A large literature has shown that excessive leverage and the subsequent deleveraging-induced fire sales are considered to be major contributing factors to many past financial crises. Brunnermeier and Pedersen (2009) and Geanakoplos (2010) model a ‘downward leverage spiral’ in which tightened leverage constraints trigger selling by highly levered investors that depresses prices further, which triggers even more selling by levered investors and even lower prices. A prominent example is the US stock market crash of 1929. In October 1929, investors began facing margin calls. As investors quickly sold assets to deleverage their positions, the Dow Jones Industrial Average experienced a record loss of 13% on 28 October 1929, known as Black Monday (Galbraith 2009). Other significant examples of deleveraging and market crashes include the US housing crisis which led to the 2007-08 global financial crisis.

The existing empirical evidence on fire sales focuses, unfortunately, mostly on economic forces other than deleveraging. For example, Coval and Stafford (2007) study open-end mutual fund redemptions and the associated non-information-driven sales. In this column, taking advantage of a unique account-level dataset that tracks hundreds of thousands of margin investors' borrowing and trading activities, we use the Chinese stock market crash in the summer of 2015 to show direct evidence of fire sales induced by deleveraging pressure (Bian et al. 2018b).

Our study covers an unusual period – from May to July 2015 – during which the Chinese stock market experienced a rollercoaster ride, and looks at two types of active margin investors. The brokerage margin market is China's official margin market. Similar to how the SEC sets a uniform initial and maintenance margin to all US brokerage firms, the China Securities Regulation Commission (CSRC) sets a constant maximum allowable leverage ratio that will trigger a margin call for all brokerage firms in China (the ‘Pingcang Line’).

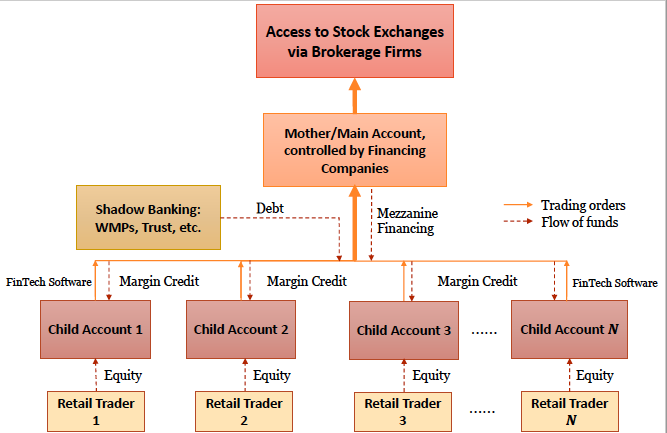

In contrast, the shadow margin market, without any regulatory rules, provides funding services to those investors who cannot meet the brokerage account requirements (say, a minimum wealth requirement). Shadow financing usually operates through a web-based trading platform which provides various service functions that facilitate trading and borrowing. The typical platform features a ‘mother-child’ dual account structure, as depicted in Figure 1. The mother account (the middle box) is connected to a distinct trading account registered in a brokerage firm with direct access to stock exchanges (the top box). The mother account belongs to the creditor, usually a professional financing company. Each mother account is connected to many (in most cases, hundreds of) child accounts, and each child account is managed by an individual retail margin trader (the bottom boxes).

On the surface, a mother account appears to be a normal unlevered brokerage account, albeit with unusually large asset holdings and trading volume. In reality, these large brokerage accounts were mother accounts, which used a FinTech software program to transmit the orders submitted by associated child accounts in real time to exchanges. As shown, the professional financing company which manages the mother account provides margin credit to child accounts; its funding sources include its own capital as mezzanine financing, as well as borrowing from China's shadow banking sector (see Figure 2). Through this umbrella-style structure, a creditor can lend funds to multiple margin traders, while maintaining different leverage limits for each trader (child account).

Figure 1 The structure of the shadow-financed system prevailed in the Chinese stock market in 2015

A child account also has a Pingcang Line, beyond which the child account would be taken over by the mother account (the creditor). Often, this switch of ownership was automated through the software system, by simply triggering the expiration of the borrower's password and immediate activation of that of the creditor. Importantly, the Pingcang Lines of shadow accounts are privately negotiated without any market-wide regulation.

