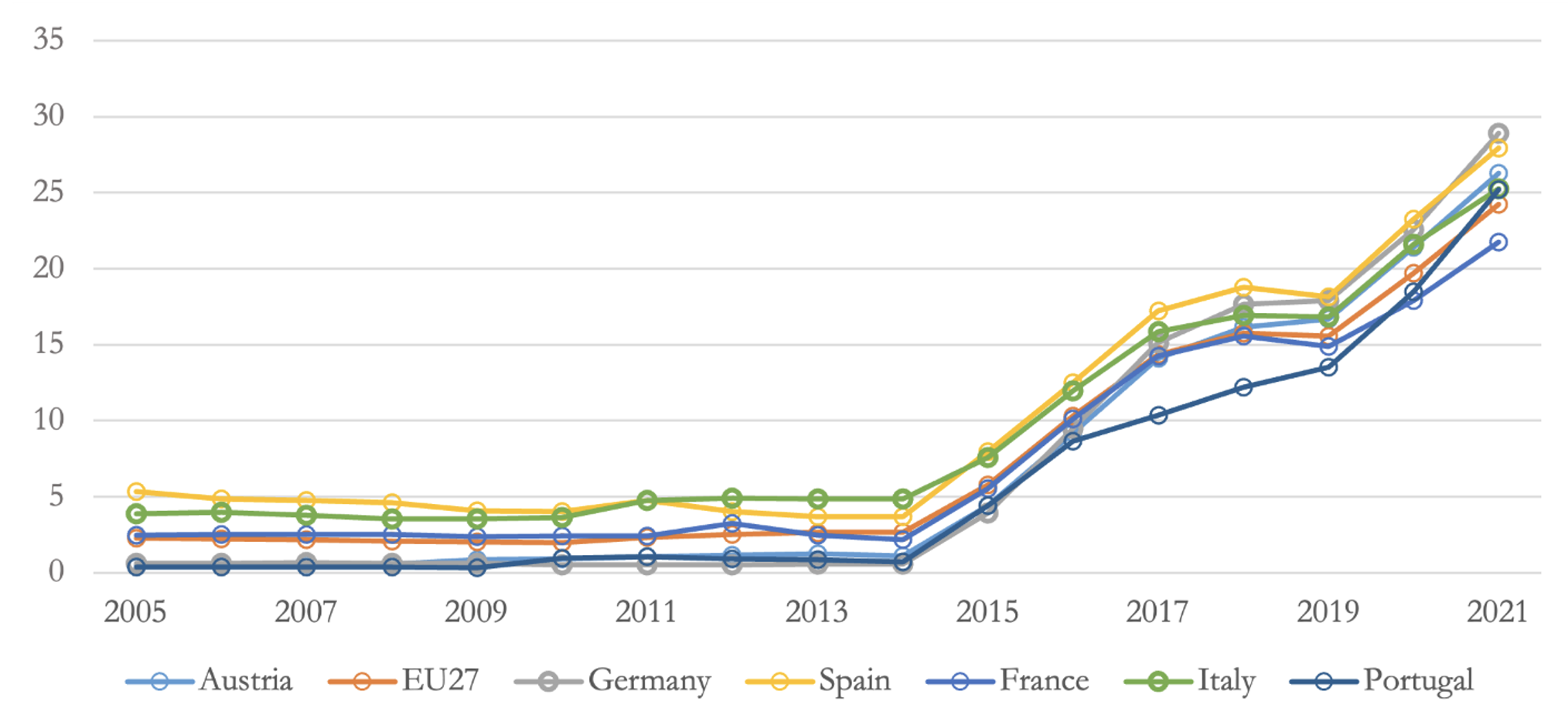

These risks have important consequences for the conduct of monetary policy and asset purchases by the ECB. In a low-inflation environment, the expansionary objective of the ECB and the need to do quantitative easing (QE) are aligned with the objective of stabilising debt markets. Figure 1 shows the large accumulation of sovereign bond holdings by the ECB driven by QE purchases and pandemic-driven purchases. In a high-inflation environment, in contrast, the ECB needs to tighten monetary policy and scale down asset purchases. This creates a potential trade-off with the objective of debt market stability. With this in mind, the ECB has introduced a new anti-fragmentation tool, the Transmission Protection Instrument (TPI). While the design of the TPI clearly identifies the conditions under which intervention by the ECB is justified, this requires the ECB to separate sustainability problems from market malfunction, which may not always be easy. Given these difficulties and in order to give more freedom to the ECB to focus on monetary stability, it is a good moment to reconsider the benefits of more radical solutions, such as the creation of a European debt agency, that we and others have advocated in the past.

