Economic growth has historically been associated with financial deepening, as reflected for example by the increase in private credit. Elevated levels of private leverage, however, also raise financial stability concerns as households and firms may be less resilient to shocks, experiencing larger increases in default rates and stronger deleverage spirals if confronted with adverse real or financial circumstances. As rapid credit growth is associated with the probability and severity of financial crises and sharper recessions (Dell’Ariccia et al. 2012, Jordà et al. 2016, Verner 2019), gauging developments in private leverage is critical for macro-financial stability.

In a recent report of the Advisory Scientific Committee (ASC) of the European Systemic Risk Board (ESRB), we offer a long-term view of the evolution of corporate leverage in the EU since the introduction of the euro, and compare it with contemporaneous trends in other advanced economies (Beck et al. 2023). The analysis covers periods of economic expansion, financial distress after 2008 and a post-crisis recovery up to the COVID-19 pandemic. Our goal is to offer some perspective beyond the conjunctural dimension, identifying structural trends and their drivers, to understand the evolving allocation of credit and its effects on financial stability.

Focusing on corporate leverage

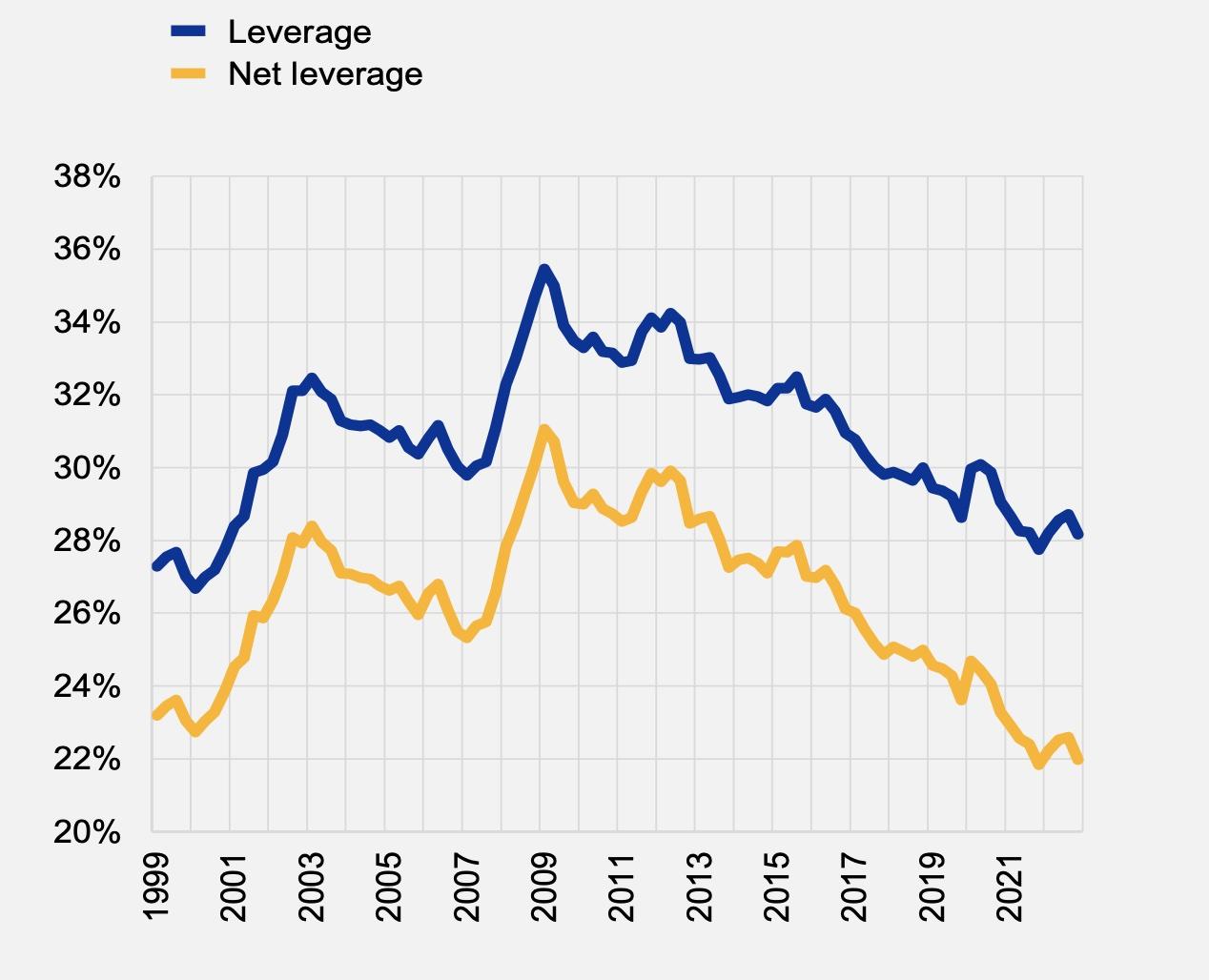

While macroprudential analysis commonly assesses the evolution of indebtedness in a particular sector by looking at the ratio of sectoral credit to GDP, for the case of non-financial corporations (NFCs), we choose to focus on corporate leverage, the traditional object of attention in the literature on firms’ capital structure. In our analysis, gross leverage is the ratio of total (bank, trade and market) debt to total assets, thus relating financial obligations to the assets available to back repayment. Net leverage subtracts cash holdings from both gross debt and gross assets, to take into account that available cash could be used to repay debt without causing a disturbance to firm operations.

