Since it was publicly proposed in May 2022 and launched in December of that year, there has been considerable controversy regarding the effectiveness of the G7-EU attempt to cap the price received by Russia for its exports of oil and refined products. Taxes on oil exports are a major component of Russian government revenue (nearly one-third by some estimates), so the price cap was designed to lower the Kremlin’s ability to finance its full-scale invasion of Ukraine while avoiding significant global economic harm by keeping world energy prices in check. And there is good reason (Johnson et al. 2023) to think that Russia’s revenue needs will keep it pumping (and exporting) as much oil as possible, even if it cannot receive the current world price. According to the International Energy Agency, Russian oil production remains around 9.5 million barrels per day (IEA 2024), and exports have remarkably steady around 7.5 million barrels per day (although there has been a big shift away from supplying the EU directly). (For more background on the cap design and intention, see Wolfram et al. 2022.)

Early indications suggested that the price cap depressed Russian revenues by almost $50 billion (O’Toole et al. 2023). On the other hand, critics have repeatedly argued (Harris 2023) that there are enough bad actors, of various kinds, in global oil markets, making it is easy to circumvent the cap. And the sale of oil tankers out of Western fleets to undisclosed buyers does suggest that the ‘shadow fleet’ has grown, likely to facilitate cap avoidance. How can we ensure that the price cap on Russian oil continues to depress Russian government revenue below what it would be without the cap?