Figure 1 ECB holdings of sovereign bonds (% of total debt)

Source: ECB

In our new work (D’Amico et al. 2022), we use some simple simulations to highlight the risks associated with a reduction of the ECB sovereign debt holdings in a high-interest-rate environment.

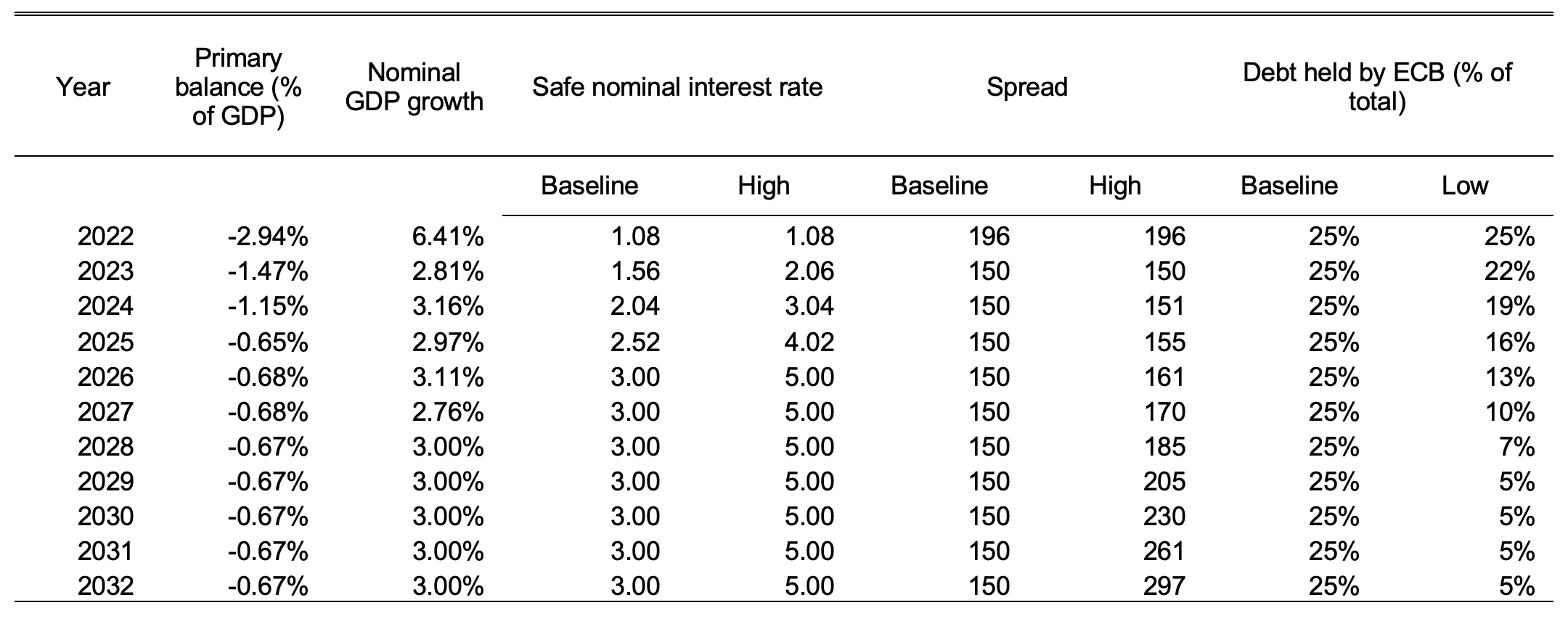

We consider the case of Italy and use as a baseline the WEO 2022-2027 projections for output, primary balance, and government debt. To extend our projections to 2032, we make simple assumptions reported in Table 1. For nominal growth, we assume 3%, and for the safe nominal interest rate, we assume 3%. Assuming inflation goes back to target, we have a 1% real growth and a 1% real rate. We assume that Italy pays the riskless rate plus a spread, which in our baseline is constant at 150 basis points. We also assume that the cost of debt service depends on the average rate (riskless + spread) in the past seven years to capture in a simple way the gradual effect of interest rates on debt service through the maturity structure.

Table 1 Assumptions for simulations

In our baseline, we assume the ECB holdings of Italian debt remain constant at 25% of the total Italian debt. We subject our baseline to two potential adverse events. One where the safe rate settles at 5% (so 3% real). One where the ECB gradually reduces its holdings of Italian debt, following the path in the table.

