Our recent Vox column triggered an interesting and lively debate (see for instance Krugman, 2013; Fatas, 2013; Watt, 2013). In it, we argued that weak private investment is partly to blame for the growth shortfall of the Eurozone compared to the US in the past few years and that putting in place conditions for stronger investment was essential to turn the recent pick up of confidence and activity in the Eurozone into a robust and self-sustained recovery (Buti and Padoan, 2013). We further argued that a policy strategy to support investment and the recovery should be articulated around three mutually reinforcing elements – reducing policy uncertainty, repairing the financial system, and undertaking structural reforms.

We would now like to push further by providing a few additional arguments. While there seems to be a large consensus around the idea that repairing the financial system is a necessary condition to revive growth in the Eurozone, other aspects of our proposed policy strategy have been criticised by some commentators. Our reading of these criticisms is that they revolve around three major arguments:

- First, differences in fiscal policy have been at the root of growth differences between the Eurozone and the US in recent years and fiscal easing is the main policy advice to support an investment recovery.

- Second, although policy uncertainty has been high in recent years, this is essentially a by-product of depressed economic conditions. Resolving policy uncertainty is unlikely to boost growth in a meaningful way.

- Finally, while structural reforms are beneficial in the long term, their short-term effect is unclear, especially in a context of depressed activity and when monetary policy is at the zero lower bound.

We will address these three arguments one by one.

Is fiscal consolidation at the root of the current investment-growth differentials between the Eurozone and the US?

It is undeniable that the front-loaded fiscal consolidation had a negative impact on Eurozone growth, and the factors that have aggravated the impact of consolidation on growth in the short term are well known.

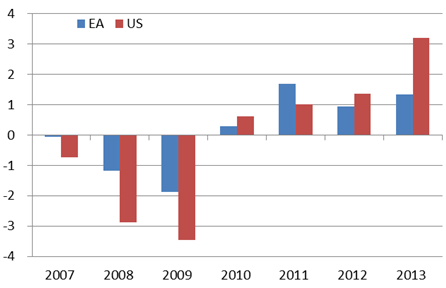

By contrast, the US had a somewhat larger fiscal expansion than the Eurozone in the early stages of the crisis (2008 and 2009), and consolidation started later (Figure 1). The jury is still out on the relative merits of a more front loaded consolidation, allowing a smaller adjustment later on, and a delayed consolidation (US) requiring a more drastic effort when the recovery is still fragile. In any event, the bursting of the Eurozone sovereign-debt crisis left no choice but to undertake a front-loaded fiscal consolidation at least in some countries.

It must be stressed, however, that since 2012 the fiscal effort has been larger in the US than in the Eurozone. Therefore, while we naturally acknowledge that fiscal consolidation can have a detrimental effect on growth; this cannot be the main explanation behind investment and growth differentials between the Eurozone and the US over the past two years. Financial fragmentation, policy uncertainty and a weaker adjustment capacity in the Eurozone are more likely to be at the core of this differential.

Looking forward, the negative effect of fiscal consolidation on growth in the Eurozone should decrease gradually in the years to come as the additional fiscal effort that needs to be undertaken has peaked since 2011. By contrast, the US economy has only just embarked on its fiscal consolidation journey and therefore still faces large consolidation needs that will weigh on growth and investment in the years to come.

Figure 1. Annual change of cyclically adjusted fiscal balance (as % of GDP)

Source: OECD Economic Outlook 93.

Have Eurozone-specific sources of uncertainty affected growth?

According to economic theory (see for instance, Bernanke, 1984), uncertainty can depress economic activity through a number of channels: investment, consumption, employment, or risk-premia (Gilchrist et al., 2010). When investment, consumption or employment decisions are costly to revert (e.g. due to fixed and adjustment costs), high uncertainty gives agents an incentive to postpone or cancel their decisions until uncertainty is resolved and more information is available. Moreover, in the current context, uncertainty is even more damaging for growth as it magnifies the effect of credit constraints and weak balance sheets, forcing banks to restrain credit further and companies to hold back investment, even if they are not liquidity constrained, to minimise the risks of irreversible decisions.

