Negotiations over phasing out fossil fuels at the recently completed COP28 climate summit in Dubai have highlighted once again just how difficult it is for the international community to coordinate their climate policies. From an economic point of view, global cooperation would be the efficient approach to driving greenhouse gas (GHG) emissions to net zero, yet free riding incentives and unresolved distributional issues stand in the way (Weder di Mauro 2023). Against this background, the EU has tightened unilateral climate policy in its ‘Fit for 55’ policy package (EU 2023). Thousands of manufacturing firms regulated in the EU Emissions Trading Scheme (EU ETS) face an accelerated schedule for reductions in the emissions cap. The resulting higher EU ETS price strengthens their incentives for abating CO2, but it might drive some firms to relocate carbon intensive production and the associated emissions to countries with lower or zero carbon prices. This past October, aiming to prevent such carbon leakage, the EU launched a new policy instrument, the Carbon Border Adjustment Mechanism (CBAM).

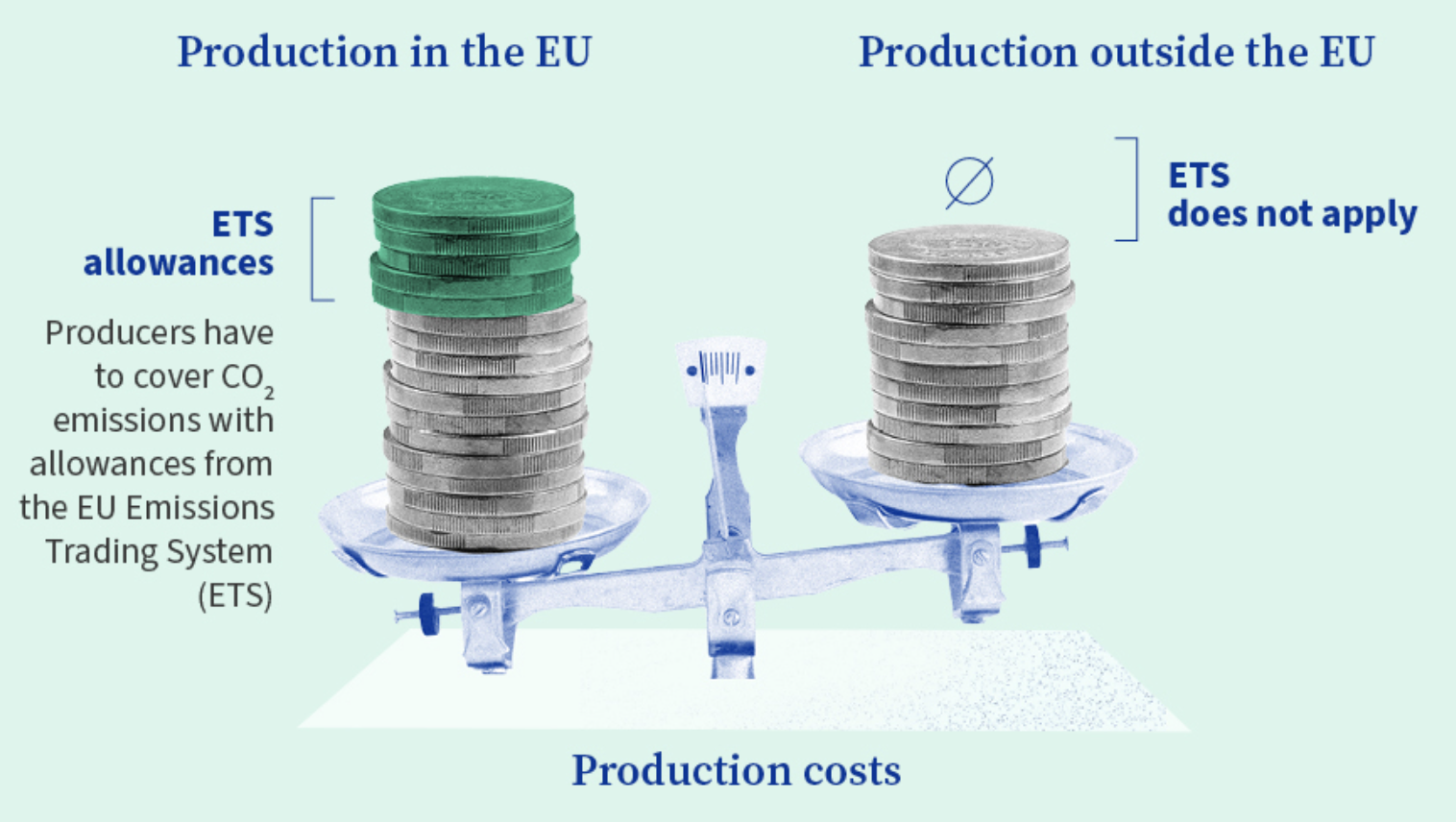

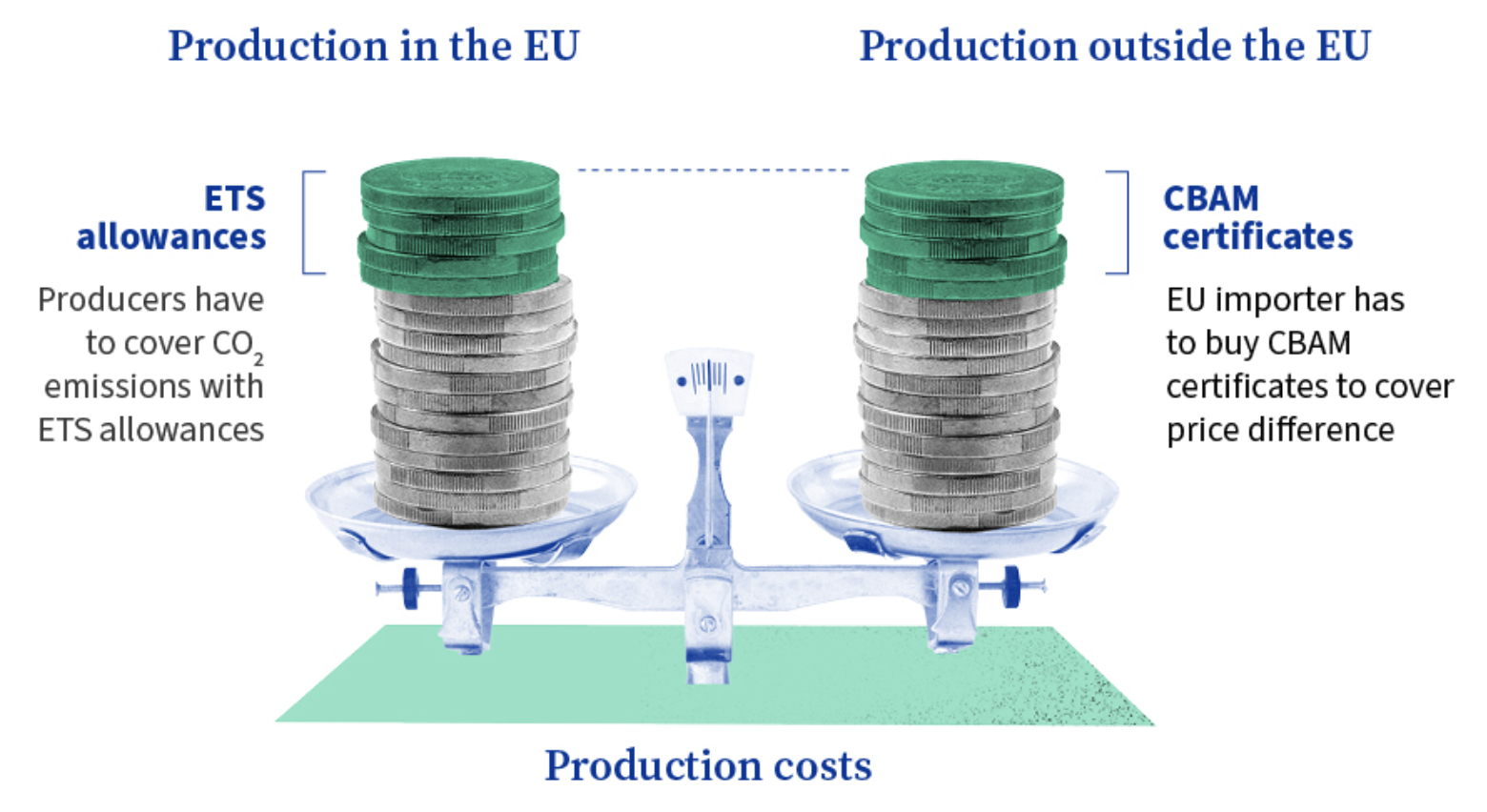

CBAM seeks to level the playing field between domestic and foreign producers of carbon intensive goods. It taxes emissions embedded in imports at a rate equal to the difference in carbon prices in the ETS vis-à-vis the source country (Figure 1). While border carbon tariffs like CBAM have long been discussed in the literature (Markusen 1975, Hoel 1996), they have thus far been regarded as incompatible with WTO rules. With the launch of CBAM last October, the EU changed this paradigm.

