Digital trade, from software sales to streaming movies, plays a bigger role than ever in the global economy. Its meteoric growth has renewed interest on the implications that this form of globalisation could have on the global economy, development opportunities, and jobs (Baldwin 2019, Nayyar 2023). A related question is how countries, especially developing economies, need to adapt their policies to the increasing digitalization of international trade (IMF et al. 2023).

In our recent work (Hanappi et al. 2023), we study how countries should tax digital trade flows. This question is central to current debates at the WTO. Recognising the many new opportunities created through digitalisation, WTO members agreed in 1998 not to impose tariffs on digital trade flows (‘digital tariffs’). The so-called ‘WTO moratorium’ has been renewed ever since, but is now questioned by a group of countries that call for more policy space – including the ability to set up digital tariffs. To help evaluate the cost and benefits of the WTO moratorium, in our research we investigate whether digital trade should be taxed at the border (i.e. with digital tariffs) or behind it via domestic taxation.

Digital trade and the WTO moratorium

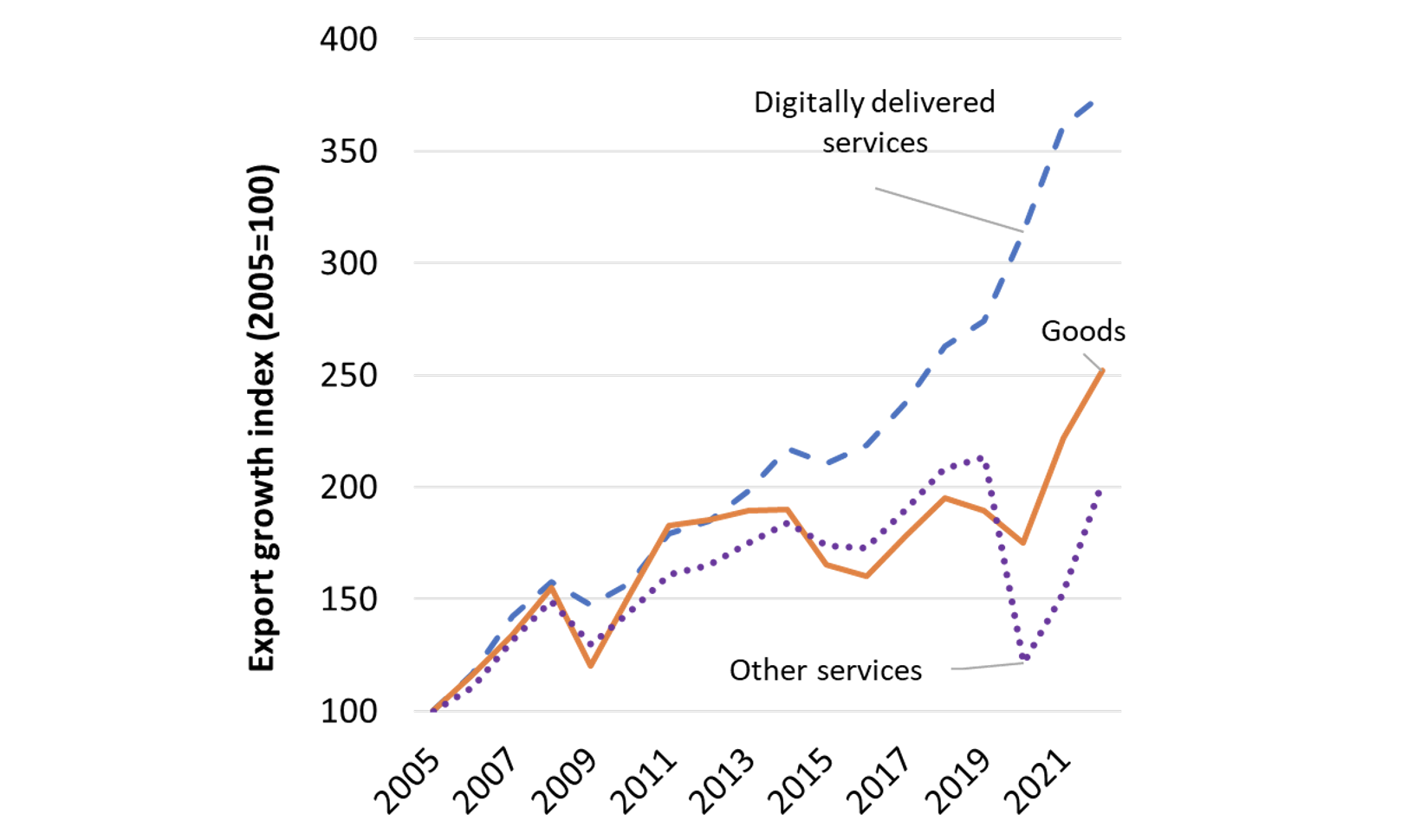

The value of global trade in digitally delivered services reached $3.82 trillion in 2022, or 54% of total global services trade and 12% of total goods and services trade combined, and its average annual growth rate was 8.1%, outpacing both goods and other services (Figure 1). Trade through digital channels has several unique benefits beyond traditional gains from trade: it contributes to the digitalisation of all aspects of the economy; enables more efficient processes that boost productivity; promotes interconnectivity, communication, and hence the transmission of existing knowledge and technology as well as innovation; and fosters inclusion by reducing trade barriers for small firms and women-led businesses (IMF et al. 2023).

Figure 1 Digitally delivered services are the fastest-growing segment of international trade

Source: IMF et al. (2023).

