Central banks in the euro area are losing money hand over fist. Some economists support a policy that, they contend, would make banks shoulder the losses. In no fewer than four Vox columns last year, De Grauwe and Ji (2023a, 2023b, 2023c, 2023e) propose to turn a large part of the €3.6 trillion in excess reserves,

currently paid at the ECB’s deposit interest rate of 4%, into unremunerated, required reserves. They assert that reserve remuneration, at a time of large excess liquidity following the ECB’s massive bond purchase programmes, amounts to a ‘subsidy to banks’ and is ‘non-sensical’. They further argue that requiring large unremunerated reserves would not prejudice the ECB’s mission (De Grauwe and Ji 2023a).

With a base of reservable deposits of €15 trillion,

each percentage point rise in unremunerated required reserves would seemingly boost the net income of Eurosystem central banks by €6 billion at the current 4% rate. De Grauwe (2023) engaged with Bundesbank President Joachim Nagel as an Invited Speaker at the Bundesbank in September as the ECB (2023) ceased remunerating the 1% required reserve.

In this first column in two-part series, we provide an alternative reading of the proposal to require large unremunerated reserves. We argue that reserve remuneration is not a subsidy to banks. Rather, requiring large unremunerated reserves amounts to a tax on banks, as it is commonly considered (Reinhart and Reinhart 1999, Bindseil 2014). The policy change (‘tails you lose’) would not be considered had interest rates stayed low and large-scale bond-buying had produced gains for central banks (‘heads I win’). In the second column, we will set out the unintended consequences for the locus of euro bank intermediation of unremunerated reserves.

Reserve remuneration is not a subsidy

De Grauwe and Ji (2023a) charge that remunerating central bank reserves amounts to ‘subsidising commercial banks’. We disagree with this characterisation, especially at a time of abundant reserves. We set out our stall in two sections. First, we recall how the Eurosystem arrived at remunerated required reserves in a world of scarce reserves. Second, we discuss the ramifications of reserve remuneration in a world of abundant reserves after massive Eurosystem bond purchases.

Genesis: Scarce reserves and remunerated required reserves

In the old, normal times in the euro area, banks demanded reserves from their national central bank to meet reserve requirements, which were by design set above normal clearing and settlement needs. Formerly, banks obtained these reserves by borrowing at the ECB’s refinancing rate against acceptable collateral. Thus, banks paid an interest equivalent to the refinancing rate to secure required reserves.

In the initial negotiations to establish the euro, participating central banks agreed to pay a market-based rate of interest on required reserves, so that banks would not pay much to hold required reserves. The Eurosystem opted for required reserves to establish a deficit in the euro money market, forcing banks to depend on ECB refinancing. And with averaging provisions, required reserves also stabilised short-term rates. The negotiations rejected the monetarist notion of creating a sharp discontinuity in the returns from holding reserves to tighten the link between reserves and money. Negotiators also rejected requiring unremunerated reserves to boost central bank profits.

This agreement was by no means the only plausible outcome of the euro negotiations in the 1990s. This is the message of an immensely useful 2011 book, The Concrete Euro, edited by two clear-headed practitioners who were present at the creation, Paul Mercier and Francesco Papadia. In negotiations that included the eventual ‘outs’ as well as the eventual ‘ins’, seemingly important central banks objected to required reserves and not even a handful of central banks had any experience in remunerating reserves (Galvenius and Mercier 2011, Table 2.2).

While required reserves were a customary tool of central banks,

they contradicted the business model of two European financial centres. Neither the Bank of England, the Riksbank, the Danmarks Nationalbank, nor the Benelux central banks operated with required reserves. The Bank of England argued that “a reserve requirement system was inconsistent with market principles” and the Luxembourg delegation was “particularly concerned that the application of a reserve requirement system would lead to a relocation of banking business to financial centres outside the euro area” (Galvenius and Mercier 2011).

By 1990, when the Fed lowered reserve requirements on non-transaction accounts to zero, this custom was becoming more honoured in the breach than the observance.

