The US government responded to the Covid-19 pandemic with an unprecedented expansion of the social safety net. This effort is estimated to have kept 17 million people out of poverty in 2020 (Census Bureau 2021, Han et al. 2020). However, the unwinding of these temporary measures has reopened questions about the appropriate generosity of the social safety net.

At the heart of these debates is whether unconditional government aid harms society by discouraging work. Because government resources are finite, policy design must contend with how to best target support to households in times of need. Existing economic research has documented both benefits and costs of government programmes that do not make aid conditional on work (Corman et al. 2018, Dahl and Gielen 2018, Mosley 2021). In the 1990s, economists theoretically analysed how imposing barriers to receiving benefits can have the effect of steering programme dollars to those who benefit the most because they will try the hardest to overcome the barriers (Nichols and Zeckhauser 1982, Besley and Coate 1992). But this conclusion requires certain assumptions that may not hold in practice, such as assuming that the barriers are no higher for low-income people than for high-income people. Until recently, there has been little research testing these assumptions, but recent advances have shown that the assumptions often fail to hold (Deshpande and Li 2019, Homonoff and Somerville forthcoming).

Barriers to benefit receipt often take the form of work requirements, which make benefits conditional on employment. Since 1996, some form of work requirement has existed in many US means-tested programmes. Proponents argue that work requirements promote self-sufficiency by encouraging work (Editorial Board 2021). Opponents contend that the primary effect of work requirements is to reduce benefits for the most vulnerable recipients in times of need (Bernstein and Spielberg 2017).

In new work, we evaluate the competing narratives about the effects of work requirements for receipt of safety net benefits (Gray et al. 2021). We focus on the Supplemental Nutrition Assistance Program (SNAP; formerly known as Food Stamps), which reached 39.9 million Americans in 2020 (USDA 2021). We examine the effect of SNAP’s work requirements on benefit receipt and labour market outcomes when work requirements were reinstated following a multi-year hiatus during the Great Recession.

In SNAP, certain adults are required to work in order to receive benefits for more than a few months. The work requirement can be satisfied by engaging in paid employment, participating in qualifying job training programs, or doing approved community service for at least 80 hours each month. These requirements apply to childless adults who are able-bodied and younger than 50. If they do not meet these requirements, they can only receive benefits for a maximum of three months within a three-year period. The requirements disappear for people aged 50 or older, who do not have time limits on how long they can receive SNAP benefits.

Our research design leveraged this sharp change in time limits at age 50. Our analytic sample included childless adults both younger and older than 50 who were on SNAP in Virginia during the 2009–2013 period, when work requirements were suspended for everyone. When requirements were reinstated in 2013, nothing changed for SNAP recipients who were already 50 or older. Younger recipients, however, now stood to lose their benefits after just a few months unless they met the work requirements. We therefore compared what happened to recipients just under age 50 and just over age 50 following the reinstatement of work requirements until the end of 2015. The difference in outcomes between these groups reveals the effects of the policy.

Critics of work requirements claim that the primary effect of this policy is to take away government assistance from vulnerable people. To evaluate this claim, we examined how many people continued to receive SNAP benefits after work requirements were reinstated. In this and other analyses, we used administrative data from the state of Virginia. The state allowed us to link individuals’ longitudinal SNAP program records to their employment and wage records.

