Over the last 20 years, independent fiscal councils (IFCs) have proliferated, most notably in Europe under the impetus of new EU law on fiscal governance, but also in other regions. These official, yet non-partisan fiscal watchdogs have now become part of good-practice fiscal frameworks (Calmfors and Wren-Lewis 2011). Traditionally, fiscal frameworks combine transparency provisions, numerical rules, and procedures guiding budget preparation and execution. Their goal is to promote financially sustainable policies without prejudice to their macroeconomic stabilisation role. With such arrangements already in place in many countries, what could possibly be the value-added of independent fiscal institutions? A new eBook gathering contributions by leading experts sheds light on the rationale for IFCs, the principles and practical considerations shaping their design and operation, and the lessons to be had from experience (Beetsma and Debrun 2018). The last part of the eBook charts possible avenues for the future of IFCs.

Download the new eBook here:

Constraining policy discretion: From rules to institutions

Discretion is a mixed blessing. It enables timely policy responses to unforeseen events at the cost of preventing credible commitments to optimal strategies. Many episodes of high inflation, excessive government deficits, and rising public debts are widely perceived to be a direct consequence of leaving macroeconomic policy in the hands of unconstrained politicians facing inadequate incentives.

Countries generally seek to ameliorate policymakers’ incentives through formal frameworks combining rules and independent institutions. While independent central banks have become the institutional backbone of monetary policy frameworks since the 1990s, numerical rules, such as caps on government deficits or expenditure growth, have also emerged and remained the main constraints on fiscal discretion. In principle, there should be little scope for independent (i.e. unelected) bodies to influence fiscal decisions. The distributive dimension of most fiscal instruments places them squarely in the political sphere and thus off limits for independent agencies (Alesina and Tabellini 2007).

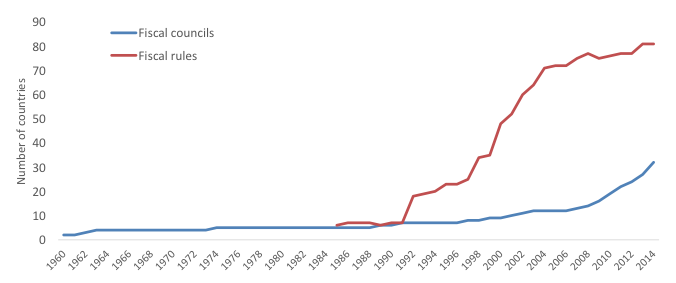

The new and growing appetite for IFCs is therefore intriguing (Figure 1). Of course, such councils differ from independent central banks in one fundamental dimension: they have no policymaking mandate. They are mainly watchdogs that must bark when political masters misbehave but can never bite them. As such, IFCs are non-partisan watchers of policy mistakes, successes, and risks.

An effective IFC thus raises the reputational costs (benefits) of bad (good) policies, but cannot directly punish or reward policymakers for their actions. IFCs can also provide limited technical inputs to the budget process, notably in the form of unbiased macroeconomic and budgetary forecasts or measures of cyclical patterns. The underlying idea is to make it harder for governments to fool the public with optimistic forecasts or biased estimates of the cyclical position.

The rise in IFCs took place after the Global Crisis of 2008-9, when the failure of increasingly complex fiscal rules to secure sustainable public debts became evident. There are now about 40 IFCs in the world, equal to roughly half the number of countries with fiscal rules. The obligation for most EU member states to assign to ‘independent bodies’ specific monitoring tasks strongly contributed to the wave.

Figure 1 Fiscal rules and fiscal councils

Source: Beetsma and Debrun (2017).

Fiscal councils in principle

The first part of the eBook revisits the reasons why governments can see a need for IFCs on top of existing elements of their fiscal frameworks. The chapter by Mulas-Granados sets the stage by showing how effective policy frameworks must appropriately balance rules and independent institutions. Independent institutions clearly dominate the realm of monetary policy, where rule-like numerical guideposts only concern the ultimate objective (inflation). The opposite is true in the fiscal realm where rules are meant to be the key constraint. Independent institutions play a complementary role by increasing fiscal transparency and raising the reputational costs of conducting undesirable policies.

The balance between rules and institutions varies not only across policy instruments, but also over time. In the 1970s and 1980s, monetary policy frameworks were often rules-based. It was only after a series of financial innovations made money supply rules irrelevant that independent central banks, accountable for delivering price stability, became the core of the framework. Frustration with the difficulty of designing and operating effective fiscal policy rules also explains, in part, the growing interest for IFCs in fiscal policy frameworks.

The ongoing rebalancing between fiscal rules and institutions, with more of the latter seen as a way to preserve the former, stems from the realisation that important complementarities exist between the two (see the chapters by Wren-Lewis and Wyplosz). For instance, IFCs are well placed to assess whether deviations from rules are justified or not, which mitigates the risk that politicians abuse escape clauses and other provisions enhancing the rules’ flexibility, such as references to cyclically-adjusted indicators. However, an IFC’s analysis can only play such a role if it is considered politically unbiased and technically sound, which requires specific features related to the independence, mandate, and tasks of the council (see the chapter by Wehner).

Fiscal councils in practice

As countries introduce IFCs to plug certain gaps in their fiscal frameworks, extensive tailoring to local circumstances takes place. This explains the great diversity of arrangements regarding the remit, size, resources, guarantees of independence, and visibility of IFCs. IFCs nevertheless have essential elements in common, most importantly a watchdog role and a corresponding duty to enrich and clarify the public debate about fiscal policy (see the chapter by von Trapp and Nicol).

