During recent crises, governments have spent significant amounts to mitigate the impact of economic downturns on citizens and corporations. The resulting pressure on public funds increases the importance of improving tax compliance. EU member states, for example, lost an estimated €134 billion in value added tax (VAT) in 2019 due to fraud and evasion (European Commission 2021). Research indicates that the ability to observe transactions reduces tax evasion (e.g. Summers and Sarin 2020). Although VAT encourages businesses to request invoices in business-to-business transactions, this ‘self-enforcement’ property does not exist in business-to-consumer dealings. Consumers may receive discounts for foregoing a paper trail, especially when interacting directly with sellers.

To increase tax compliance in the provision of services to households, several countries have introduced policies to encourage consumers to demand legally provided services (e.g. Williams and Nadin 2014). One approach is to reward compliant taxpayers, as also used in other domains (e.g. Rehman et al. 2019). In a recent paper (Burgstaller et al. 2023), we study the effect of monetary incentives on consumers' willingness to choose legally provided services and the premium they are willing to pay for these. We focus on tax credits that offer favourable tax treatments to consumers of services, as granted in several European countries (OECD 2021).

Tax credits take different forms, which may influence their effectiveness. In several countries – including Germany, Italy, Belgium, and France – tax credits can be claimed via annual tax returns, which requires consumers to pay the full price upfront. This implementation may lead to a low take-up rate among households with lower incomes, who cannot afford to pay the higher price of declared services upon consumption. In addition, the procedure to obtain the tax credit may be too burdensome for some households. Therefore, Sweden has shifted to a system in which tax credits are granted at source, i.e. as an immediate price reduction and where the seller handles the administration with the tax authority. Previous literature shows that simplifying application and reducing administrative burdens increases take-up of governmental transfers (e.g. Moffit and Ko 2022). Refund rates also vary, with Germany offering 20% of labour costs while France and Sweden provide a 50% refund (OECD 2021).

We examine the effect of the different types of tax credits using two experimental surveys. Participants are asked to put themselves in a situation of buying a service that is conducted in their household, such as painting walls. Our sample consists of 1,974 homeowners, who are more likely to demand household services such as renovation work than renters. In the choice experiments, subjects choose between two offers that vary with respect to four characteristics – in particular, the price of the offer and whether the offer includes an invoice. As is common in such negotiations (Doerr and Necker 2021), we use the term ‘without invoice’ to signal that the transaction will not be declared to the public authorities. We randomly assign participants to policy scenarios which represent different designs of tax credits. We vary the type of the tax credit (granted via tax return/at source), the refund rate (20/30%), and whether the financial benefit is made salient by displaying the price including the tax credit.

Tax credits increase the demand for legally provided services

Household tax credits increase the willingness to pay for offers with invoice. When the refund rate of the tax credit is 20%, the tax credit via tax return and the tax credit at source increase the willingness to pay by a similar magnitude. When the refund rate is 30%, the tax credit granted at source is more effective than the tax credit granted via the tax return. The increase of the refund rate from 20% to 30% has hardly any effect. These results suggest an interaction between the rate of the tax credit and its administrative implementation.

The two most effective tax credits are a credit granted at source with a rate of 30% and a credit granted at source with a rate of 20% when the final price including the tax credit is displayed. These two tax credits do not differ significantly in their effectiveness, which implies that governments can achieve the same effect when they provide a 10 percentage point lower tax refund but ensure that consumers understand the financial benefit.

