Since the start of the war of aggression against Ukraine, one sanction instrument widely discussed for the EU was a tariff on imports of gas from Russia (Sturm 2022, Gros 2022). That idea is now moot because Russia itself has largely stopped exporting gas to the EU. This was to be expected on game theoretic grounds because if Russia wanted to hurt the EU it had to do so before Europe had become independent of Russian gas by filling its storage and lining up alternative supplies (Ehrhart and Schlicht 2022).

Bygones are bygones. The EU must now manage the situation created by Russia’s de facto embargo on gas exports to Europe which has sent spot prices on Europe’s exchanges to very high levels. The prices paid by residential consumers have also increased, albeit much less so than the spot prices. Prices for households have on average doubled or tripled, while spot prices on the exchange have increased by a factor of ten or more (after briefly reaching 15 times the previous levels).

Consumers are already anxious about the increases that they have been confronted with. Consequently, politicians are in a state of near panic as they contemplate the effects of more massive price increases. Sky-high prices on the spot market for gas are also affecting electricity prices, which are also reaching unprecedented levels on the forward exchanges. This combination has led to mounting pressure to ‘do something’ to shield consumers from rocketing energy prices.

From an economic point of view, the best approach would be to let consumers pay the market price, while providing poorer households with lump-sum income transfers. Another economically sensible approach would be to provide only a limited base amount to needy households at low prices but charge the full market price for the rest.

Unfortunately, many countries have not followed these economic principles and have instead introduced subsidies, which lower the price consumers face. There is also increasing pressure to put a lid on gas prices overall with the justification that ‘markets are no longer functioning rationally’. The high price of gas has led to high electricity prices because during peak demand gas provides the marginal power generating capacity. This is why some governments (Spain and Portugal) for example are subsidising the use of gas in electricity generation to keep the price of power low.

Households are the policy focus at this point because their need for heating dominates total gas demand during the winter and finding energy substitutions would be most difficult for them in the short run (and of course, households constitute voters). But some countries also provide ‘price mitigation’ support for industry, especially energy intensive firms and SMEs.

Calculating the fiscal and welfare costs of subsidies

The fiscal cost of providing energy subsidies is often at the centre of discussions on how governments should react to high gas prices. The total amounts promised by governments now run into the hundreds of billions across the entire EU (Bruegel 2022).

For economists, the fiscal cost represents only a transfer (from the government to households), not a net loss to society. The only net loss to society results from some agents consuming more gas with a marginal value below the price society must pay.

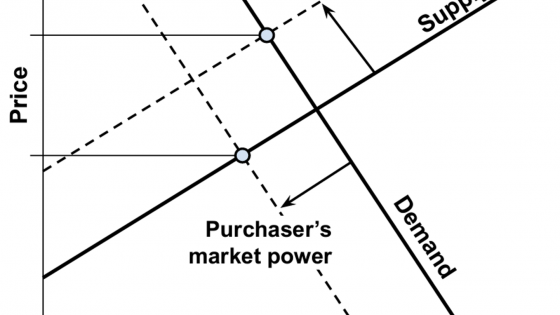

The size of this welfare loss, also called the ‘Harberger triangle’ depends crucially on the elasticity of demand (Hines 1999). The lower the elasticity of demand, the smaller the welfare cost for any given fiscal outlay, because, if few consumers adjust their demand in response to lower prices, the subsidy becomes mainly a transfer.

The elasticity of demand by residential consumers is usually assumed to be low in the very short run because households cannot switch quickly to other fuels. A typical estimate for the short-run price elasticity of demand for natural gas is about 0.1 (see Auffhammer and Rubin 2018). This implies immediately that the standard triangle welfare loss from energy subsidies should be low (if they do not last long).

However, energy subsidies have another effect which is much more important than the triangle welfare loss. Energy prices subsidies mean that gas demand will fall less than it otherwise would have done. This means that Europe will have to import more gas than it would have done if consumers had to pay a higher price. Higher import demand from Europe puts even more pressure on global (LNG) gas prices and thus worsens the term of trade for the entire EU. Gros (2022c) shows that this effect could be an order of magnitude more important than the standard triangle welfare cost.

