Trust is a key factor in international attractiveness, as evidenced by the World Bank’s Ease of Doing Business Index, the World Economic Forum’s Global Competitiveness Reports, or Transparency International’s Corruption Perception Index. Trust is particularly important for emerging countries that wish to increase their participation in global value chains because it is critical to the growth and expansion of complex industries with multiple interfirm relationships.

Trust is multifaceted: it includes confidence in governments, market institutions, and the financial reliability of creditors. It also involves interpersonal trust – a network of shared norms and behaviours, known as social capital. This latter and broader aspect of trust significantly impacts various economic areas, including finance, innovation, firm structures, and labour markets (Algan and Cahuc 2014). Recent research highlights its critical role in the COVID-19 pandemic (Cohen et al. 2022) and in monetary policy (Ji and De Grauwe 2022).

In a recent paper (De Sousa et al. 2023), we explore how trust influences specialisation in economic complexity, a key driver of growth and development. As countries specialise in complex industries, they tend to experience faster growth due to knowledge accumulation and technological spillovers (Kelly and Ó Gráda 2016, Atkin et al. 2021). Our research highlights the role of trust in enhancing specialisation in industries with intricate input-output relationships.

Trust and economic complexity

The core of our argument is that complexity leads to higher verification costs, which trust may alleviate. In a simple formal model in which complexity captures the difficulty of verifying the quality of transactions between firms, we show that trust acts as a substitute for costly verification in complex industries, leading high-trust locations to specialize in such industries. Trust, therefore, becomes a catalyst for the success of complex industries.

We exploit the geographic distribution of economic activity and trust across US states to explore this prediction. To measure complexity, we propose a new index that flexibly combines two key margins: (1) how complex each individual input market is (the intensive margin of complexity) and (2) how many complex inputs the firm must acquire (the extensive margin of complexity).

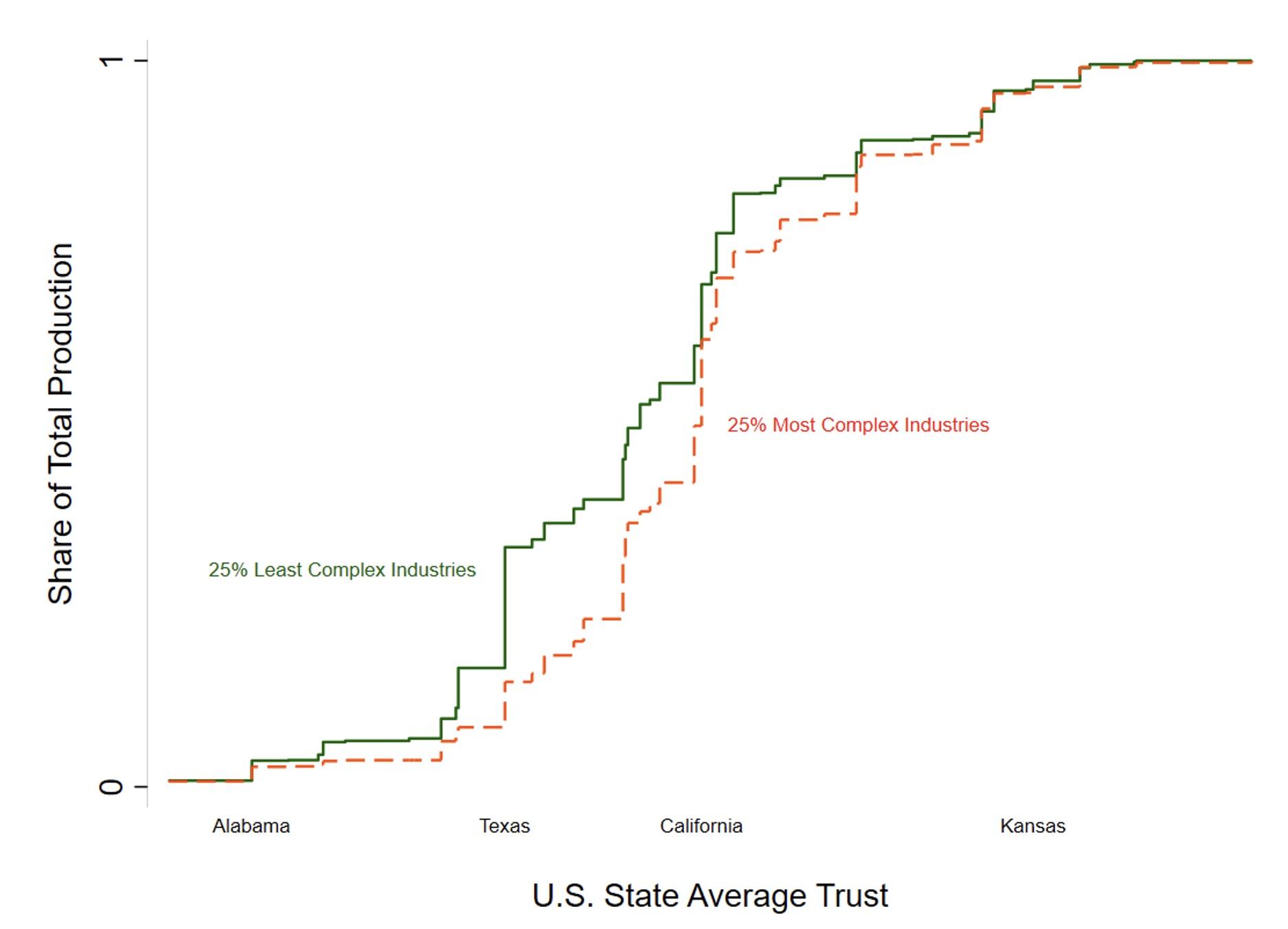

As an illustration, Figure 1 displays the cumulative distribution function of the 2007 output of the 25% least complex and 25% most complex industries by US states, ordered on the x-axis from the lowest to highest average trust. The distribution of the 25% least complex industries stochastically dominates the distribution of the 25% most complex industries, suggesting that high-trust states attract a comparatively larger share of complex industries.

