Emerging markets and developing economies (the ‘South’) have become important actors in the global economy (IMF 2017, UNCTAD 2018). By 2018, the South accounted for roughly 45% of world GDP. At the same time, relations within the South have become much preponderant in international trade (Hanson 2012) and global migration (World Bank 2023).

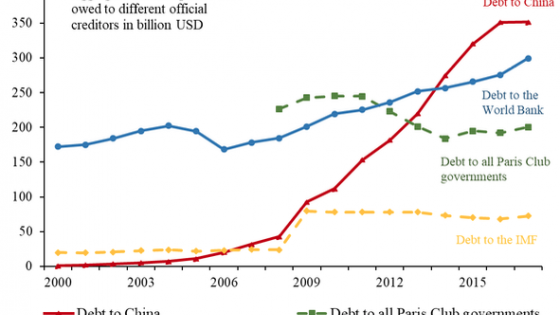

Countries in the South have also started to play a major role in international financial investments, not just as holders of bank deposits and reserves in the North. For example, China has become an important lender in Africa, Asia, and Latin America, and the renminbi has become more widely used (Horn et al. 2020, Clayton et al. 2023). Russia has deepened its economic ties with China (Financial Times 2022, Horn et al. 2022). The Gulf countries have recycled some of the petrodollars by investing in other emerging markets and developing economies (The Economist 2023).

Despite the increasing attention on the role of the South in global finance, little systematic evidence exists on its importance in international investments. Does the financial integration of the South only mirror economic activity, or does finance surpass growth? How does the South integrate, and with whom? The lack of evidence is partly due to a lack of comparable bilateral data needed to map the relations between pairs of countries.

Perhaps the most widely used dataset on international investment positions (IIPs), compiled by Lane and Milesi-Ferretti (2001, 2007), compares external assets and liabilities for each country vis-à-vis the rest of the world. Our dataset can be thought of as a bilateral version of theirs, covering the four main types of investment (functional categories in the IIP). Most studies concerned with bilateral international investments focus on a single investment type (e.g. Portes and Rey 2005, Aviat and Coeurdacier 2007, Stein and Daude 2007, Aggarwal et al. 2012, Brei and von Peter 2018).

In our new research (Broner et al. 2023), we analyse the rise of the South in global finance by combining bilateral international investments for bank loans and deposits, portfolio investment in debt and equity, foreign direct investment (FDI), and international reserves. The data come from the Bank for International Settlements (BIS) for bank loans and deposits; the IMF for portfolio investment; the United Nations and the IMF for FDI; and the IMF for international reserves, and cover annual positions for 2001-2018 for most countries and jurisdictions in the world. By aggregating the bilateral data, we capture most of the aggregate IIPs at the country level and the dynamics of those positions, relative to using the already available aggregate data. The code to process the data and most of the data are available here.