Figure 1 CBAM attempts to create a level playing field

a) Unilateral carbon pricing

b) Carbon pricing and CBAM

The perfect is the enemy of the good: CBAM aims for more than just leakage prevention

Conceptually, CBAM improves upon the current policy response to leakage, which has been to make overly generous transfers of valuable pollution rights to polluters free of charge (Muuls et al. 2010, Martin et al. 2014). By pricing embedded carbon, CBAM not only eliminates leakage-inducing distortions, but also encourages cost-effective abatement outside EU borders (Böhringer et al. 2022). Doing this right requires data on direct and indirect carbon emissions for each exporter, which are difficult to obtain (Fowlie and Reguant 2018). Therefore, the EU will initially charge CBAM tariffs in only a handful of energy intensive sectors. Where carbon intensity measures are not available, importers may fall back on country specific averages (Bellora and Fontagné 2022). These simplifications make CBAM tractable, but they come with important drawbacks. First, incomplete sector coverage gives an incentive to offshore unregulated final products that contain CBAM-regulated intermediates. For example, an EU car manufacturer can avoid the CBAM tariff on imported steel by moving production of the entire car abroad. As the ETS price rises, this could devastate EU industry and worsen carbon leakage (Young 2022). Second, carbon intensity benchmarks at the country level weaken the incentive to reduce carbon emissions and generate undesirable arbitrage, such as re-routing of exports via third countries with lower benchmarks.

Because of these evasion opportunities, CBAM tariffs are unlikely to prevent carbon leakage across the spectrum. Within CBAM sectors, non-EU exporters will suffer not only from high tariffs lowering demand for their products, but also because costly monitoring and reporting of emissions erect new non-tariff barriers to trade. Such extraterritorial effects do not help mitigate the concern, voiced prominently at COP28, that CBAM will reduce EU imports from developing and emerging economies by more than required to prevent carbon leakage.

Refocusing on leakage: A Leakage Border Adjustment Mechanism

We argue that the difficulties with CBAM can be largely avoided if one is willing to ditch the policy´s secondary goal of implementing ETS carbon prices among non-EU exporters, and fully focus on carbon leakage. In Campolmi et al. (2023), we propose an alternative policy, called the Leakage Border Adjustment Mechanism (LBAM), which is a non-discriminatory, product-specific tariff on imports designed to exactly offset leakage. When imposed in tandem with an ETS price increase, LBAM sterilises the increase in foreign sales to the EU market.

