The tightening grip of new sanctions on nations such as Iran and Russia were unprecedented in their severity (Danielsson et al. 2022) and complexity. These sanctions encompassed a broad spectrum: from freezing assets, trade curbs, and targeting key sectors, to imposing restrictions on banking operations and singling out influential individuals and businesses. In response to these penalties, target governments often deploy comprehensive mitigation strategies (Cecchetti and Berner 2022) – including the implementation of specific macroeconomic policies, subsidies, government contracts, and loans – further complicating the landscape. As a result, companies encounter diverse and often unforeseen challenges due to sanctions, with the extent of their impact varying according to their distinctive attributes and the nature of their operations.

The growing intricacies of sanctions have made it increasingly difficult for researchers to precisely measure their economic footprint on firms. The evidence on the firm-level impact of sanctions is scant. Previous research such as Nigmatulina (2022) and Lastauskas et al. (2023) has compared sanctioned to non-sanctioned entities in the context of Russia post its 2014 annexation of Crimea. However, with recent sanctions, the line between the treatment (those exposed to sanctions) and control groups has become blurry as firms can be affected through multiple, priori unknown channels.

Often labelled as 'targeted' or 'smart', these sanctions are purported to influence mainly the interests of key decision-makers, nudging them to change their strategies. However, the complexities in gauging a firm's exposure to layered sanctions make it difficult to determine their true precision or 'targeted' success in impacting the interests of political leaders.

Flexible framework for measuring sanction exposure

To understand the economic impact of sanctions and derive insights into their political effectiveness, one needs to have a flexible framework that can account for their multi-layered nature. One way to do this is to analyse stakeholders' perceptions. The idea is that if sanctions were truly affecting firms, it would be echoed in stakeholders' discussions, especially during events like conference calls. Previous studies, exemplified by Hassan et al. (2019, 2020), have employed this approach, utilising textual analysis of earnings conference-call transcripts to construct firm-level exposure to specific shocks such as Brexit. This strategy doesn't presuppose which firms are impacted by the event and accommodates any potential effect channel.