Most existing research (see for instance, Dixit et al., 1994) has established a negative correlation between uncertainty and growth, and the issue of the causal relationship between uncertainty and growth has been the subject of much academic discussion. There is now ample evidence showing that causality runs from growth to uncertainty, but also from uncertainty to growth. Regarding the latter, the results from both modelling exercises and econometric work based inter alia on the study of unpredictable shocks like natural disasters (see for instance, Bloom, 2009), indicate that uncertainty shocks can have a substantial depressing effect on growth.

The unprecedented increase in tail risks in 2011 and first half of 2012, when the survival of the Eurozone was widely questioned, qualifies as such an uncertainty shock. Debt markets seized up, the financial system in the Eurozone became fragmented, and the transmission of an accommodative monetary policy was impaired. This has clearly heightened the amount of uncertainty with which economic agents have had to cope in the Eurozone.

Some US economists have argued that policy uncertainty is one of the factors which have contributed to make the US recovery sluggish by historical standards. It is, however, worth stressing, that the recent peaks of policy uncertainty observed in the US around the presidential election and in relation to the fiscal cliff, are not comparable in nature and scale with the uncertainty generated by risks of a collapse of EMU.

Comparisons of levels of policy uncertainty between the US and the Eurozone should be interpreted with a lot of caution because indicators of policy uncertainty are not constructed in the same way in the two regions. With this caveat in mind, however, Figure 2 shows that policy uncertainty in the US was lower than the Eurozone during most of 2012, and has decreased during 2013 close to pre-crisis levels. By contrast, in the Eurozone policy uncertainty has remained elevated throughout this period, despite having receded in recent months. Furthermore, this recent decrease probably reflects expectations of bold policy measures being taken to reinforce EMU, notably in terms of banking union. Failure to deliver could quickly bring uncertainty back to elevated levels. Overall, bold policy action is needed in the Eurozone to reduce uncertainty and restore confidence and thereby support investment and growth.

Figure 2. Policy Uncertainty Index (Baker, Bloom, and Davies), 2010=100

Source: Baker, Bloom, and Davies at www.policyuncertainty.com

Do structural reforms boost growth in a low-growth environment?

In our previous Vox piece we provided evidence that structural reforms in product and labour markets boost growth. Here we provide additional evidence of the impact of structural reforms, taking into account the macroeconomic environment . We make the following points:

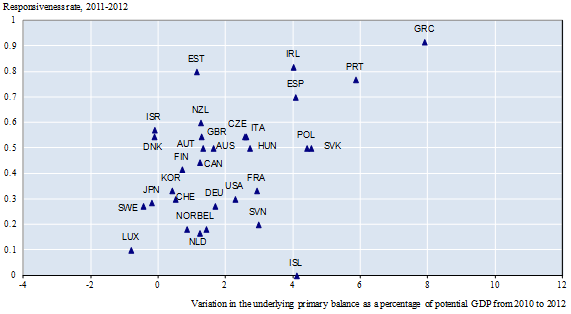

- First: a restrictive macroeconomic environment is not necessarily an obstacle to reforms. Eurozone countries that have been among the most active at reforming, have also undertaken substantial budgetary consolidation, and this has been particularly the case for countries that have been under market pressures or financial-assistance programmes (Figure 3) .

Figure 3. Countries most active at reforming have also consolidated their budget

Note: The responsiveness rate indicates the extent to which OECD countries have followed-up on "Going for Growth" policy recommendations. It is measured as the ratio of actions taken in response to specific recommendation over the total set of recommendations.

Source: OECD (2013a) and OECD Economic Outlook Database

This can well raise legitimate concerns about the impact of reforms that are implemented in a context of budgetary retrenchment and overall weak demand. If monetary policy is unable to respond, any negative short-run demand effects of reforms cannot be mitigated. Clearly, the payoff from reforms may take more time to materialise in such a case. Recent OECD work has shown for instance that some reforms of unemployment benefit or employment protection legislation can reduce employment in the first few years after the change if introduced in a weak conjuncture (OECD, 2012).

