The Trade Facilitation Agreement (TFA), signed in 2013 with entry into force in 2017, is the first multilateral agreement since the creation of the WTO, and one in which all WTO members participate (172 WTO members are TFA signatories, including 42 African countries). The TFA includes publication of information, advance rulings, appeal or review of decisions, freedom of transit, transparency and border agency cooperation, and the setting up of formalities that implement least trade-restrictive measures to achieve underlying policy objectives (e.g. ‘single-window’ systems, a ban on mandatory Pre-Shipment Inspection (PSI) for classification/valuation). The introduction of measures making the use of customs brokers mandatory is also forbidden. The freedom of transit (i.e. the prohibition of non-transport related fees) objective is particularly important for landlocked countries.

The bottom-up approach in the TFA gives extensive leeway (Hoekman 2016 notes that the occurrence of the wording “should” in the TFA provisions is twice as high as in the related WTO agreements on customs valuation and import licensing). Technical assistance may not be forthcoming, and TFA provisions cannot be enforced through the WTO dispute settlement mechanism. Thus, the TFA presents no effective commitment threat for signatories. In sum, the TFA is a best-shot endeavour based on promises rather than on legal content. However, one benefit of the TFA is that it is sufficiently specific that progress on implementation can be monitored relatively easily at the country level, making it easier to estimate compliance with the proposed objectives of reducing time at customs.

The African Continental Free Trade Area (AfCFTA)

The AfCFTA’s main mandate is to eliminate trade barriers to boost intra-Africa trade. All but one African country has signed the AfCFTA, which entered into force on 30 May 2019. Yet, many odds and ends are still to be concluded, notably negotiations on a common set of rules of origin (RoO) for some products with high applied tariffs as products where MFN tariffs are highest have been excluded from lists of tariff offers.

Time and costs associated with crossing borders are best estimated from customs-level data where shipment characteristics are described in sufficient detail and the shipment is classified into an inspection or no-inspection channel allowing us to establish a causal relation between time in customs and assignment to customs channels. For Peru, Carballo et al. (2021) estimate that shifting import shipments from inspection to no-inspection in Peru returns a 20% tariff-reduction estimate for a 1-day reduction at the median time. For Albania, Fernandes et al. (2021) estimate that a similar shift results in an estimated 1.8% annual percent increase in import volumes. Volpe et al. (2015) carry out a similar exercise for all HS6 product-level exports of Uruguayan firms where the choice is between ‘green’ (no customs inspection) and ‘red’ lanes (customs inspection)’ over a long period. They estimate that a 10% increase in the median time spent in customs is associated, on average, with a 1.8 percentage point reduction in the growth of firm-level exports.