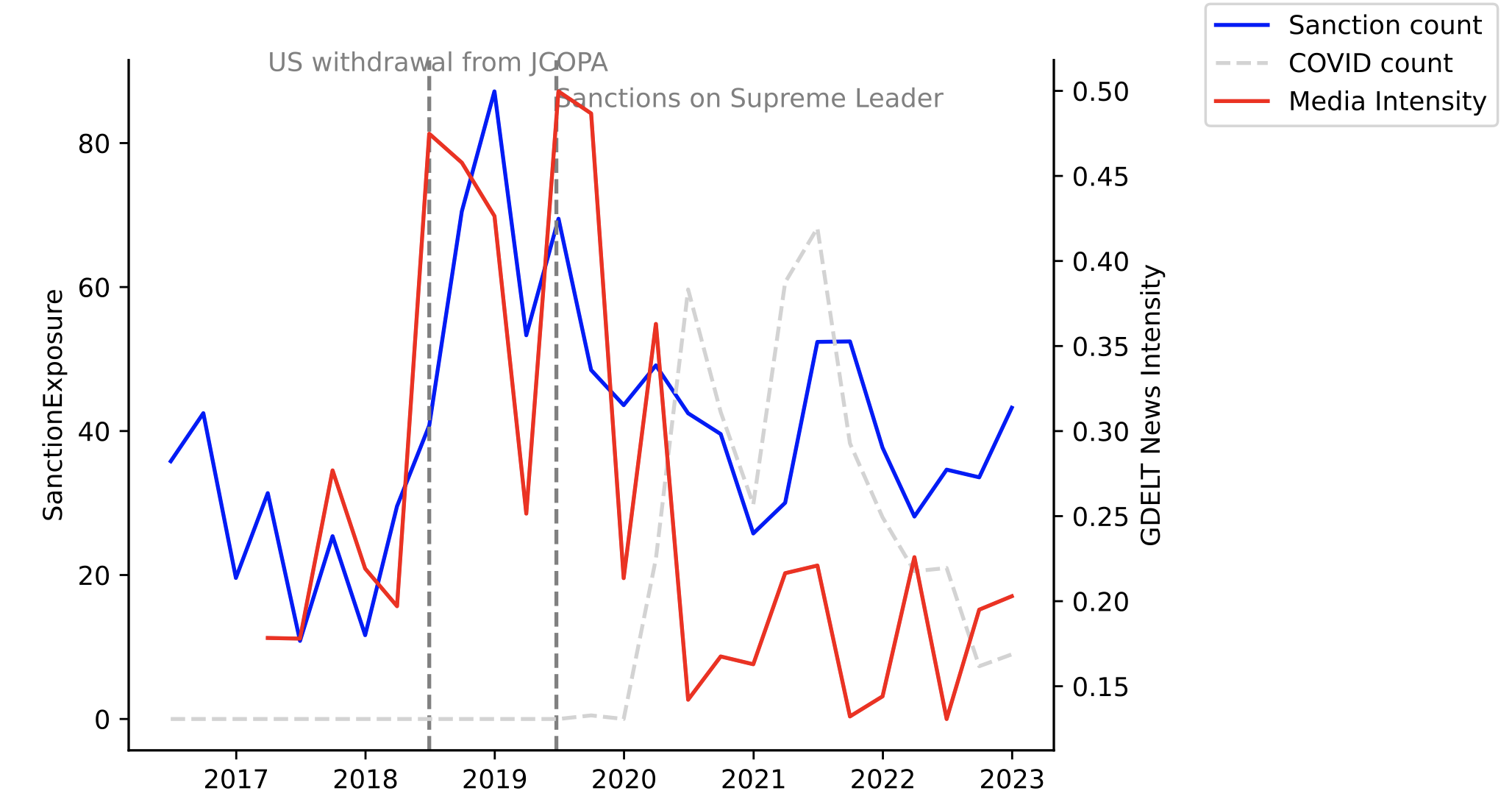

Inspired by this methodology, in my recent paper (Shamsi 2023) I delve into the transcripts of announcement conferences and reports of annual meetings of Iranian public firms. To ascertain that sanctions-related discussions mirror real-world sanction shocks, I examined the frequency of sanction mentions, adjusted by the total word count in these documents, over a timeline. The media sanction intensity measure is also displayed, calculated as the percentage of global online news coverage monitored by GDELT that mention sanctions and Iran. This media sanction intensity measure is reported to capture real-world sanction events. Reassuringly, as shown in Figure 1, there seems to be an intuitive evolution over time of counts of “sanction”, reaching its zenith when the Trump administration opted to exit the Iran nuclear deal unilaterally. To contextualise the magnitude of this shock, I compare it to the concern surrounding COVID-19. At its peak, the sanctions concern was 20% more severe than that of the COVID-19 shock, underscoring the substantial risk that sanctions represent to Iranian firms.

Figure 1 Count of "sanction" in firm meetings over time

To precisely gauge each firm's exposure to sanctions, I use a language pattern recognition technique developed in computational linguistics. This helps me to distinguish between language associated with sanction versus non-sanction topics. Utilising a sanction-focused text library and another generic one, I identified frequently occurring two-word combinations (bigrams) in sanction-specific texts (commonly known as a TF-IDF vector). By tallying how often these bigrams appeared in firms' documents relative to their overall content, I was able to derive a metric representing the proportion of sanctions-related conversations. The derived sanction exposure resonated with industry nuances. For instance, firms within trade-heavy sectors displayed elevated sanctions exposure, reinforcing the metric's validity in capturing genuine variations in firm-level sanctions exposure.

Precision in sanctions: Are they truly targeted?

Given that I have a measure of each firm's exposure to sanctions, I explore the extent to which intricate and multi-layered sanctions are targeted to disproportionately impact the interests of political decision-makers. Using definitions laid out by Draca et al. (2023) to identify Iranian politically connected entities, I found no disproportionate sanction exposure for these firms. Contrary to their purported precision in punishing specific entities while sparing others, these results suggest that the concept of "targeted sanctions" is largely meaningless in practice. As sanctions become more complex, they indiscriminately impact firms across a wide spectrum, regardless of their political connections.