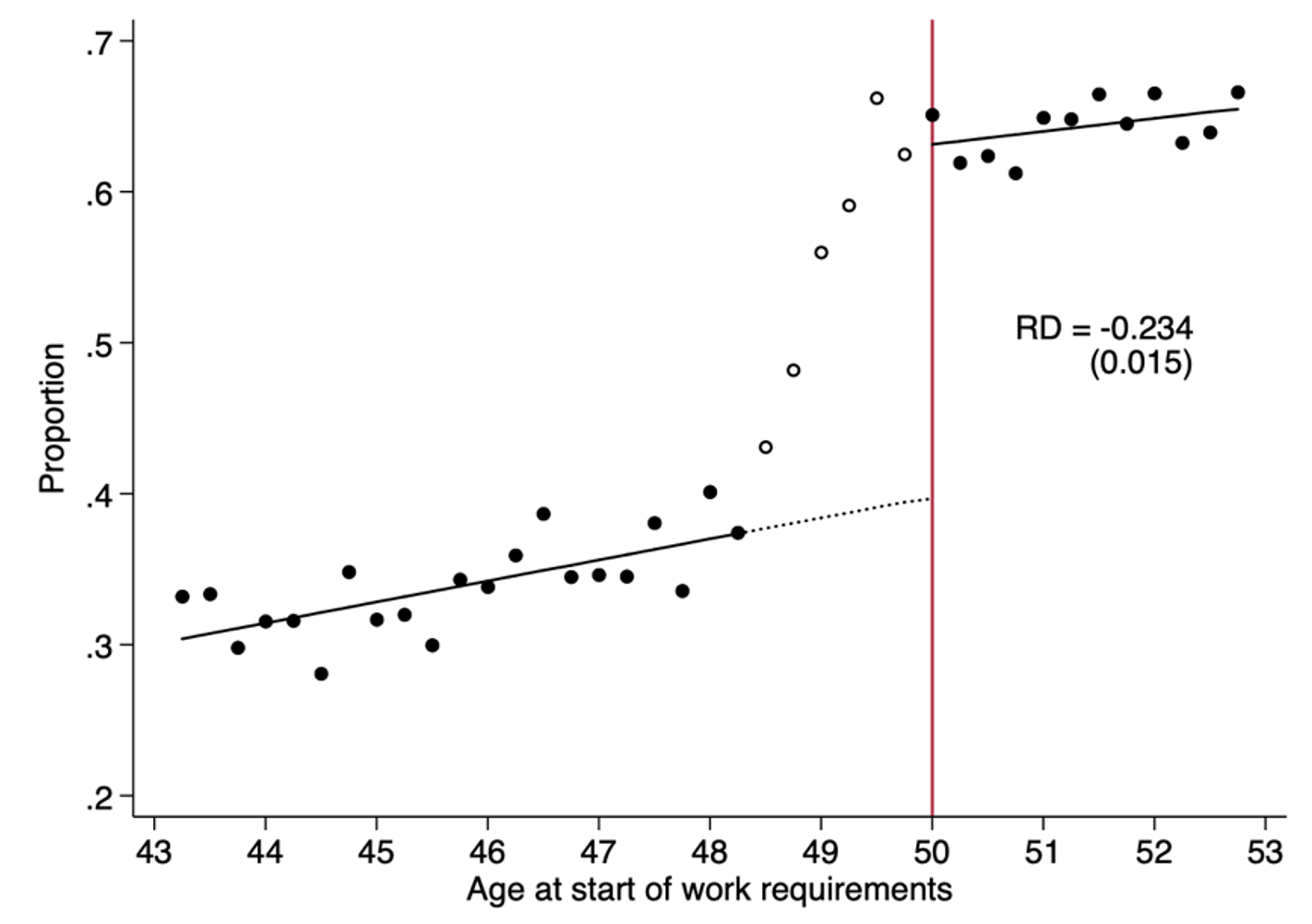

We found that recipients who faced work requirements in 2013 were substantially more likely to leave SNAP within 18 months than their older counterparts who did not face work requirements. Figure 1 displays this result graphically. The vertical axis shows the fraction of recipients still receiving SNAP, as a function of their age when work requirements were reinstated. Among recipients who had just turned 50, 63% were still receiving SNAP benefits 18 months later (solid line to the right of the red vertical line). By contrast, we estimate that fewer than 40% of their counterparts just under age 50 were still receiving benefits at that time (dotted line to the left of the red vertical line).1,2 These results are estimated by analysing only incumbent programme participants. When instead analysing aggregate programme use, we estimate that work requirements reduced the overall number of people receiving benefits by 53%.