Our study

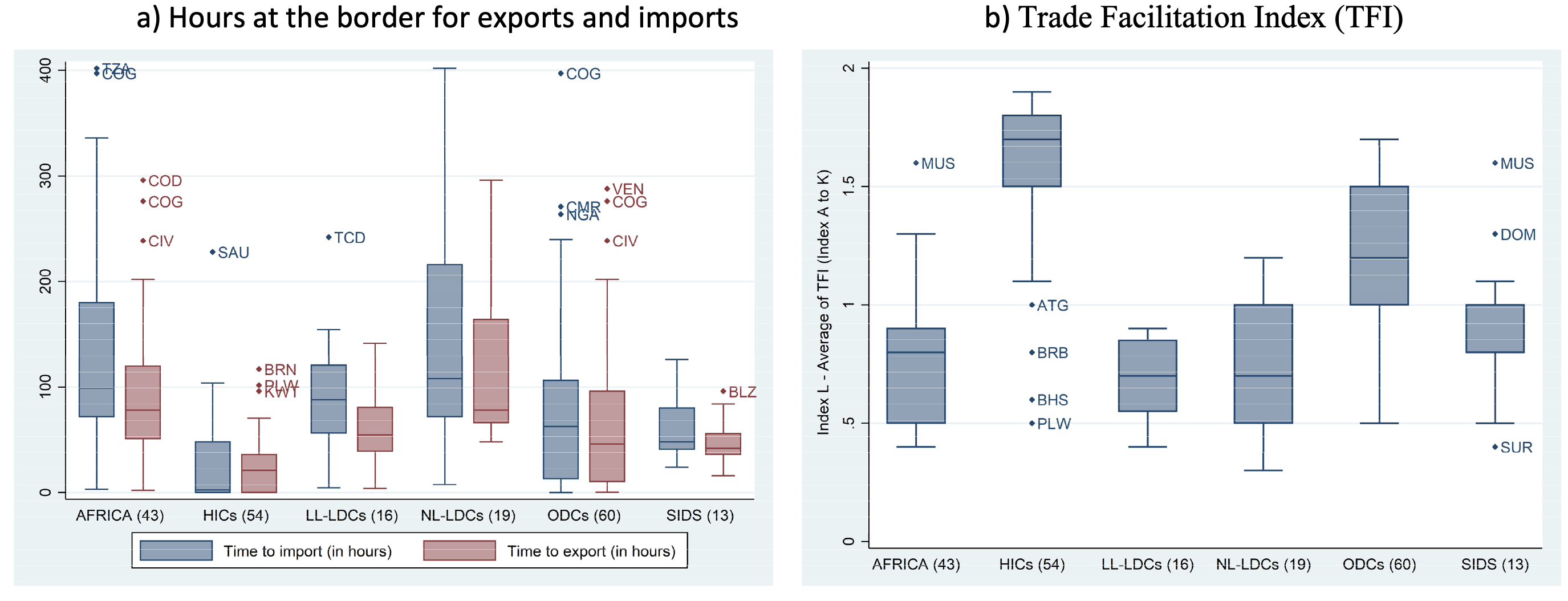

Lacking the granularity of shipment-level data to carry out case studies for a sufficiently large sample of countries, in a recent paper (de Melo et al. 2023d) inspired by Hillbery and Zhang (2017), we present ballpark estimates of achievable reductions in customs-related trade costs from implementing the TFA across several country groupings. The estimates are based on survey-based measures (e.g. Doing Business (DB) data displayed in figure 1a) combined with the OECD customs performance indicators (summarised in the Trade Facilitation Index (TFI) values displayed in figure 1b).

The box plots show large heterogeneity for border compliance times (Figure 1a), especially for the AfCFTA, NL-LDCs, and LL-LDCs groups. The two LDC groups have the lowest median values for the average TFI index (Figure 1b). The median score for the HICs is higher than the best score (Mauritius) in the Africa group, an indication of the relative efficiency of customs across Africa.

Overall, there is less heterogeneity within the ODC and HIC groups.

Figure 1 Box plots

Notes: Number of countries in group in brackets. Abbreviations: LL is landlocked: HICs is High income countries; ODCs are other developing countries; SIDS is small island developing states. Box plot: Bar in the middle is the median value, shaded area is the interquartile range and minimum maximum values correspond to +/- 1.5 times the interquartile range. For the Small island Developing States (SIDS) group, SIDS that are also LDCs (3) or HICs (7) are excluded. The ODCs group excludes all developing countries that are also LDC and/or SIDS. TFI scores range from 0 (no implementation) to 2 (full implementation of TFA measures).

Source: de Melo et al. (2023 figures 2 and 4) from World Bank, Doing Business (DB) data 2020. Data captures regulatory reforms implemented between May 2018 and May 2019.