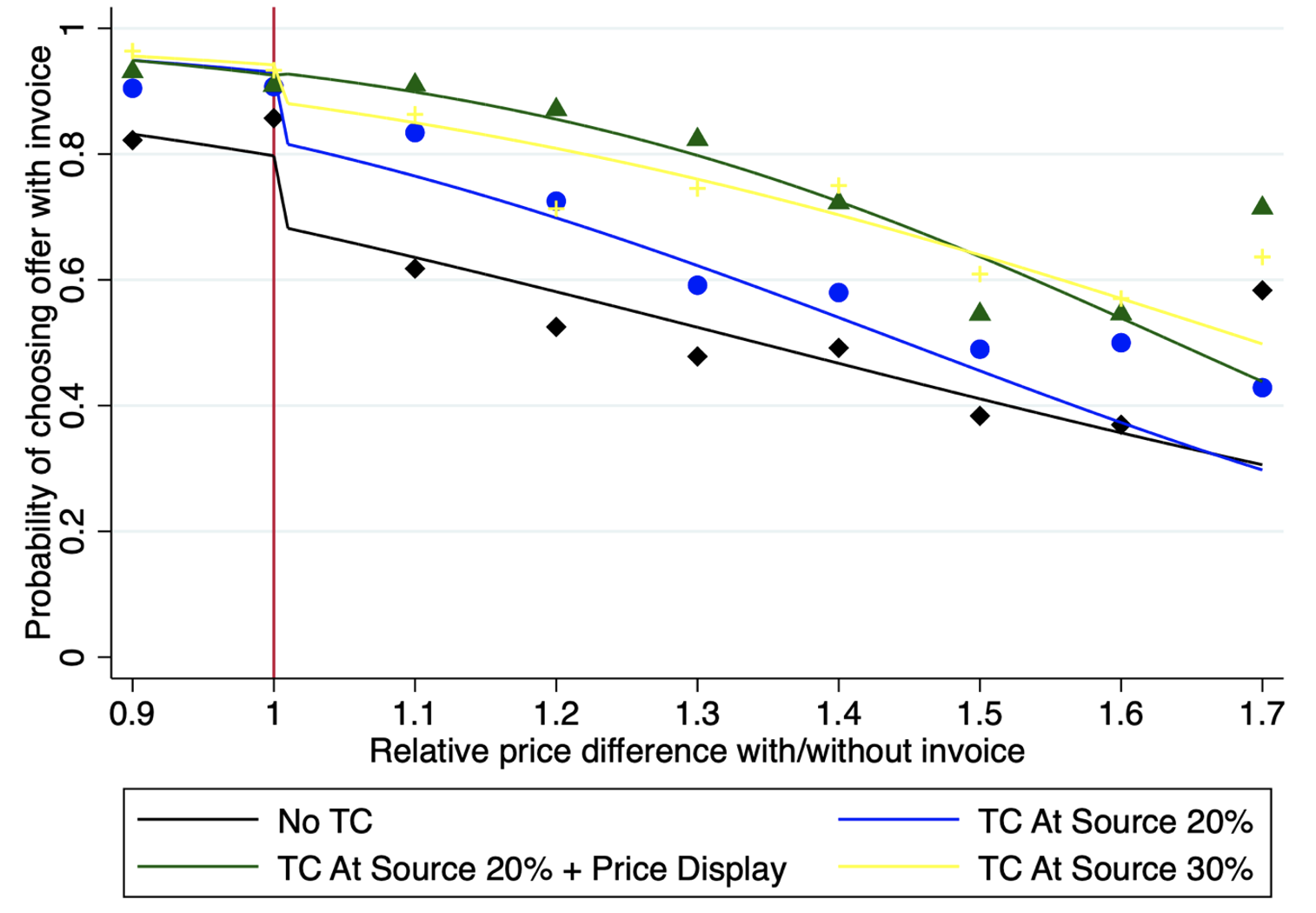

Figure 1 shows how the probability that respondents choose an offer with invoice varies depending on the price premium for receiving an invoice and across different types of tax credits. Unsurprisingly, a higher price premium decreases the willingness to choose an offer with invoice. Remarkably, even when the price is higher, some respondents prefer offers without invoice. The probability that an offer with invoice is chosen increases when a tax credit exists. Doerr and Necker (2021) find that the price premium for an invoice is between 1.2 and 1.5 in the German setting with a tax credit claimed via the tax return. At these price premia, the probability of choosing an invoice is highest with the two most effective tax credits.

Figure 1 Probabilities to choose an offer with invoice over price premia and policy scenarios

Note: The points show the fraction of choices in which the respondents chose the service with invoice at each price premium for an invoice depending on the tax credit. The price premia are calculated as ratios between the offer with invoice and the offer without invoice. The maximum likelihood fits, depicted by the lines, are estimated with logistic regression on the choice task level for each treatment group.

Consumers’ willingness to pay for an invoice is less than the financial value of the tax credits

The increase in the willingness to pay for an invoice is much less what we would expect if individuals had fully factored in the financial benefit of the tax credit. For most tax credits, willingness to pay is only about one third, or even less, of the financial value. It is higher for the two most effective tax credits. Our results suggest that the costs of taking up the subsidy are only partially reduced by the shift from via tax return to at source, but they are substantially reduced by helping people understand the financial benefit of the tax credit. Therefore, governments should use strategies to help people understand the financial benefit of tax credits rather than increasing their rate to increase their effectiveness.