Figure 1 Effect of work requirements on receipt of SNAP benefits

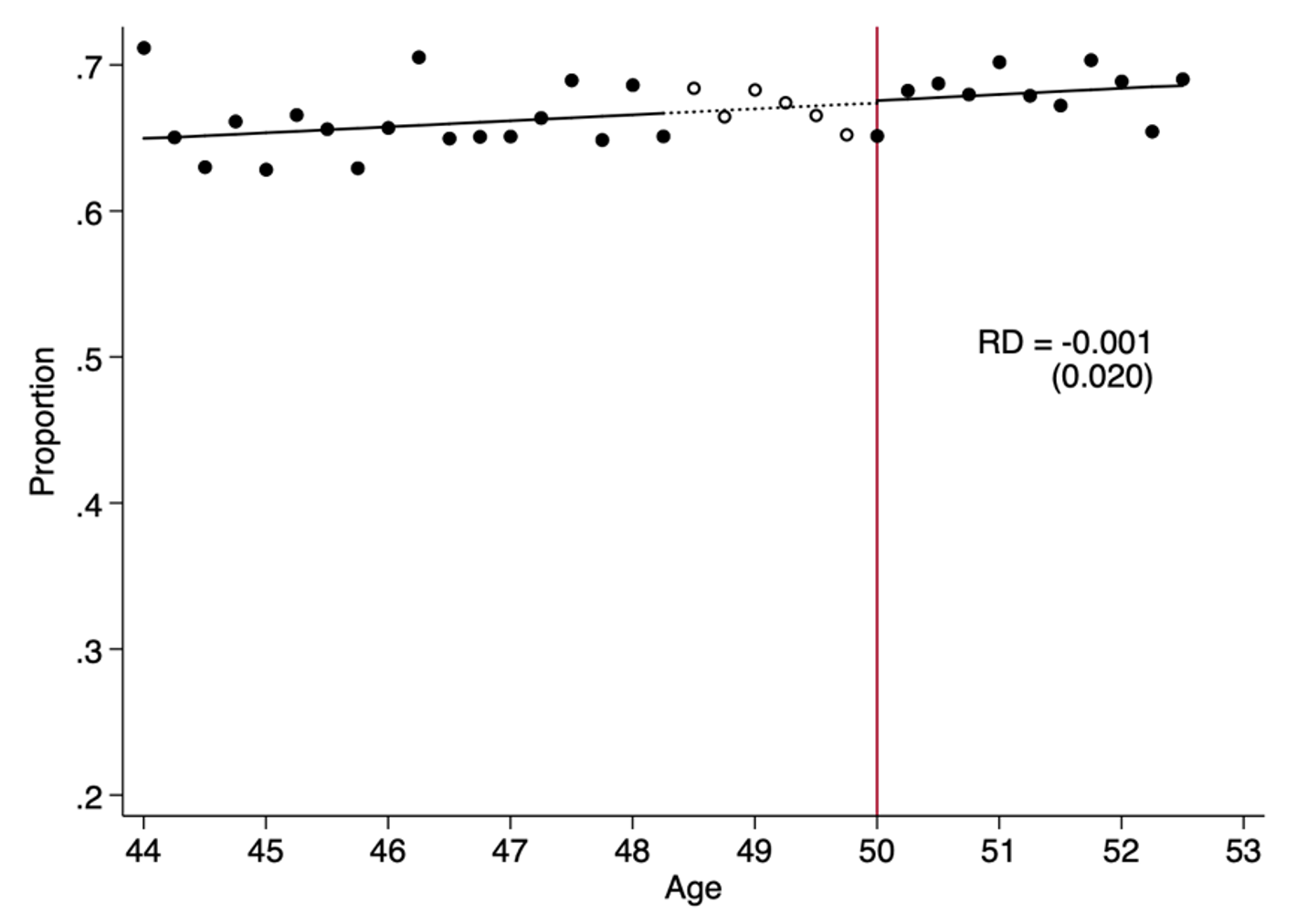

The validity of these estimates would be called into question if recipients who were just under age 50 were substantially different from recipients slightly older than 50. For example, eligibility criteria for disability insurance also loosen at age 50. Receipt of disability benefits changes labour market opportunities and income, and may therefore indirectly affect SNAP utilisation independent of the work requirements. To check whether the large difference in SNAP benefit receipt (see Figure 1) could be explained by such factors, we repeated our analysis using data from 2011 instead of 2013. During this time period, all SNAP recipients were exempt from work requirements regardless of age, so we can measure the differences in benefit receipt around age 50 caused by factors other than work requirements. Figure 2 shows there was no difference in benefit receipt across the age 50 threshold during this time period.3

Figure 2 Placebo test for work requirements

Our findings that work requirements remove government aid from many would-be recipients are exactly the concerns raised by critics of the policy. However, proponents of work requirements would point out that losing benefits may be a good thing for former recipients. The purpose of work requirements is to encourage people to become economically self-sufficient by incentivizing work. It is possible that recipients under age 50 leave SNAP not because they are unable to meet work requirements, but because responding to work requirements causes their employment income to rise above the SNAP eligibility income cut-off. If that is the case, then work requirements could be helpful to both recipients and taxpayers.

