Inflation dynamics: From too low to too high in a matter of months

When the COVID-19 pandemic began, and even as the global economy began to recover in early 2021, concerns focused on the risks around inflation being too low. By the middle of 2021, however, it became clear that inflation was picking up much faster than expected around the world. Supply disruptions caused by the pandemic were exacerbated by the rapid rebound in activity, as well as by changes in the composition of demand.

Then, in late 2021, commodity prices started to accelerate faster and more broadly than historic precedents, with sharp increases in the prices of oil, natural gas, electricity, and most foodstuffs. These price increases accelerated in 2022 after the invasion of Ukraine. The corresponding spike in electricity and natural gas prices fed directly into prices of many goods and services, leading to a bigger and faster pass-through into core inflation.

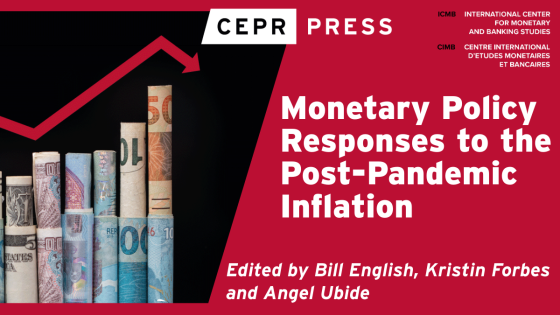

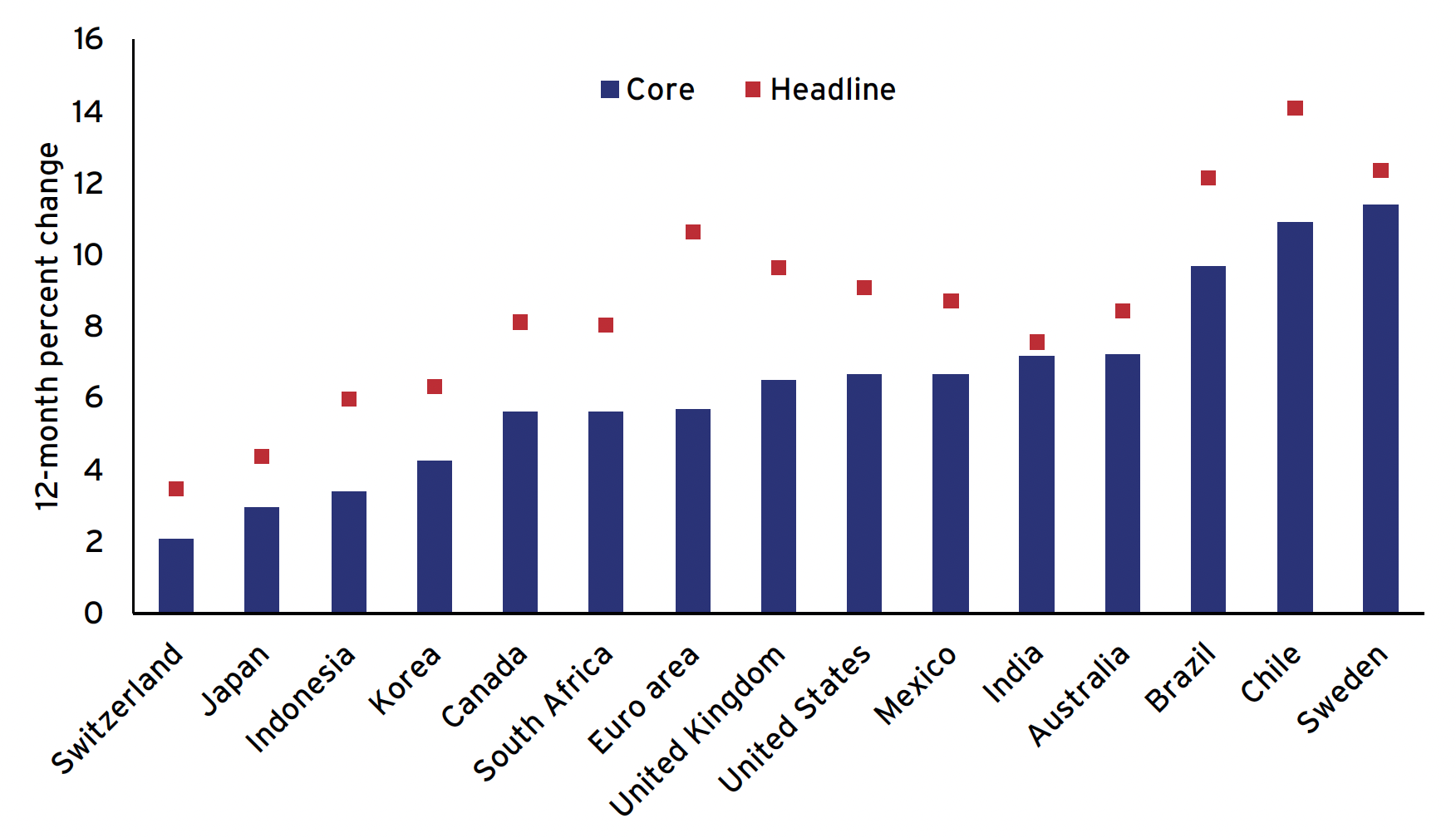

This sequence of supply shocks led to synchronised spikes in inflation in most countries around the world (Figure 1). Indeed, the first principal component of inflation explains a much higher fraction of the variation in both headline and core inflation than before COVID in different groups of countries (Figure 2).

Figure 1 Peak CPI and core inflation rate of each country in our book

Source: Based on data from the World Bank Global Inflation Database, OECDStat, National Sources.

Note: Economies ordered by peak core inflation rate. Türkiye excluded. Inflation rates are for the 12-month period ending in the month of the latest data release available at the time of liftoff. Core inflation for most economies is all items excluding food and energy. For Indonesia, core is all items excluding food. For Australia, data is the Monthly CPI Indicator, rather than the quarterly CPI, and core excludes volatile items and holiday travel.

