Businesses play an important role in the transmission of higher monetary policy rates to the wider economy. This includes direct effects on investment and employment in response to higher borrowing costs, as well as indirect effects via weaker aggregate demand. The corporate sector may also amplify the impacts of interest rates if a material number of firms become insolvent or financially vulnerable. This can also have knock-on impacts to the financial system if lenders become distressed. Using new data from a survey of firms, we study how the UK corporate sector is being impacted by the significant and rapid increase in interest rates since 2021.

Higher interest rates have reduced investment, sales, and employment

The Decision Maker Panel (DMP) survey is a collaboration between the Bank of England and academics from King’s College London and the University of Nottingham. It surveys Chief Financial Officers from around 2,500 firms a month. The DMP is unique in providing insights into firms across a broad range of sectors. Between November 2023 and January 2024, firms in the DMP were asked questions about how changes in interest rates since the end of 2021 (both on existing and new borrowing as well as on deposits) have impacted their sales, capital expenditures, and levels of employment.

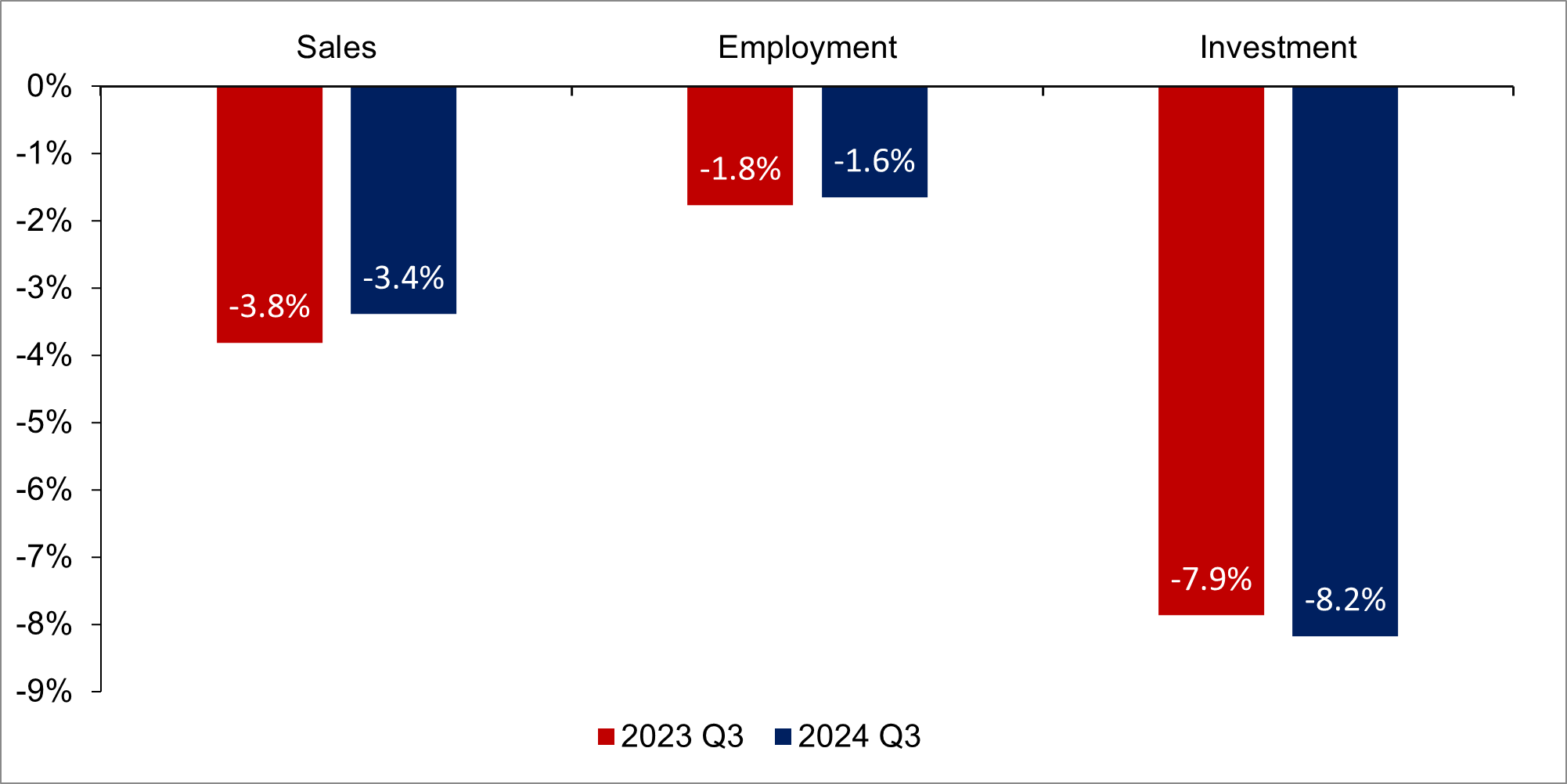

At the aggregate level, firms reported, as of 2023 Q3, that higher interest rates have resulted in 8% lower capital expenditure than would have been the case if interest rates had remained unchanged. They also report that their sales were 4% lower, and that the number of workers they employ is 2% lower (Figure 1). On average, firms expected the additional impact of higher rates over the next year – in response both to past and expected increases in interest rates – to be minimal. However, there was variation within the survey period, with firms in January (after the yield curve moved lower) reporting slightly smaller impacts on investment over the coming year to 2024 Q3 – in contrast to the growing negative impact reported by firms in November.