- Second point: In spite of this many structural reforms can support demand either directly, such as in the case of reforms that stimulate investment (e.g. improvements in framework or regulatory conditions), or indirectly by boosting confidence and thereby bringing market relief.

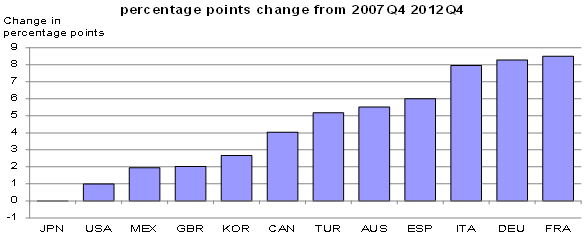

A key condition for these effects is availability of credit to firms to invest and for households to support spending, underlining the necessity of banking repair in the Eurozone to support the reform process. Reform of pension systems shows how policy actions now can raise confidence and have fairly immediate direct impacts. For instance, delaying effective retirement age to reflect increases in life expectancy, delivers a strong signal that one of the main sources of long-term budgetary pressures is being addressed through reform. This can have short-term benefits through confidence and lower market pressures – allowing for the pace of consolation in the short term – and through higher employment rates, in this case of older workers. Indeed, one notable feature of the last crisis episode, especially as compared to earlier severe downturns, has been the increase in the labour force participation rate of workers aged between 55 and 64 (Figure 4 and OECD, 2013b). This has been particularly the case in Eurozone countries that had very low participation rates a decade ago, and that have implemented substantial reforms in pension systems and pre-retirement schemes in the years preceding the crisis Reforms in countries such as France, Germany and Spain have included a phasing out of job search exemptions for workers over 55, an extension of the minimum contributory period for full-pension entitlement and stronger financial incentives for remaining active at or close to retirement age. In line with these reforms, these countries and others have refrained from encouraging premature exit of older workers from the labour force, a practice often observed in the past.

Figure 4. Labour-force participation of older workers since the crisis

Source: OECD, Labour-force statistics database.

- Third point: Reforms aimed at reducing regulatory barriers to firm entry and at exposing sheltered sectors to stronger domestic and foreign competition can boost both growth and employment, while involving little or no budgetary cost in the short term (Bourlès et al., 2010; Conway et al., 2006).

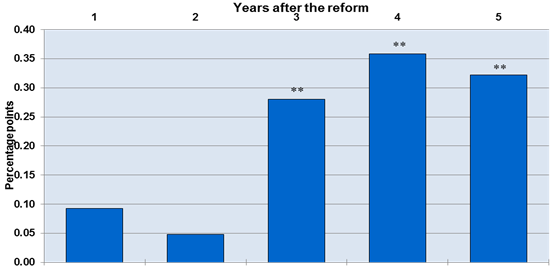

While there is no question that typical reforms in this area can take some time to materialise (Figure 5), fairly rapid employment gains can nonetheless be expected in sectors such as retail trade and services. It is important to bear in mind that in the longer term, reforms that boost growth through employment gains in the private sector will greatly facilitate fiscal consolidation adding to fiscal space. Furthermore, recent work (Andrews and Criscuolo, 2013) has shown that more competition-friendly regulation tends to be associated with higher levels of investment in knowledge-based capital, a fundamental source of growth for advanced economies.

Figure 5. Changes in labour-force participation following a 'typical' product-market reform

Note: The bars measure the estimated increase in the labour force participation each of the first five years after a reform is implemented where the reform is equivalent to the average size of reform across OECD countries observed in the past 30 years.

Source: OECD (2012), Chapter 4.

- Fourth point: Labour and product-market reforms can boost growth through improved competitiveness, provided they complement each other.