Although the WTO Agreements cover all types of trade, the only multilateral rule specific to digital trade is the WTO moratorium on digital tariffs (its legal, and somehow antiquated name, is a moratorium on customs duties on electronic transmissions).

While the surge in digital trade is due to the technological innovations that enabled these new forms of international exchanges, WTO agreements such as the moratorium, by acting as a commitment device, contribute to lower policy uncertainty and facilitate investment and trade. As others have recently noted, the erosion of this credibility can have long-term negative consequences (Handley et al. 2024).

Studies of the potential economic impact of the WTO moratorium have been scarce to date and focused primarily on the fiscal revenue effects. While these estimates differ widely, existing studies have in common that fiscal revenue implications tend to be small, between 0.01% and 0.33%, as a share of overall government revenue on average (Andrenelli and López González 2023). More importantly, we believe that this may not be the most prominent issue. A different question is whether the WTO moratorium facilitates or hinders efficient policy design on digital trade.

Revenue effects of tariffs versus VAT on digital trade

In our paper, we examine both fiscal revenue and efficiency, and show that imported digitised products under the scope of the moratorium are best taxed through existing domestic consumption taxes such as value added taxes (VATs), where collection methods can be adapted for digital transactions.

We start by estimating an upper bound of digital trade flows that arise from the transformation of physical products previously generating customs revenue into digitised products traded electronically. To do this, we take a list of six-digit HS codes of products at the forefront of digital transformation and calculate a counterfactual trade value based on growth rates prior to widespread digitalisation of the economy. Digital trade is estimated to be the difference between physical trade recorded in these products and the counterfactual. We then compare the maximum static revenue potential of two instruments governments can use to tax these flows: hypothetical tariffs in the absence of a WTO moratorium and VATs.