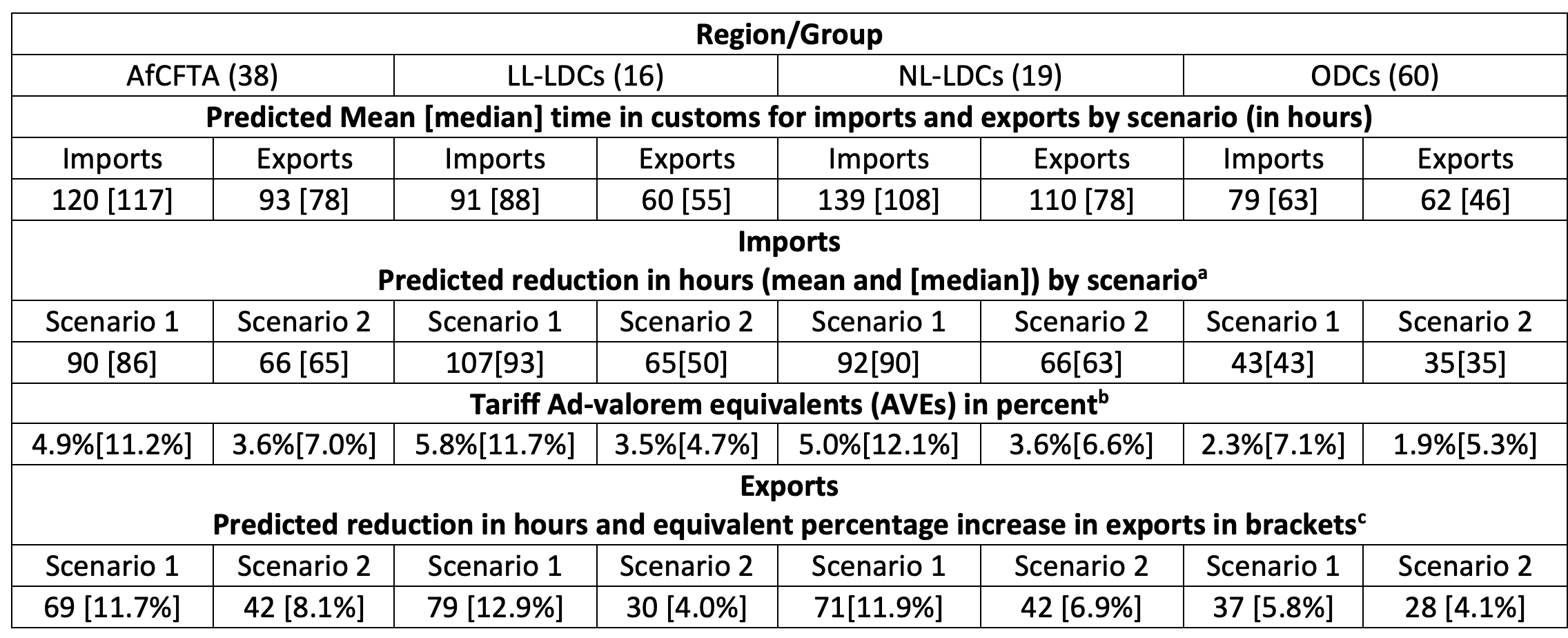

Table 1 reports our preferred estimates by group and Figure 2 gives estimates for selected countries in AFCFTA. Estimates are obtained in two steps. In the first step, Doing Business values of time in customs for each (163) country are regressed on a cross-section of the Trade Facilitation Index (TFI) indicator values and control variables (geographic, and structural economic variables) using a negative binomial estimator. For all estimated models, a higher TFI score is significantly associated with less time spent in customs for imports and exports. Satisfied that predicted values are close with time in customs recorded in the Doing Business, in a second step we carry out two simulations reported in Table 1. Scenario 1 captures a more aspirational long-term objective, with scenario 2 considered a plausible objective for the medium term.

Table 1 Ad-valorem equivalents (AVEs) of improvements in Trade Facilitation indicators (TFIs) (group averages, 2019-2020)

Notes: Mean and median values [in brackets] reported for each group. The two convergence scenario estimates are from simulating the reduction in time at customs from improvements in the OECD TFI indicator. a/Scenario 1 – Convergence to the average of top-2 countries in the sample defined on ODCs: TFI of each country takes the average of the top 2 TFI index values in the ODC group. a/Scenario 2 – Convergence to the average top-2 within each region/group. TFI of each country takes the average of the top 2 TFI index values within each region/group. b/For imports, the time reduction estimate is translated into an AVE using two conversions :(i) from Hummels and Schaur (2013) that an extra 24 hours in customs is equivalent to a 1.3% tariff at destination; (ii) From Carballo et al. (2021) reported in brackets discussed in text. c/For exports, reduction in times are translated into extra export growth using the Volpe et al. (2015) estimate for Uruguay exports that a 10% reduction in time raises export growth by 1.8%.