The rise of the South in global financing

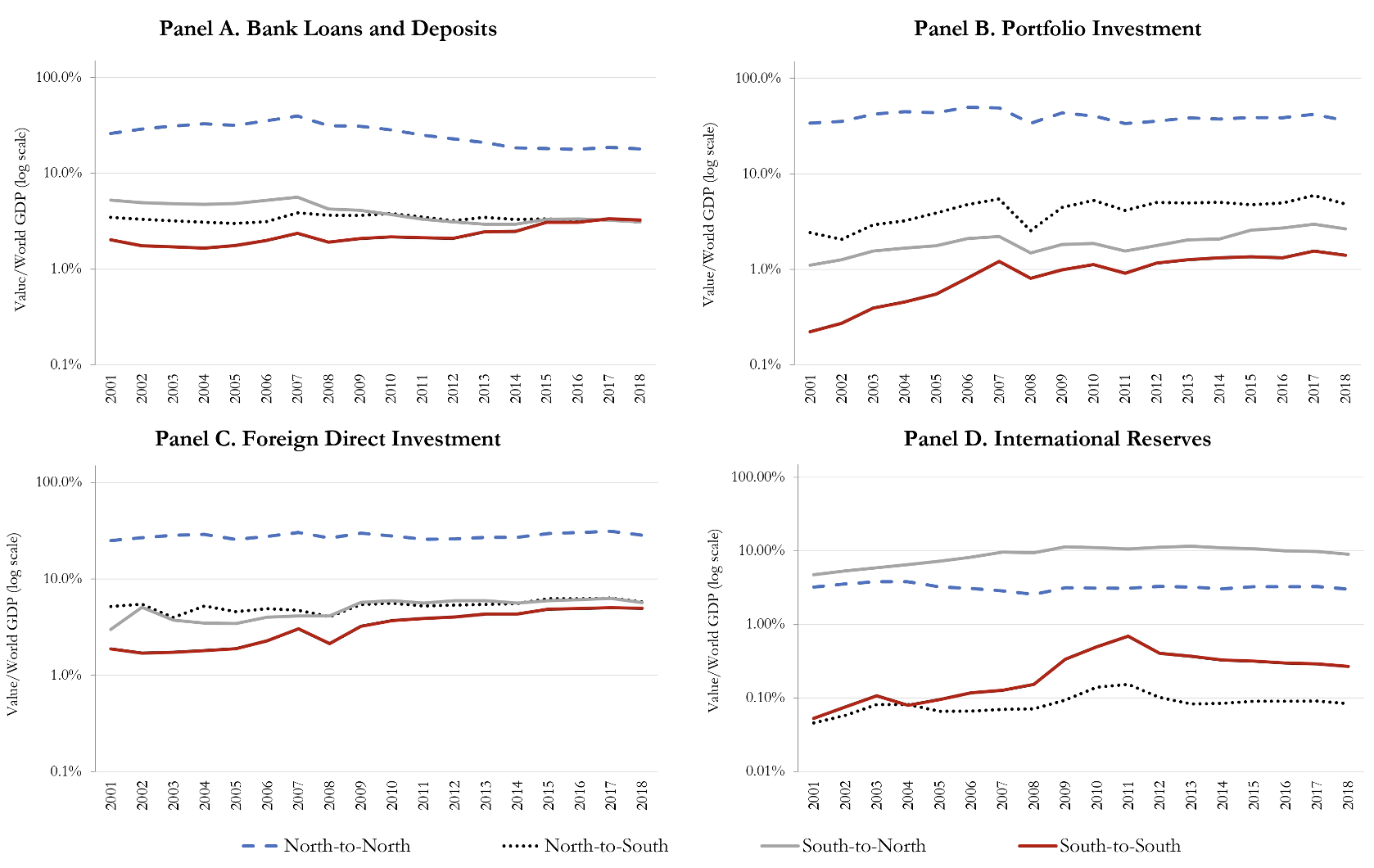

Our main findings document the rise of the South in global finance since 2001. First, the South has increased its participation in global investments both as a share of the total and relative to world GDP. South-to-South investments have been the ones that grew the fastest throughout the sample, followed by North-to-South and South-to-North investments, outpacing North-to-North investments (Figure 1). Investments involving the South grew particularly fast after the 2007–08 global financial crisis. By 2018, South-to-South investments and those between the South and the North had risen to 8% and 26% of global investments, respectively. Links established since 2001, capturing the growth in the extensive margin, accounted for a sizable share of the South-to-South investments by 2018. Country-to-country regressions confirm that these trends are shared across a wide range of countries in the South.

Figure 1 Size of international investment positions, by bloc

Source: Broner et al. (2023)

Second, portfolio investment and international reserves involving the South grew faster than FDI, which in turn grew faster than bank loans and deposits. Despite this growth, the weight of the South in portfolio investment remained smaller in magnitude than that in other investments. In contrast, South-to-North reserves accounted for a hefty 73% of the global total in 2018. In 2001, the South had mainly been a destination of FDI from the North and a source of loans and deposits and international reserves to the North. By 2018, the South had grown substantially as a source of FDI to both the North and the South and as a destination of loans and deposits from both the North and the South.