Figure 1 Average firm estimates of the total impact of higher interest rates on sales, employment, and investment in 2023 Q3 and 2024 Q3

Notes: The results are based on the question: “Holding other factors constant, what is your best estimate of the impact of changes in interest rates since the end of 2021 on the [number of employees/capital expenditures/sales] of your business in each of the periods: 2023 Q3, 2024 Q3?”. Firms were asked to consider interest rates both on existing and new borrowing and the impact on their deposits. The chart shows data collected between November 2023 and January 2024. N = 2,284 firms.

The indirect impact of higher interest rates on demand is important for firms

Higher interest rates can affect investment and employment through a number of channels. They influence aggregate demand in the economy directly, through the interest rate channel, and this can diminish firms’ need to invest (via reduced capacity constraints), desire to invest, and may also reduce the ability to fund investment for those firms which rely exclusively on internally generated cash flow to pay for capital expenditures (Joseph et al. 2019).

They also operate through the credit channel: increasing external financing costs (Gertler and Karadi 2015), which can make new debt more expensive or make servicing existing debt more costly, both of which reduce the affordability of investment. Further amplification can occur through the balance sheet channel if interest rates result in lower asset prices, which reduces the value of collateral a firm may use to secure borrowing (Bahaj et al. 2022, Lian and Ma 2021) or leads to an increasing risk of breaching loan covenants which may prevent a firm from taking on more debt (Greenwald 2019). Even if a firm has no borrowing, the opportunity cost of investing any free cash flow will also go up.