Figure 1 shows the development of both gross and net leverage for the euro area. The most striking finding is an unprecedented steady decline in corporate leverage, a trend that is confirmed for most EU countries and across NFCs in different industries and of different sizes since 2008 (Beck et al. 2023). The decline in net leverage is even more marked, as firms have been increasing their cash reserves. The result appears when using national accounts covering the full population of firms, as well as databases constructed with accounting statements and tax filings. Asset revaluations have contributed to reducing leverage ratios in the low interest rate environment but do not explain the whole decline (Sánchez Serrano 2022).

Figure 1 Aggregate leverage in the euro area, 1990 to 2021

Sources: Eurostat, ECB, Haver Analytics and authors’ calculations

This trend is partially matched in the US, where tax filing data have recently shown a somewhat less pronounced decline in gross borrowing (though in the US there is evidence of rising leverage among listed firms), as shown in Dobridge et al. (2022). A clear distinction is that bond issuance by large US NFCs has been sustained since 2009, while in the EU the rise in bond funding from a lower base has been more limited.

Clearly, a general decline in corporate leverage does not necessarily imply fewer financial stability concerns, which depend on its main causes. First, if NFCs reduce their leverage in response to worse prospects or higher uncertainty, perhaps associated with more limited access to bank funding, they may not become less vulnerable. Second, falling average leverage in the aggregate may conceal important subsets of NFCs exposed to debt overhang problems and at high risk of financial distress (usually called ‘zombies’). Only the study of more granular data can address these issues.

What explains the trend?

While it may seem puzzling to see lower corporate leverage in a long phase of falling rates, under ideal conditions NFCs should remain indifferent between debt and equity (Modigliani and Miller 1958). In reality, the existence of multiple frictions (including tax advantages linked to debt financial and distortions related to limited liability and informational asymmetries) makes a firm choose its leverage by balancing advantages and costs of debt financing relative to other funding sources, including self-financing through retained earnings. Variations in leverage over time may reflect changing investment needs, changes in the relevance of debt tax shields or bankruptcy costs. Yet a steady trend suggests a structural change in the economic or regulatory environment. The report considers possible drivers of changing credit demand or supply drawn from the academic literature that can explain the decline in corporate leverage over the past 15 years.

A reduced credit supply may be due to recent crises that induced bank regulatory reforms, while demand-side factors include lower tax shields, a decline in investment opportunities, and a change in corporate asset composition that alters firms’ preferred funding sources.

- During the global financial and European sovereign debt crises, many banks, especially in periphery countries of the euro area reduced lending and applied structurally tighter lending standards; consequently, many European NFCs embarked on a process of gradual deleveraging, in part by reducing investment (Kalemli-Ozcan et al. 2022). Yet the decline persisted in the much more benign period since 2014, also in better-performing economies.

- Regulatory reforms after 2009 raised the capital and liquidity requirements of banks, affecting their willingness to lend. The reforms have potentially affected corporate lending more than other loans (e.g. Gropp et al. 2019; De Jonghe et al. 2020).

- Falling leverage over many years could be the result of a gradual adjustment to lower target leverage, related to lower benefits from tax deductibility of interest expenses associated with lower corporate and income tax rates.

- The decline in aggregate investment rates in developed economies in recent decades, partly as a result of the global relocation of manufacturing activities to emerging countries, is a likely cause of the reduction in credit demand.

- As net leverage has declined even faster due to the rise in corporate cash holdings, the corporate sectors of most advanced economies have become net lenders (on a flow basis) to other sectors in recent years.

- The transition to a digital economy has led to the growing importance of intangible capital investment. This change in business models has affected both credit supply (as intangible assets are poor collateral in default) and credit demand (as intangible capital is not acquired upfront as traditional physical plant and equipment, but built over time with heavy involvement of skilled human capital (Doettling et al. 2022). There is evidence that NFCs with a high ratio of intangible to tangible capital have lower leverage and tend to accumulate larger cash reserves (Falato et al. 2022).

The report does not undertake a formal empirical assessment of the relative importance of these factors, but the evidence (in particular a comparable leverage decline across firm sizes) suggests a role for shifts in both credit demand and supply curves for bank lending. It is likely that reduced growth prospects, bank regulatory changes and a change in business models all contribute to the surprising result, in contrast to evidence of rising mortgage leverage and public debt. The report also shows an increasing role (though from a very low level) for market and non-bank finance for NFCs in Europe, albeit the trend does not alter the overall picture of declining indebtedness.