Economic impacts and transmission mechanisms

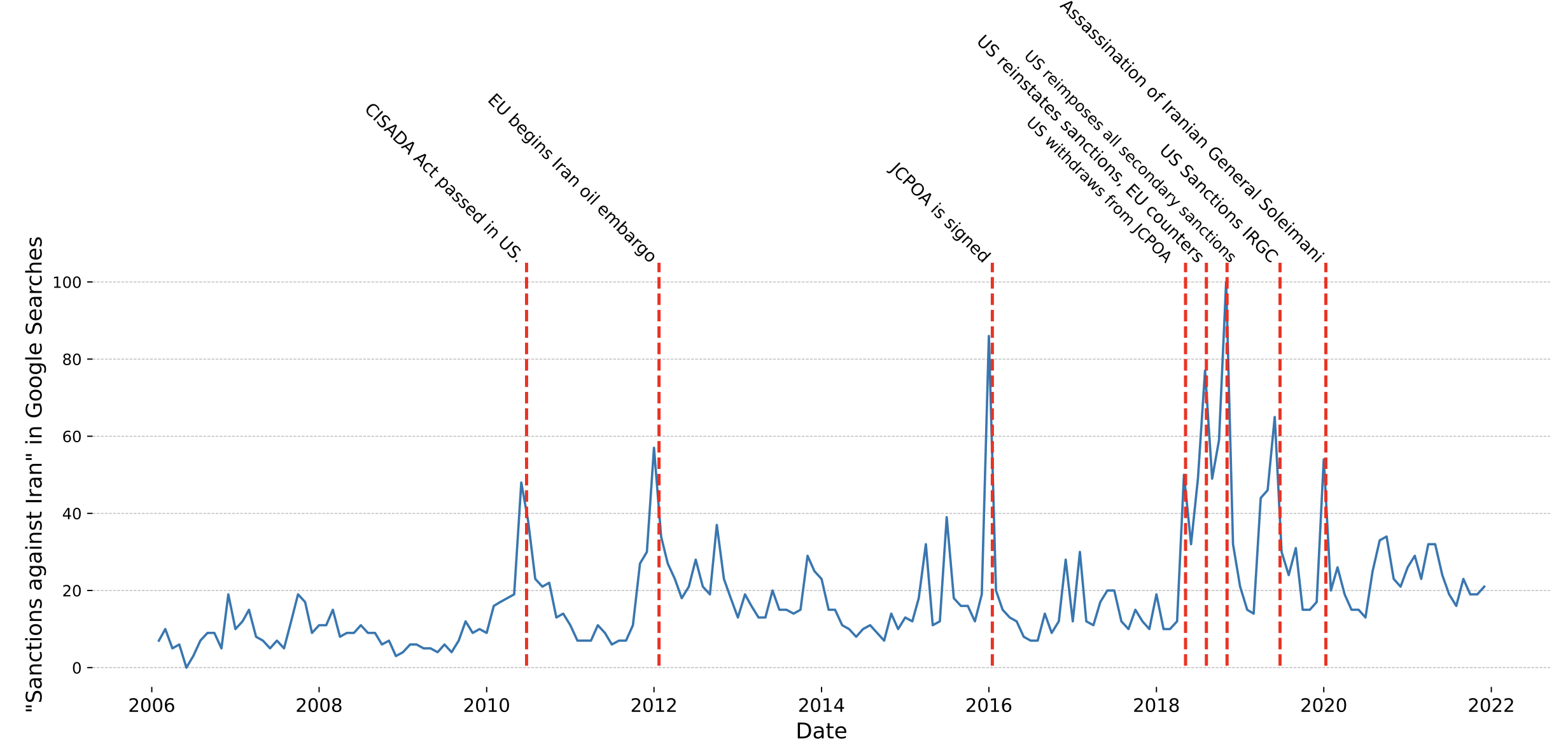

While sanctions might not precisely target politically connected entities, they can still have a significant economic impact on firms, irrespective of their political affiliations. I investigate the extent of this impact on business performance. I first examine whether firms with high sanction exposure experience an excessive negative return following news about the imposition of sanctions. The underlying premise is that to the extent that news about sanctions is unanticipated, firms with greater exposure should display a more negative excess return, signalling a diminished future revenue stream. As there are many sanction-related events, I use a systematic method from Amiti et al (2020) to identify key events, selecting days with high Google searches for "sanctions against Iran". As shown in Figure 2, these dates are then verified with media reports to pinpoint major sanction-related incidents.

