Nursing homes are expensive: in some European countries, a one-year nursing home stay costs as much as three to four times the median income among retirees (OECD, 2023). No wonder there are various public programmes in place to protect people against these costs. The level of generosity, however, varies substantially: in Nordic countries and the Netherlands, over 90% of expenses are paid publicly, while this is only 65% in the UK and 45% in Portugal (Mueller and Morgan 2020). In countries that apply means-testing like the US, the UK, and France,1 individuals need to fully deplete their own financial resources before they gain access to public support. As a result, those who need care for a long time face out-of-pocket payments of tens of thousands of euros.

With population ageing, governments across Europe strive to limit public spending on care, while offering protection against excessive out-of-pocket payments. It requires a careful design of the co-payments that nursing home residents have to pay, which should balance the benefits and costs of insuring older people against long-term care costs.

Out-of-pocket payments create a financial risk but may incentivise an efficient use of care

Insurance is valuable because it provides access to care that many individuals could otherwise simply not afford (Nyman 1999). Yet, even when people are able to meet their care costs, they are usually better off with an insurance (Cutler and Zeckhauser 2000). Why so? Whether someone will need care is not known in advance. In the Netherlands, about half of the 70-year-olds will not use any nursing home care over their life, but 5% will end up living in a nursing home for seven years or more (Wouterse et al. 2022). This makes it uncertain how much of their financial resources someone will have to allocate to their care – that is, it induces a financial risk. As a matter of fact, most people dislike being exposed to such a risk; they may respond by building precautionary savings, which may be inefficient at the macroeconomic level (De Nardi et al. 2016). The reduction in financial risk is therefore another reason why insurance is valuable.

Yet, insurance comes at a cost. Obviously, it needs to be paid for.2 Furthermore, it provides an incentive for people to use care beyond what is socially optimal, because what they pay for their care is below what it costs to society. One possible way to curb this moral hazard is to levy co-payments on care users, as those create an incentive to use care only when its benefits meet its true costs.

However, the case for co-payments on nursing home care is less compelling than for other types of health care. After all, most people would prefer to spend their golden years at home. If nursing homes are a last resort, the scope for moral hazard is small, and co-payments should not affect nursing home admissions. Yet empirical evidence is scarce.3 Kim and Lim (2015) establish that older people in South Korea spend fewer days in nursing homes when co-payments on nursing home and home care benefits simultaneously increase. Hackman et al. (2023) show that US residents postpone their return back home when facing lower co-payments. But this study includes many patients who need rehabilitative care after a hospitalisation; they are expected to recover, and get out. For people who are admitted with a permanent need for long-term care, the question is more whether co-payments affect their decision to enter in the nursing home in the first place.

A Dutch reform creates the opportunity to test for the existence of moral hazard in nursing home admissions

We examine this question using Dutch data (Tenand et al. 2023). The Netherlands offers comprehensive coverage of formal long-term care, with no means-testing (Bakx et al. 2023). Yet users are charged co-payments, which depend on one’s financial resources and are capped at moderate levels, such that the financial accessibility of nursing homes is ensured. For nursing home residents, annual co-payments represented in 2016 roughly 55% of disposable income, on average (Bakx et al. 2020). Yet, as public expenses on long-term care have come close to 4% of GDP – the highest rate in the world (OECD 2023) – the Netherlands has engaged in measures to guarantee the sustainability of its system.