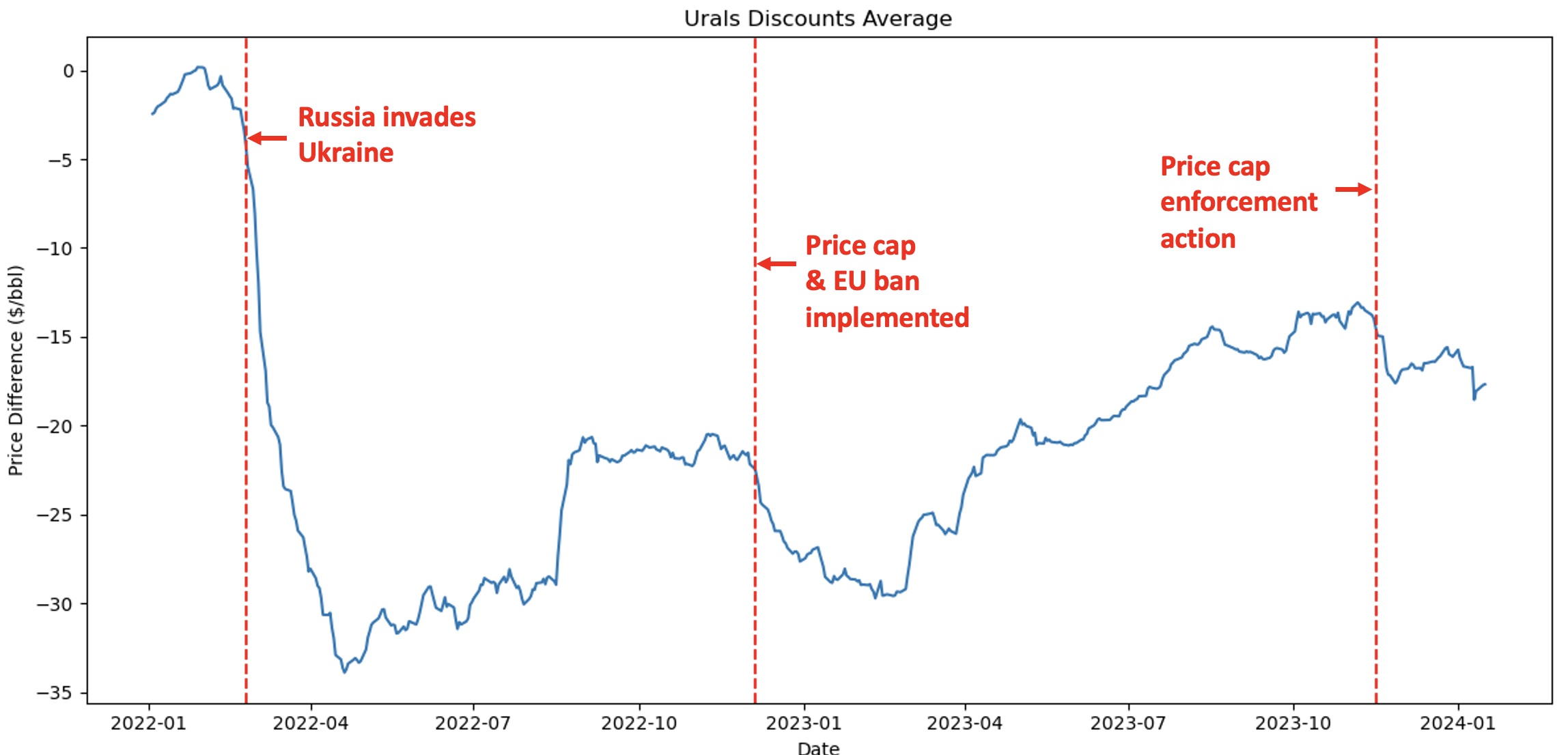

Prices for Urals crude oil, the main grade sold by Russia, offer one lens on this question. Before the invasion of 24 February 2022, the Urals price closely tracked global oil prices, as summarised by the Brent benchmark price. But the war has changed that. Figure 1 plots the difference between Urals and Brent prices (the ‘Urals discount’) over time since January 2022.

Figure 1

Notes: 5-day rolling average

Sources: Neste, Investing.com (Brent, Urals), Bloomberg (subscription required), Datastream (subscription required)

The story so far

The evolution of this discount story has four chapters:

1 Before the February 2022 invasion

Before the war, the Urals discount was usually small and negative, reflecting the fact that buyers saw Russian oil as basically interchangeable with other oil products, if discounted by a couple of dollars. (At the prevailing prices, a couple of dollars amounted to about a 5% discount.) This is analogous to the market price for beef with a little extra fat: it tracks the price of lean beef very closely, but usually with a slight discount.

2 Immediately after the invasion

Immediately after the invasion, some shipping companies (particularly in Northern Europe) and customers (including the US) declined to do business with Russia. UK dockworkers refused to unload ships carrying Russian oil, and similar protests erupted in Scandinavia as Global Witness, other NGOs, and various media outlets raised awareness regarding shipments. Many major oil companies announced that they would not buy oil from Russia. The stigma tied to Russian oil lowered the price Russia could charge, represented by the plunging Urals discount after the left-most red dashed vertical line in Figure 1. Russian oil sold for a discount of as much as $35 per barrel from the world benchmark price, or about a third off.

The discount shrunk as the war ground on and public interest drifted away from Ukraine. The upward movement (shrinking discount) was dramatic in mid-August 2022, apparently motivated by good economic news in the US which drove up Brent prices by about 3% on a single day. This may have convinced traders that a recovering world economy would begin to turn a blind eye to Russia’s war aggression, leading to a lower Urals discount.

3 After the price cap was imposed

On 2 December 2022, the G7 countries, the EU, and Australia announced that starting on 5 December prices for Russian oil shipment that used services from their countries had to be below $60 per barrel. Service providers covered by the price cap included shipping, insurance, trade finance, and flagging. Companies were at risk of facing sanctions if they could not attest that the Russian oil they carried had been sold at or below the cap. At the same time, the EU banned imports of Russian oil.

The price cap was designed to accomplish two objectives (Rosenberg and Van Nostrand 2023). One was to keep Russian oil supplying the global market to avoid the price shock that many feared if significant volumes were sidelined. The other was to deprive Russia of revenues.

In Figure 1, 5 December is the second dashed vertical red line. The price cap seems to have depressed Urals prices for several months, before these prices started drifting back up (and the discount shrank). The most notable uptick came at the end of February 2023, possibly tied to statement from Alexander Novak, Deputy Prime Minister of Russia, blaming the price cap for announced reductions in Russian exports. During 2023 there were reported violations of the price cap and various commenters weighed in on the lax enforcement.