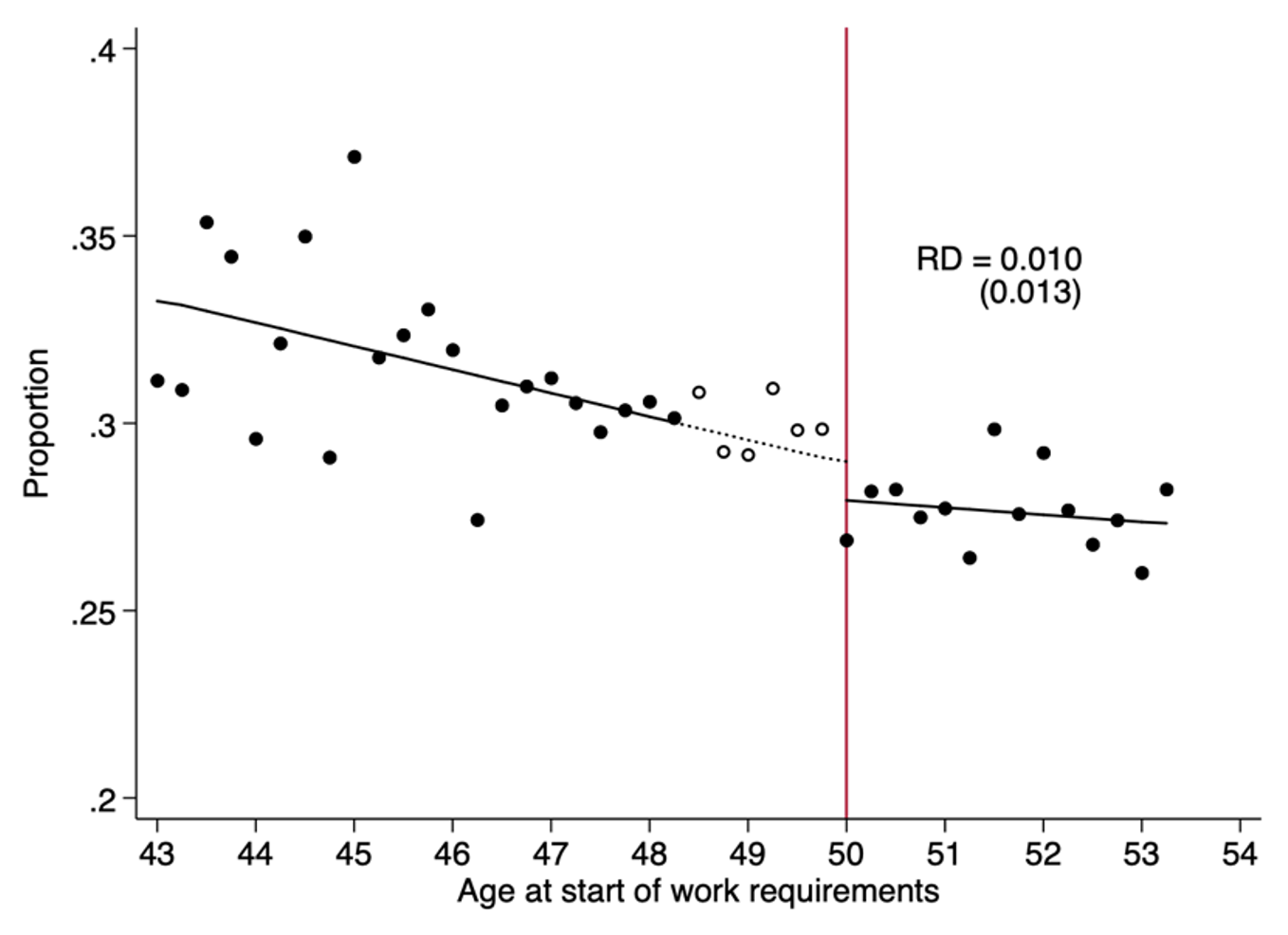

We found little support for this hypothesis. First, our analyses suggest that loss of benefits is disproportionately higher among those recipients under 50 who face the largest barriers to working. Specifically, work requirements cause homeless people to lose benefits at a higher rate than other SNAP recipients.4 Second, we checked directly whether work requirements caused the recipients under 50 to work at higher rates than the older recipients. We found no detectable difference in the fraction of recipients who have jobs on either side of the age 50 threshold. Figure 3 shows this result graphically. In contrast to our findings for benefit receipt, the impact on having a job is either quite small or zero. The only potential improvement in labour market outcomes that we observed was an increase in earnings for a small fraction of recipients near a key income eligibility threshold, but even this result was statistically fragile. In sum, we found little to no effect of SNAP work requirements on economic self-sufficiency, but large negative effects on benefit receipt.