Figure 2 Timeline of Google searches for “sanctions against Iran” and key political events

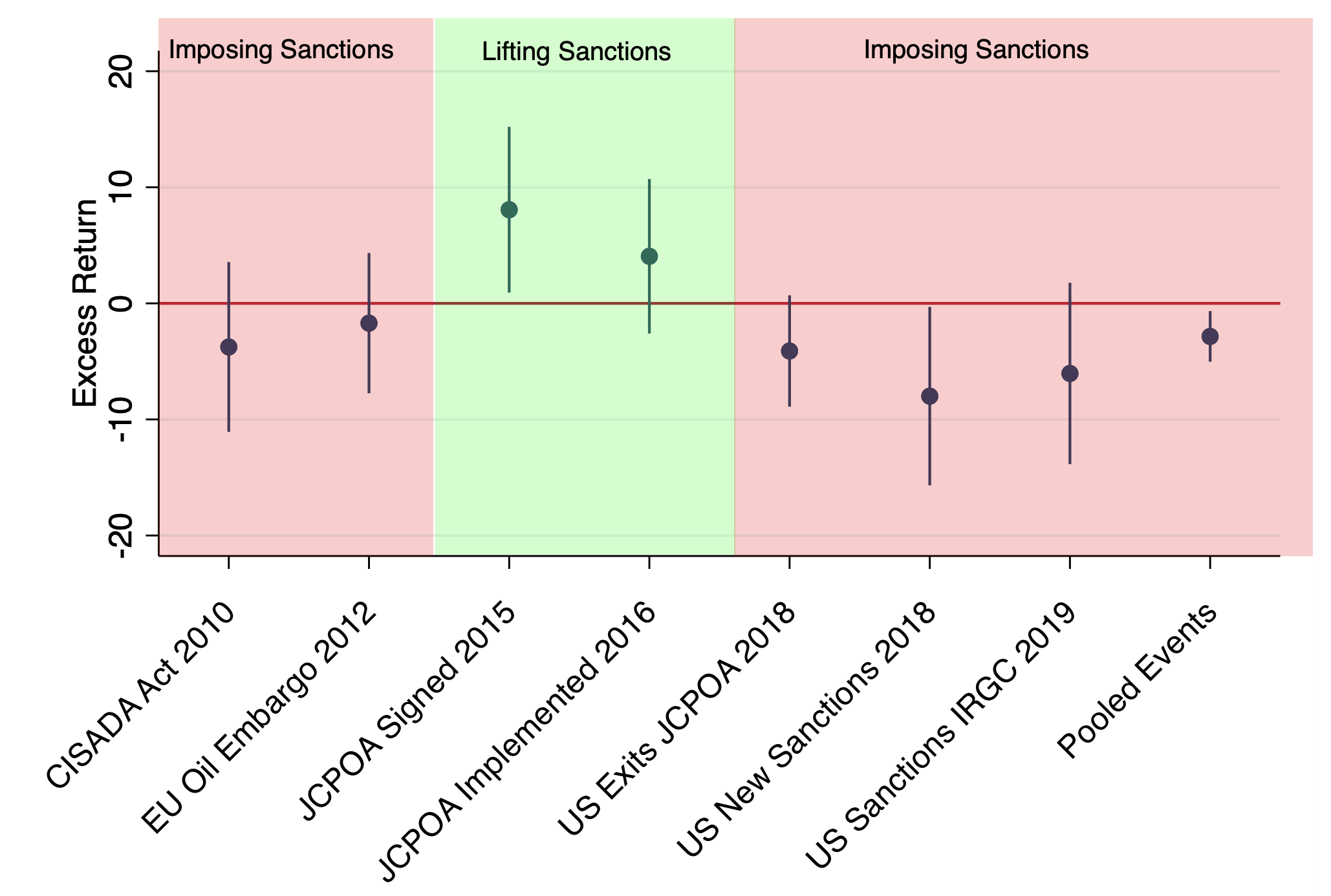

The findings presented in Figure 3 show a consistent pattern: firms with pronounced sanctions exposure tend to have the expected return fluctuations following these events. Specifically, grim news (the imposition of sanctions) usually precipitated a decline in returns for exposed firms. Conversely, positive news led to a surge. Complementing this, a deeper dive into firm-level performance revealed a discernible negative effect from sanctions, including reductions in sales and investments. Notably, the impact on hiring was comparatively less severe, which is understandable as employment costs are typically considered sticky in the short term, often viewed as short-term fixed costs.

Figure 3 Excess returns of sanction-exposed firms around key sanction-related events