Tax credits are subject to free riding

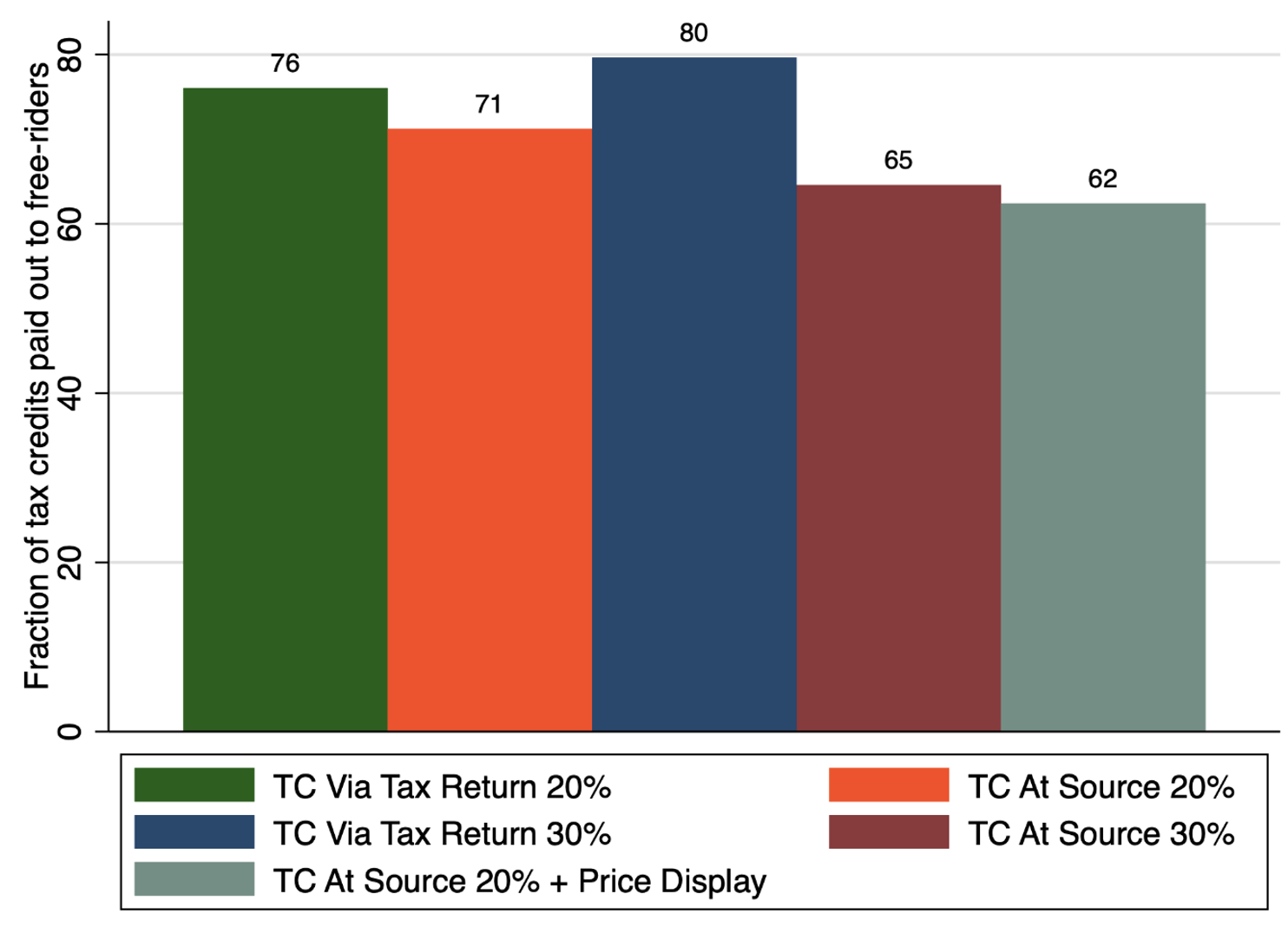

Our study shows that even without a tax credit, in 55% of decisions respondents choose an offer with invoice. This implies that tax credits are related to substantial free riding, which we measure as the fraction that would claim the tax credit even though they would have selected an offer with invoice also without it. According to our estimates, the share of free-riders ranges between 62% and 80%, depending on the tax credit (see Figure 2). Since our results apply to the provision of small-scale jobs in the household, we expect that this problem is even more pronounced for larger jobs, for which having a guarantee is important. These results further question the tax credits’ overall efficiency in reducing non-compliance.

Figure 2 Fraction of tax credits granted to free riders

Note: We obtain the fraction of free riders by taking the difference between the rate of offers with invoice in the no tax credit condition and the different tax credit conditions. We consider whether respondents report they would actually use the tax credit, which we obtain from on a post-experimental question.

Policy implications

Although tax credits are effective in reducing the demand for illegally provided services, governments should consider that the willingness to demand legally provided services is already substantial when no tax credit is in place. Hence, the increases in tax compliance are rather modest. We conclude that if governments want to use tax credits, they should implement them in a way that helps consumers to easily understand the financial benefit rather than trying to improve their attractiveness by increasing the rate of the refund. One way to implement this would be to require sellers to state the final price including the tax credit. However, governments should rigorously weigh up the benefits and costs of the tax credit, keeping in mind that all types of tax credits are associated with considerable free riding.

References

Burgstaller, L, A Doerr and S Necker (2023), “Do Household Tax Credits Increase the Demand for Legally Provided Services?”, Cesifo Working Paper No. 10211.

Doerr, A and S Necker (2021), “Collaborative tax evasion in the provision of services to consumers: A field experiment”, American Economic Journal: Economic Policy 13(4): 185-216.

European Commission (2021), Study and reports on the VAT gap in the EU-28 Member States: 2021 final report.

Moffit, R and W Ko (2022), “Take-up of social benefits”, VoxEU.org, 24 August.

OECD (2021), Bringing Household Services Out of the Shadows: Formalising Non-Care Work In and Around the House.

Rehman, O, M Waseem and J Slemrod (2019), “Pecuniary and non-pecuniary motivations for tax compliance: Evidence from Pakistan”, VoxEU.org, 15 May.

Summers, L and N Sarin (2020), “Increasing tax compliance in the United States”, VoxEU.org, 24 April.