The decision to require reserves and to remunerate them at market rates came late, only after it became clear who would be ‘in’ and ‘out’. Still, the weight of the Bank of England and Riksbank in the negotiations arguably tipped the Governing Council to opt to remunerate required reserves as a compromise. Required reserves were originally set at 2% of specified liabilities, and their remuneration was set originally at the ECB’s refinancing rate, and then at the lower deposit rate in October 2022 (ECB 2023).

Today: Abundant reserves and unremunerated required reserves?

Nowadays when abundant reserves more than fully satisfy the needs for clearing balances, the remuneration of reserves is much more consequential. Recall that the Eurosystem loaded commercial banks with excess reserves through its large-scale bond purchase programmes. These are the same excess reserves that De Grauwe and Ji (2023a) would cease remunerating.

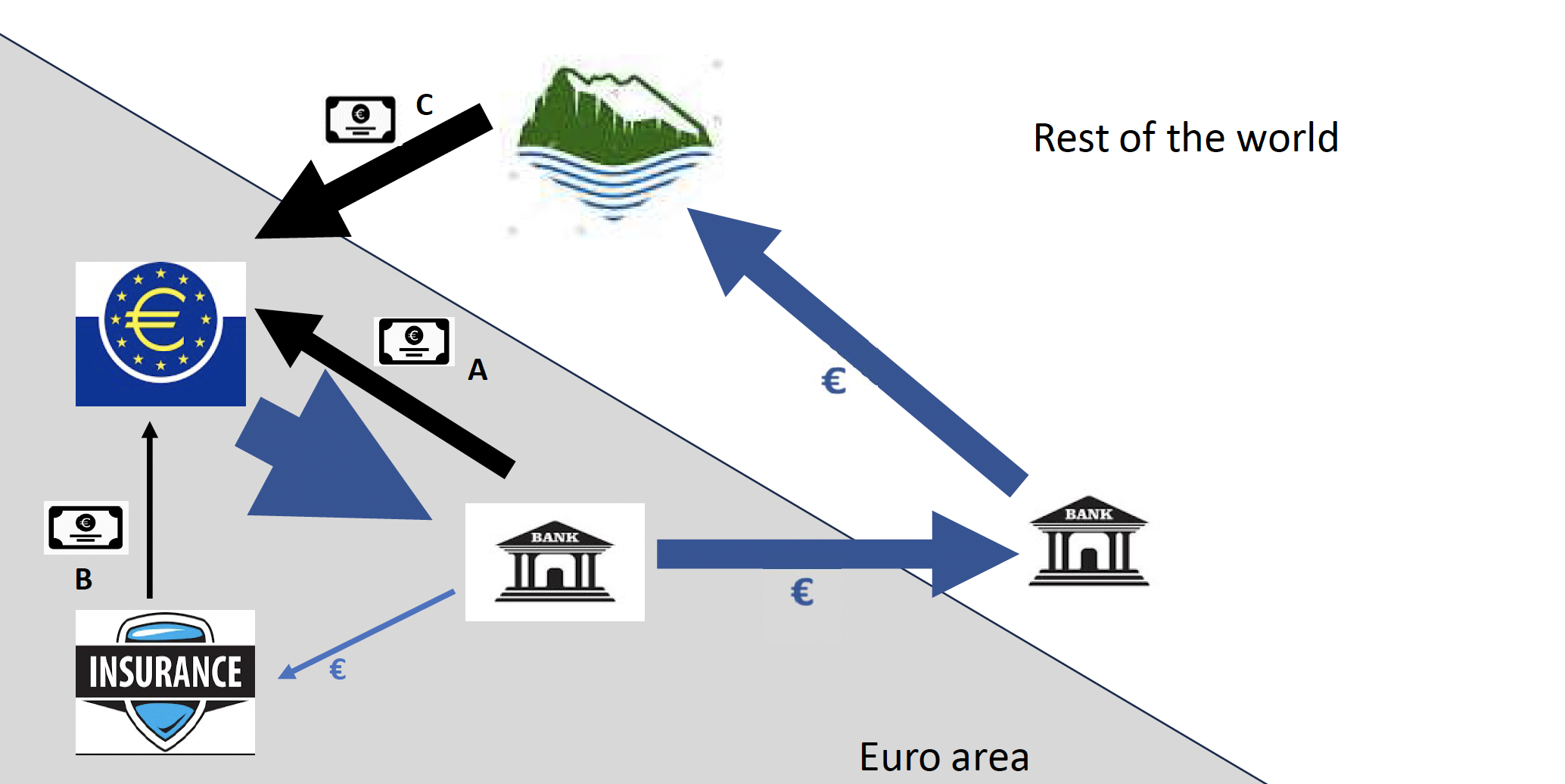

When a central bank buys domestic bonds, the seller can be a domestic bank or a domestic or foreign institutional investor. Figure 1 labels the purchase from a domestic bank as A; the purchase from a domestic institutional investor as B (where ‘Insurance’ is a particular case of an aggregate including pension funds and investment funds); and the purchase from a foreign institutional investor as C. A and C are empirically important cases (ECB 2017), as indicated in the figure with the thickness of the bond arrows in black.

Here we focus on purchases from domestic banks, A, to make the case that remunerating reserves is not subsidising banks. But the reasoning only strengthens when the other two other cases are considered.

Figure 1 ECB bond buying (quantitative easing): Flow of funds

Note: Width of arrows is proportional to the size of the flow in ECB, 2017, not including “other sectors” residual. Insurance represents insurance companies, pension funds and investment funds.

Source: Avdjiev et al (2019); authors’ adaptations.

In this case, the central bank exchanged freshly created ‘central bank reserves’ for a bond held by a commercial bank. Banks only agreed to this exchange if they deemed it beneficial. Consider the case in which a commercial bank intended to hold a bond to maturity and considered selling it and holding the asset obtained in exchange for the same period. The bank would be willing to sell the bond if the present value of the central bank reserves, including remuneration in the event that short-term interest rates again turned positive, is equal to or exceeds the price of the bond.

