Editors' note: This column is a lead commentary in the VoxEU debate on euro area reform.

The Stability and Growth Pact (SGP) has been criticised from the very start. However, the nature of the debate has evolved over time. In the late 1990s and early 2000s, the main criticism amongst experts was the procyclicality of the headline deficit rule – it would force fiscal consolidation in bad times, while no constraint would bind in good times. Consistently, the reform of 2005 shifted the focus from the headline to the structural deficit (except, however, for the 3% deficit threshold that continues to strike a divide between the preventive and the corrective arms of the SGP).

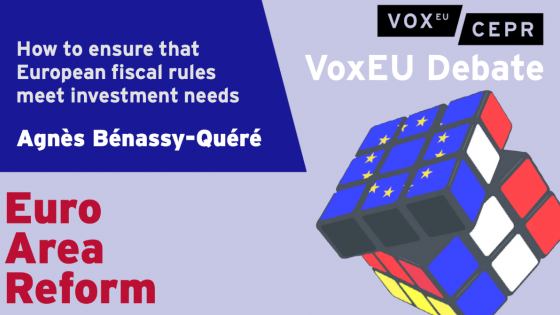

Up to 2008, though, the share of investment in total public spending was increasing year after year in the euro area. From 6.2% in 1995, this share increased to 7.2% in 2008. The public investment boom was especially pronounced in Spain (10.0% to 11.2% of total public spending over the same period). Germany was a major exception, with a post-unification V-shaped evolution (Figure 1).

Figure 1 General government gross capital formation in percent of total expenditure (%)

Source: Eurostat.

After 2008, aggregate public investment in the euro area declined sharply, from 7.2% of total spending in 2008 to a low of 5.4% in 2016, and it has remained at a low level despite the slight rise in the ratio for Germany. In the last 15 years, the share of investment in total public spending has collapsed in Italy and especially in Spain, but it has also declined in France. In this context, the ‘quality’ of public spending has made its way into the discussions on fiscal rules. To the extent that investment, unlike current expenditures, contributes to future GDP growth, and hence to the denominator of the debt-to-GDP ratio, it would make sense to treat the two different types of spending differently. However, after the procyclical fiscal contraction of 2011–13, this debate has been overshadowed by the need to make the rules simpler and more friendly to countercyclical policies. Here, some convergence is visible among experts along four lines (e.g. Bénassy-Quéré et al. 2018, European Fiscal Board 2020, Martin et al. 2021):

- The need to refocus on the debt objective. A gradual decline of the debt-to-GDP ratio is needed to protect governments from self-fulfilling crises and to rebuild fiscal buffers to prepare for large exogenous events. Depending on long-term growth, the same deficit can lead to different debt dynamics, and hence to sustainability risks. This explains the need to focus on debts rather than deficits. However, governments have no direct control over the debt ratio. Hence, there is a need to complement the debt path with a more operational rule.

- An expenditure rule in place of the structural balance. In order to fulfil the debt adjustment target, capping expenditure growth seems more appropriate than monitoring the reduction of the structural deficit, since (i) it is easier to communicate and less prone to measurement errors, (ii) it leaves more room for countercyclical fiscal policy during a downturn, and (iii) it enforces countercyclical fiscal policy better when the economy is booming (e.g. IMF 2018).

- A differentiation across countries. The 60% debt threshold dates back to a time when nominal growth was believed to be around 5% yearly on average (hence, debt could be stable at 60% of GDP with a 3% deficit). This uniform debt benchmark is now widely (although not unanimously) regarded as an inappropriate medium-term guideline. Potential growth is down, debt levels are up, and the never-ending global demand for ‘safe assets’ suggests that higher debt levels can meet a stable demand with still low real borrowing costs. The 60% threshold is especially problematic when combined with the ‘1/20th rule’, which requires that 1/20th of ‘excess debt’ be eliminated each year. This combination could end up in excessive, procyclical, and/or unrealistic fiscal tightening in some countries. In fact, different positions in the cycle and different growth perspectives require different deleveraging speeds.