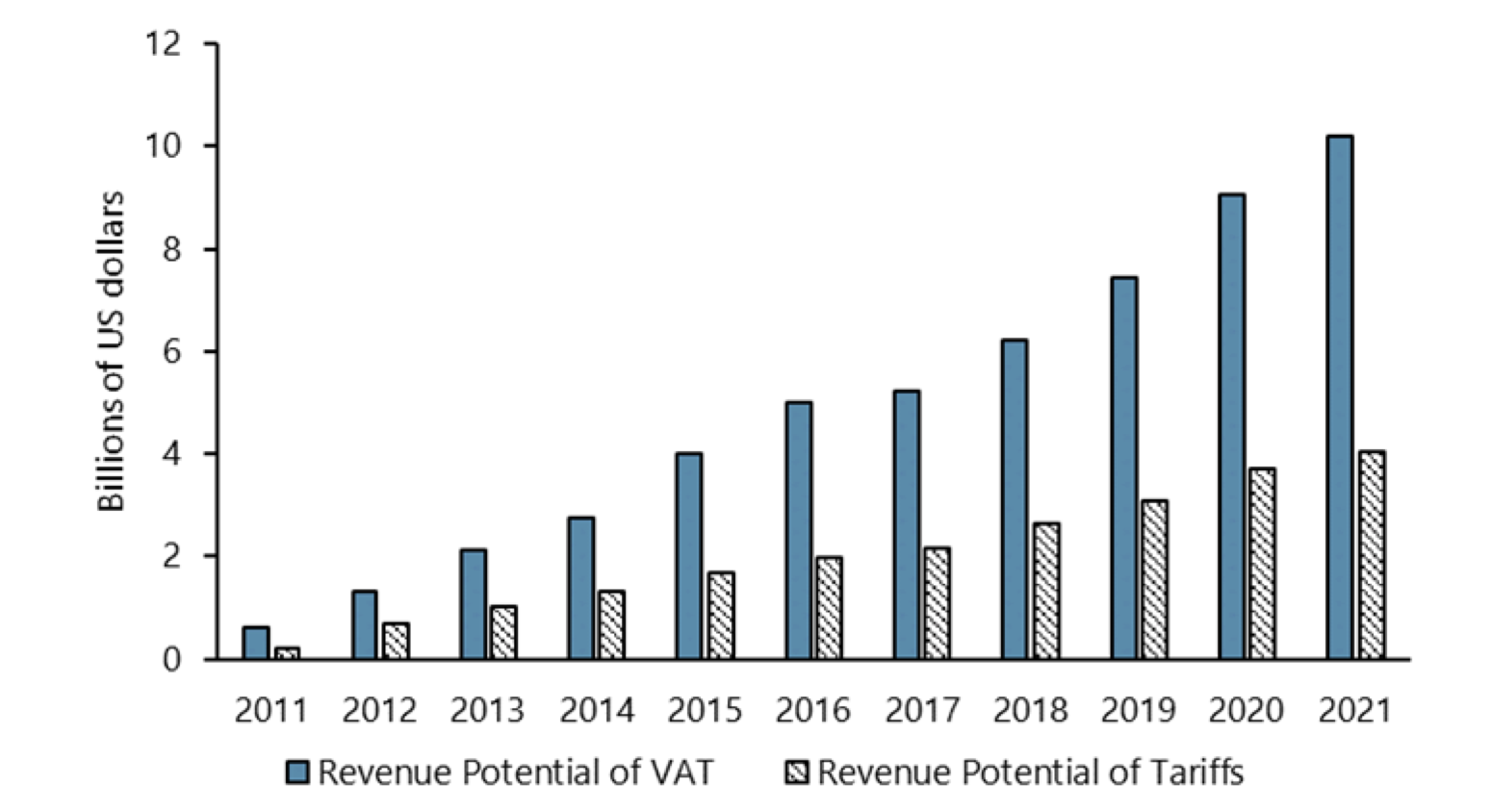

Our results show that not only is the maximal revenue potential of VAT on trade in these digitized products greater, globally about 2.5 times higher than that of tariffs at current rates (Figure 2), VAT is also more economically efficient. This is because VATs are (1) broad-based taxes on final consumption excluding intermediate inputs, thus creating less distortions per dollar raised; (2) easier to administer as they build on existing tax infrastructure; and (3) easier to implement. Our study discusses extensive experience and emerging best practices with VAT applied to digital transactions across all income groups.

Figure 2 Estimated revenue potential of taxing digital trade, 2011–21

Source: Hanappi et al. (2023).