This stylised representative (bank) agent case assuming a ‘sell and hold’ strategy,

highlights a crucial point: banks factored in reserve remuneration in the states of the world with positive interest rates when selling bonds to the ECB during QE. Moreover, banks set loan and deposit interest rates based on anticipated reserve remuneration. Recall that the ECB had from its inception remunerated reserves at its policy rate, so only the most imaginative bankers would have factored in the possibility of the ECB’s requiring large unremunerated reserves.

From the bank’s point of view, the imposition of large unremunerated reserves amounts to an unforeseen income loss owing to a central bank’s unilateral decision. Unlike a government treasury opting to forgo coupon payments on its bonds, the imposition of large unremunerated reserves is perfectly legal. This unexpected income loss of the bank amounts to an unexpected tax levied by the central bank. Instead of regarding the act of remunerating central bank reserves as a subsidy, one should thus see the act of ceasing to remunerate central bank reserves as the imposition of an unexpected tax on euro area banks, consistent with Bindseil (2014, Chapter 8).

Let us review the bidding. In the case considered, central banks exchanged their floating rate IOUs for a fixed-rate bond held by the banks. Interest rates subsequently increased much more than anyone expected at the time of the purchases. As a result, commercial banks benefitted from the exchange, holding floating-rate central bank reserves instead of the fixed-rate bonds. The interest rate rise has also led to financial losses for the central bank, making quantitative easing (QE) seem ex-post disadvantageous, from a narrow viewpoint of the central bank finances.

If interest rates had remained very low or even negative, the situation would have differed: central banks might have profited from the exchange over the entire bond holding period while still remunerating reserves. Essentially, De Grauwe and Ji's (2023a) proposal arrives when an unfavourable outcome for central banks' finances has materialised and suggests that central banks change their means of payment from something akin to a floating-rate note into something resembling a banknote that pays no interest. This is all very legal, but perhaps not well advised.