- Compliance and ownership. Although the 3% threshold seems to have exerted a ‘magnet effect’ (Caselli and Wingender 2018), compliance with the debt rule and medium-term objectives has been somewhat disappointing (European Fiscal Board 2019). One reason has been the lack of ownership at national level, which itself can be explained by (i) the complexity of the rules, (ii) the limited credibility of the sanctions, and (iii) the ‘one size fits all’ nature of the rules. Simplifying the rules, turning sanctions into incentives, and giving more leeway to governments to propose a debt trajectory are different ways to raise national ownership.

From stabilisation to allocation

The climate emergency, the Covid-19 crisis, and now the war in Ukraine have shifted the focus back to investment. The question, then, is how to combine fiscal sustainability and incentives to invest.

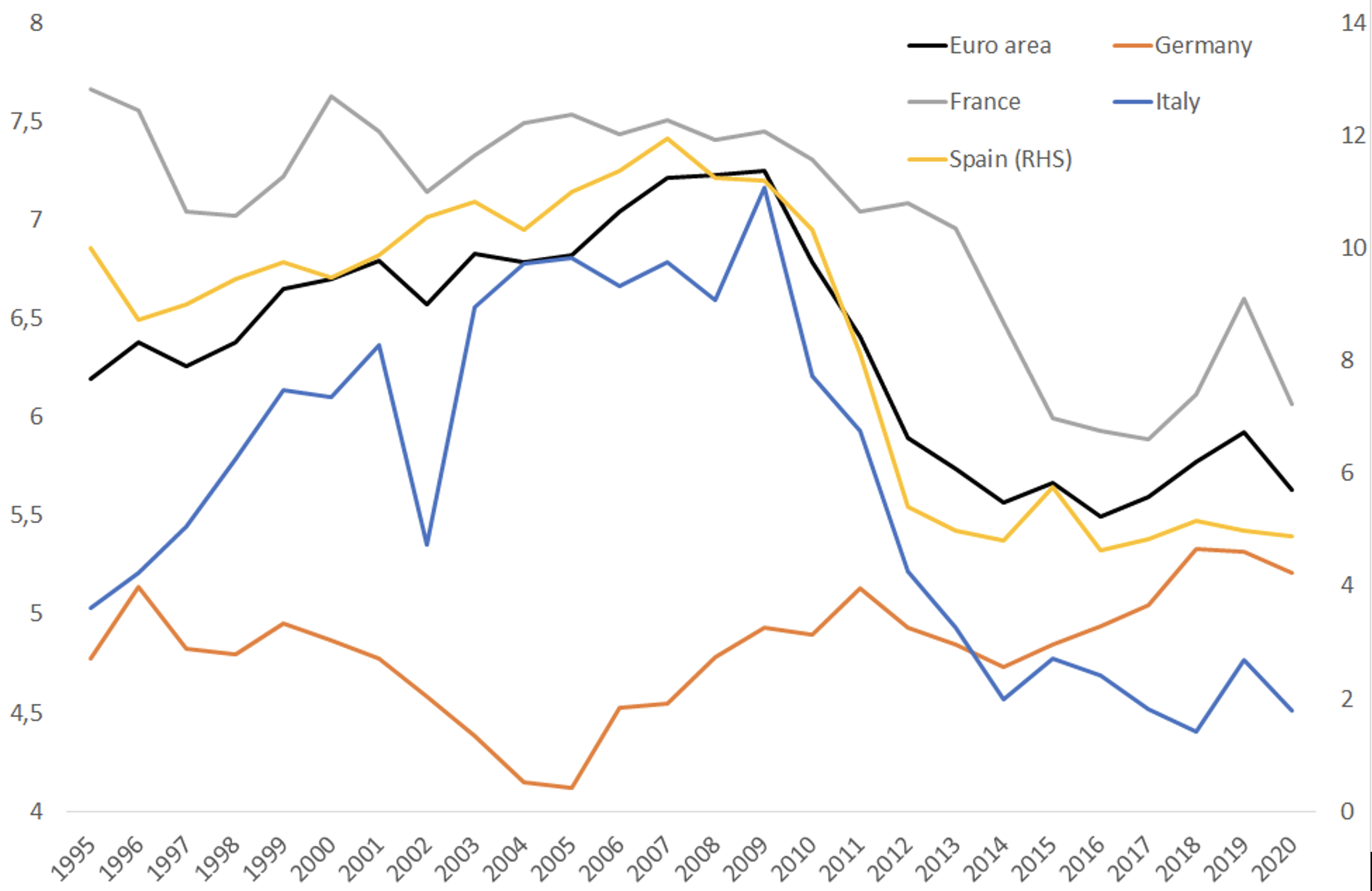

Figure 2 Actual versus required energy-related investment in the EU (public and private, constant € billion per year)

Note: Constant euros of 2015.

Source: European Commission (2021b).

In 2015, an ‘investment clause’ was introduced as a flexibility of the SGP, but with very strict strings attached. To start with, only those investments that are co-financed by the EU are eligible. Furthermore, the clause can be called only when the output gap is below -1.5%. Finally, only limited and short-lived deviations of the structural deficit are allowed (less than 0.5 percentage points, the deficit having to stay below the 3% boundary). In brief, the existing investment clause seems to be of little help for the problem at stake, which is the need to heavily co-invest (along with the private sector) in the green transformation of the economy.

In order to safeguard investment, two routes have been proposed:

- A (green) golden rule (Darvas and Wolff 2022). Excluding ‘green’ investments from the calculation of expenditure (or deficit) ceilings would encourage governments to cut current expenditure rather than public investment expenditures. Aside from the risk of ‘greenwashing’, the main objection to such a proposal is that it would imply departing from the prime objective of the fiscal rules, which is debt sustainability. Granted, accumulated greenhouse gas (GHG) emissions are