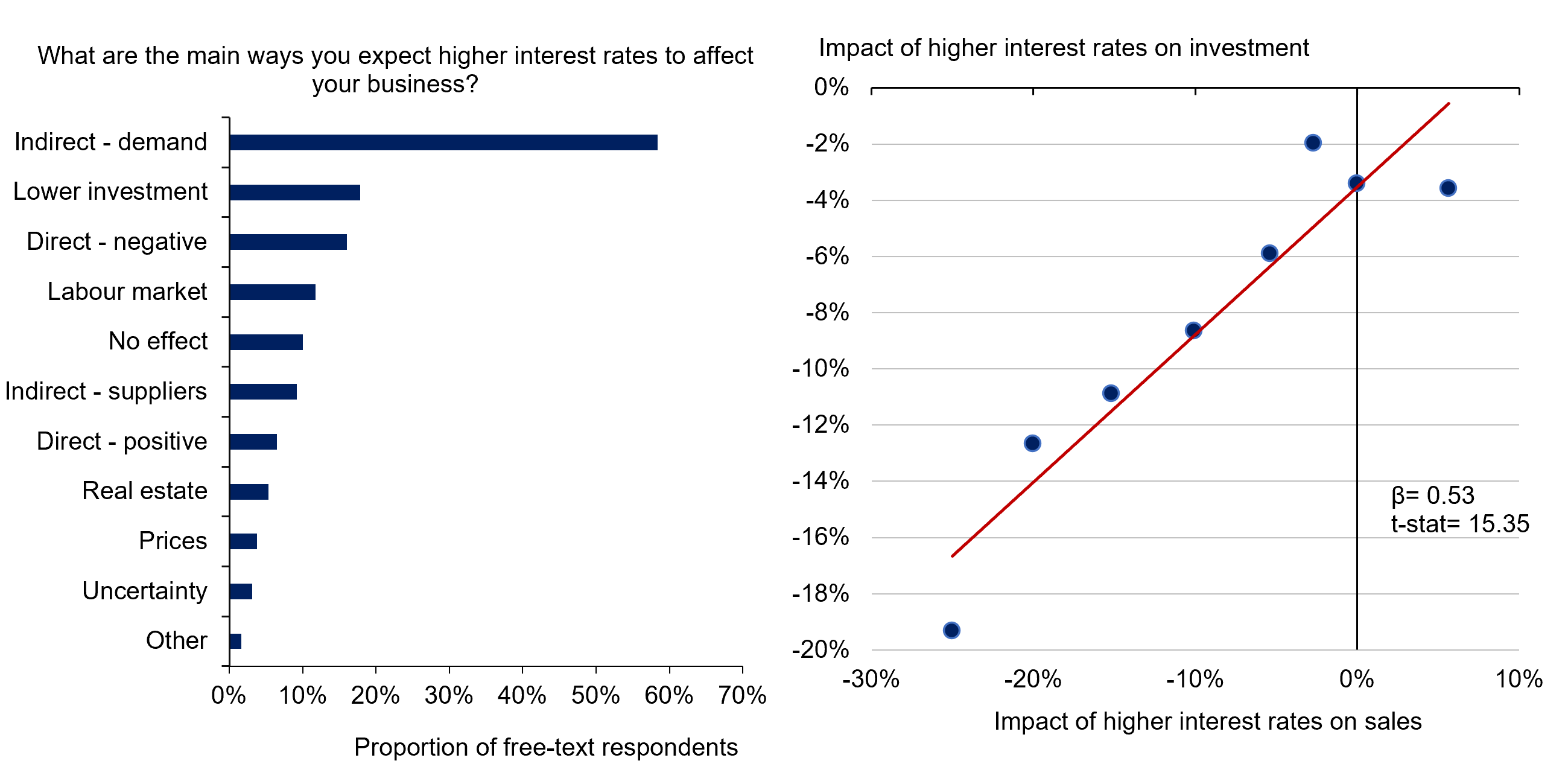

The DMP survey can help assess the extent to which these channels are at work and their relative importance. There is evidence that both interest rate and credit channels have been important. The left panel of Figure 2 presents the free-text responses firms provided as to the main ways that they expect higher interest rates to affect their business over the next 12 months, grouped into the topics they refer to. Respondents widely cite ‘indirect effects through demand’ as important, and the proportion of firms referring to such effects has increased relative to when this question was previously asked earlier in the tightening cycle.

The right panel of Figure 2 shows the strong correlation at the firm level between the estimated impacts of higher interest rates on sales and investment. It implies that for each percentage point reduction in sales, capital expenditures are 0.5% lower. This strong relationship suggests that the general lower demand effects from high interest rates, which will come through to firms via lower sales, are leading firms to reduce their investment expenditures. While higher user cost may reduce firm investment and production capacity and therefore result in lower sales, the extent to which firms report lower demand as important suggests this is not a large effect. A similar correlation is present for employment. These two pieces of evidence are consistent with demand channels being both salient for firms and having an important impact on their investment and employment decisions.

Figure 2 Impact of higher interest rates on firm sales and capital expenditures (right panel) and the proportion of free-text survey responses grouped by theme (left panel)

Notes: The results on the left panel are created by manually assigning free-text responses to the question ‘In your own words, what are the main ways that you expect higher interest rates to affect your business over the next 12 months?’, to each theme. N= 800 comments. The results in the right panel are based on the question: ‘Holding other factors constant, what is your best estimate of the impact of changes in interest rates since the end of 2021 on the [number of employees/capital expenditures/sales] of your business in each of the periods: 2023 Q3, 2024 Q3?’. Firms were asked to consider interest rates both on existing and new borrowing and the impact on their deposits. Each dot represents 12% of the sample of firms, grouped according to the estimated impact of higher interest rates on sales. The chart shows data collected between November 2023 and January 2024. N = 2,289 firms.