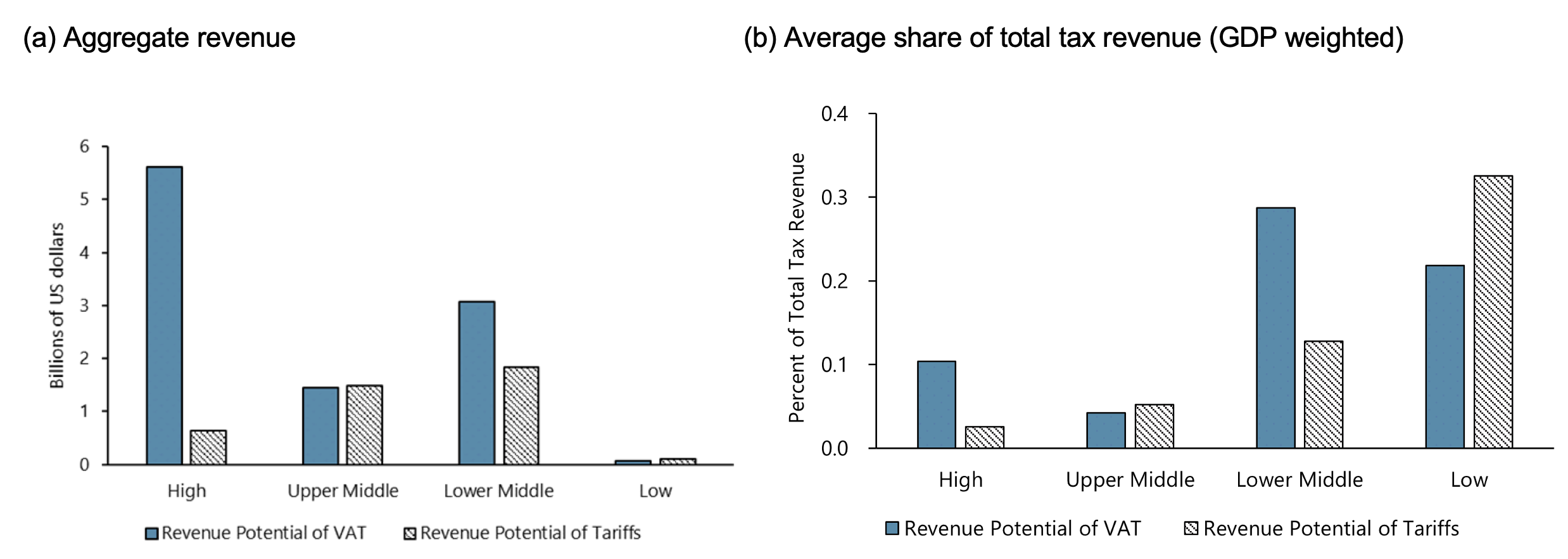

Comparing different income groups, Figure 3 reveals the difference in revenue potential is the largest in dollar terms for high-income countries due to their large share of global imports combined with low tariffs relative to VAT rates. Upper and lower middle-income countries are heterogenous, with revenue potential roughly the same for the former group and VAT ahead in the latter group. Low-income countries have low revenue potential for both instruments due to low imports in digitised products. In only five countries among lower middle- and low-income countries does the estimated revenue potential under tariffs exceeds that under VAT by more than 0.1 percentage points of total revenue.

Figure 3 Revenue potential by income groups of taxing digital trade

Source: Hanappi et al. (2023).