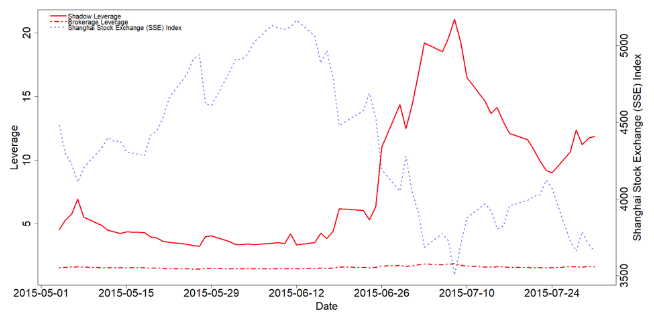

Figure 2 offers a summary of the funding sources for these two margin systems. Unlike in the brokerage margin system, regulators do not know the total shadow market size, not to mention a detailed breakdown of the shadow funding sources.

Figure 2 The funding sources for the brokerage- and shadow-financed margin systems in the Chinese stock market

We calculate the daily leverage for each account as account total assets over account equity (defined as assets - debts). Figure 3 plots the asset-weighted leverage ratios for two types of margin accounts, together with the SSE index from May to July in 2015. The leverage of the shadow accounts fluctuates more dramatically than that of brokerage accounts, with strong negative correlation with the SSE index.

Figure 3 Asset-weighted leverage, brokerage vs shadow accounts

Fire sales: Account-level and stock-level evidence

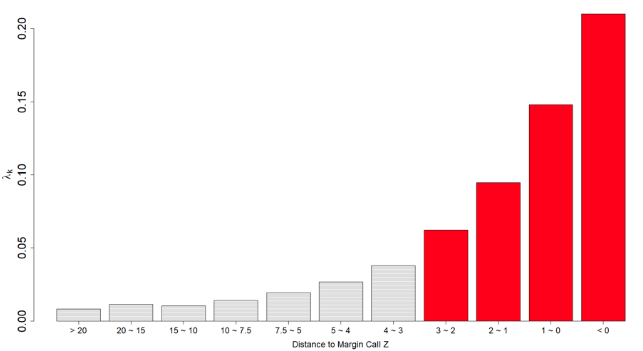

Each day, we construct the distance-to-margin call (DMC) for each margin account, defined as the distance between the account's leverage and its Pingcang Line, scaled by the volatility of the account’s stock portfolio. The DMC measure gives the number of standard deviations of downward movements in asset values necessary to push the current leverage up to its Pingcang Line.

The accounts with lower DMCs are more likely to face margin calls, and are subject to high selling pressures. One way to see it is to compare the selling intensities for the same stock on the same day but sitting in accounts with different DMCs; we report the results in Figure 4. Investors begin to intensify their selling when a two-to-three standard deviation return movement would lead to loss of control of their accounts. For this reason, in our study we refer to accounts with DMC below 3 as ‘fire sale accounts’.

Figure 4 Selling intensities for accounts with different DMCs

Note: Plots the coefficients from regressing account net selling of stock shares on the previous day’s DMC dummies. Fire sale accounts are in red.

Stocks with high fire sale exposure – that is, stocks that are disproportionately held by those fire sale accounts – significantly underperform stocks with low fire sale exposure initially; and these differences approach zero in the long run (30 to 40 trading days). This pattern of short-term price impact that reverts in the long-run is unique to a fire sale story, and is hard to reconcile with other more canonical explanations.