Inelastic supply: The key issue

The key reason that any subsidy for energy consumption imposes such a high cost on Europe is that the supply of gas is itself very price inelastic. There is no spare capacity that could be brought to the market within a few months. The only source of additional supplies for Europe is thus gas not consumed elsewhere, i.e. mainly in Asia which itself relies only on LNG supplies. This means that any amount not consumed in Asia can be easily re-routed to Europe. But Asian demand, which is larger than that of Europe (Gros 2022a) will fall only if consumers in Asia feel higher prices.

Unfortunately, European countries are not the only ones trying to protect consumers from high gas prices. Some major Asian importers, such as Japan and South Korea, have also enacted measures to limit the price increases faced by households. One must thus assume that the global supply of gas for Europe is as inelastic as European demand. This might be one of the reasons why Asian gas demand has so far fallen little and why the additional demand from Europe due to the lack of Russian gas has sent spot gas prices so high.

The key point is thus the following: a low elasticity of demand for gas cuts two ways. Even a substantial price subsidy to EU consumers will not lead to much lower gas savings. But the same applies also to the rest of the world. A very high increase in price will be needed to induce consumers elsewhere to reduce their consumption to free up even small additional supplies for Europe.

This low elasticity of gas supply for Europe has several implications (Gros 2022c):

- Almost all of the expenditure on subsidies will end up in higher import costs. The money given to consumers to enjoy cheaper gas will thus not just represent a transfer from taxpayers to consumers, but a transfer from taxpayers to foreign gas suppliers.

- Russia still exports substantial amounts of gas (including LNG and via pipeline to Turkey and China). It would thus benefit from the higher global gas price due to higher EU demand. This is the opposite of what is needed at present (Chaney et al. 2022).

- A price subsidy will lead to higher import prices, but this means that the price paid by the consumer falls less than anticipated when the subsidy was introduced. The increase in import prices then induces policymakers to increase the subsidy. Any attempt to cap the domestic price could thus set in motion a chain of ever higher spot prices and higher subsidy rates to keep the price for consumers down. EU-wide subsidies could have such a strong impact on import prices that ultimately consumer prices increase anyway because the increase in the import price essentially overwhelms the subsidy.

- The terms of trade loss from an EU-wide gas price subsidy could amount to a considerable fraction of the total gas import bill, which this year could end up being as much as €200-250 billion for the EU.

- Member States acting under national political priorities do not take this effect into account. Each individual Member State seems to assume that the gas market price is not affected by its own actions. This might be true for the smaller Member States, but actions by Germany, which accounts for almost a third of EU gas consumption, could have a measurable impact on global gas prices. This constitutes a clear externality which justifies common efforts to reduce gas demand. In this sense the European Commission was justified in proposing common targets for the reduction of gas use throughout the EU (European Commission 2022a).

More generally, a highly inelastic supply of gas for Europe implies that the optimal policy would be a tax on gas use to ensure that every user considers the fact that their rate of consumption increases the price for everybody (Johnson 1951). This is the same logic that was behind the proposals to put a tariff on Russian gas imports (Sturm 2022).

Conclusions

Extreme gas prices are exacting a significant toll on the European economy, reducing households’ purchasing power and increasing costs for industry. Member States are reacting to the widespread political pressure for compensation by enacting many support schemes.

High gas prices constitute a tax on Europe given that 90% must be imported and this tax must be borne by somebody. If it is not the consumer, it must be the taxpayer (often the same person). Only a few political leaders have been brave enough to acknowledge this reality.

What no European government has acknowledged is that subsidising gas consumption only worsens the problem. As households and SMEs face less of an incentive to reduce their own gas consumption European import demand remains higher than it would have been otherwise. Given the very limited supply from the rest of the world this implies substantial further price increases, thus augmenting even further the burden on Europe (and, in a vicious circle, increasing the demand for additional protective measures).