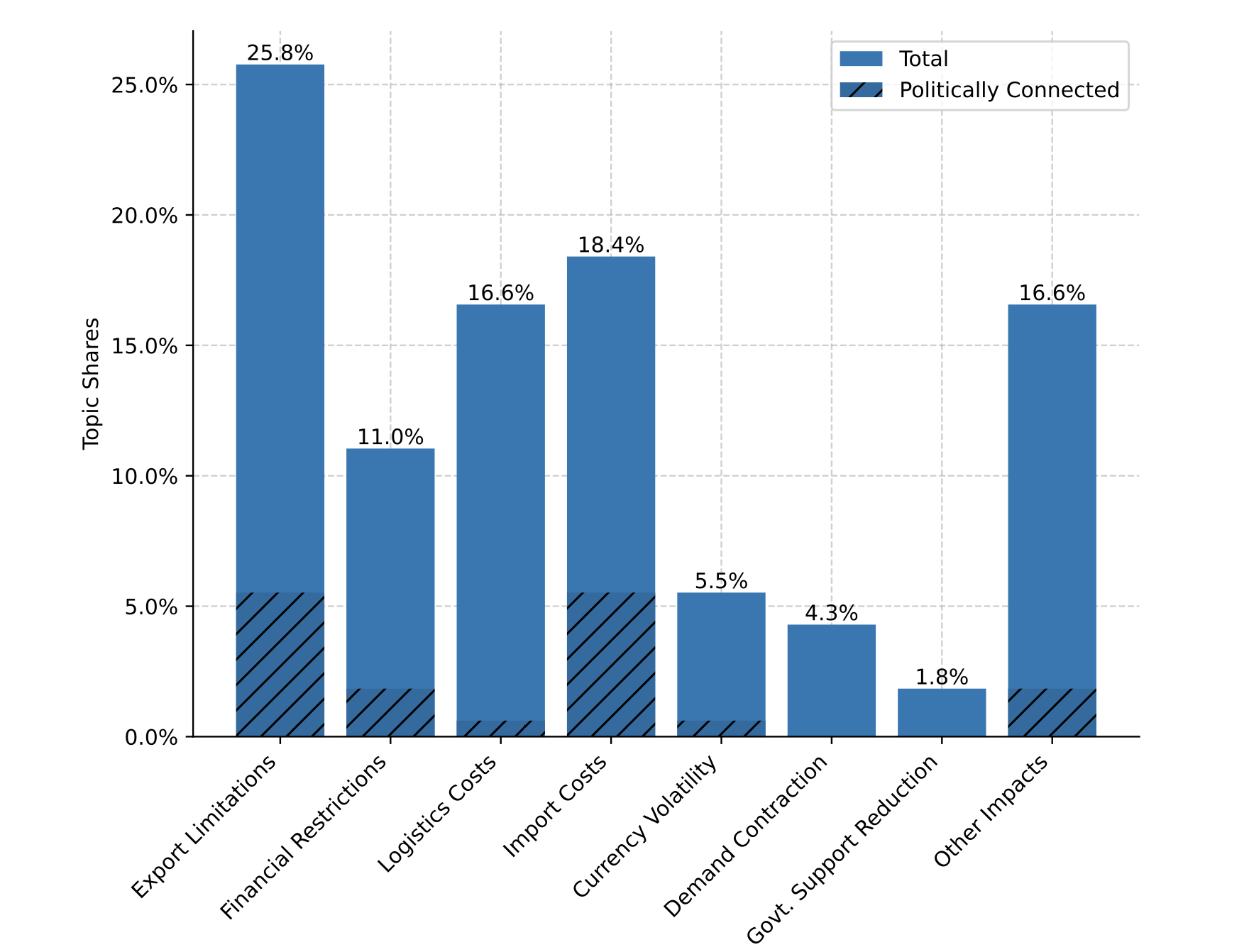

Having established the negative effects of sanctions on firms' performance, I delve into the mechanisms through which these sanctions affect businesses. The multifaceted nature of economic networks means that sanctions can influence companies through a multitude of channels, potentially interacting with each other. To investigate this, I discern the primary concerns of a firm's stakeholders, as their perception would encapsulate the cumulative effects of various channels. To this end, I return to the text and utilise a two-stage exercise. In the first stage, I conduct interviews with business professionals from within and outside of Iran to identify the primary channels of concern. Following this, a panel of expert auditors categorise each mention of "sanction" within the transcripts into these channels. The findings, presented in Figure 4, demonstrate that sanctions influence firms through diverse channels. The most dominant impact arises from export limitation, followed by increased import costs and increased logistics costs.

Figure 4 Channels through which sanctions affect Iranian firms based on firms’ meetings

Conclusion: The outlook

In sum, this column shows that amidst the growing intricacies of sanctions, we can employ adaptive methodologies to address critical policy-centric queries. Methodologically, when assessing the impact of the myriad sanctions on firms, it's imperative to consider every potential avenue through which sanctions may operate, as well as the countermeasures of the affected government. The perception of stakeholders of these firms can aid in this understanding. On the policy front, my research suggests that the prevalent notion of sanctions as surgically precise tools may