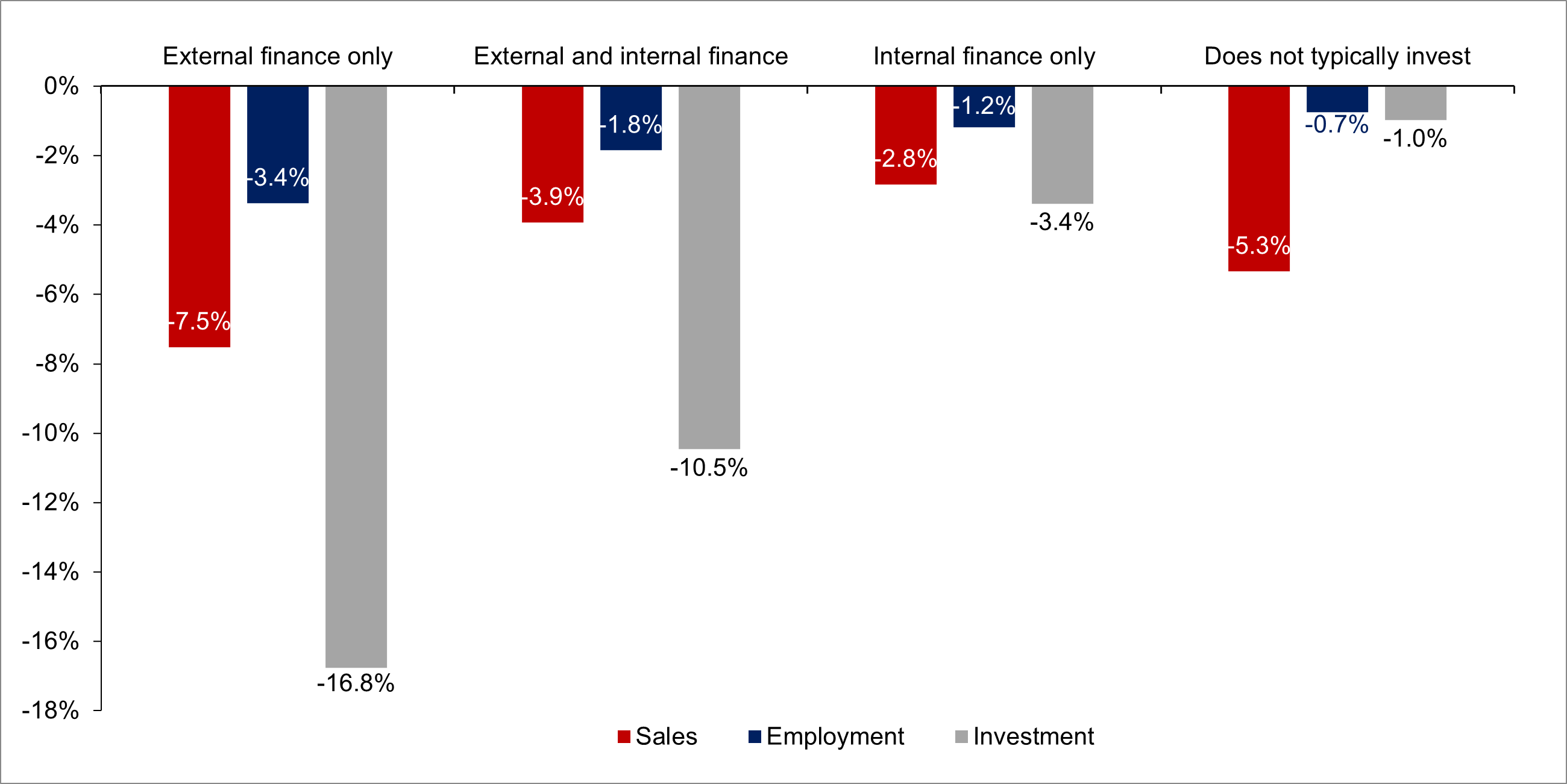

Firms that are most reliant on external finance report largest adjustments to higher interest rates

The responses from firms in the DMP also provide evidence that the external financing channels are important in the transmission of interest rates to investment. Firms were asked to report how they ordinarily fund investment, enabling us to separately identify firms that are reliant on external finance for investment alone (10% of the firms), those who use a mix of external and internal cash flow (40% of firms) and those who solely use internal cash flow (45% of firms). Figure 3 demonstrates that those firms that only use external finance to finance investment report significantly larger impacts from higher interest rates on investment of around 20%. This is double the impact reported by firms who use a mix of internal and external cash flow to fund investment and several times larger than that reported by firms using solely internal cash flow.