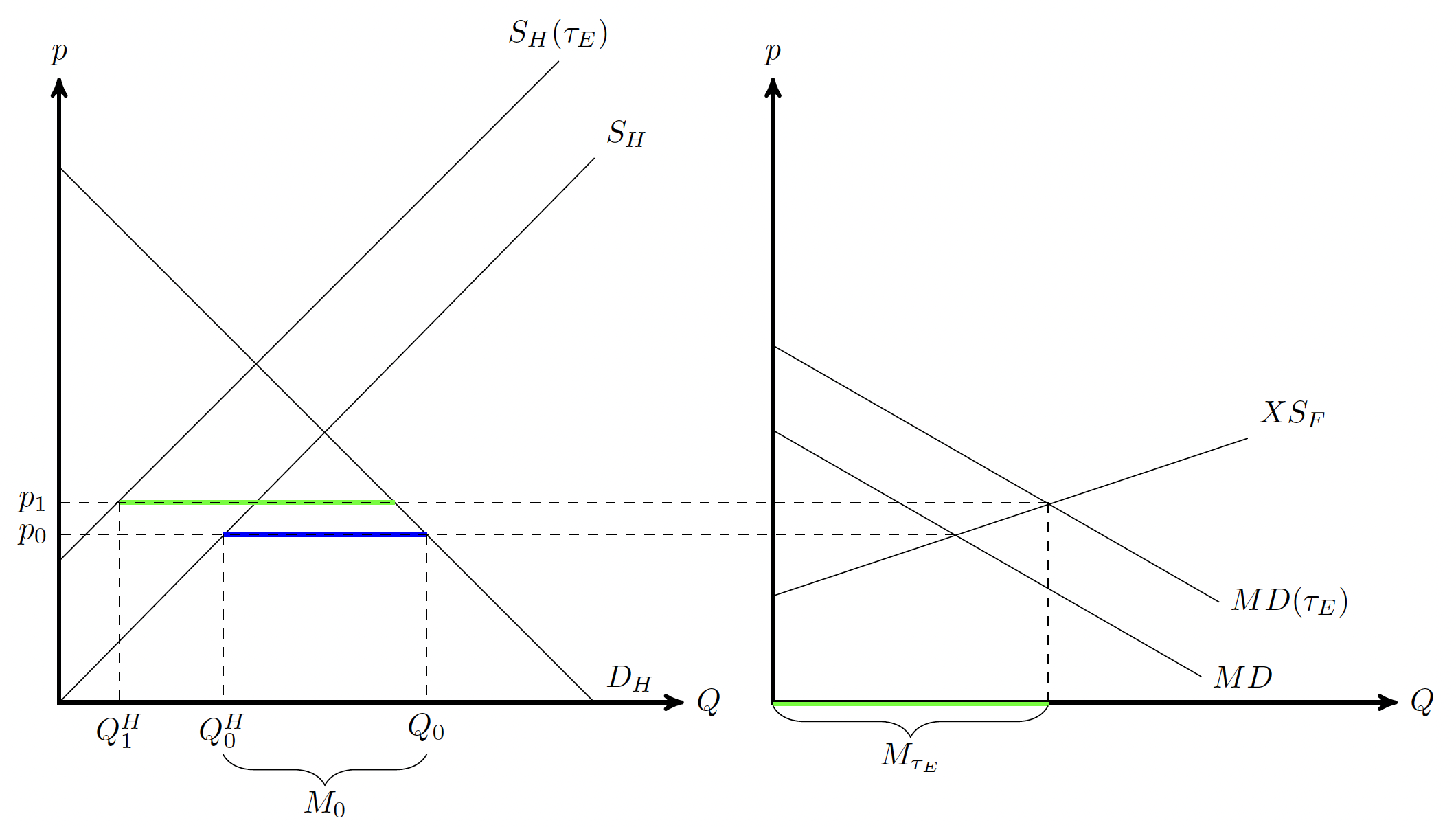

Figure 2 Carbon leakage without border adjustment

We illustrate this idea with two countries: Home and Foreign. Figure 2 depicts Home’s demand (DH), supply (SH), and the resulting import demand curve MD. Foreign is characterised by supply curve XSF. The pre-tax equilibrium obtains at price p0 with imports M0. A unilateral carbon price τE raises marginal costs in Home, shifting up its supply curve to SH(τE). Without border adjustments, the price rises to p1. The corresponding increase in imports from M0 to M(τE) induces carbon leakage, as we assume that production is more carbon intensive in Foreign than in Home.