also a liability and unmitigated climate change would undoubtedly lead to large damage costs and lower GDP, and hence also be a threat to debt sustainability. However, it remains that national debts will have to be served with national budget resources or continued debt rollover, regardless of the type of expenditures that have been financed through debt. Another problem is that excluding a category of spending would alleviate the pressure to make this spending efficient (as measured, for instance, by carbon abatement costs) and introduce inefficient distortions between different kinds of spending (e.g. public funding for housing retrofitting would be considered as a green investment but not professional training in this area). Finally, a (green) golden rule would depart from the necessity to simplify the rules and it would require a common and precise definition of what constitutes a ‘green’ investment.

- A climate investment fund (IMF 2021, Garicano 2022). Since green investment is mostly targeted to achieve a common commitment concerning greenhouse gas emissions (the Paris Agreement, the Fit-for-55 package), a common funding of related investments makes sense. Such an approach would allow investment projects across Europe to be prioritised based on their carbon abatement costs, using a single methodology, and building on the experience of NextGenEU. Such a fund could be transitory, ending for instance in 2050 in line with the horizon of EU emissions commitments. It would require a new increase in own resources, which in turn would raise the question of transfers across the member states. Absent such transfers, a climate investment fund would de facto be close to a golden rule, with each member state financing its own investment (Darvas 2022). However, it would allow for financing a key economic and political ambition through a common fiscal tool, safeguarding the simplicity of fiscal rules and incentivising all member states to invest more in the green transition. Another possibility would be that those countries with lower abatement costs achieve more ambitious reductions in GHG emissions and receive more funding for this purpose. Last but not least, the access to the fund could be conditioned on compliance with fiscal rules, turning existing sanctions into incentives.