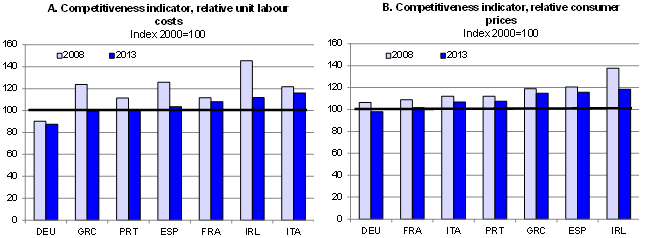

Southern Eurozone countries have been quite active in reforming labour-market policies (especially Greece, Portugal and Spain), including in areas where it has proved difficult to reform in the past (wage bargaining and employment protection). For instance, both Portugal and Spain have implemented changes to collective bargaining arrangements to give firms more leeway in the application of agreements and make wages more responsive to local economic conditions. These countries are making some progress in regaining competitiveness as measured in terms of unit labour costs and, to a lesser extent, when measured in terms of relative prices (Figure 6). Labour-market reforms are contributing to wage moderation and will over time help to raise productivity. However, the adverse impact on real wages and domestic demand would be mitigated – and the favourable impact on exports be boosted – by more effective product-market reforms to reduce prices.

Figure 6. Unit labour costs and price-competitiveness developments

Source: OECD Economic Outlook Database.

- Fifth point: Restoring fiscal sustainability and improving competitiveness are necessary conditions for these countries to reduce current-account deficits and return to healthy growth.

Clearly, such an adjustment would be facilitated by stronger external demand. In this regard, the uneven pace of structural reforms across Eurozone countries is not helpful (See Figure 5 above). More active reforms and relatively higher inflation in Eurozone surplus countries would help achieve intra-Eurozone rebalancing and hence overall growth, and would ensure that as deficit countries take measures to restore competitiveness and fiscal sustainability, surplus countries implement their own reforms to support global demand. Desirable reforms in surplus countries include reduced barriers to entry in the services sector to reorient activity towards domestic consumption and boost investment in such sector.

Conclusion

Overall, while fiscal consolidation in the Eurozone will be less of a drag on growth in the years to come than in 2011-12, the ongoing recovery will remain fragile and sluggish unless targeted measures are taken to support the economy and, in particular, investment spending. Such measures should aim at restoring a fully functional financial sector, reducing policy uncertainty and opening up investment opportunities in both surplus and deficit countries through structural reforms.

References

Andrews, D and C Criscuolo (2013), "Knowledge-Based Capital, Innovation and Resource Allocation", OECD Economics Department Working Papers, No. 1046, OECD Publishing.

Bernanke, B (1983), ‘Irreversibility, uncertainty, and cyclical investment’, The Quarterly Journal of Economics, MIT Press, Vol. 98(1), pp. 85-106, February.

Bourlès, R et al. (2010), “Do Product Market Regulations in Upstream Sectors Curb Productivity Growth: Panel Data Evidence for OECD Countries”, OECD Economics Department Working Papers, No. 791.

Buti, M and P C Padoan (2013), "How to make Europe's incipient recovery durable: End policy uncertainty", VoxEU.org, 12 September.

Conway P, D de Rosa, G Nicoletti and F Steiner (2006), “Regulation, Competition and Productivity Convergence”, OECD Economics Department Working Papers, No. 509.

Dixit, A K and R S Pindyck (1994), Investment under uncertainty, Princeton University Press, Princeton, N.J.

Fatas, A (2013), blog, Antonio Fatas on the global economy, 15 September 2013.

Gilchrist, S, J Sim and E Zakrajsek (2010), "Uncertainty, financial friction and investment dynamics", 2010 Meeting Papers 1285, Society for Economic Dynamics.

Krugman, P (2013), "Uncertain at the OECD", The New York Times, 12 September.

OECD (2013a), Going for Growth 2013, OECD Publishing.

OECD (2013b), OECD Employment Outlook 2013, OECD Publishing.

OECD (2012), Going for Growth 2012, OECD Publishing.

Watt, M (2013), Social Europe Journal, 24 September.