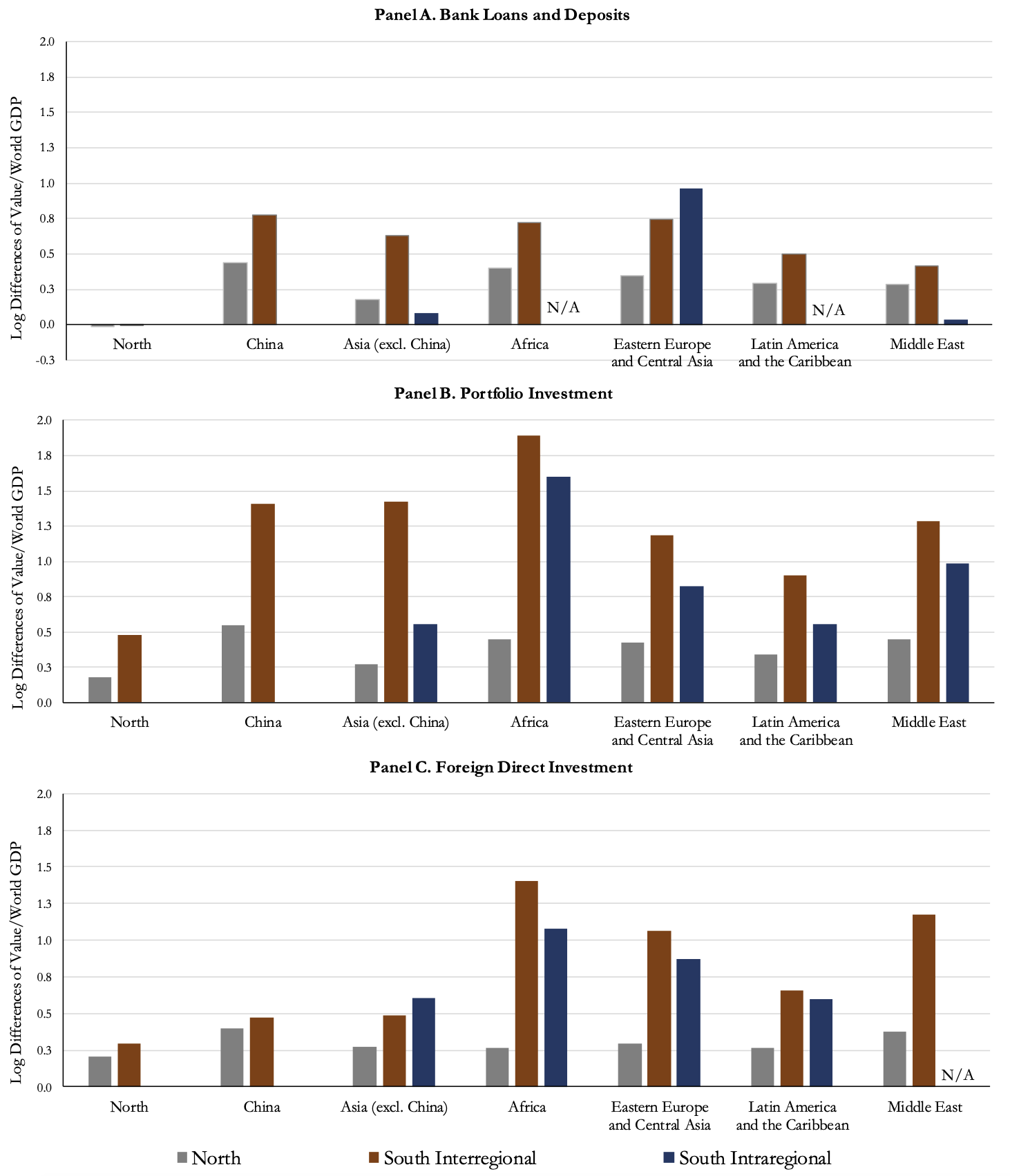

Third, these results are not driven by the growing heft of China. China is not unique when it comes to the financial integration of the South; the growth of international investments involving China is not very different from that involving other South regions. In fact, Africa is the region with the fastest growth in portfolio investment and FDI, and Eastern Europe and Central Asia is the region with the fastest growth in loans and deposits (Figure 2). In general, the growth of investments involving regions of the South grew faster than those among the North. Investments between the regions of the South tended to grow more rapidly than those within the same South regions. While offshore financial centers (OFCs) have captured much attention in recent discussions as conduits of international investments (Coppola et al. 2021), including them as a separate group or as part of the North and South does not change our overall conclusions and tends to reinforce the trends documented in our work.

Figure 2 Growth of international investment positions, by South regions

Source: Broner et al. (2023)

The bilateral data assembled for our paper map the international investment positions between countries across the four main types. As such, they could be valuable for other research, for example on the exposure and transmission of shocks across countries or on the role of financial centres in intermediating investments across countries. They could also be used to explore whether different types of international investments and trade in goods and services are complements or substitutes at the bilateral level. The data could be complemented along various dimensions, notably by incorporating information on the nationality of the ultimate lenders or borrowers. The data could also be enriched to include bilateral information on underrepresented investment types (official loans and trade credit) and off-balance sheet positions (derivatives, credit lines, and guarantees). The bilateral nature of the data allows researchers to shed new light on the process of international financial integration.

References

Aggarwal, R, C Kearney and B Lucey (2012), “Gravity and Culture in Foreign Portfolio Investment”, Journal of Banking and Finance 36(2): 525–38.