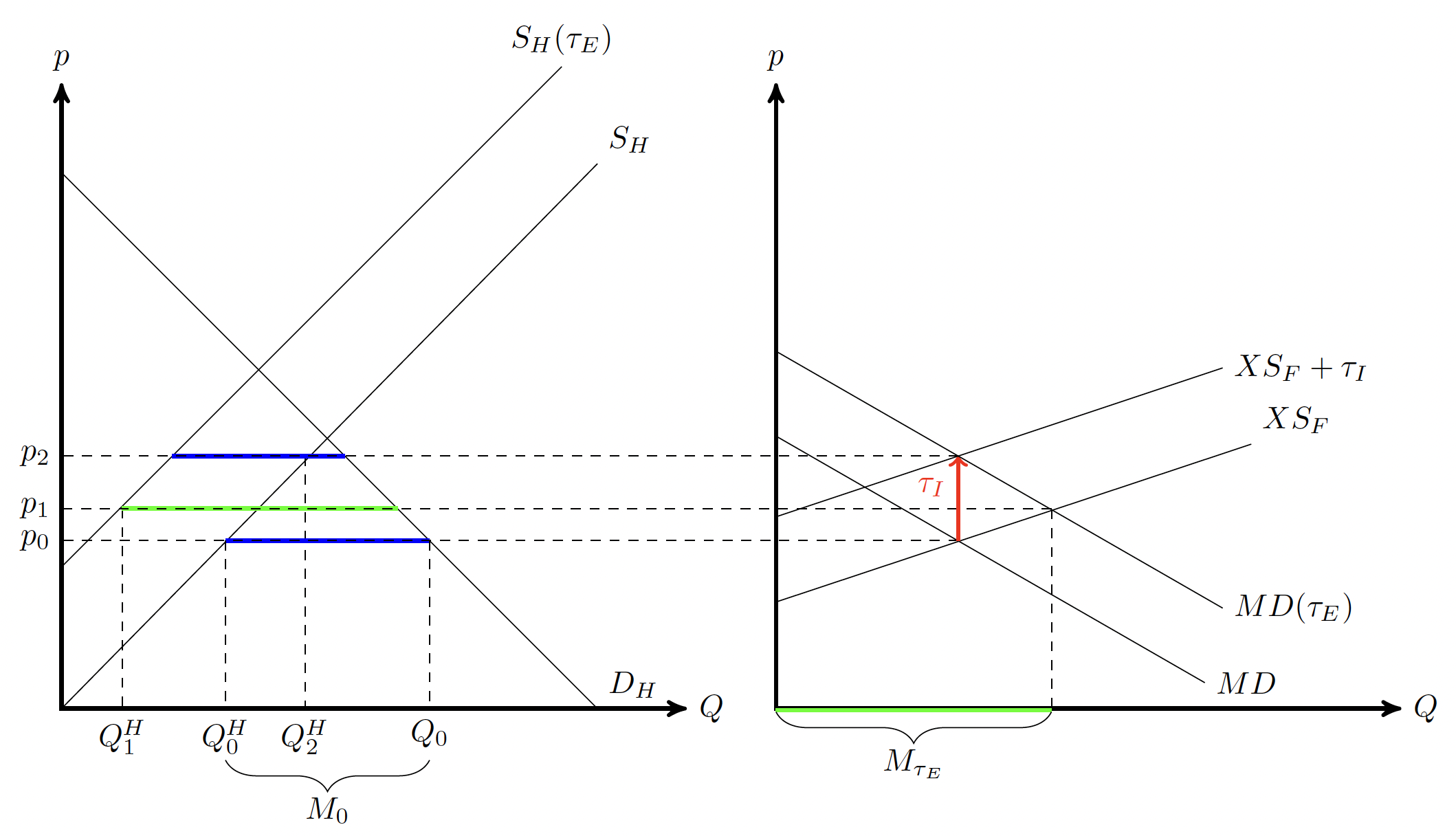

Figure 3 LBAM tariff sterilises leakage

The LBAM tariff τI we propose would shift out Foreign’s export supply, raise the equilibrium price to p2, and lower import demand in Home. Specifically, the tariff is chosen such that imports revert to their pre-tax level M0, eliminating carbon leakage.

Low information requirements allow for easy application of LBAM to all traded goods

Note that LBAM tariffs are not based on carbon embedded in imported goods. Their computation requires only three pieces of information: (1) the carbon intensity of EU production at the industry level (to compute how an ETS price change affects EU producer prices); (2) how consumption patterns of EU consumers change when relative prices of EU and foreign products change (substitution elasticities); (3) how foreign exports change with a change in world prices (foreign export supply elasticities). LBAM’s lower information requirements not only dramatically reduce monitoring costs compared to CBAM, but also allow for adjusting border tariffs across all tradable sectors, thus avoiding the distortions created by CBAM’s narrow sector coverage.

Quantitative assessment of anti-leakage policies

We compare CBAM and LBAM policies in a quantitative trade model, calibrated to comprehensive data on bilateral trade flows between the EU27 and 56 countries, with econometrically estimated returns-to-scale and substitution elasticities for 131 industries. Using ‘hat algebra’ (Dekle et al. 2007, Ossa 2014), we compute changes in outcomes when the EU carbon price rises from an initial equilibrium at $15 to $105 per ton of CO2. While this policy change always reduces EU welfare and global emissions,

the quantitative implications crucially depend on the accompanying anti-leakage policy.