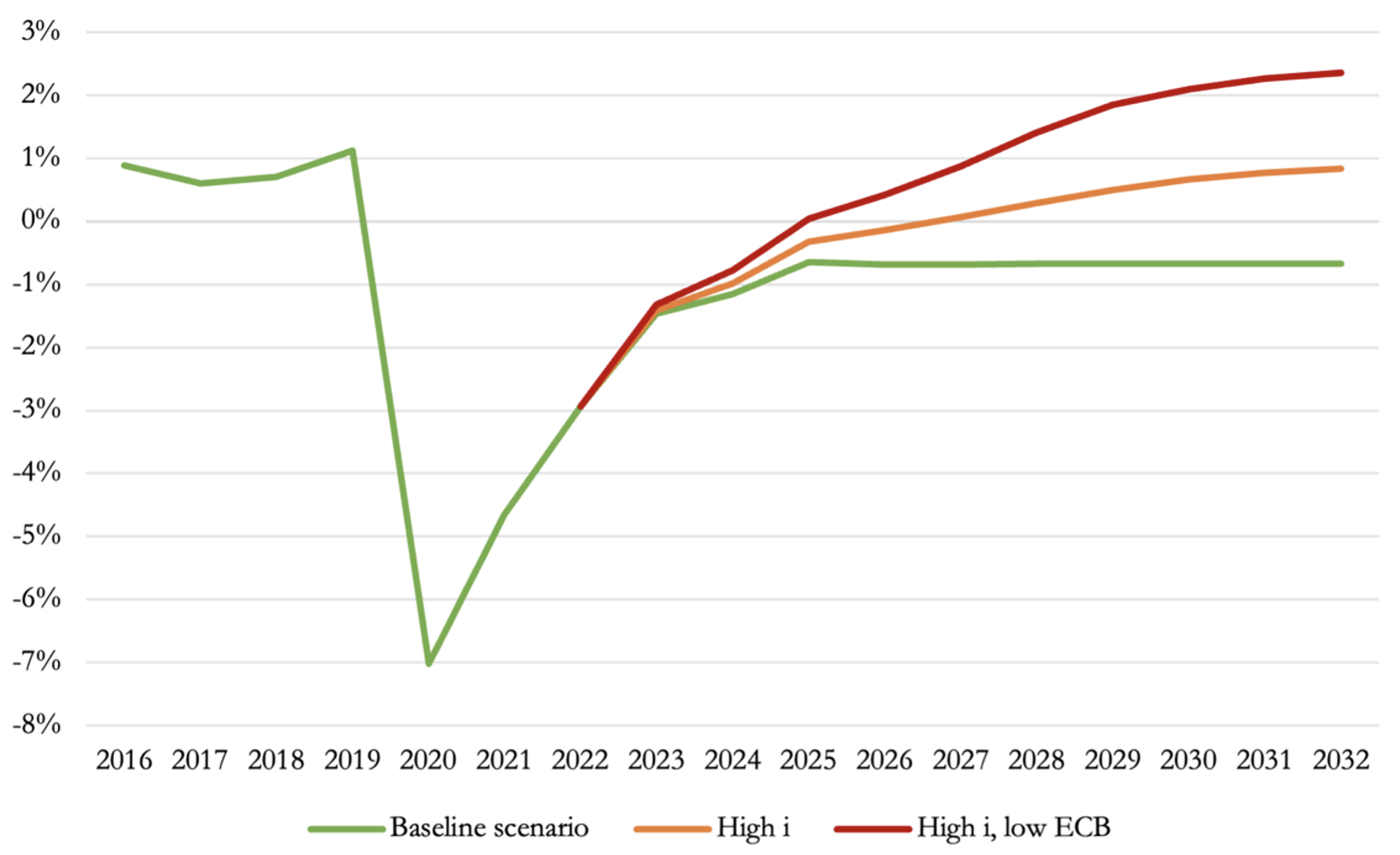

Figure 1 shows the path of the debt-to-GDP ratio in four scenarios. The green line corresponds to the baseline. The yellow line to a scenario with higher interest rates. The red line combines higher interest rates and a declining path of ECB holdings. The dashed red line includes feedback from the debt to the spread, leading to the spreads in the “high spread” column in Table 1.

To make the illustration especially stark, we keep the path for the primary balance unchanged in all cases.

The reason for the distance between the first two scenarios (green and yellow lines) is just higher interest payments. The reason for the distance between the second and third scenarios (yellow and red line) is that if the ECB keeps its debt holdings equal to 25% of total debt, this removes a constant fraction of interest payments from the debt accumulation equation. This happens because the interest payments made on debt held by the ECB are essentially returned to the national governments.

In the solid red line, the ECB scales down its debt holdings, and the interest payments returned to national governments are smaller. The dashed red line adds to this effect an endogenous change in spreads that further increases the cost of debt. This additional effect is relatively small. However, the higher spreads in the table – which are based on a simple empirical extrapolation – are likely to be too optimistic, as the debt dynamics in the red scenario may easily trigger a self-fulfilling spiral.