4 After countries increased enforcement

In the autumn of 2023, the price cap coalition took several steps to increase enforcement. On 12 October, the price cap coalition countries issued an advisory outlining recommended actions to comply with the cap. This seems to have had little impact on the prices, perhaps because the announcement may have been lost amidst myriad concerns about the impact of Hamas’ terrorist attack in Israel on 7 October. In addition, the price cap enforcement action was criticized as too limited.

On 16 November 2023, however, the US Treasury announced sanctions against three entities that had allegedly transacted in Russian oil above the cap. This meant that any of those entities’ assets already in US banks were frozen and the entities lost the ability to use the US financial system, as any further transactions would also be frozen. This announcement was followed soon by sharp reductions on the price paid for Urals. Relative to the four weeks before 16 November, the Urals discount widened by more than 20%. To be clear, in a period of turbulent events, no one can be entirely confident about what is driving specific price movements, but this evidence is at least circumstantial.

Enforcing the price cap may also have an impact beyond the Urals discount. Not all of Russia’s oil sales are its Urals blend. It also exports oil from Eastern ports, mainly headed for China. A strictly enforced price cap gives Chinese buyers the ability to negotiate for a lower price, as they know that Russia’s next-best option is to sell the oil under the price cap. So, we should expect lower revenues for these other sales as well although these price data are not reliably observed.

The value of greater transparency

A striking thing about oil prices is just how opaque they are. Even at the price cap, Russian oil sales amount to almost half a billion dollars per day. For most commodities, there is a publicly listed spot price and an exchange or market maker that stands ready to buy and sell (with some commission) at that price. For oil, Argus Media, one of the companies that reports data, describes how it collects data as, “[t]he price assessments in Argus Crude are based on market surveys that are conducted over the telephone and through electronic mail exchanges” (Argus Media 2010). This sounds like, “we just call people and ask what price they’re paying”. Surely Argus is careful, but this approach seems destined to leave holes. Especially under the threat of sanctions, it’s easy to imagine that people who answer Argus’ call are reluctant to tell the truth. That said, the price movements we document above are consistent with other reports on Russian oil revenues – when the Urals prices are low, their finances suffer.