The key point is thus that the marginal cost of gas is much higher than the price. This conclusion is independent of the simple model used here. It derives from first principles that apply in a situation where Europe faces – at least in the short run – a highly inelastic supply of gas.

One way to internalise the externality arising from inelastic supply would be a tax on gas. However, as this might be politically impossible, governments could achieve the same incentive effect by subsidising gas savings, for example by paying households to consume less this winter than last. This would also involve expenditure, but the model predicts that such subsidies would mostly pay for themselves through lower import prices – but only if implemented at EU level. If any single Member State implements such a scheme, it would bear the full fiscal cost, while the rest of the EU would gain (even if only marginally) from lower import prices.

The broad conclusion is that the Commission should strenuously oppose any (domestic) gas price cap or subsidy and it should recommend Member States to employ savings subsidies instead. A concerted push to encourage energy savings would not only reduce the terms of trade loss, thus strengthening support for continuing the sanctions. But it would also diminish the revenues Russia earns on its exports of gas outside the EU.

Another way to reduce the terms of trade loss for the EU would be to bundle the gas purchases of Member States via a common gas purchasing mechanism (Cramton et al. 2022). A common EU Energy Purchase Platform already exists (European Commission 2022b), but participation is only voluntary, and no attempt has been made so far to impose an external price cap, i.e. a maximum which the EU would be willing to pay (Martin and Weder di Mauro 2022). This approach would also be vastly superior to the present situation of Member States outbidding each other in a tight market while at the same subsidising consumption.

References

Auffhammer, M and E Rubin (2018), “Natural gas price elasticities and optimal cost recovery under consumer heterogeneity: Evidence from 300 million natural gas bills”, NBER Working Paper No. w24295.

Bruegel (2022), “National policies to shield consumers from rising energy prices”.

Chaney, E, C Gollier, T Philippon and R Portes (2022), “Economics and politics of measures to stop financing Russian aggression against Ukraine”, VoxEU.org, 22 March.

Chepeliev, M, H Hertel and D van der Mensbrugghe (2022), “Cutting Russia’s fossil fuel exports: Short-term pain for long-term gain”, VoxEU.org, 9 March.

Cramton, P, A Ockenfels and S Stoft (2022) “An EU gas-purchasing cartel framework”, VoxEU.org, 26 May.

Ehrhart, K M and I Schlecht (2022), “Introducing a price cap on Russian gas: A game theoretic analysis”, Working paper.

European Commission (2022a), “Save Gas for a Safe Winter: Commission proposes gas demand reduction plan to prepare EU for supply cuts”, Press release.

European Commission (2022b), “Energy Security: Commission hosts first meeting of EU Energy Purchase Platform to secure supply of gas, LNG and hydrogen”, Press release.

Gros, D (2022a), “When the taps are turned off: How to get Europe through the next winter without Russian gas”, Centre for European Policy Studies.

Gros, D (2022b), “Optimal tariff versus optimal sanction: The case of European gas imports from Russia”, Centre for European Policy Studies.

Gros, D (2022c), “Why gas price caps and consumer subsidies are both extremely costly and ultimately futile”, Centre for European Policy Studies.

Hines, J R (1999), “Three sides of Harberger triangles”, Journal of Economic Perspectives 13(2): 167-188.

Johnson, H G (1951), “Optimum welfare and maximum revenue tariffs”, The Review of Economic Studies 19(1): 28–35.

Martin, P and B Weder di Mauro (2022) “Winter is coming: Energy policy towards Russia”, VoxEU.org, 23 July.

Stern, D.I. (2012), “Interfuel substitution: a meta‐analysis”, Journal of Economic Surveys 26(2): 307-331.

Sturm, J and K Menzel (2022), “The Simple Economics of Optimal Sanctions: The Case of EU-Russia Oil and Gas Trade”, Working paper.