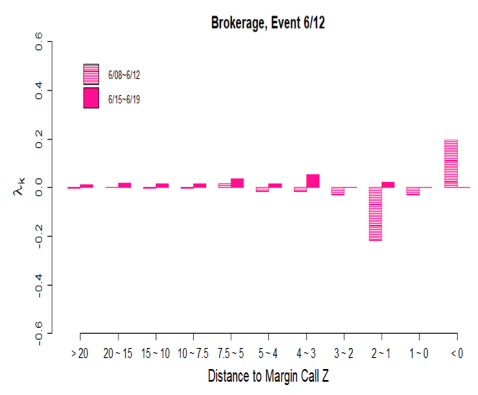

Regulatory announcement

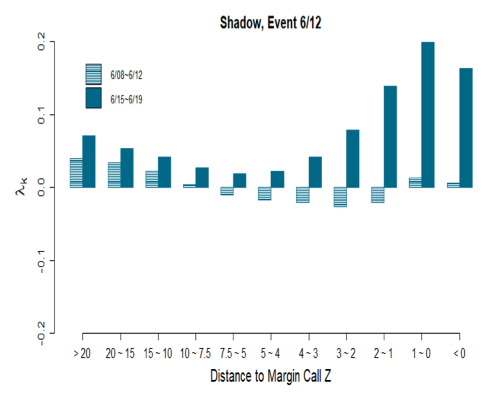

On 12 June 2015, the CSRC released a set of draft rules that would explicitly ban new shadow accounts, potentially triggering the leverage-induced fire sales. In Figure 5, we repeat the same exercise as in Figure 4, based on the sample of five days before and after this announcement, but separately for the brokerage and shadow accounts. The 12 June regulatory tightening significantly increases the selling intensities of shadow accounts within each DMC bin, but not that much for the brokerage accounts.

Figure 5 Selling intensities for accounts with different DMCs for the 12 June 2015 regulatory announcement

Notes: This figure plots the regression coefficients as per Figure 4, estimated separately for the brokerage and shadow accounts for the five trading days before and after 12 June 2015.

Which contributed more to the market crashes – shadow or brokerage?

Another policy-relevant question is whether brokerage or shadow margin accounts contributed more to the market crash. Our data point to the shadow accounts. Panel A of Figure 6 shows that our shadow accounts cover a much smaller portion of the total market capitalisation compared to the brokerage accounts in our sample.1 However, Panel A offers a misleading picture of how these two types of accounts relate to fire sales. By plotting the fire sale accounts across these two types, Panel B delivers the opposite message. Compared to the brokerage system, there is a much higher proportion of stock market cap held by shadow fire sale accounts! What is more, a measure of fire sale exposure constructed from the shadow accounts predicts price declines and subsequent reversals much more strongly than that constructed from the brokerage accounts.

Figure 6 Total market capitalisation held in accounts in our sample

Conclusion

Our paper uses unique account-level data for brokerage-financed and shadow-financed margin traders in the Chinese stock market to study the role of deleveraging and fire sales in the Chinese stock market crash of summer 2015. We show that margin investors heavily sell their holdings when they edge toward their funding constraints. This selling pressure causes stocks that are disproportionately held by investors who are close to receiving margin calls to be exposed to fire sale risk, especially during periods when the market is in rapid decline. Consistent with this view, we show that stocks with greater fire sale risk exposure experience larger abnormal price declines relative to stocks with lower fire sale risk. In a companion study, we show how these (de)leverage-induced actions may lead to idiosyncratic risks that are transferred across stocks (Bian et al. 2018a). Taken together, these two studies quantitatively evaluate the impact on the stock market from deleveraging selling activities.

References

Bian, J, Z Da, D Lou and H Zhou (2018a), “Leverage network and market contagion,” working paper.

Bian, J, Z He, K Shue and H Zhou (2018b), “Leverage-Induced fire sales and stock market crashes”, working paper.

Brunnermeier, M and L Pedersen (2009), “Market liquidity and funding liquidity,” Review of Financial Studies 22: 2201–2238.

Coval, J and E Stafford (2007), “Asset fire sales (and purchases) in equity markets,” Journal of Financial Economics 86: 479–512.

Galbraith, K J (2009), The Great Crash 1929, Houghton Mifflin, New York, NY.

Geanakoplos, J (2010), “The leverage cycles,” NBER Macroeconomic Annual 24: 1-66.

Endnotes

[1] Our sample covers about 5% of the actual size for each margin account. As a result, the relative asset sizes of the two account types shown in Panel A roughly reflect their relative asset holdings in the entire market.