Figure 2 Principal components in inflation

Source: Calculations based on inflation data from the OECD, IMF, World Bank Global Inflation Database, national sources.

Note: Sample includes 34 economies; 17 advanced economies (CAN, CHE, CZE, DEU, DNK, ESP, FRA, GBR, HKG, HUN, ISR, ITA, JPN, KOR, NOR, SGP, SWE, USA) and 17 emerging markets (BRA, CHL, CHN, COL, IDN, IND, MEX, MYS, PER, PHL, POL, RUS, THA, TUR, TWN, ZAF).

Over time, the tightening of labour markets also began to contribute to higher inflation. This amplified the effect of supply shocks and raised worries about second-round effects as the inflation shocks became larger and longer lasting than expected. Central banks were forced to re-evaluate their standard strategy of treating supply shocks as only having a temporary impact on inflation.

Central bank responses to high inflation

Central banks’ strategies for responding to this spike in inflation differed based on two factors: the risks of inflation expectations becoming unanchored, and the flexibility to pivot quickly from easing to tightening monetary policy. Emerging markets, with less confidence in the stability of inflation expectations, and less encumbered by asset purchases programmes and forward guidance, reacted faster. By the end of 2021 most emerging markets had started raising rates, and some had already tightened policy considerably. By contrast, central banks in advanced economies were slower to tighten monetary policy. Confidence in the stability of inflation expectations and reluctance to change their guidance on the likely timing of rate increases and duration of asset purchases led to a more protracted response.