The debate on how to safeguard investment will not be settled overnight. The problem is that the commitments to invest in climate change mitigation and adaptation need to be taken without delay. How can we square the circle?

A holistic approach

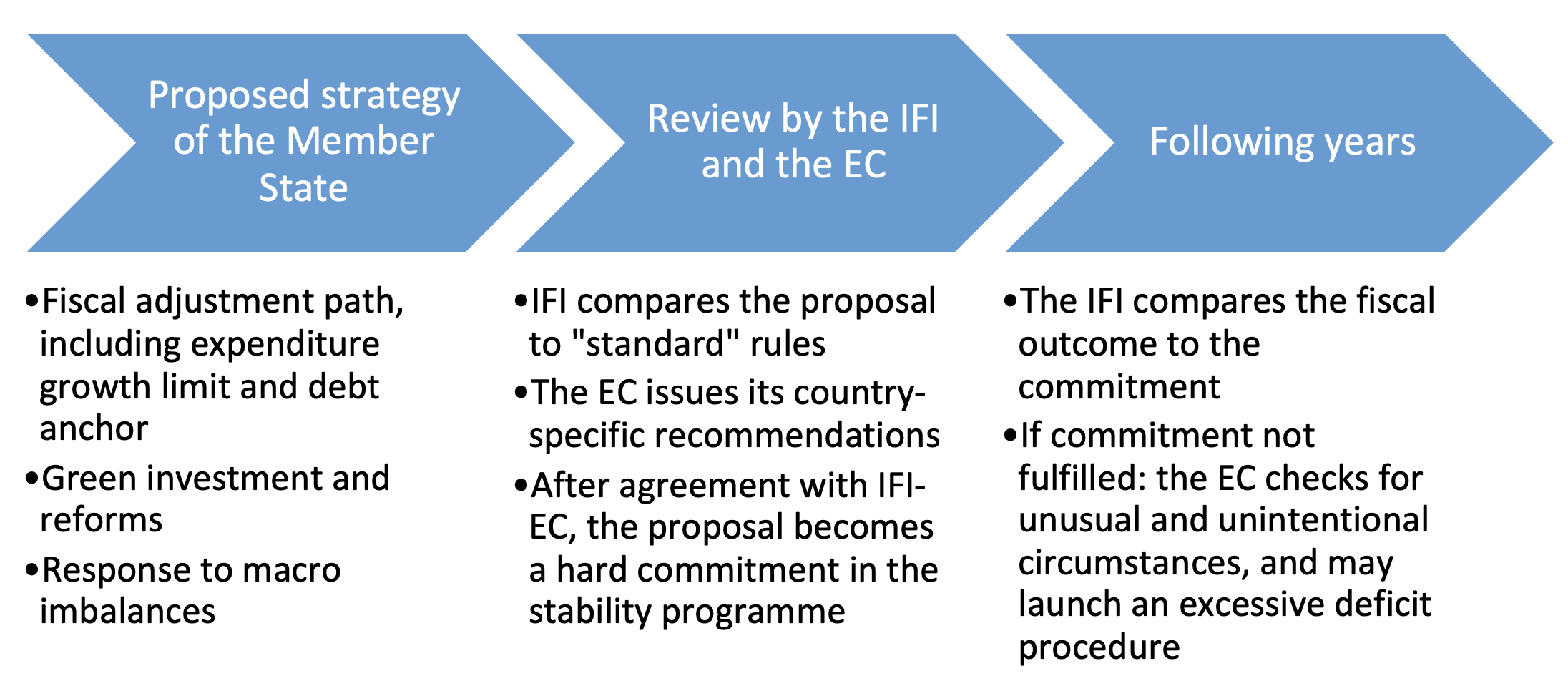

Numerical fiscal rules will never be able to address all possible contingencies. Therefore, Blanchard et al. (2021) have proposed moving from fiscal rules to fiscal ‘standards’, which would rely on country-specific assessment of debt sustainability. A less radical approach could be to design a ‘standard’ European rule (an expenditure growth limit, anchored on debt adjustment objectives) and ask national governments to present a comprehensive strategy that would include three elements: (i) a numerical fiscal adjustment path; (ii) concrete green investments and reforms (not just investments); and (iii) a credible response to macroeconomic imbalances as identified in the country-specific recommendations. The latter aspect should not be forgotten when assessing fiscal sustainability, as the euro area crisis was largely a consequence non-fiscal imbalances (e.g. Koll and Watt 2022). After agreement with the Commission, this comprehensive strategy would be considered as a hard commitment from the member state, within its stability programme.

Figure 3 A comprehensive strategy

Note: EC: European Commission; IFI: independent fiscal institution.

This approach would be more holistic than the golden rule approach. For instance, a country experiencing tensions in its construction sector and a current account deficit could be asked to reduce public subsidisation of house retrofitting and accelerate fiscal adjustment accordingly. Conversely, a country with excess savings could be asked to accelerate its investment programme, even though this may temporarily increase its government deficit. This approach would be compatible with the introduction of a common investment capacity if there were agreement on creating such a capacity, but the latter would not be a precondition.

Since the monetary unification, much has been learned about the functioning and deficiencies of the initial setup. Concerning fiscal rules, there has been a tendency to progressively add layers of complexity. The challenges of decarbonisation and strategic autonomy should not be another occasion to add more layers. Rather, they could be used as an opportunity to adopt a broad approach to sustainability, encompassing its fiscal, financial, macroeconomic, and environmental dimensions, and providing the right incentives at national level. By involving national governments upstream in the definition of their own ‘flexibilities’, this approach could help stricter enforcement downstream.