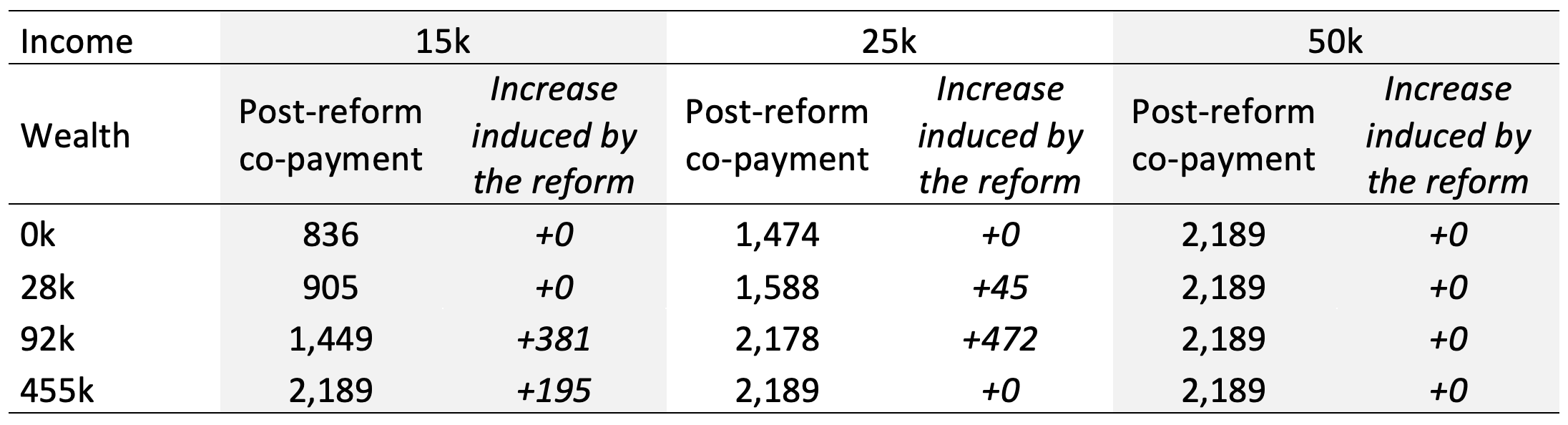

We look at a co-payment reform announced in April 2012, which consists of an increase of co-payments for people with taxable wealth. The increase in co-payments for nursing home care is highest for people with high wealth, while those with no taxable wealth are not affected (Table 1). Overall, there is substantial heterogeneity with respect to the magnitude of the co-payment increase, with a median increase among those who are affected of +€200 per month.

Table 1 Effect of the reform on the co-payment for nursing home care, by income and wealth

Notes: The increase induced by the reform is the difference between the post-reform and the pre-reform co-payments. Co-payments are expressed in euros per month. `k' stands for thousands of euros. Income is defined as annual net income. Wealth is defined as financial assets and real estate excluding own residence. The selected values for wealth (other than zero) correspond to the 5th, 75th and 95th percentiles of the wealth distribution among the Dutch aged 65 or older in 2013. For a benchmark, the 25th and 75th percentiles of the income distribution are 15k and 21k. Values calculated for year 2023, expressed in current euros.

The reform creates an opportunity to capture how co-payments affect nursing home use. We implement a difference-in-differences approach and assess whether nursing home care use has evolved differently for those who were affected by the reform, compared with those who were not. We focus on individuals aged 66 or older with care needs.

The co-payment increase induces people to postpone their nursing home admission, but the financial risk rises