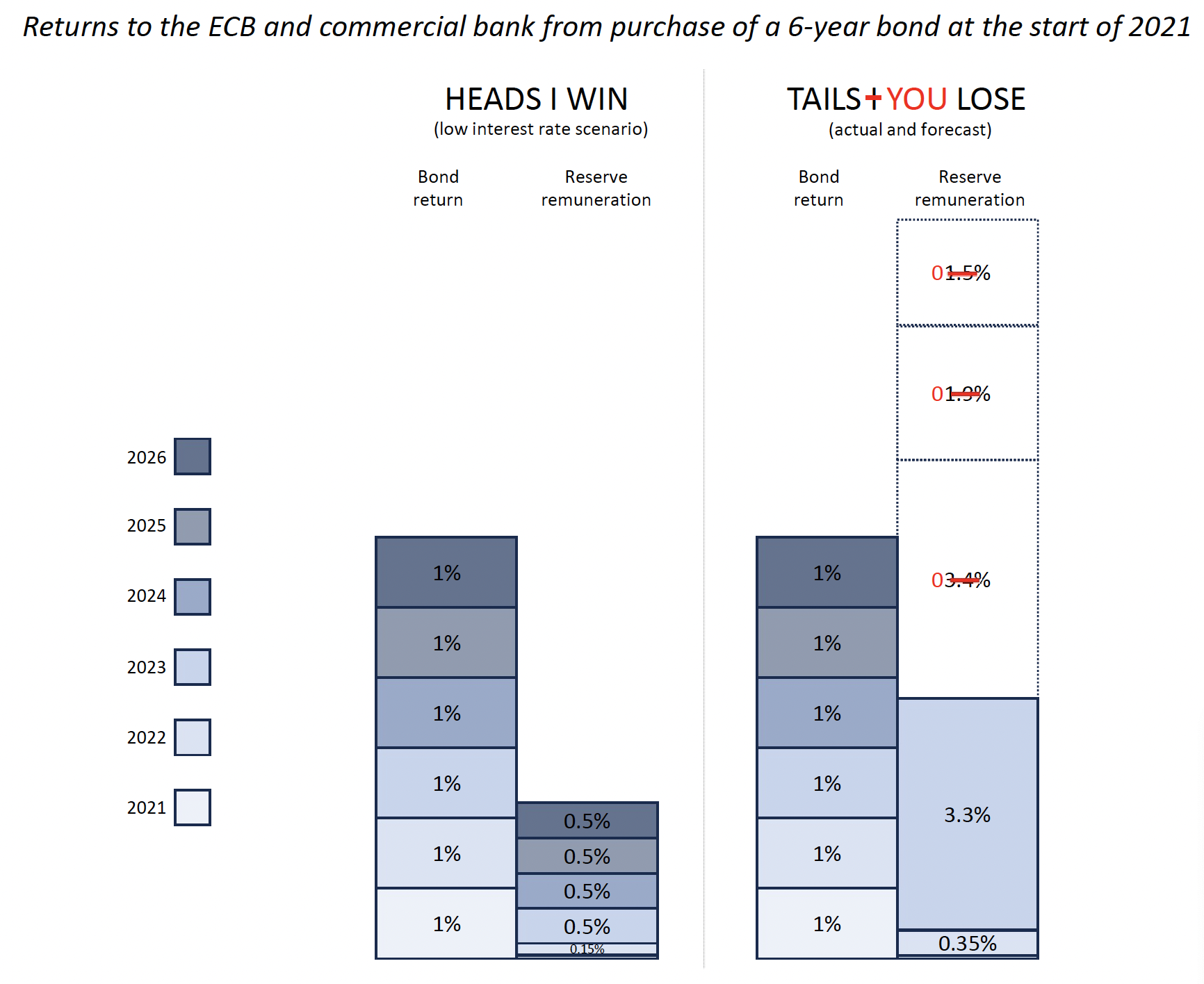

Figure 2 illustrates this ‘heads I win, tails you lose’ approach with the case of the Eurosystem’s buying a six-year bond yielding 1% a year in 2021 from a representative bank. The left panel considers a counterfactual scenario in which the ECB deposit rate remains at low levels. The right panel considers the actual ECB deposit rate through 2023 and then plots forecasts for it in 2024 through 2026 from the ECB’s Survey of Professional Forecasters (SPF).

Red edits in the right panel indicate the effect of a decision to stop remunerating reserves from 2024 on: the policy lops off the return received by the banks at the end of 2023. In both panels the ECB wins, and the banks lose, in the right panel because of the decision to cease remunerating reserves.