Source: de Melo et al. (2023, table 4)

The results give a range of estimates at the group level. For the 38 AfCFTA signatories, feasible improvements (as captured by improving to an average of the two best indicator values in the respective group) suggest a reduction of 65 hours (2.7 days) for imports which translates into an equivalent reduction in tariffs in the range of 3.6% - 7.0%. This is significant since average applied tariffs for African countries are 12.4%. To these gains should be added the reduced time of 42 hours (1.7 days) in customs for exports, translating into 8.1% increase in exports. This extra export growth estimate suggest that implementing the TFA should be important for the development of regional value chains in Africa.

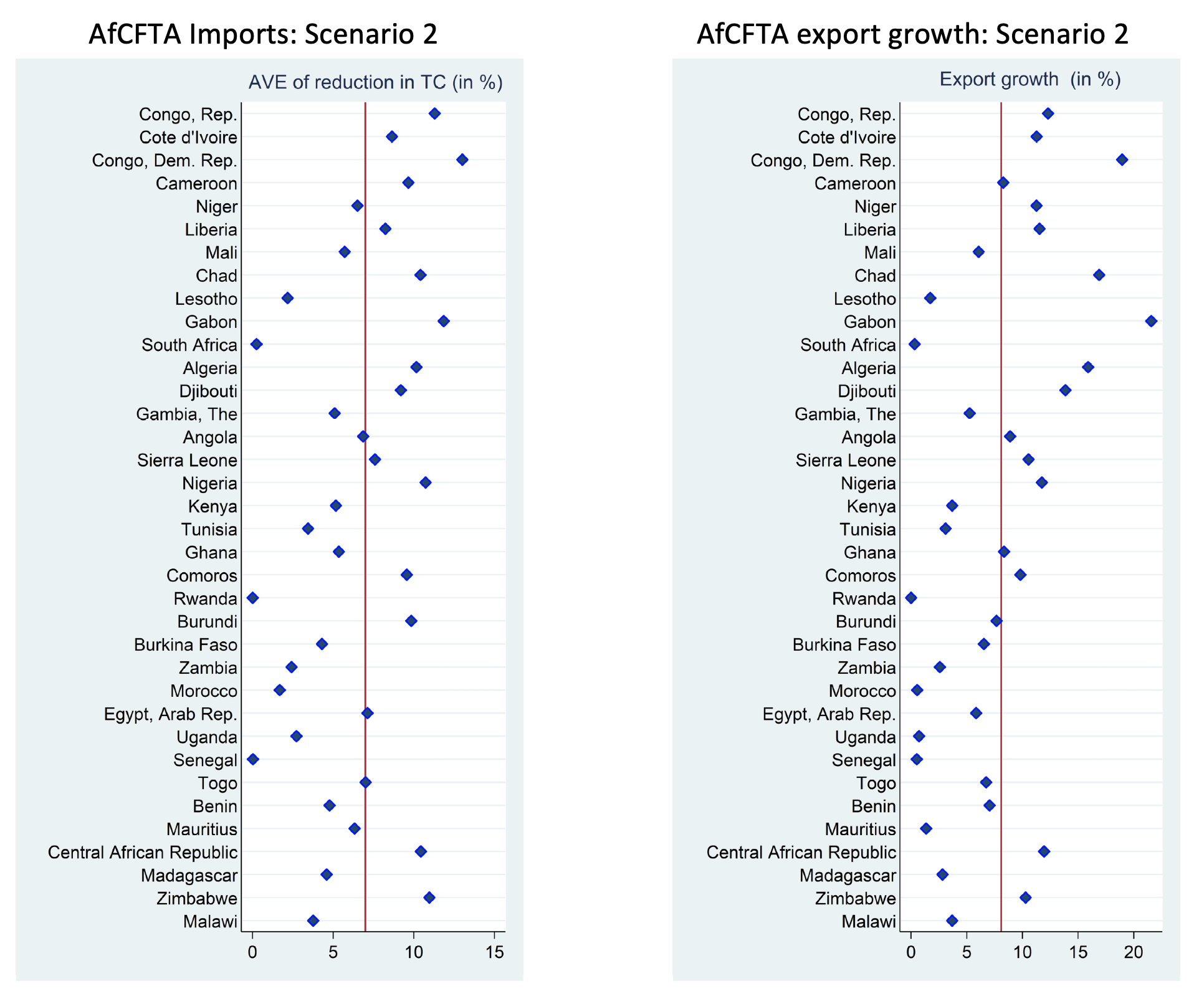

Figure 2 reports country-level estimates under scenario 2 for the 38 AfCFTA signatories countries with no missing data. By construction, countries at the top of their respective groups (e.g. Rwanda, Senegal, and South Africa on the import side and South Africa, Morocco, Uganda, Rwanda, and Senegal on the export side) are assumed not to reduce time in customs. This is pessimistic, so estimates at the group level are arguably on the low side.

Figure 2 Country-level estimates of reduction in hours at customs from TFA implementation among AfCFTA members

Notes: See table 1 for scenario 2. AVEs = Ad-valorem equivalents, TC= Trade Costs. D. R. Congo, Algeria, and Comoros are not TFA signatories. Vertical red line is median value for the 43 African countries in the AfCFTA group. Estimates are for countries with no missing data.

Source: de Melo et al. (2023), figure 4

Conclusions

A handful of case studies of time in customs based on transaction-level data show that customs reforms, some along the lines suggested by the disciplines in the Trade Facilitation Agreement (TFA), should benefit developing countries, especially for those in groups with adverse geographical characteristics. Our ballpark estimates for a large sample suggest that taking the TFA disciplines seriously would boost significantly intra-African trade, the key objective of the African Continental Free Trade Area (AfCFTA). Taking results from the less ambitious counterfactual scenario suggests that feasible improvements