Figure 3 Average firm estimates of the total impact of higher interest rates on sales, employment, and investment in 2023 Q3, by how firms finance investment

Notes: The results are based on the question: “Holding other factors constant, what is your best estimate of the impact of changes in interest rates since the end of 2021 on the [number of employees/capital expenditures/sales] of your business in each of the periods: 2023 Q3, 2024 Q3?”. Firms were asked to consider interest rates both on existing and new borrowing and the impact on their deposits. How firms fund their investment is based on the question: “How does your businesses typically finance its investment?” with options for different forms or external and internal finance. Firms were allowed to select multiple options. N= 2, 289 firms.

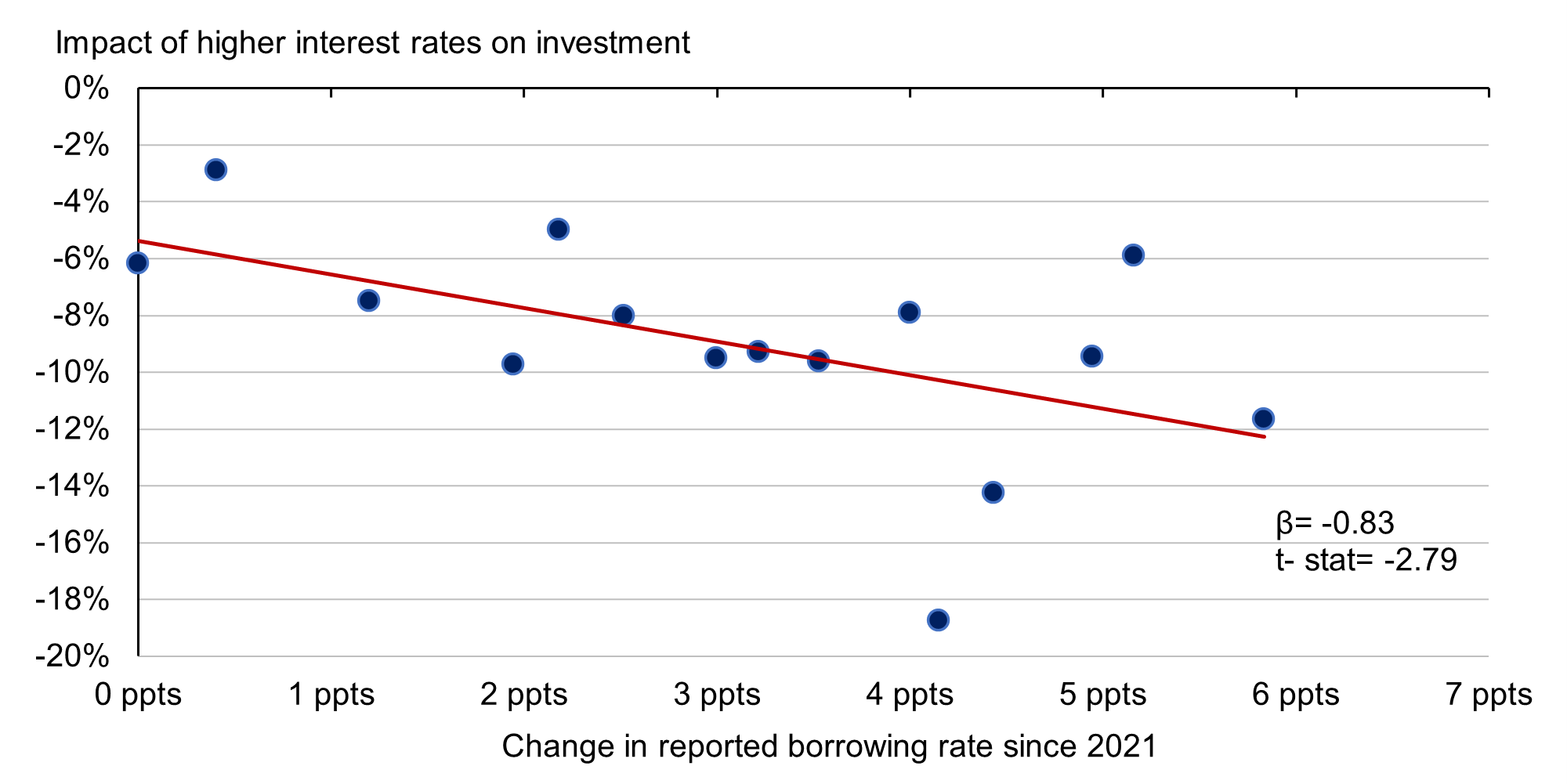

Focusing on firms with debt, it is clear that the size of the change in the interest rates that these firms face on their borrowing is important in explaining the negative response in investment. On average, firms report that the interest rates they are paying on their borrowing have increased from around 3.5% at the end of 2021 to almost 7% at the start of 2024. But there is heterogeneity across firms. The change in interest rates that individual firms face will depend on whether they have any fixed-rate debt, and when those fixed-rate loans were taken out, but also on factors such as how those loans are secured and how lenders view their credit risk. Figure 4 uses a binned scatterplot to show the relationship between the reported change in the interest rates that firms face on their borrowing since 2021 and the impact that they report that higher interest rates has had on investment to date. The downward slope shows that a larger increase in the cost of borrowing is associated with larger cuts in investment. This may be due to the fact that higher borrowing costs have reduced the availability of cash flow for investment, but also the higher cost of new debt making projects less profitable. A similar relationship also holds when looking at the level of interest rates on firm borrowing rather than the change in these rates.

Figure 4 Binned scatterplot of reported changes in borrowing costs since 2021 and reported impact of higher interest rates on investment

Notes: These results are based on responses to the questions: ‘Holding other factors constant, what is your best estimate of the impact of changes in interest rates since the end of 2021 on the [number of capital expenditures/sales] of your business in each of the periods: 2023 Q3, 2024 Q3?’ and ‘What is the approximate average annualised interest rate on the interest-bearing borrowing that your business has, both now and at the end of 2021?’. Each dot represents 7% of the sample of firms, grouped according to the change in borrowing rate since the end of 2021. N = 806 firms.