Figure 3 Effect of work requirements on employment

As currently designed, SNAP work requirements do not appear to improve economic self-sufficiency while substantially reducing benefits paid to SNAP recipients. On one hand, this makes work requirements costly to society. On the other hand, work requirements save taxpayers money by reducing the number of people receiving benefits. This sets up a trade-off between savings to taxpayers and harm to would-be SNAP recipients. We analysed this trade-off, accounting for the impact on government budgets.5 The analysis showed that SNAP without work requirements would likely be more effective than other existing programmes at channelling public spending to low-income adults.

Debates are likely to continue regarding the shape and scope of the safety net. In designing off-ramps from the Covid-19 expansions, policymakers should consider the evidence: work requirements do more to remove people from benefits than to bolster employment.

Authors’ note: Mary Zaki is an Assistant Research Professor at the University of Maryland and Financial Economist at the Federal Deposit Insurance Corporation. Work on this paper was conducted while Mary Zaki was employed by the University of Maryland. The analysis, conclusions, and opinions set forth here are those of the authors alone and do not necessarily reflect the views of the Federal Deposit Insurance Corporation or Wayfair.

References

Bernstein J, and B Spielberg (2017), “Why Medicaid Work Requirements Won’t Work”, New York Times, 22 March 2017. Op-ed.

Besley, T and S Coate (1992), “Workfare versus Welfare: Incentive Arguments for Work Requirements in Poverty-Alleviation Programs,” American Economic Review 82(1): 249–261.

Census Bureau (2021), “Supplemental Poverty Measure in the United States: 2020” (accessed 26 September 2021).

Cohen E (2020), “Housing the Homeless: The Effect of Housing Assistance on Recidivism to Homelessness, Economic, and Social Outcomes” Working paper.

Corman H, D Dave, and Nancy Reichman (2018), “Welfare Reform in the US: Effects on Female Crime and Civic Participation,” VoxEU.org, 8 September.

Dahl G, and A Gielen (2018), “Welfare Dependence from One Generation to the Next,” VoxEU.org, 29 May.

Deshpande, M and Y Li (2019), “Who Is Screened Out? Application Costs and the Targeting of Disability Programs,” American Economic Journal: Economic Policy 11(4): 213-48

Desmond M (2012), “Eviction and The Reproduction of Urban Poverty” American Journal of Sociology 118(1): 88-133.

Editorial Board (2021), “Biden’s Cradle-to-Grave Government”, The Wall Street Journal, 28 April.

Gray C, A Leive, E Prager, K Pukelis, and M Zaki (2021), “Employed in a SNAP? The Impact of Work Requirements on Program Participation and Labor Supply”, NBER Working Paper 28877.

Han, J, B Meyer and J Sullivan (2020), “Income and Poverty in the COVID-19 Pandemic”, Brookings Papers on Economic Activity, Summer: 85-118.

Homonoff, T and J Somerville (forthcoming), “Program Recertification Costs: Evidence from SNAP,” American Economic Journal: Economic Policy.

Mosley M (2021), “The Importance of Being Earners: Using Welfare to Deliver a Targeted Stimulus”, VoxEU.org, 3 August.

Nichols, A and R Zeckhauser (1982), “Targeting Transfers through Restrictions on Recipients,” American Economic Review 72(2): 372–377.

USDA (2021), “Supplemental Nutrition Assistance Program” (accessed 26 September 2021).

Endnotes

1 Correspondingly, the percentage of recipients losing SNAP increased by 64%, from a baseline of 37 percent to 60%.

2 The gradual uptick in enrollment between ages 48.5 and 50 in Figure 1 (hollow dots) is an artifact of individuals turning 50 within 18 months of the reinstatement of the work requirements. Individuals under 50 were subject to work requirements at their next SNAP renewal (‘recertification’) immediately following the reinstatement of work requirements. These renewals were staggered across months. Hence, the older the age cohort, the smaller the fraction and the shorter the period subject to work requirements.

3 In the study, we also checked directly for observable differences in recipient characteristics across the age 50 threshold.

4 Previous scholarly work has shown that unstable housing is a barrier to employment (Desmond 2012, Cohen 2020).

5 See the calculations for the Marginal Value of Public Funds available at the site Policy Impacts (accessed 26 September 2021).