Editors' note: This column is a lead commentary in the VoxEU debate on euro area reform.

Increasing green public investment while consolidating budget deficits will be a central challenge of this decade. The EU has set the ambitious goal of a 55% greenhouse gas emissions reduction by 2030 compared to 1990 and zero net emissions by 2050. This will require a major increase in green investments, of which is a sizeable part should be public investment. At the same time, major fiscal consolidations are needed after the extraordinary fiscal support during the Covid-19 crisis. The consolidations will be framed by European fiscal rules. Past consolidation episodes resulted in major public investment cuts. How can the EU ensure that public investment will increase when fiscal consolidation is implemented?1

The fiscal rules debate

A buoyant academic and policy analysis literature has assessed the EU fiscal rules. We see a broad consensus on the fact that the current rules face technical problems (measurement of potential output and structural balances) and are not well implemented, but not on other questions, including on the role of judgement, country-specificity, and the degree of centralisation in fiscal surveillance (e.g. Martin et al. 2021).

A comprehensive and broad-based reform will hence take time and is unlikely to be completed by the reinstatement of fiscal rules in 2023, but the need to increase green public investment is imminent. In this column, we assess the scope for adapting the rules to make room for increased public green investment.

Green investment needs to meet EU targets

European Commission scenarios suggest an immediate expansion of annual investment in clean and efficient energy use and transport by about 2% of GDP in order to reach the EU’s climate targets (European Commission 2020). This estimate is in line with those of D’Aprile et al. (2020) for the EU and the International Energy Agency (2020) for the world, among others. It does not include the cost of flanking social policies which cannot be regarded as green investment.

The share of the public and private sectors in green investment needs

Most of the new investment has to be private, but the public share will be significant. For overall climate-related investments in energy and transport, the 2019 National Energy and Climate Plans foresaw an average 28% public funding share in the EU (European Investment Bank 2020).2 If one assumes that the new additional green investments were in line with this 28% public share, an annual additional public investment of about 0.6% of EU GDP would result. This is a major fiscal effort that will need to be financed.

The share of public funding can be reduced by appropriate government regulation, taxation policy and, in particular, a higher carbon price. However, a drastic carbon price increase might not be socially sustainable and the European industry might not cope with that either. Moreover, some green investments cannot be done by the private sector because of market failures.

It is also crucial to remove distortions in the taxation and subsidisation of the energy system to incentivise more private investment. But the updated estimates3 of Coady et al. (2019) show that they amounted to a mere 0.15% of GDP in the EU in 2020. Eliminating explicit subsidies could cover about one-fourth of the new public investment need.