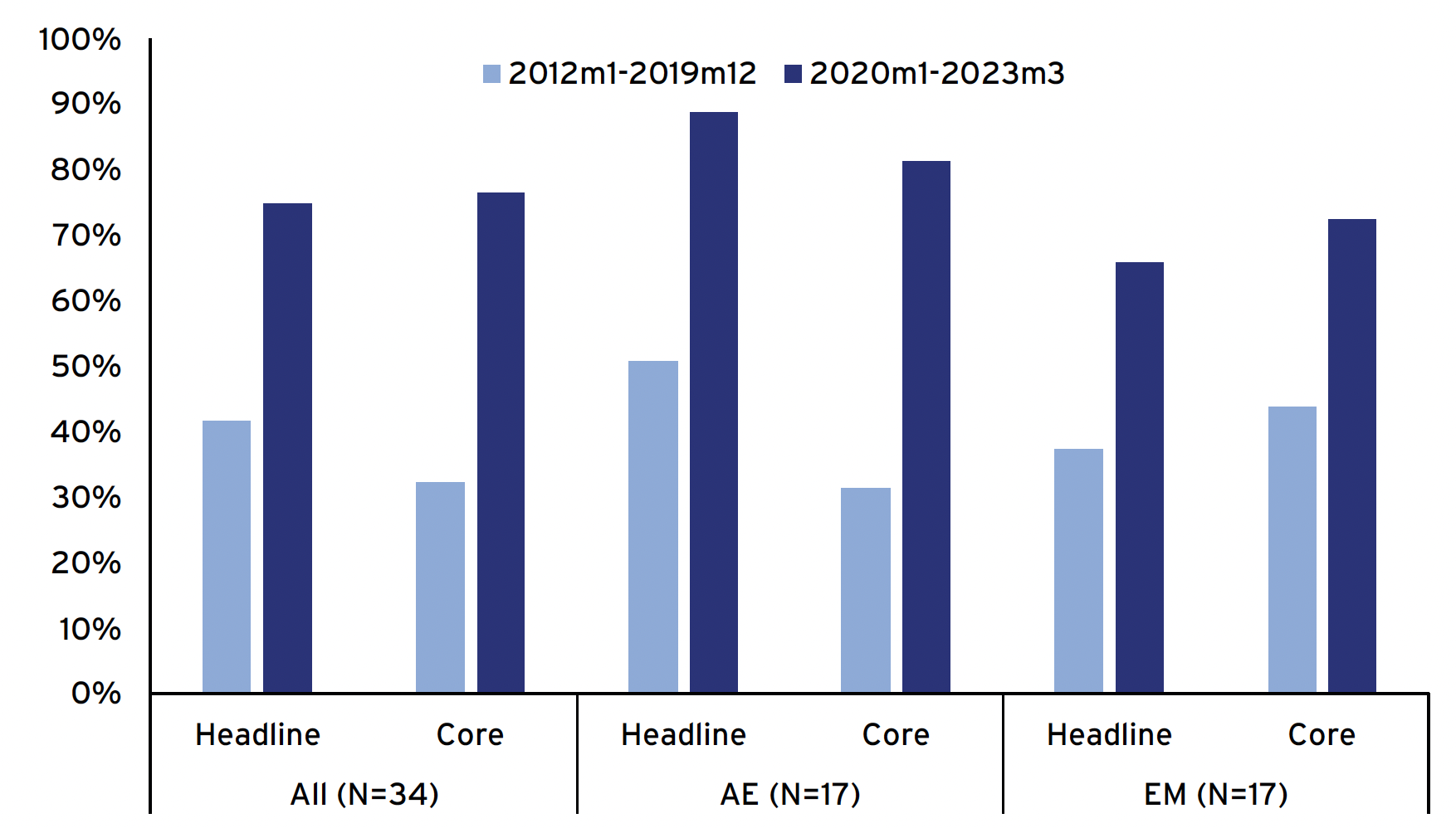

As a result, by the time of lift-off (i.e. the first rate hike of the cycle), both headline and core inflation were well above target in most advanced economies (Figure 3).

Figure 3 Inflation rates at time of lift-off

Source: World Bank Global Inflation Database, OECDStat, national sources.

Note: Economies ordered by date of lift-off. Japan excluded. Inflation rates are for the 12-month period ending in the month of the latest data release available at the time of lift-off. Core inflation for most economies is all items excluding food and energy. For Indonesia, core is all items excluding food. For Australia, data are the Monthly CPI Indicator, rather than the quarterly CPI, which was not produced until after lift-off in August 2022, and core excludes volatile items and holiday travel.

While the shift to tightening policy was delayed in many advanced economies, most central banks subsequently moved very quickly.

The delay did not appear to have had a significant cost in terms of inflation outcomes. Why not? Possibly because much of the inflation spike was driven by global shocks (and not tight labour markets), because inflation expectations were well anchored (or even anchored below targets), and because financial conditions tightened well before lift-off as investors began to expect a shift (putting downward pressure on activity even before the first rate hikes).

After lift-off, central banks faced a second challenge: calibrating the policy response. Policymakers kept revising up their plans for tightening policy as economies proved more resilient than expected and the supply side was slower to recover. They also became concerned that high inflation would become embedded in wage and price setting, and risk management considerations shifted from justifying more cautionary increases in interest rates to more aggressive tightening.