in Trade Facilitation Indicator values would translate into significant reduction in time at customs for 38 African countries engaged in the AfCFTA. On the import side, times in customs would be reduced by 2.7 days, equivalent to a reduction in tariffs in the range of 3.6-7.0%. On the export side, the average time in customs would be reduced by 1.7 days, translating into an 8.1% increase in exports. These are quantitatively significant gains since average applied tariffs for African countries are currently 12.4%.

References

Carballo, J, A Graziano, G Schaur and C Volpe Martincus (2021), “Import Processing and Trade Costs”, CESifo WP9170

de Melo, J, Z Sorgho and L Wagner (2023), “Reducing Wait Times at Customs: How Implementing the Trade Facilitation Agreement (TFA) can Expand Trade among AfCFTA countries”, CEPR Discussion Paper 18651.

Fernandes, A M, R Hillberry and A Mendoza Alcàntara (2021), “Trade Effects of Customs Reform: Evidence from Albania”, World Bank Economic Review 35(1): 34-57.

Hillberry R and X Zhang X (2017), “Policy and Performance in customs: Evaluating the trade facilitation agreement,” Review of International Economics 26(2): 438-480.

Hoekman, B (2016), “The Bali trade facilitation agreement and rulemaking in the WTO: milestone, mistake or mirage?”, in Bhagwati J N, P Krishna and A Panagariya (eds), The world trade system: Trends and challenges, Cambridge: MIT Press.

Hummels, D and G Schaur (2013), “Time as a Trade Barrier”, American Economic Review 103(7): 2935-59

Moïsé E and F Le Bris (2013), « Trade Facilitation Indicators: The Potential Impact of Trade Facilitation on Developing Countries’ Trade”, OECD Trade Policy Papers 144, Paris: OECD.

Neufeld N (2014), “The Long and Winding Road: How WTO members finally reached a Trade Facilitation Agreement”, WTO Staff Working Papers ERSD 2014-06, WTO: Economic Research and Statistics Division.

Volpe M C (2016), Out of the Border Labyrinth: An Assessment of Trade Facilitation Initiatives in Latin America and the Caribbean, IDB Publications.

Volpe M C, J Carballo and A Graziano (2015), “Customs,” Journal of International Economics 96(1): 119-137.

World Trade Organization (2021), “First Review of the operation and implementation of the trade facilitation Agreement”, Geneva: Switzerland