Figure 2 Heads I win, tails you lose

Note: Both panels profile on the left the returns of a 6-year bond yielding 1% per year bought by the central bank at the beginning of 2021, and on the right the remuneration of bank reserves that served as the means of payment. Each rectangle in a column represents the return in a given year, with its height proportional to the return. The left panel profiles the returns in a counterfactual scenario in which the ECB deposit facility rate was 0% in 2021 (as it was for reserves exempted from the negative deposit interest rate), 0.15% in 2022 (as it was on average), and then remained at 0.5% in 2023-2026. Over the entire holding period, the bond return (6%) exceeds reserve remuneration (2.15%): the ECB wins, the bank loses. The right panel profiles the actual returns through 2023 and then forecasts from the ECB’s Survey of Professional Forecasters for 2024-2026, allowing the deposit facility rate gradually to decline to 1.5% in 2026. Over the entire holding period, reserve remuneration (10.45%) exceeds the bond return (6%): the ECB loses, the bank wins. Zeroing reserve remuneration lops off the right bar at 2023: the bank loses, the ECB wins.

Banks would remember such a ‘heads I win, tails you lose’ approach. Governor Pierre Wunsch of the National Bank of Belgium has warned: “We need to be very cautious... Next time we need to use QE, I wouldn’t like to see banks having to run the probabilities of this leading to losses for central banks and speculating whether they need to boost buffers as we might tax them later” (Kaminska 2023).

Conclusion

In conclusion, the remuneration of reserves does not suffer from a ‘lack of economic foundations’, especially when reserve demand is sated, and marginal liquidity services are zero. When a central bank unexpectedly halts interest payments on reserves after trading them for long-term bonds, it levies a new tax on banks to boost its profit. Any prospective usefulness of central bank bond buying (‘QE’) advises caution in taking such a step.

In the second column in this series, we question the frequent assumption that bank owners or bank borrowers would pay the tax imposed by large unremunerated reserves.

References

Avdjiev, S, M Everett and H S Shin (2019), “Following the imprint of the ECB’s asset purchase programme on global bond and deposit flows”, BIS Quarterly Review, March, pp. 69-81.

Bindseil, U (2014), Monetary policy operations and the financial system, Oxford University Press.

De Grauwe, P (2023), “The role of central bank reserves in monetary policy”, Bundesbank Invited Speakers Series, 4 September.

De Grauwe, P and Y Ji (2023a), “Monetary policies that do not subsidise banks”, VoxEU.org, 9 January.

De Grauwe, P and Y Ji (2023b), “Monetary policies with fewer subsidies for banks: A two-tier system of minimum reserve requirements”, VoxEU.org, 13 March.

De Grauwe, P and Y Ji (2023c), “The extraordinary generosity of central banks towards banks: some reflections on its origin”, VoxEU.org, 15 May.

De Grauwe, P and Y Ji (2023d), "Towards monetary policies that do not subsidise banks", Centre for European Policy Studies (CEPS).

De Grauwe, P and Y Ji (2023e), “Unremunerated reserve requirements make the fight against inflation fairer and more effective”, VoxEU.org, 7 November.

De Grauwe, P and Y Ji (2023f), “Fighting inflation more effectively without transferring central banks’ profits to banks”, presentation to SUERF BAFFI Bocconi webinar, Expanding zero-interest minimum reserve requirements: aims, effects, and side-effects, 12 December.

ECB (2017), “Which sectors sold the government securities purchased by the Eurosystem?”, ECB Economic Bulletin 4: 61-64.

ECB (2023), “ECB adjusts remuneration of minimum reserves”, Press Release, 27 July.

Galvenius, M and P Mercier (2011), “The story of the Eurosystem framework”, in P Mercier and F Papadia (eds), The concrete euro: implementing monetary policy in the euro area, Oxford University Press.

Kaminska, I (2023), “Pre-positioning for a financial repression debate”, POLITICO Pro Morning Central Banker Europe, 17 October.

Reinhart, C and V Reinhart (1999), “On the use of reserve requirements in dealing with capital flow problems”, International Journal of Finance & Economics 4(1): 27–54.