In the end, central banks followed three stages for adjusting their policy interest rates. First, move quickly to raise rates to a restrictive level to help bring inflation down and anchor inflation expectations. Second, fine tune the stance to a sufficiently restrictive level. Finally, keep rates at that sufficiently restrictive level until policymakers were “confident” that inflation was returning to target – what the Bank of England’s Huw Pill labelled the ‘Table Mountain’ approach.

After central banks began raising interest rates, those that had implemented asset-purchase programmes in response to the pandemic also began shrinking their balance sheets (so-called quantitative tightening, or QT). This also occurred sooner and faster than expected. As central banks realised they would need to tighten monetary policy significantly, they did not need to worry about QT limiting their ability to raise rates. Some central banks also used the start of QT programmes to emphasise their commitment to combat inflation and welcomed the fact that QT, by affecting rates along the yield curve, spread the adjustment to higher interest rates across different sectors of the economy.

With only one historical episode of QT, however, there was substantial uncertainty about how it would affect financial conditions and liquidity in the markets for the assets being unwound. Most central banks chose ‘passive’ QT, allowing assets held by the central bank to run off (sometimes subject to caps or limits). The Bank of England, the Riksbank and the Reserve Bank of New Zealand also sold assets in order to shrink their balance sheets more quickly. After starting QT, central banks attempted to put it on autopilot, confirming that adjustments in policy rates are the primary tool for tightening monetary policy. By the end of 2023, central banks had made meaningful progress in reducing the size of their balance sheets, while the impact on financial markets and measures of market functioning was minimal to date.

Economies have, so far, adjusted remarkably well to this aggressive tightening in monetary policy. Inflation has fallen rapidly and employment remains robust. The gloomy prognostications about the need for large increases in the unemployment rate to restore price stability have not materialised, at least not yet. The aggressive monetary policy response that central banks ultimately put in place may have been enough to ensure that the inflationary effects of the COVID-related disruptions actually ended up being transitory.

Seven lessons for monetary policy

The size and persistence of the inflation shocks, the associated forecasting mistakes, and the losses from swollen balance sheets have generated significant criticism of central banks. What are some lessons for the future?

First, inflation forecasting must be improved. Inflation is difficult to forecast even in tranquil times (Stock and Watson 1999). It becomes materially more difficult after a series of supply and global shocks. Forecasting is especially difficult if the effects are nonlinear or the effects interact with the state of the economy, as there may be limited historical experience to identify the break points.

Capturing inflation dynamics may now require new approaches and new data.

Second, the standard textbook response of simply ‘looking through’ supply shocks must be revisited. Instead, it is necessary to incorporate a careful analysis of the current stance of policy, the nature and duration of the shock(s), and the appropriate management of risks in each direction. The textbook response assumes that the policy setting is appropriate absent the shock, that the supply shock will not affect inflation expectations or wage and price setting behaviour, and that the inflation risks are symmetric. Each of these assumptions, however, was on shaky ground during the post-pandemic inflation.

Third, interest rates remain the primary instrument for tightening policy and bringing down inflation. Central banks relied on a wide range of tools to ease policy and support their economies during the pandemic (such as balance sheet policies, forward guidance, exchange rate intervention and programmes supporting banks, credit, and liquidity). In contrast, central banks quickly reaffirmed that interest rates were the main instrument for tightening monetary policy and bringing down inflation. This asymmetry reflects the constraint of the effective lower bound (ELB) on interest rates, as well as their limited experience using balance sheets to tighten policy.

Fourth, central banks should maintain flexibility and a willingness to adjust policy in either direction. Some easing tools – such as QE, forward guidance, and yield curve control (YCC) – rely on their persistence and expectations of future action (or lack of action) for their effectiveness. This feature can make these policies difficult to change quickly. Clearer communication, aided by well defined, state-contingent triggers or thresholds, is needed to make it easier to adjust these policies sooner than anticipated if the economic outlook changes.

Fifth, central banks should discuss how fiscal policy could affect the economic outlook, risks, and overall price stability. Fiscal policy bolstered central banks’ efforts to support the economy during the pandemic. When commodity prices spiked, the array of energy price caps and subsidies limited the impact on inflation expectations, supported incomes, and had important effects on inflation dynamics more broadly. While central banks may assume the continuation of ‘current policies’ in their baseline forecasts, they should make greater use of alternative scenarios that reflect how some of these measures would change their inflation forecasts.