Clearly, a public discussion where ideologues trade barbs based on dubious and hardly verifiable facts is noisier and much less informative than a civil conversation around objective analysis and assessment of fiscal performance. In addition to authoritative analysis, a clever communication strategy placing the IFC’s narrative at the centre of the debate is essential when the government has superior information about the state of public finances (as discussed in the chapter by Alt and Lassen).

In certain environments, an IFC can be called to perform more specific functions. For instance, IFCs can reduce the costs of coordinating fiscal policy within highly decentralised and federal states. The chapter by Escrivá, Janeba and Langenus dissects the cases of Belgium, Germany and Spain, where IFCs’ inputs can help alleviate coordination failures among national and subnational government entities on politically sensitive issues, such as the apportionment of the fiscal effort required under EU rules. By extension, IFCs could also facilitate a more decentralised fiscal governance in the EU while avoiding coordination failures (as indicated in the chapter by Ódor).

While many IFCs exhibit desirable features (independence, expertise, communication, access to information, etc.), experience remains too limited in time and across countries to draw definitive conclusions about their effectiveness and its determinants. In addition, even if data were not a binding constraint, identifying the impact of institutions on policy outcomes is intrinsically challenging since many factors can jointly contribute to observed fiscal outcomes and to the emergence of IFCs themselves. The chapter by Lledó concludes that preliminary evidence is nevertheless encouraging. In general, the presence of an IFC correlates with greater fiscal transparency and better compliance with fiscal rules.

Lessons from experience

As always with institutional constraints on policy discretion, the effectiveness of IFCs depends on the extent to which the political system owns the new balance between rules and institutions. Hence, it is relevant to contrast the experience in ‘homegrown’ councils with that of councils created under external pressure such as a full blown fiscal crisis. The latter could be more fragile and suffer from a weak impact in the budget game (Horvath). By contrast, some of the most prominent homegrown councils, such as the Swedish Fiscal Policy Council (Jonung) and the UK’s Office of Budget Responsibility (Page), were set up to address known gaps in the national fiscal framework and could a priori be more effective.

In practice, such a distinction is not as clear-cut as one might think. Some IFCs born under pressure (e.g. the Irish Fiscal Advisory Council, the Portuguese Fiscal Council and Spain’s Independent Authority for Fiscal Responsibility) commanded sufficient political consensus at birth to enhance fiscal credibility post-crisis (as argued in the chapter by Horvath). While the combination of strong political ownership, strict independence and skillful communication is a clear recipe for success (as argued in the chapter by Sunshine), low ownership can put the IFC under existential threat (Kopits).

Policy lessons

The contributions in the eBook offer a number of policy lessons:

- A good fiscal framework requires the right balance between rules and independent institutions. The latter can raise the reputational/political costs of deviating from well-defined rules, contributing to better fiscal performance.

- The design of IFCs is crucial for their effectiveness. This requires a mandate addressing country-specific gaps in the conduct of fiscal policy, and legal and operational independence, which implies sufficient resources and unrestricted access to relevant information.

- IFCs are inherently fragile, especially in light of their dependence on politicians’ will to fund their activities. Strong political ownership, skillful public communication and interactions with stakeholders in the budget process promote success, whereas low ownership can directly threaten the IFC’s relevance or existence.

The way forward

Where do we go from here? Is the recent trend in rebalancing fiscal frameworks towards a greater role for independent institutions likely to continue? Will a handful of success stories suffice to catalyse the global spread of fiscal councils? Can we expect the emergence of new forms of fiscal councils, such as councils with a more direct influence over policy? Or will fiscal councils disappear or only subsist in a diminished form to the point of irrelevance?

So far, both success stories and failures are too country-specific to be generalised, making it difficult to foresee if the momentum in favour of IFCs will continue. Those who see the glass half full place hope in a growing role for independent fiscal institutions. The chapter by Asatryan and Heinemann points to the potential development of the European Fiscal Board – the first and only supranational IFC – into a strong player in EU fiscal governance. Over time, IFCs may also morph into decision makers on limited policy levers – those less subject to distributive effects – as proposed by Basso and Costain in their chapter. However, the chapter by von Hagen reminds us that one can also see the glass half empty. Mighty fiscal watchdogs might very well turn into inconsequential lapdogs unless they refocus on effectively targeting common-pool problems, for instance by facilitating the role of a strong finance minister in centralising the budget. Only time will tell, but a safe bet is that the future development of IFCs will, to a substantial extent, depend on the country-specific circumstances.

References

Alesina, A and G Tabellini (2007), “Bureaucrats or Politicians? Part I: A Single Policy Task”, American Economic Review 97(1): 169–179.

Calmfors, L and S Wren-Lewis (2011), “What are fiscal councils, and what do they do?”, VoxEU.org, 21 April.

Beetsma, R and X Debrun (2017), “Fiscal Councils: Rationale and Effectiveness”, in L Ódor (ed.), Rethinking Fiscal Policy after the Crisis, Cambridge University Press.

Beetsma, R and X Debrun (2018), Independent Fiscal Councils: Watchdogs or Lapdogs?, A VoxEU eBook.

IMF (2017), Fiscal Rules Dataset 1985-2015.