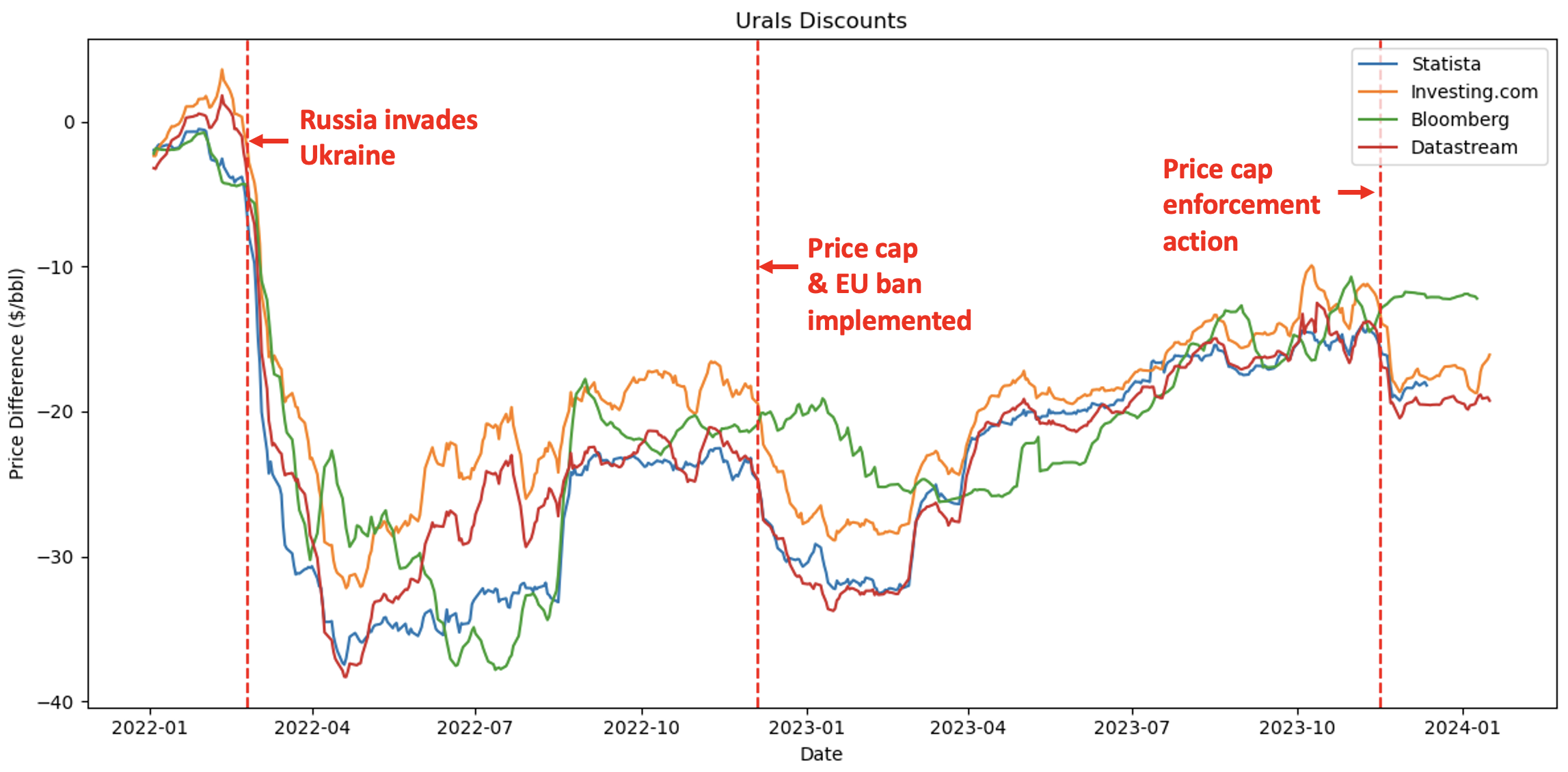

Figure 2 is based on data from four different sources, none of which directly agree with one another. The differences are important. For example, if we look at the data from Bloomberg, neither the 5 December 2022, price cap announcement nor the 16 November 2023, sanctions announcement had a detectable impact on the discount. The sources have very little documentation explaining how they construct their data series, so we have been unable to reconstruct why these differences might appear.

Figure 2

Notes: 5-day rolling average

Sources: Neste, Investing.com (Brent, Urals), Bloomberg (subscription required), Datastream (subscription required)

For such a large, economically important commodity, we have surprisingly low visibility into the prices that are paid. This seems problematic given the importance of stopping Russia’s aggression against Ukraine (and potentially others).

It is time to consider reasonable ways to increase visibility into this market, so customers, intermediaries, and governments can better understand what is really going on. In our view, Europe and the US should step up their enforcement of the oil price cap. For example, recent actions to require that service providers collect more detailed documentation on the prices paid for Russian oil are a step in this direction. And the case for lowering the cap is also strong. But without much more transparency, it is hard to guide and assess the precise impact of the policy – or the ability of bad actors to continue to facilitate and finance the Russian occupation of Ukraine.

References

Argus Media (2010), Methodology and Specifications Guide.

Harris, R (2023), “The Origins and Efficacy of the Price Cap on Russian Oil”, Russia Matters, 14 September.

IEA – International Energy Agency (2024), Oil Market Report – February 2024.

Johnson, S, L Rachel and C Wolfram (2023), “A Theory of Price Caps on Non-Renewable Resources”, NBER Working Paper 31347.

O’Toole, B, O Khakova, T Wlostowski, and C Lichfield (2023), “Rebooting the Russian oil price cap”, Atlantic Council, 9 November.

Rosenberg, E and E Van Nostrand (2023), “The Price Cap on Russian Oil: A Progress Report”, US Department of the Treasury, 18 May.

Wolfram, C, S Johnson, and L Rachel (2022), “The Price Cap on Russian Oil Exports, Explained”, Policy Brief, Mossavar-Rahmani Center for Business and Government.