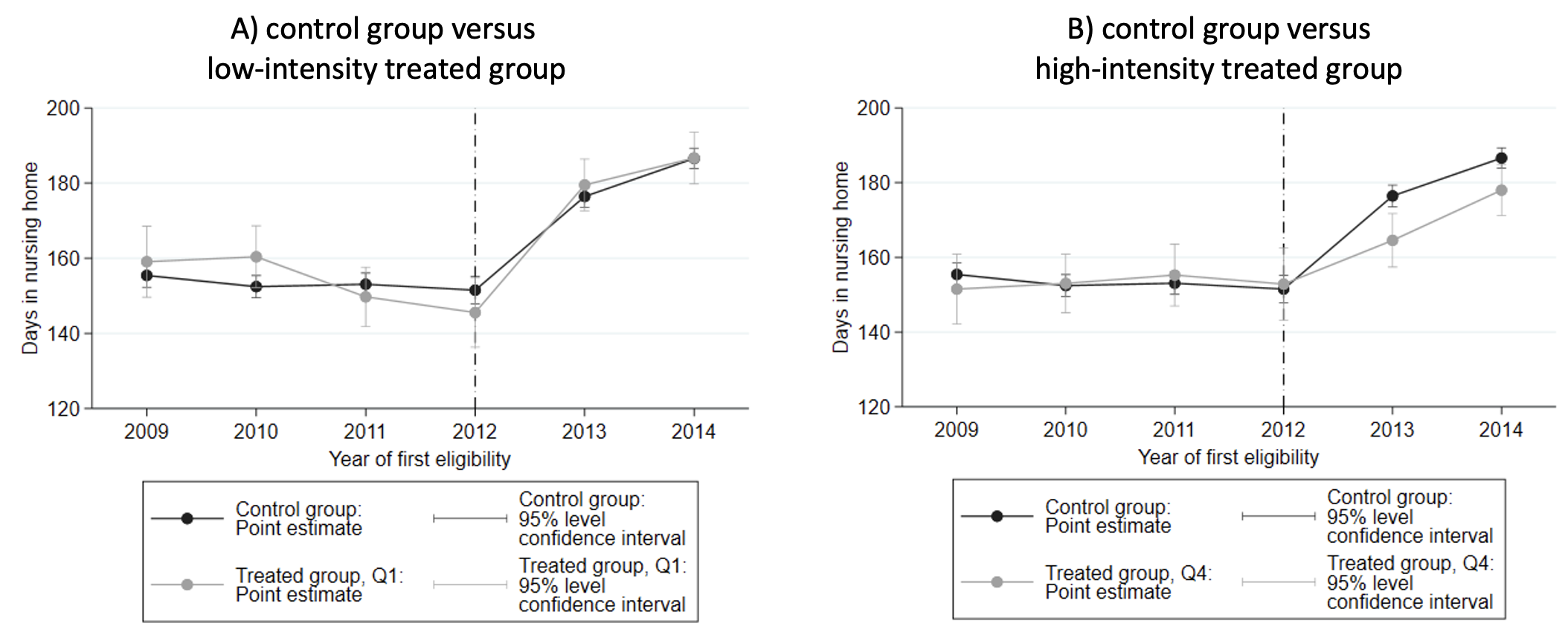

As hypothesised, individuals exposed to a higher co-payment increase experience a decrease in nursing home use, relative to those little or not affected by the reform. Figure 1 shows the average number of days that people spend in a nursing home within twelve months, depending on the year in which their care needs make them eligible for a nursing home admission. The black series corresponds to people whose co-payments do not change with the reform (the ‘control group’). In panel A, the grey series corresponds to people who are affected by the co-payment reform but experience an increase in the monthly co-payment for nursing home of less than €60 (the ‘low-intensity treated’). In Panel B, the grey series corresponds to people who experience an increase in the monthly co-payment higher than €600 (the ‘high-intensity treated’). Both panels show that all groups had similar use before the reform. Panel A shows that the control group and the low-intensity treated group experience the same evolution over time. By contrast, the high-intensity treated group experiences a lower increase in the duration of nursing home care use than the control group (Panel B) following 2012 and the co-payment reform. This is exactly what we expect to see if co-payments weigh on the individual’s decision regarding an admission.

Figure 1 Time spent in a nursing home, depending on treatment intensity, by year of first eligibility

Notes: Population is individuals 66+, singles, who became eligible for nursing home care for the first time between 2009 and 2014 (N=79,559). Nursing home care use within the 12 months following the individual's first eligibility for nursing home care. Within the treated group, quartiles are defined with respect to treatment intensity: quartile 1 (resp. 4) groups the 25% individuals who experienced the smallest (resp. largest) change in co-payment due to the reform. The reform was announced in Q2-2012. In these graphs, year 2012 excludes observations from Q1-2012.

For every hundred euros extra co-payment per month, the use of nursing home care decreases by 0.8 days. The group whose co-payment increases by over €600 per month postpones nursing home care admission by an average of ten days. Further, postponing a nursing home admission has limited offsetting effects in the form of increased home care costs, and no effect on medical care spending. As a result, the co-payment increase leads to a – small – decrease in public spending on health care.

Finally, the reform leads to a sizable increase in the financial risk for the group affected by the reform. Like in most other countries, co-payments in the Netherlands are charged in every period that care is received. Although the increase in the monthly co-payment is relatively low, it is amplified by the many months that someone might end up spending in a nursing home. As a consequence, the reform induces a substantial increase in the payments people may face over their lifetime, that is an increase in the financial risk people face.