Lessons from the past

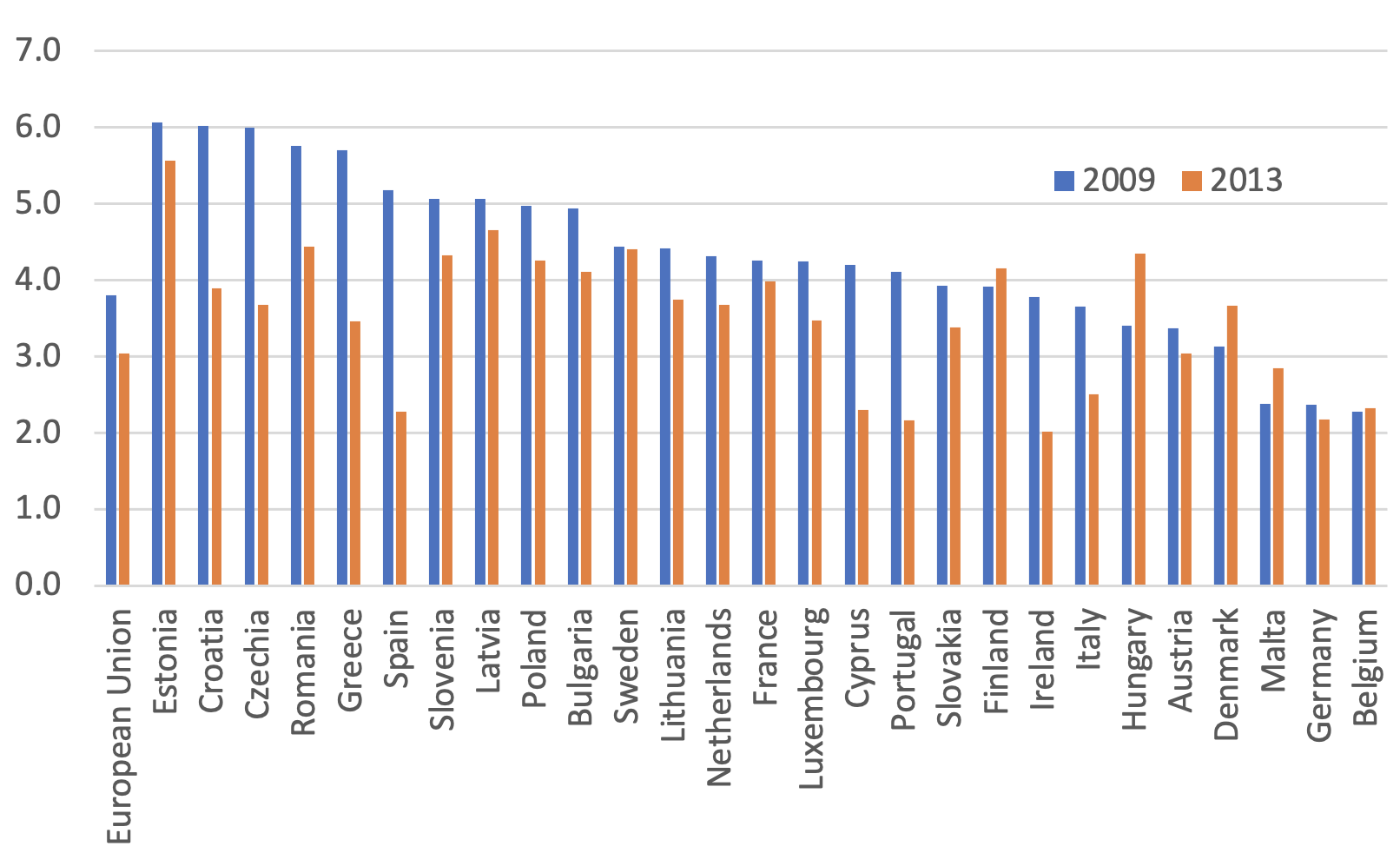

Public investment was a victim of fiscal consolidation in previous episodes (Figure 1). Gross public investment fell by 0.8 percentage points of GDP from 2009 to 2013 in the EU, and fell even further by 2016. Even in the group of long-standing EU members that did not face market pressure, the real value of public investment was slightly lower in 2013 than in 2009, while overall primary expenditures increased by about 5% in this period. There were only a few countries where public investment as a share of GDP remained unchanged or increased (Belgium, Denmark, Finland, Hungary, Sweden). In countries under market pressure, investment cut was more dramatic. Other more future-oriented spending items, such as research and development and education spending, were also cut.

Figure 1 Gross public investment, 2009 and 2013 (% GDP)

Source: November 2021 AMECO dataset.

There are reasons why politicians prefer cutting investment over current spending. First, in ageing societies, the interests of future generations have less electoral support. Vote-maximising politicians are likely to decide against the future, as seen in previous fiscal consolidation episodes. Second, fiscal rules disadvantage investments by treating them fully as current expenses, even though the benefits of investments accrue over long periods. This biases the political economy further against investment. Basic accounting logic would allow net investments to be funded by deficits as they increase the stock of assets (Blanchard and Giavazzi 2004).

Options for dealing with the trade-off between fiscal consolidation and increased green public investment

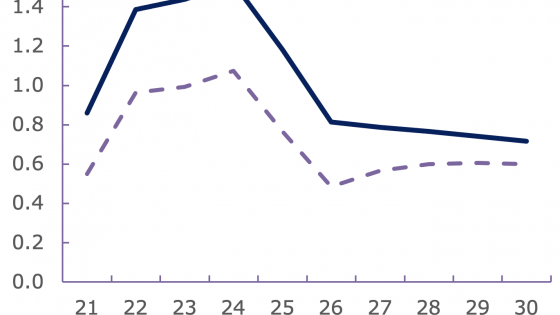

Fiscal consolidation will have to start when EU fiscal rules are reinstated from 2023. According to our simulations (Darvas and Wolff 2021), the speed of consolidation can be moderate – half a percent per year – under a flexible interpretation of current EU fiscal rules. This flexible interpretation would neglect the 1/20th debt reduction rule (a rule that de facto has not been implemented on account of other relevant factors such as the implementation of structural reforms).

However, to increase climate spending by 0.6% of GDP, governments would need to cut other spending by 1.1 percentage points, so that the 0.5% overall consolidation is achieved. Such deep cuts to non-climate spending simply will not happen given our political systems.