Figure 2 Debt-to-GDP paths under four scenarios for Italy

So far, we have assumed that the primary balance path is fixed. We now consider the other extreme case in which fiscal policy fully adjusts to the adverse scenarios considered above so as to keep the debt level on the same path as in the baseline. In that case, the path for the primary balance is plotted in Figure 3. Preventing the debt increases shown in Figure 2 requires a substantial increase in fiscal effort.

Figure 3 Primary balance under three scenarios for Italy

What are the benefits of a European debt agency given this outlook?

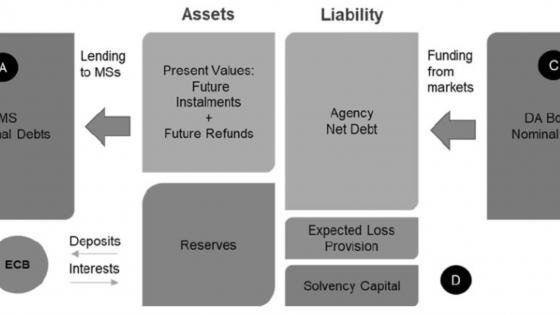

A debt agency would have a role different from the ECB, but it could play a fundamental stabilising role, especially to stabilise expectations in the medium/long run.

A debt agency would issue European debt instead of relying on money financing like the ECB. This means that the cost of debt held by the agency would typically be higher than in the case of debt held by the ECB. The resources needed by the agency to cover its interest payments would need to be financed by contributions of member States. But the nature of the agency’s liabilities is precisely its advantage, as the agency’s acquisitions of the national debt would not be tied directly with the creation of money for the euro area and so would be less constrained by the needs of monetary expansion and contraction.

While the reduction in the cost of borrowing is not as large as in the case of monetary financing, the reduction can still be significant, as the capacity of the agency to extract contributions from member States would rest on the enforcement capacity of the EU. In D’Amico et al. (2022), we discuss a specific way in which national contributions could be designed and argue that they can be designed in such a way that all countries benefit. The early experience of NextGenerationEU (NGEU) highlighted the appetite for supernational debt in the euro area. More recently, EU bonds have experienced a worrisome increase in spreads (Bonfanti and Garicano 2022). This is likely a symptom of market illiquidity and irregular scheduling of issuances of EU bonds or of broader uncertainty about the future of European fiscal integration. Both problems would be ameliorated by the creation of the agency. However, understanding better the market for EU debt is a crucial step for the effective design of the agency.

The ECB would maintain its lender-of-last-resort role and would intervene to tackle market disruptions in sovereign debt markets, but in normal times it could more easily reduce its holdings if, on the other side, there is a debt agency capable of absorbing national debt.

Summing up, the ECB has played a de facto role as the main debt stabiliser in the euro area. Looking forward, maintaining this role will face new challenges. A European debt agency could use the power of common debt issuance to separate the problem of preventing debt crises from the need for monetary stability.

References

Amato, M, C A Favero, E Belloni, L Gobbi, and F Saraceno (2022), “Creating a Safe Asset Without Debt Mutualization: The Opportunity of a European Debt Agency”, VoxEU.org, 22 April.

Amato, M and F Saraceno (2022), “Squaring the Circle: How to Guarantee Fiscal Space and Debt Sustainability with a European Debt Agency”, BAFFI CAREFIN Centre Research Paper No. 2022-172.

Avgouleas, E and S Micossi (2021), “On selling sovereigns held by the ECB to the ESM: institutional and economic policy implications”, CEPS Policy Insight.

Bonfanti, G. and L. Garicano (2022), “Do financial markets consider European common debt a safe asset?”, Bruegel blog.

Corsetti, C, L P Feld, P R Lane, L Reichlin, H Rey, D Vayanos and B Weder di Mauro (2015), “A New Start for the Eurozone: Dealing with Debt”, VoxEU.org, 15 April.

D’Amico, L, F Giavazzi, V Guerrieri, G Lorenzoni, and C-H Weymuller (2022), “Revising the European Fiscal Framework”.

Micossi (2022), “Managing sovereign debts held by the Eurosystem: Operational and legal constraints”, VoxEU.org, 1 April.

Pamies, S, N Carnot, and A Patarauk (2022), “Revisiting the link between government debt and sovereign interest rates in the euro area,” Quarterly Report on the Euro Area 20(4): 39-46.

Leandro, A and J Zettelmeyer (2019), “The Search for a Euro Area Safe Asset”, PIIE Working Paper 18-3.