Applying CBAM tariffs to all imports (CBAM-ID) would deliver the highest emissions reductions (Figure 4)

and the lowest welfare loss for the EU (Figure 5). In contrast, the real-world CBAM (CBAM-EU) is limited to very few sectors and thus improves only marginally on the reference case without any border adjustment (No-BAM). The new LBAM tariffs (LBAM), thanks to being applied across all sectors, prevent import leakage more effectively than the EU’s CBAM, and at lower welfare costs.

Figure 4 Global emissions changes when raising ETS price from $15 to $105 per tonne of CO2

Source: Authors’ representation based on Campolmi et al. (2023)

Figure 5 EU welfare change when raising ETS price from $15 to $105 per tonne of CO2

Source: Campolmi et al. (2023)

What about export leakage?

Figure 4 shows that a considerable part of emissions leakage derives from the displacement of EU exports in third countries. Neither CBAM nor LBAM address this ‘export leakage’. We investigate EU export subsidies that neutralise cost disadvantages to EU producers from carbon pricing (LBAM-X) and find drastic effects on global emissions. Jointly with LBAM tariffs, LBAM export subsidies achieve 89% of the emissions reductions that would be obtained by taxing embedded carbon in the ideal CBAM-ID, while also further mitigating the EU welfare loss of carbon pricing. Export subsidies are not part of CBAM and likely prohibited by current WTO rules (Cosbey et al. 2018). Our findings cast a spotlight on the opportunity costs of an asymmetric policy focus on import leakage.

Are LBAM tariffs WTO compatible?

While it is uncertain whether CBAM will withstand possible challenges by WTO members, we argue that the compatibility of LBAM import tariffs with WTO rules is no worse than CBAM, and likely better.