Sixth, monetary policy will have a much larger effect on the fiscal outlook in the future, potentially leading to more political pressure on central banks. Although it is unclear where interest rates will settle, it is unlikely that they will fall back to the very low levels seen before the pandemic. The extent to which higher interest rates will affect public finances over the medium term will depend on many factors, but what is clear is that higher debt-to-GDP ratios and higher interest rates have materially narrowed the room for fiscal policy mistakes.

Finally, central banks must be able to achieve their monetary policy goals while supporting financial stability. As central banks accelerated interest rate hikes, several financial institutions and sectors came under stress (such as the liability-driven investment sector in the UK, regional banks in the US, and Credit Suisse in Europe). Central banks should plan for these types of situations when financial stability concerns could require actions that seem to work against monetary goals. For example, they should plan in advance for ways to reinforce their liquidity standing facilities if needed to provide emergency liquidity or to support market functioning in periods of systemic stress – all in ways that minimise the impact on monetary policy.

Conclusion

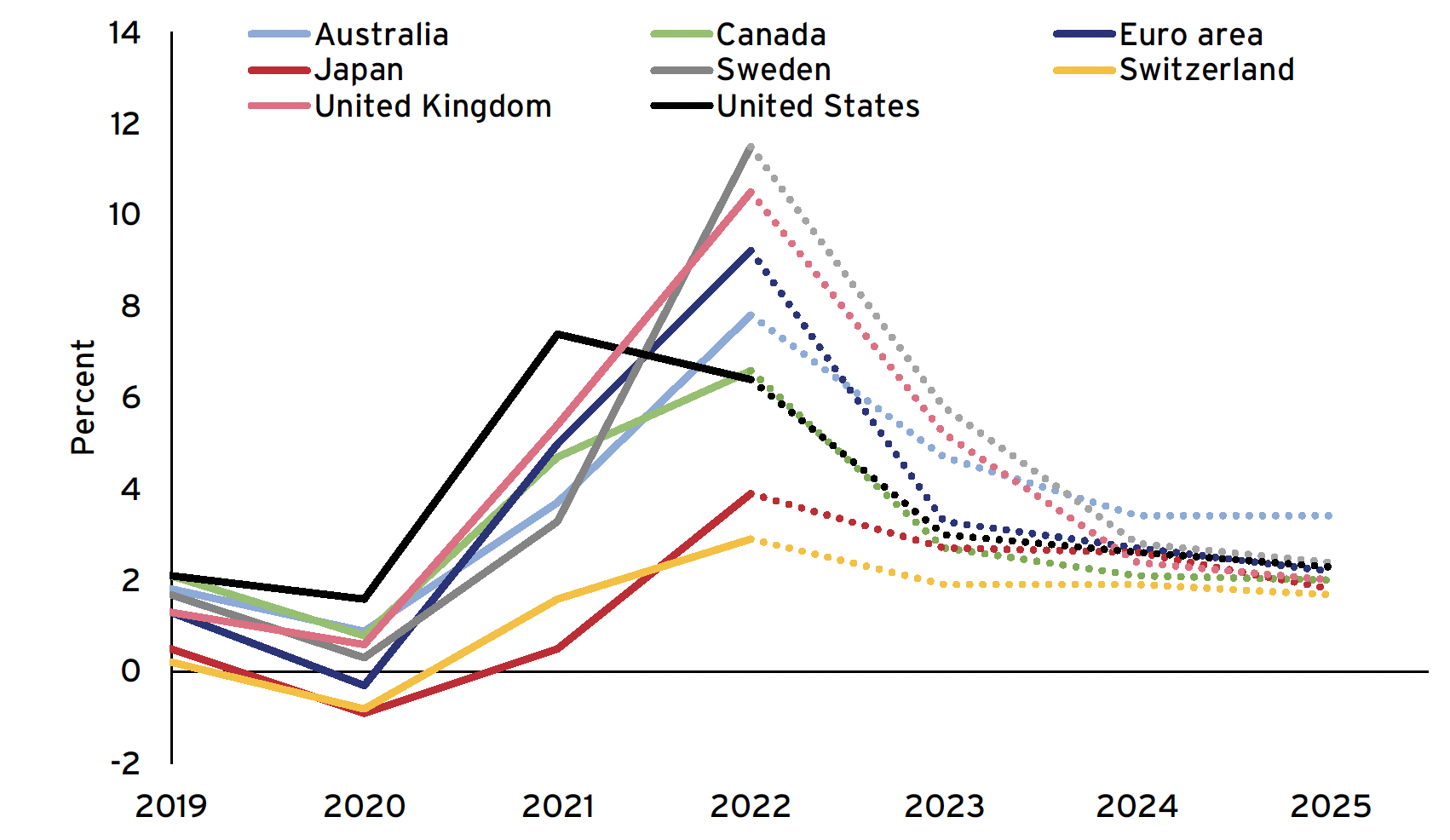

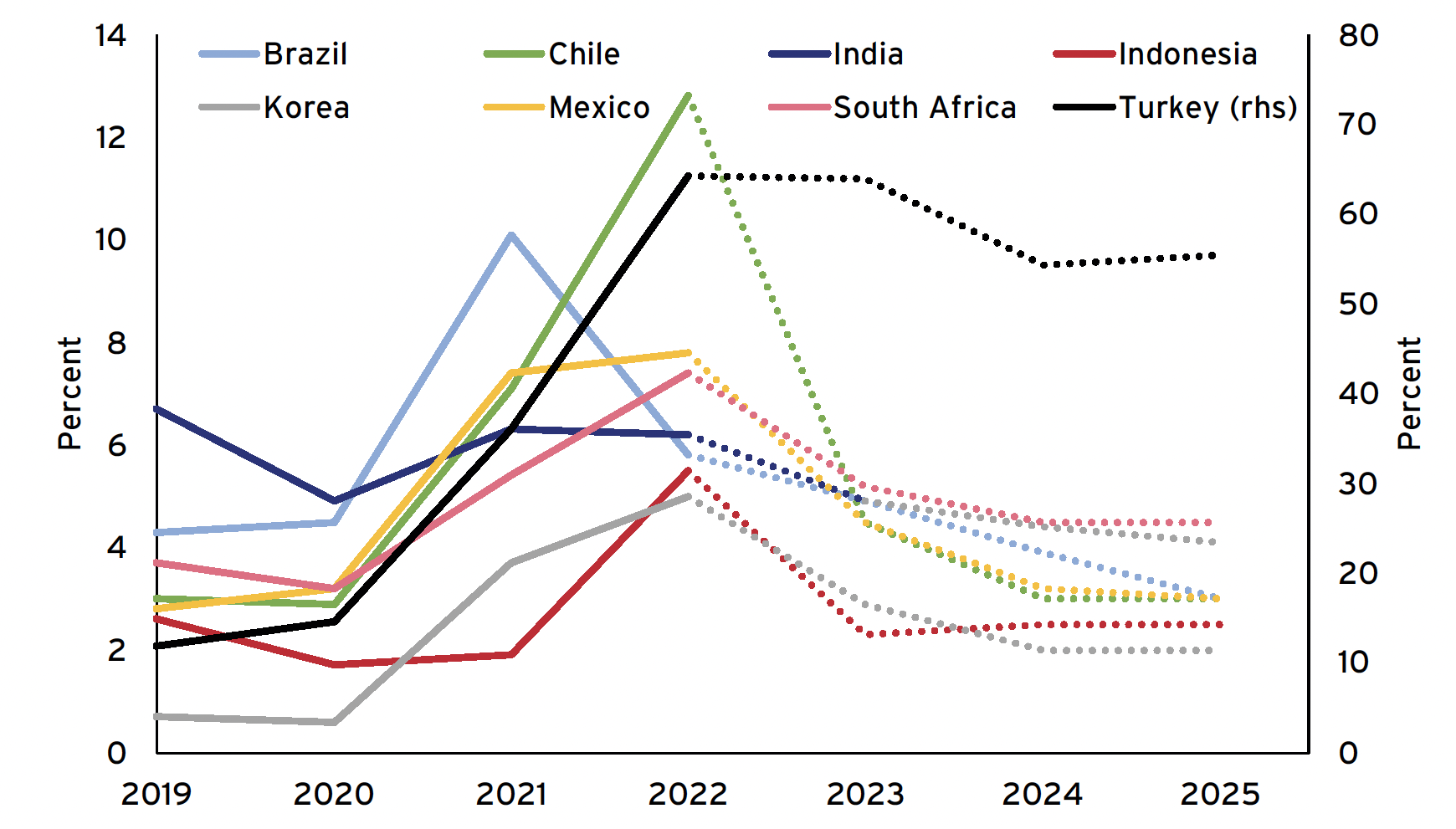

At this stage, it seems possible, although not assured, that monetary policy will achieve a soft landing. Inflation appears to be on track to return close to target in most countries (Figure 4) without a significant slowdown in activity. Some emerging market central banks – those that led the tightening cycle – have already started cutting rates, and most central banks are signalling that they are likely to follow in coming months. The robust policy response to the pandemic described in English, Forbes and Ubide (2021) appears to have successfully avoided the protracted weakness in employment and output and persistent low inflation that followed the Great Recession. In fact, unemployment rates today are not only close to pre-pandemic levels in most countries, but lower than 2019 levels in many cases (and these levels were previously believed to be around full employment in many cases).