A cap on lifetime out-of-pocket payments could improve financial protection

Our study provides evidence that financial incentives matter when deciding upon long-term care options, even for people with high care needs. Our results point to the presence of moral hazard; as a consequence, co-payments not only have a mechanical role in decreasing public spending by shifting costs to users, but they also improve the efficiency of the system. As such, the Dutch long-term care system, with its moderate income- and wealth-dependent co-payments, offers an interesting example: it retains some room for financial incentives to contain unnecessary care use, while ensuring fairly high financial protection. Yet, even in this generous system, the benefits of co-payments may be dwarfed by the sizable financial risk induced by the accumulation of co-payments over the years.

Thus, how to improve on the design of co-payments? A cap on how long people are charged co-payments, or on their lifetime co-payments, could be a way to reduce the exposure to the risk of bearing high long-term care expenses while preserving financial incentives. The case for such a scheme has earlier been made in theoretical contributions (Klimaviciute and Pestieau 2020). In the policy arena, it has become prominent in the UK following the so-called Dilnot Report (Dilnot 2011), and the announcement that a cap on lifetime out-of-pocket payments on social care would be implemented (Dilnot et al. 2022). In the US, Cohen and Butler (2021) call for generous public support after people have spent two years with long-term care needs.4 In summary, fine-tuning co-payments will be key in ensuring the best insurance against long-term care costs, while also containing costs.

References

Bakx, P, J Bom, M Tenand and B Wouterse (2020), “Eigen bijdrage aan ouderenzorg”, Netspar Design Paper No. 139.

Bakx, P, E van Doorslaer and B Wouterse (2023), “Long-Term Care in the Netherlands”, NBER Working Paper No. 14916.

Cohen, M A and S M Butler (2021), “The Middle Ground For Fixing Long-Term Care Costs: The WISH Act”, Health Affairs Forefront.

Cutler, D M and R J Zeckhauser (2000), “The anatomy of health insurance”, in Handbook of Health Economics, Vol. 1, pp. 563-643, Elsevier.

De Nardi, M, E French and J B Jones (2016), “Savings after retirement: A survey”, Annual Review of Economics 8: 177-204.

Dilnot, A (2011), Fairer care funding: The report of the Commission on Funding of Care and Support, Vol. 1, The Stationery Office.

Dilnot, A, A Dixon, D Sturrock and C Tallack (2022), “'Does the cap fit: How do the proposed changes to the social care cap affect people’s protection from catastrophic costs?”, Presentation, IFS.

Hackmann, M B, R V Pohl and N Zierbath (forthcoming), “Patient versus provider incentives in long term care”, NBER Working Paper 25178.

Kim, H B and W Lim (2015), “Long-term care insurance, informal care, and medical expenditures”, Journal of Public Economics 125: 128-142.

Klimaviciute, J and P Pestieau (2020), “Insurance with a deductible: a way out of the long term care insurance puzzle”, Journal of Economics 130(3): 297-307.

Kotschy, R and D Bloom (2022), “Reckoning with the growing demand for long-term care”, VoxEU.org, May.

OECD (2023), OECD Health Statistics.

Mueller, M and D Morgan (2020), “Focus on: Spending on long-term care”, OECD Policy Brief, November.

Nyman, J A (1999), “The value of health insurance: the access motive”, Journal of Health Economics 18(2): 141-152.

Tenand, M, P Bakx and B Wouterse (2023), “The impact of co-payments for nursing home care on use, health, and welfare”, EsCHER Working Paper No. 2023009.

Roquebert, Q and M Tenand (2017)”, Pay less, consume more? The price elasticity of home care for the disabled elderly in France”, Health Economics 26(9): 1162-1174.

Suari-Andrieu, E, R van Ooijen, R Alessie and V Angelini (2019), “Giving with a warm hand: evidence on estate planning and bequests”, Nestpar Design Paper No. 120, Network for Studies on Pensions, Aging and Retirement.

Wouterse, B, A Hussem and A Wong (2022) “The risk protection and redistribution effects of long‐term care co‐payments”, Journal of Risk and Insurance 89(1): 161-186.