Figure 1 Trust and the cumulative distribution of production across US states

Notes: Cumulative distribution of production across US states ordered by their average trust levels in 2007. Trust by state is computed using data from the General Social Survey, and complexity is measured at the 4-digit level by using data on an industry’s input-output relationships. The output is derived from the Annual Survey of Manufactures and the Economic Census.

There are several possible explanations for the observed statistical relationship between trust and complexity. One is that strong institutions, such as impartial and efficient courts, could foster both an environment conducive to complex industries and a higher level of trust. Focusing on the US allows us to control for common factors like federal institutions and policies, as well as language and currency. Exploiting differences in trust among US states and differences in complexity across industries leads to a difference-in-differences approach that isolates the specific impact of trust on specialisation in complexity, while carefully accounting for the main characteristics of different industries and states.

Using value-added data for 79 4-digit manufacturing industries and 48 US states during the period 2004–2012, we show that US states with a high level of trust produce more in more complex industries than states with low levels of trust. The effect of trust is economically substantial. To get an order of magnitude of our results, compare two states, i.e. Indiana (at the median of US states in terms of trust) and Utah (one standard deviation higher in terms of trust). We consider household-appliance manufacturing, an industry whose complexity level is one standard deviation above the median. If, other things equal, trust in Indiana were to increase to the level of Utah, then Indiana’s production in household appliances would increase by 32%.

We also address potential concerns related to confounding factors and reverse causality. In particular, we can exclude a number of alternative mechanisms that might be correlated with the level of trust and call into question the trust-complexity effect (for example, the quality of institutions, income per capita, skill endowment, or linguistic and birthplace diversity). We also verify that intra-industry delegation (Cingano and Pinotti 2016), the high-technology dimension, and industry skill intensity differ from production complexity and do not affect our results. We address reverse causality in the relationship between trust and specialisation with an instrumental variable approach inspired by the literature on the determinants of trust.

Beyond individual determinants, such as age and education, trust appears to be negatively correlated with contemporary experiences of racial discrimination and racial attitudes (Alesina and La Ferrara 2002). We use two different proxies for racial discrimination that are highly (and negatively) correlated with a state’s average trust and argue that they are not directly related to economic specialisation. Our IV results enhance the overall body of evidence supporting our findings that trust shapes states’ specialisation in complex industries.

Conclusion

Social norms – trust in particular – quietly influence the economy by shaping specialisation of countries or regions in certain industries involving numerous complex input-output relationships. In that context, trust might be complementary to foreign direct investment inflows (Lo Turco et al. 2017) in acting as a catalyst to develop more complex manufacturing. Trust might also play an essential role in the integration of countries in global value chains, which definitely rely on interfirm relationships.

Our results suggest that policies that aim to promote generalised trust would have large economic impacts. Finally, policies aimed at increasing trust tend to only affect the concerned jurisdiction, without spilling over to neighbours (Baldwin 2016): we can presume that this makes such policies especially attractive for policymakers.

References

Alesina, A, and E La Ferrara (2002), “Who trusts others?”, Journal of Public Economics 85: 207–34.

Algan, Y, and P Cahuc (2014), “Trust, growth, and well-being: New evidence and policy implications”, in P Aghion and S Durlauf (eds.), Handbook of Economic Growth, Elsevier, 49–120.

Atkin, D, A Costinot, and M Fukui (2021), “Globalization and the ladder of development: Pushed to the top or held at the bottom?”, NBER Working Paper 29500.

Baldwin, R (2016), The great convergence, Harvard University Press.

Cingano, F, and P Pinotti (2016), “Trust, firm organization, and the pattern of comparative advantage”, Journal of International Economics 100: 1–13.

Cohen, D, M Péron, and Y Algan (2022), “Trust: The other factor in the Covid-19 crisis”, VoxEU.org, 2 February.

De Sousa, J, A Guillin, J Lochard, and A Silve (2023), “Trust and specialization in complexity: evidence from US states”, Journal of Economic Behavior and Organization, forthcoming.

Hausmann, R, J Hwang, and D Rodrik (2007), “What you export matters”, Journal of Economic Growth 12: 1–25.

Hidalgo, C A, and R Hausmann (2009), “The building blocks of economic complexity”, PNAS 106: 10570–5.

Ji, Y, and P De Grauwe (2022), “Trust and monetary policy”,VoxEU.org, 2 April.

Kelly, M, and C Ó Gráda (2016), “Adam Smith, watch prices, and the industrial revolution”, Quarterly Journal of Economics 131: 1727–52.

Levchenko, A A (2007), “Institutional quality and international trade”, The Review of Economic Studies 74: 791–819.

Lo Turco, A, D Maggioni, and B Javorcik (2017), “Impact of foreign direct investment on the production complexity of domestic firms”,VoxEU.org, 29 June.

Nunn, N (2007), “Relationship-specificity, incomplete contracts and the pattern of trade”, Quarterly Journal of Economics 122: 569–600.