Figure 4 Inflation in advanced economies and emerging markets from 2019 to 2025e

a) Advanced economies

b) Emerging markets

Source: Data based on IMF World Economic Outlook, October 2023.

Note: End of period annual consumer price inflation.

Of course, the story of the post-pandemic inflation is not yet over. While inflation has been falling quickly and is forecast to return to targets, it still has some way to go in many economies. Forecasts missed much of the upward spike in inflation, and some of the nonlinearities and interactions that caused these forecast errors could play a role (in either direction) as inflation falls. Some of the impact of the sharp tightening in monetary policy on the real economy is still to come and may play out differently than historic precedents. And of course, further global shocks or supply shocks could suddenly shift inflation in either direction.

Moreover, while the central bank response to the post-pandemic period of high inflation seems to have been successful by many standard economic goalposts, the aggressive tightening of monetary policy over 2021-2023 generated new challenges and risks. Higher rates have caused financial stress for households, businesses, and financial institutions; bankruptcies are picking up, and housing transactions have largely frozen in many countries. The fiscal positions of many countries have worsened and could require substantial adjustments – austerity that will be difficult and politically unpopular.

Could central banks have provided less stimulus in response to the pandemic? Or removed the stimulus sooner, resulting in less inflationary pressure and thereby reducing the need to hike interest rates as aggressively while still fostering a full recovery? The narrative chapters in this volume should provide a valuable resource for this assessment, as any judgement should be based on information that central banks had at the time of their decisions, not on hindsight, and thereby take account of the uncertainties around the pandemic.