Thus, policymakers will face a hard choice between scaling back climate ambitions, amending fiscal rules to make public climate investment possible, or designing a new redistributive EU climate fund to circumvent fiscal rules. In our view, climate targets must prevail, for two main reasons. First, European backtracking on emission reduction targets might be followed by similar backtracking in non-EU countries, which would risk irreversible deterioration of the environment. Second, for most EU countries, there is negligible risk of fiscal unsustainability. For these countries, financing public climate investment by debt is sensible.

This leaves the EU with three options for fostering green public investment. One would be a general relaxation of EU fiscal rules. However, this would not provide incentives to increase public investment, and additional fiscal resources could well be used for recurrent consumptive spending given the political economy reality.

A second option would be to centrally fund all EU climate expenditure, possibly via EU borrowing. In our simulations (Darvas and Wolff 2021), we show that this is already the road undertaken for a number of southern and eastern EU countries via the Recovery and Resilience Facility (RFF) until 2024. An advantage of continuing with this approach and widening it to all EU countries would be the approval of national green investment plans by the Commission and the Council. This could help ensure consistency with EU goals and prevent greenwashing. However, such a fund would need to have a much larger capacity than NextGenerationEU (NGEU) and would need to be in place for decades.

The treatment of the RRF in EU fiscal indicators and fiscal rules provides lessons on how a new EU climate fund would be treated. In line with the European System of Accounts and a Council legal option, in September 2021, Eurostat4 concluded that national spending financed by RRF grants will not be included in national deficit and debt indicators, but spending financed by RRF loans will be (Darvas 2022).

The justification for excluding RRF grants is that EU borrowing to finance these grants should not be counted as member-state debt because “there is no match between the grants received from the RRF by the individual Member States and the amounts that potentially will have to be repaid by each individual Member State, as the two elements are calculated on the basis of different criteria” and “there is great uncertainty on what amount each Member State will be liable for” (para. 38 of the Eurostat guidance). Thus, EU debt used to finance the grants constitutes only “a contingent liability for the Union budgetary planning”, but not a national debt (para. 42). RRF grants do not matter for deficits either. RRF grants are thus exempt from EU fiscal rules.

It is different for spending financed by RRF loans. A country that borrowed from the EU is liable to repay the full amount of the loan (along with its interest) to the EU. Thus, spending financed by RRF loans is not exempt from fiscal rules.

An EU climate fund would be recorded the same way as the RRF. If it entailed major cross-country redistribution, its political feasibility looks difficult. Yet, without any re-distributive elements, spending by this fund would not alleviate the constraint coming from fiscal consolidation requirements.

The third option, which we favour, would be a green golden rule: allowing green investment to be funded by deficits that would not count in the fiscal rules. This would provide incentives to undertake them, because such investment would be excluded from the consolidation requirements. The critical issue is the definition of green investment. A defining criterion of climate investment should be a direct reduction of harmful emissions. National fiscal councils and audit offices, the European Commission, the European Court of Auditors, and the Council should play a role in assessing compliance with the green golden rule.

A further advantage of a green golden rule is that it could be utilised by all EU countries. In contrast, a non-redistributive EU climate fund offering only loans might not incur significant demand, partly because some EU countries can borrow at a cheaper rate than the EU, and partly because demand for RRF loans was also moderate, suggesting that borrowing from the EU is not a popular action.

Contrary to public investment, where the positive growth effects are well established in the literature (e.g. Tenhofen et al. 2010), the impact of green investment on growth is uncertain as many green investments would only replace functioning ‘brown’ infrastructure. A green golden rule can therefore be problematic in countries with debt sustainability problems. Such countries should, initially, rely only on NGEU for their green investment as they cannot ignore risks to budget constraints. Only after NGEU expires after 2026 will the question of a green golden rule become relevant for these countries.

Legal options

Ultimately, certain elements of the 2011 Six-Pack legislation5 and the 2012 Treaty on Stability, Coordination and Governance (TSCG)6 should be revised to include a green golden rule in the EU fiscal framework. This might take years. But until that is achieved, there are pragmatic options for fostering such a rule in the preventive arm of the SGP, though not in the corrective arm. This requires a revision of:

- the existing ‘investment clause’ to alter the adjustment path in the next years, and

- the medium-term objective (MTO) to change the long-run anchor for the structural balance.

A Council decision would be sufficient for these changes.