Aviat, A and N Coeurdacier (2007), “The Geography of Trade in Goods and Asset Holdings”, Journal of International Economics 71(1): 22–51.

Brei, M and G von Peter (2018), “The Distance Effect in Banking and Trade”, Journal of International Money and Finance 81(C): 116–37.

Broner, F, T Didier, S Schmukler and G von Peter (2023), “Bilateral International Investments: The Big Sur?”, Journal of International Economics, 103795.

Clayton, C, A Dos Santos, M Maggiori and J Schreger (2023), “Internationalizing like China”, VoxEU.org, 27 January.

Coppola, A, M Maggiori, B Neiman and J Schreger (2021), “Redrawing the Map of Global Capital Flows: The Role of Cross-Border Financing and Tax Havens”, Quarterly Journal of Economics 136(3): 1499–1556.

Financial Times (2022), “How the Ukraine War Could Boost China’s Global Finance Ambitions,” March 7.

Hanson, G (2012), “The Rise of Middle Kingdoms: Emerging Economies in Global Trade”, Journal of Economic Perspectives 26(2): 41–64.

Horn, S, C M Reinhart and C Trebesch (2020), “China’s Overseas Lending and the Looming Developing Country Debt Crisis”, VoxEU.org, 4 May.

Horn, S, C M Reinhart and C Trebesch (2022), “China’s Overseas Lending and the War in Ukraine”, VoxEU.org, 11 April.

Lane, P R and G M Milesi-Ferretti (2001), “The External Wealth of Nations: Measures of Foreign Assets and Liabilities for Industrial and Developing Countries”, Journal of International Economics 55(2): 263–94.

Lane, P R and G M Milesi-Ferretti (2007), “The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970–2004”, Journal of International Economics 73(2): 223–50.

Portes, R and H Rey (2005), “The Determinants of Cross-Border Equity Flows”, Journal of International Economics 65(2): 269–96.

Stein, E and C Daude. 2007. “Longitude Matters: Time Zones and the Location of Foreign Direct Investment”, Journal of International Economics 71 (1): 96–112.

The Economist (2023), “Welcome to a New Era of Petrodollar Power,” April 9.

UNCTAD (United Nations Conference on Trade and Development) (2018), Forging a Path Beyond Borders: The Global South.

World Bank (2023), World Development Report 2023: Migrants, Refugees, and Societies.