That said, an overarching lesson of this experience for central banks is the importance of symmetry in their responses to high and low inflation. While the effective lower bound should affect risk management and the choice of policy tools when inflation is low, central banks must remain equally resolute in their willingness to address upside risks to inflation. The upcoming reviews of policy frameworks by the main central banks should assess whether the focus in some countries shifted excessively to containing deflation. If so, reviews should aim to strengthen the ability of central banks to respond to all kinds of shocks.

Hopefully the lessons learned from the monetary policy responses to the post-COVID inflation will be a useful guide for policy during the next business cycle.

References

Bernanke, B and O Blanchard (2023), “What Caused the U.S. Pandemic-Era Inflation?”, Hutchins Center Working Paper No. 86, June.

De Santis, R and TommasTo Tornese (2024), “The nonlinear impact of retail energy supply shocks on inflation and economic activity”, VoxEU.org, 7 January.

Di Giovanni, J, SSebnem Kalemli-Ozcan, AlAvaro Silva, and M A Yıldırım (2023), “Supply chains, trade, and inflation”, VoxEU.org, 19 January.

Du, W, K Forbes, and M Luzzetti. (2024), “Quantitative Tightening Around the Globe: What Have We Learned?”, paper prepared for the US Monetary Forum (forthcoming).

Eggertson, G B and D Kohn. (2023), “The Inflation Surge of the 2020s: The Role of Monetary Policy”, Hutchins Center Working Paper No. 87, August.

English, B, K Forbes, and Á Ubide (eds) (2021), Monetary Policy and Central Banking in the Covid Era, CEPR Press.

English, B, K Forbes, and Á Ubide (eds) (2024), Monetary Policy Responses to the Post-Pandemic Inflation, CEPR Press.

Forbes, K, J Gagnon, and C G Collins (2022), “Low Inflation Bends the Phillips Curve around the World”, Economia 45(89): 52-72.

Stock, J and M Watson (1999), “Forecasting Inflation”, Journal of Monetary Economics 44: 293-335.

Summers, L (2021), “The Biden Stimulus Is Admirably Ambitious. But It Brings Some Big Risks, Too”, Washington Post, 4 February.