The current investment clause allows for temporary deviations from the MTO (or from the adjustment path towards it), amounting to at most 0.5% of GDP under rather strict conditions, such that a negative GDP growth or a level of GDP more than 1.5% below its potential. When all conditions are met, only national co-financing of projects co-funded by the EU under certain EU funds can be considered. The temporary deviation must be corrected by the fourth year. These conditions are not specified in any EU legislation, but are based on a Council decision, informed by a Commission proposal,7 a Council legal service option and an EFC compromise agreement.8

Possible revisions of the investment clause could include the removal of the GDP condition, extending the scope to new green public investment, increasing the 0.5% maximum deviation, and allowing a longer time to correct the temporary deviation.

The determination of the MTO is codified in Article 2a of Regulation 1466/97,9 and public investment is explicitly mentioned as a consideration for the MTO. We propose that a first calculation of the MTOs follows the procedure described in the latest (2017) version of the Code of Conduct of the Stability and Growth Pact,10 and then in a second step, these MTOs are lowered by the increase in the net green investment the country aims to implement. Fiscal surveillance should ensure that the extra fiscal space provided by a lowered MTO is solely used for net green investment. A limitation of the proposed MTO correction is that the floor of the MTO is minus 1% for euro-area and ERM2 members with public debt below 60%, and minus 0.5% when debt is over 60% of GDP.

Conclusions

Increasing green investments in periods of budget consolidation will prove politically close to impossible if these investments are undertaken by cutting current expenditures or raising taxes. It is also not recommended that long-term capital investments be funded from current revenues. Instead, economic and accounting logic suggests that net capital investments be funded by deficits, reflecting the long lifetime of green infrastructure. A green golden rule would provide the right incentives for this. A major and justified worry is ‘greenwashing’, or the desire of governments to declare current spending as green capital investments. This needs to be addressed through a narrow definition of green investments and strong institutional scrutiny. A second worry is that green investments have uncertain growth effects. In countries with debt sustainability concerns, such investments should therefore not be funded with national deficits. And indeed, until 2026, it is the EU recovery fund that will provide for that funding. Until a green golden rule is agreed on and legally implemented, there is scope to allow for some of such investment to take place by using the existing flexibilities.

References

Blanchard, O and F Giavazzi (2004) “Improving the SGP through a proper accounting of public investment”, CEPR Discussion Paper No. 4220.

Coady, D, I Parry, N P Le and B Shang (2019), “Global Fossil Fuel Subsidies Remain Large: An Update Based on Country-Level Estimates”, IMF Working Paper 19/89.

Darvas, Z (2022), “A European climate fund or a green golden rule: not as different as they seem”, Bruegel Blog, 3 February.

Darvas Z and G Wolff (2021), “A Green Fiscal Pact: climate investment in times of budget consolidation” Bruegel Policy Contribution 18/2021.

D’Aprile, P, H Engel, G van Gendt et al .(2020), Net-zero Europe: Decarbonisation pathways and socioeconomic implications, McKinsey & Company.

European Commission (2020), Impact assessment accompanying the document ‘Stepping up Europe’s 2030 climate ambition. Investing in a climate-neutral future for the benefit of our people’, SWD/2020/176 final.

International Energy Agency (2021), Net Zero by 2050. A Roadmap for the Global Energy Sector.

Martin, P, J Pisani-Ferry and X Ragot (2021), “A new template for the European fiscal framework”, VoxEU.org, 26 May

Tenhofen, J, G Wolff and K H Heppke-Falk (2010), “The Macroeconomic Effects of Exogenous Fiscal Policy Shocks in Germany: A Disaggregated SVAR Analysis”, Jahrbücher für Nationalökonomie und Statistik 230(3): 328-355.

Endnotes

1 This column was written before the outbreak of the war in Ukraine.

2 The EIB (2021) reported a 45% unweighted average public share in the EU. We calculate the weighted average at 28%. IRENA’s (2021) 1.5°C scenario estimated a 22% public share at the global level in 2019, which would decline to 17% beyond 2030.

3 https://www.imf.org/en/Topics/climate-change/energy-subsidies

4 https://ec.europa.eu/eurostat/documents/10186/10693286/GFS-guidance-note-statistical-recording-recovery-resilience-facility.pdf

5 https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/eu-economic-governance-monitoring-prevention-correction/stability-and-growth-pact/legal-basis-stability-and-growth-pact_en

6 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:42012A0302(01)

7 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52015DC0012&from=EN

8 http://data.consilium.europa.eu/doc/document/ST-14345-2015-INIT/en/pdf

9 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:01997R1466-20111213

10 http://data.consilium.europa.eu/doc/document/ST-9344-2017-INIT/en/pdf