be more myth than reality, especially when sanctions are complex and multi-layered. While they undoubtedly inflict economic pain, their success in specifically targeting political elites remains uncertain. Sanctions cause significant distress, but this distress isn't disproportionately borne by policy makers, thus diminishing their likelihood of achieving political objectives.

References

Amiti, M, S H Kong and D Weinstein (2020), “The effect of the US-China trade war on US investment”, NBER Working Paper No. 27114.

Cecchetti, S and R Berner (2022), “Russian sanctions: Some questions and answers”, VoxEU.org, 21 March.

Danielsson, J, C Goodhart and R Macrae (2022), “Sanctions, war, and systemic risk in 1914 and 2022”, VoxEU.org, 10 March.

Draca, M, J Garred, L Stickland and N Warrinnier (2023), “On target? Sanctions and the economic interests of elite policymakers in Iran”, Economic Journal 133(649): 159–200.

Hassan, T A, S Hollander, L Van Lent and A Tahoun (2019), “Firm-level political risk: Measurement and effects”, Quarterly Journal of Economics 134(4): 2135–202.

Hassan, T A, S Hollander, L Van Lent and A Tahoun (2020), “The global impact of Brexit uncertainty”, NBER Working Paper No. 26609.

Lastauskas, P, A Proškutė, A Zaldokas, M Juust and J Berzins (2023), “How firms adjust to economic sanctions”, VoxEU.org, 17 April.

Morgan, T C, C Syropoulos and Y V Yotov (2023), “Economic sanctions: Evolution, consequences, and challenges”, Journal of Economic Perspectives 37(1): 3–29.

Nigmatulina, D (2022), “How US sanctions increased the economic activity of sanctioned Russian firms”, VoxEU.org, 19 November.

Shamsi, J (2023), “Understanding Multi-Layered Sanctions: A Firm-Level Analysis”, Centre for Economic Performance, LSE, 7 November.