References

Bénassy-Quéré, A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel, N Veron, B Weder di Mauro and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No 91.

Blanchard, O, L Alvaro, and J Zettelmeyer (2021), “Redesigning EU fiscal rules: From rules to standards”, PIIE Working Paper 21-1.

Caselli, F and P Wingender (2018), “Bunching at 3 Percent: The Maastricht Fiscal Criterion and Government Deficits”, IMF Working Paper No. 18/182.

Darvas, Z, and G Wolff (2022), “How to reconcile increased green public investment needs with fiscal consolidation”, VoxEU.org, 7 March.

Darvas, Z (2022), “A European climate fund or a green golden rule: not as different as they seem”, Bruegel Blog, 3 February.

Duarte Lledo, V, P Dudine, L Eyraud and A Peralta-Alva (2018), “How to Select Fiscal Rules: A Primer”, IMF Fiscal Affairs Department How-To Note.

European Commission (2021a), “'Fit for 55': delivering the EU's 2030 Climate Target on the way to climate neutrality”, Communication from the Commission to the European Parliament, the Council, the EESC and the CoR, COM/2021/550 final.

European Commission (2021b), “Impact Assessment Report Accompanying the Proposal for a Directive of the European Parliament and of the Council on energy efficiency”, SWD(2021) 623 final.

European Fiscal Board (2019), “Assessment of European fiscal rules with a focus on the six and two-pack legislation”.

European Fiscal Board (2020), Annual Report.

Feld, L and W H Reuter (2022), “Reforming the European fiscal framework: Increasing compliance, not flexibility”, VoxEU.org, 31 March.

Garicano, L (2022), “Combining environmental and fiscal sustainability: A new climate facility, an expenditure rule, and an independent fiscal agency”, VoxEU.org, 14 January.

IMF (2021), “IMF Staff Contribution to the European Commission Review of the EU Economic Governance Framework”.

Koll, W and A Watt (2022), “The Macroeconomic Imbalance Procedure at the Heart of EU Economic Governance Reform”, Intereconomics 57(1): 56-62.

Martin, P, J Pisani Ferry and X Ragot (2021), “Reforming the European fiscal framework”, French Council of Economic Analysis Note No. 63.