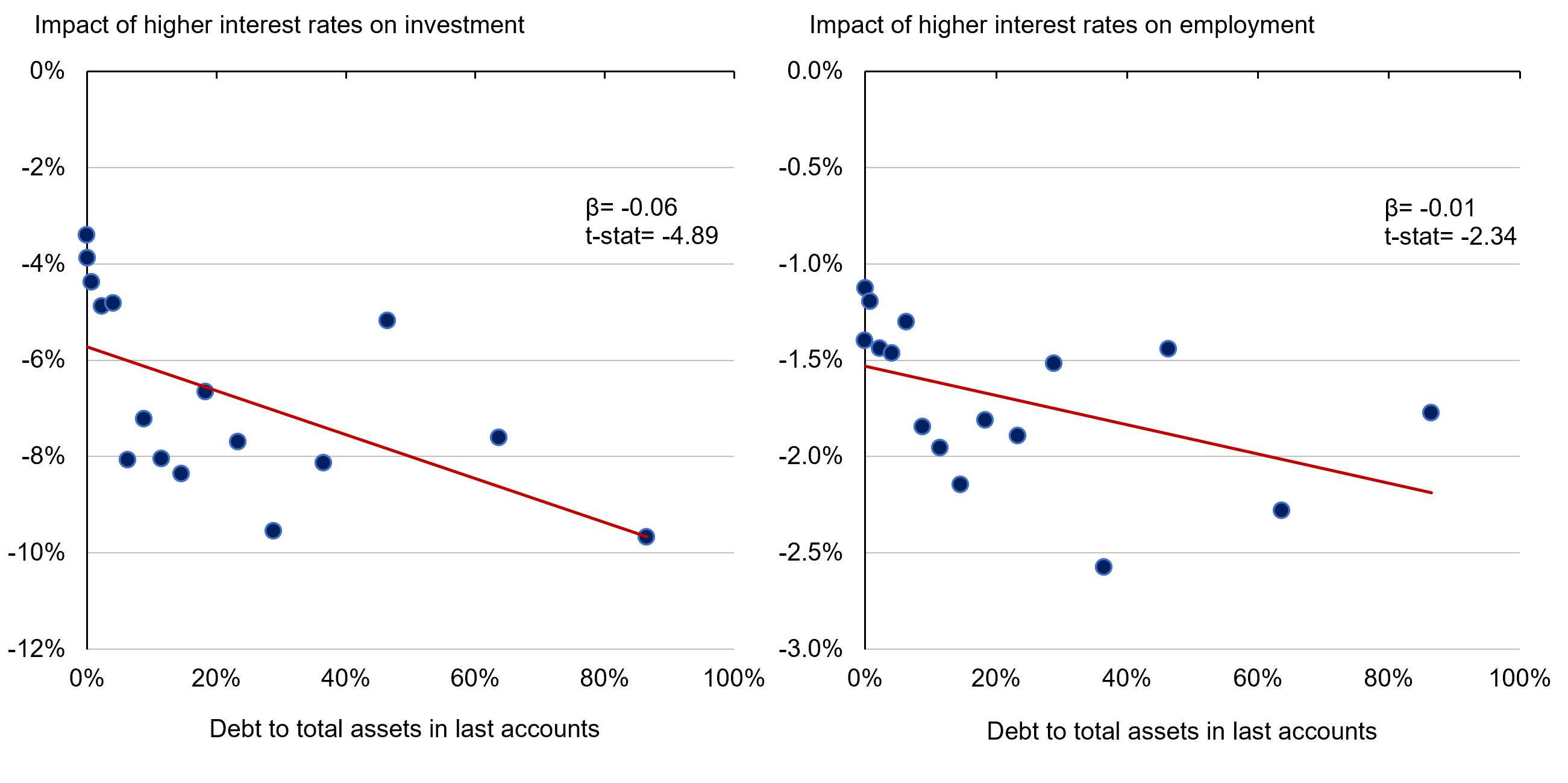

The role that the funding arrangements of firms play in the transmission of higher interest rates to the real economy highlights the importance of the financial system and understanding how interest rates are impacting financially vulnerable firms. To some extent, a larger impact of higher rates for financially weaker firms is a normal part of the transmission mechanism. However, these impacts may become worrying for policymakers if there is a sufficiently large number of vulnerable firms, or if the adjustments being made by indebted firms are sufficiently outsized that they amplify macroeconomic downturns and losses for lenders. Figure 5 shows the relationship between the impacts of higher interest rates on investment and employment and versus firms’ prior level of indebtedness. It demonstrates that more leveraged firms report larger falls in investment and employment, but these relationships are not obviously non-linear.

Figure 5 Binned scatterplot of firm debt to asset ratios and reported impacted of higher interest rates on investment (left panel) and employment (right panel)

Notes: These results are based on a regression using firms’ responses to the questions: ‘Holding other factors constant, what is your best estimate of the impact of changes in interest rates since the end of 2021 on the [number of capital expenditures/employment] of your business in each of the periods: 2023 Q3, 2024 Q3?’. Each point represents 6% of the sample, grouped according to debt to assets ratios. Debt to asset ratios are calculated using company account data from Bureau van Dijk FAME and are mostly for financial year 2021. N = 2,266 firms for the left panel, and N = 2,326 for right panel.

Conclusions

Firms in the DMP report that higher interest rates since 2021 have reduced investment by 8%, employment by 2%, and sales by 4%. These impacts reflect both the direct reaction of firms to a higher cost of capital, as well as firms internalising the indirect impact of higher interest rates via lower demand. The evidence also underscores the importance of financing channels, with firms that report being reliant on external finance to fund investment reporting the largest negative impacts from interest rates on investment and employment.

References

Bahaj, S, A Foulis, G Pinter and P Surico (2022), “Employment and the residential collateral channel of monetary policy”, Journal of Monetary Economics 131.

Gertler, M and P Karadi (2015), “Monetary Policy Surprises, Credit Costs, and Economic Activity”, American Economic Journal: Macroeconomics 7(1).

Greenwald, D (2019), “Firm Debt Covenants and the Macroeconomy: The Interest Coverage Channel”, MIT Sloan Research Paper No. 5909-19.

Joseph, A, C Kneer, N van Horen and J Saleheen (2019), “All you need is cash: corporate cash holdings and investment after the financial crisis”, Bank of England Staff Working Paper No. 843.

Lian, C, and Y Ma (2021), “Anatomy of Corporate Borrowing Constraints”, The Quarterly Journal of Economics 136(1).