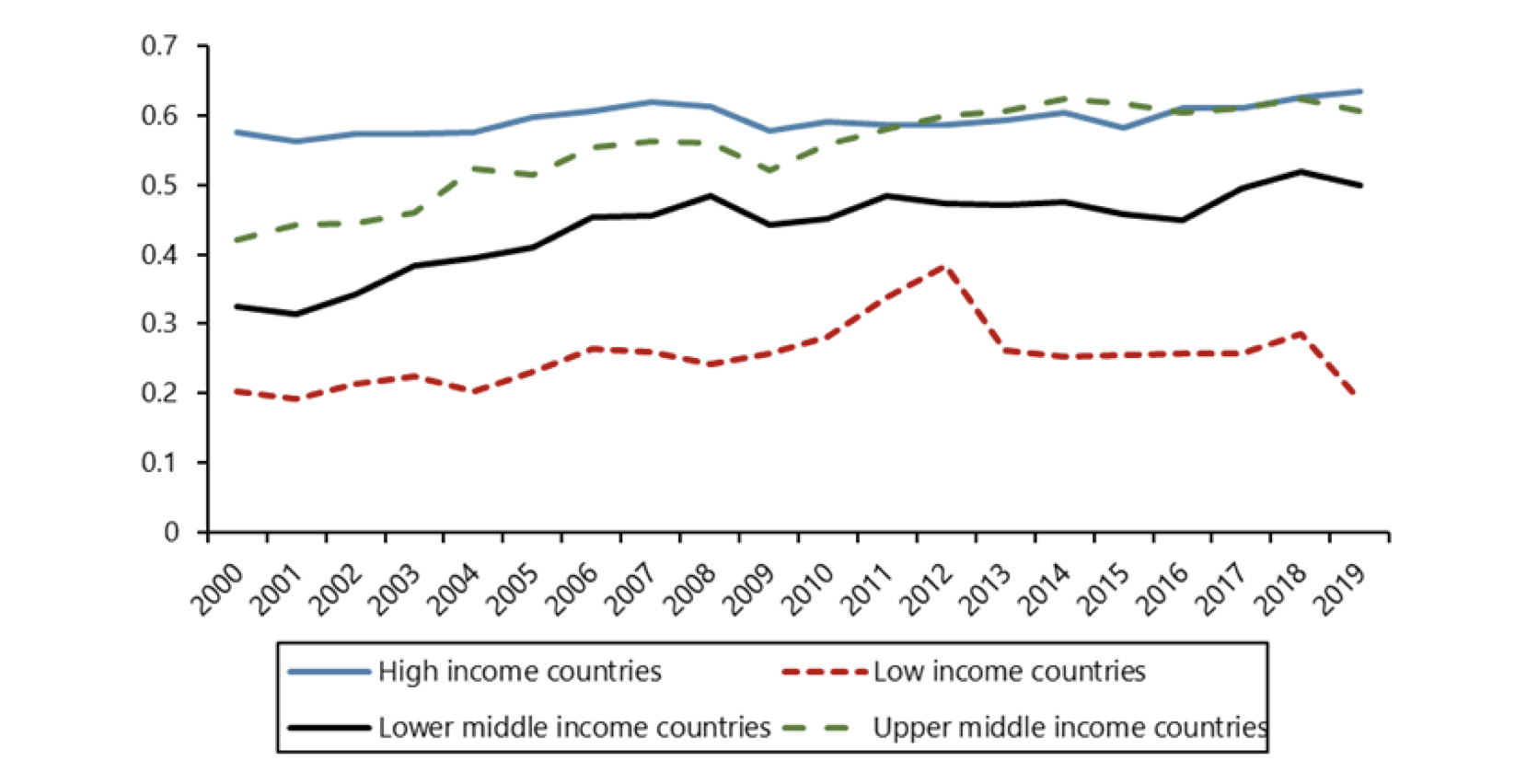

Finally, we examine the efficiency of different VAT systems by comparing the C-efficiency ratios, a statistic which captures how close a country’s VAT system is to an ideal VAT – i.e. one that is perfectly enforced and levied at a uniform rate. Stark differences emerge across income groups (Figure 4). C-efficiency is still relatively low in low- and lower middle-income countries, compared with others. This trend suggests that significant broad-based revenue gains could be realised in these countries by improving VAT policy design and investing in VAT administration and compliance measures.

Figure 4 Efficient design and implementation of VAT varies by income group

Source: Hanappi et al. (2023).

The WTO moratorium as a commitment device to efficient digital taxation

Tax systems need to adapt to the increasing digitalisation of economic activity, including in international trade. Our research compares two specific policy options to mobilize tax revenue from digital trade: discriminatory measures such as tariffs and broad-based nondiscriminatory measures such as VAT. It shows that VAT is not only less distortionary and thus more efficient, it can also generate higher revenues. These revenue streams could be mobilised through VAT by investing in administrative capacity to better capture digital flows and increase coverage and compliance. Going beyond the static revenue gains, investment in a well-functioning VAT system has been shown to have long-term benefits in terms of raising tax revenue efficiently (Acosta-Ormaechea and Morozumi 2021).

These findings point to the WTO moratorium on digital tariffs as one example of a commitment device to help countries focus reform efforts to implement more efficient policies. Such efforts should certainly be complemented by global policy coordination and support for developing countries to modernize their tax systems. But it is in the interest of all countries that the WTO moratorium is extended.

Authors’ note: The views expressed are those of the authors and they do not necessarily represent the views of the institutions they work for.

References

Acosta-Ormaechea, S and A Morozumi (2021), “The value-added tax and growth: design matters”, International Tax and Public Finance 28: 1211-1241.

Andrenelli, A and J López González (2023), “Understanding the Potential Scope, Definition and Impact of the WTO E-commerce Moratorium”, OECD Trade Policy Papers No. 275.

Baldwin, R (2019), The globotics upheaval: Globalization, robotics, and the future of work, Oxford University Press.

Hanappi, T, A Jakubik and M Ruta (2023), “Fiscal Revenue Mobilization and Digitally Traded Products: Taxing at the Border or Behind It?”, IMF Notes No. 2023/005.

Handley, K, N Limão, R D Ludema and Z Yu (2024), “The value of WTO commitments along the global supply chain”, VoxEU.org, 21 February.

Nayyar, G, D Vorisek, S Yu (2023), “Unlocking the promise of services-led growth”, VoxEU.org, 23 March.

IMF OECD, UNCTAD, World Bank and WTO (2023), Digital Trade for Development.