First, LBAM tariffs are non-discriminatory in the sense that all foreign exporters of a given product will face the same tariff, independent of the carbon content of their production. This simplicity derives from the fact that LBAM focuses on leakage prevention and gives up on CBAM’s secondary objective to reduce foreign emissions. Second, Staiger (2022) views the increase in imports induced by an ETS price increase as a market access favour that the EU never meant to give. Consequently, taking it away with an LBAM tariff does not limit foreign market access. Thus, LBAM keeps foreign firms at the status quo ante and does not negatively affect their exports. As a result, we expect that LBAM will be met with less political opposition than CBAM, which induces import reductions from dirty origin countries. Third, because LBAM does not require information on the carbon content of imports, it sidesteps costly monitoring and hence avoids erecting non-tariff trade barriers. Finally, since the same LBAM tariff rate is applied to all origin countries, it solves the arbitrage problem that plagues CBAM.

In conclusion, border carbon adjustments like CBAM constitute an important step forward from current anti-leakage policies, but only if they are implemented in all sectors to prevent evasion and do not impose unnecessary economic harm on Europe’s trading partners. The Leakage Border Adjustment Mechanism demonstrates that these requirements can be satisfied while keeping the administrative burden to a minimum.

Authors’ note: This work was supported by the Centre for Inclusive Trade Policy Innovation Fund, ESRC grant number ES/W002434/11. Funding by the German Federal Ministry of Education and Research (BMBF) through COMPLIANCE (grant 01LA1806C) and by the German Research Foundation (DFG) through CRC TR 224 (Projects B06 and B07), is gratefully acknowledged.

References

Bellora, C and L Fontagné (2022), “The EU in search of a WTO-compatible Carbon Border Adjustment Mechanism”, VoxEU.org, 26 March.

Böhringer, C, C Fischer, K E Rosendahl and T F Rutherford (2022), “Potential impacts and challenges of border carbon adjustments”, Nature Climate Change 12(1): 22–29.

Campolmi, A, H Fadinger, C Forlati, S Stillger and U Wagner (2023), “Designing Effective Carbon Border Adjustment with Minimal Information Requirements. Theory and Empirics”, CEPR Discussion Paper 18645.

Cosbey, A, S Droege, C Fischer and C Munnings (2019), “Developing Guidance for Implementing Border Carbon Adjustments: Lessons, Cautions, and Research Needs from The Literature”, Review of Environmental Economics and Policy 13(1): 3–22.

Dekle, R, J Eaton and S Kortum (2007), “Unbalanced Trade”, American Economic Review 97(2): 351–55.

EU (2023), “‘Fit for 55’: Council adopts key pieces of legislation delivering on 2030 climate targets”, press Release by the Council of the EU, 25 April.

Fowlie, M and M Reguant (2018), “Challenges in the measurement of leakage risk”, AEA Papers and Proceedings 108: 124–29.

Garicano, L, C Fischer, S Kortum and C Gollier (2021), “CEPR-EAERE Climate Policy 1: Carbon Border Adjustment Mechanism”, CEPR webinar, 7 May.

Hoel, M (1996), “Should a carbon tax be differentiated across sectors?”, Journal of Public Economics 59(1): 17–32.

Markusen, J R (1975), “International externalities and optimal tax structures”, Journal of International Economics 5(1): 15–29.

Muûls, M, U Wagner and R Martin (2010), “Still time to reclaim the European Union’s Emissions Trading System for the taxpayer”, VoxEU.org. 24 May.

Muûls, M, R Martin, J Colmer and U Wagner (2023), “Does Pricing Carbon Mitigate Climate Change? Firm-Level Evidence from the European Union Emissions Trading Scheme”, Review of Economic Studies, forthcoming.

Nordhaus, W D (2015) “Climate Clubs: Overcoming Free-Riding in International Climate Policy”, American Economic Review 105(4): 1339–70.

Ossa, R (2014), “Trade Wars and Trade Talks with Data”, American Economic Review 104(12): 4104–46.

Staiger, R (2022), A World Trading System for the Twenty-First Century, The MIT Press.

Weder di Mauro, B (2023), “Climate and Conflict: Why COP needs to be reformed”, VoxEU.org, 23 November.

Young, M (2022), “Improving carbon border adjustment mechanisms”, VoxEU.org, 22 August.