General equilibrium implications

The decline in corporate leverage implies that credit otherwise flowing to NFCs can be reallocated to finance other sectors or assets. Such a shift might generate financial instability if increased credit supply elsewhere (especially if concentrated in specific sectors or assets) were to produce greater systemic risk as a result of unsustainable valuations or exposure to more correlated shocks. A relevant instance is the real estate sector, where credit and valuations have gone through major fluctuations not only in recent decades, contributing to magnifying (if not causing) the effects of financial crises (Jordà et al. 2016)

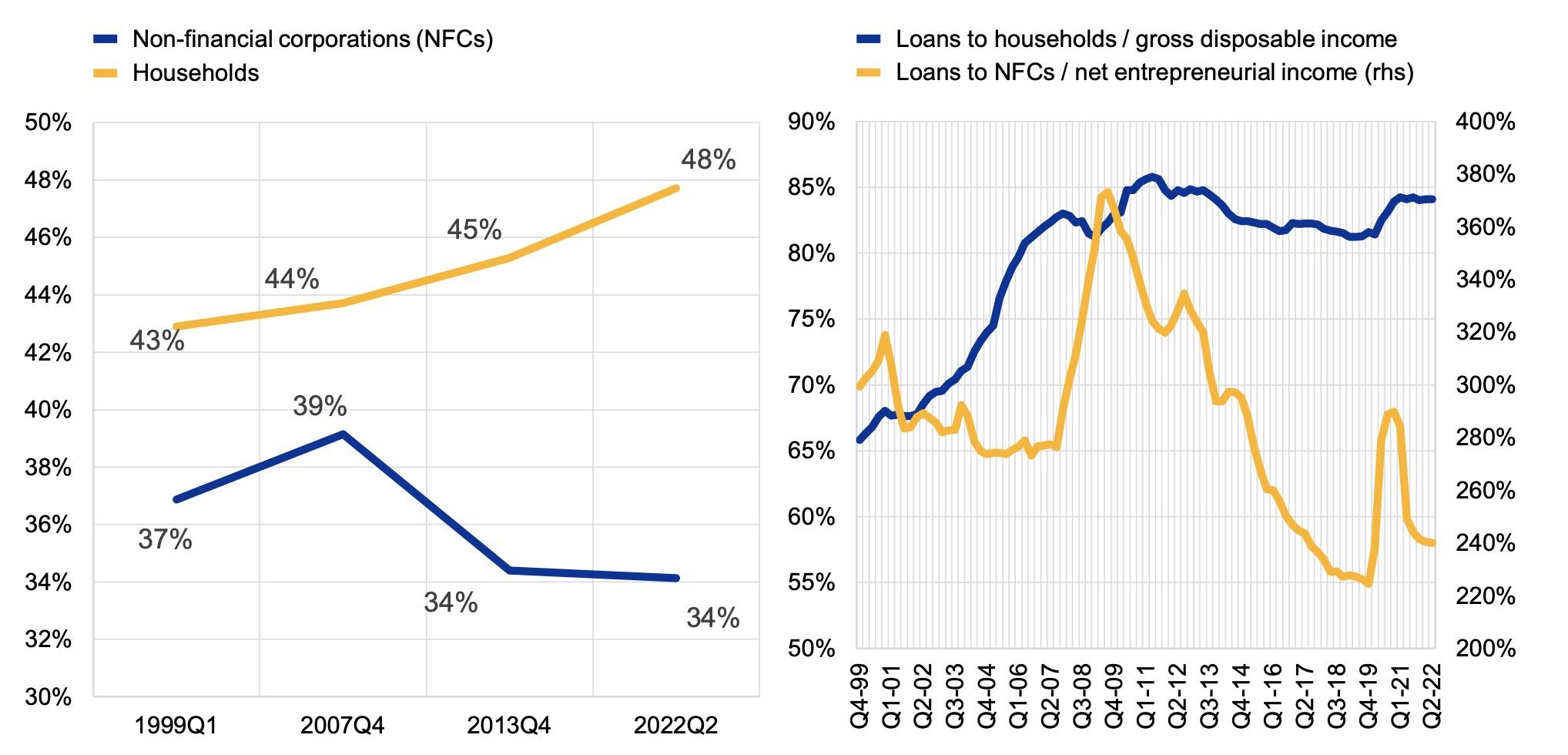

Figure 2 Distribution of bank loans according to borrower sector, euro area

Sources: ECB (who-to-whom) accounts and authors’ calculations.

In the EU, there is a major reallocation of credit to governments and, to a lesser extent, to household mortgages over this period. Figure 2 shows the steady rise of mortgage lending in banks’ portfolios. This trend is somewhat different from the US, where the importance of mortgage lending relative to corporate lending has risen less since 2008, even taking into account the greater role of market financing of mortgages.

Conclusions and policy implications

Our analysis has several implications for macroprudential authorities. First, a steady improvement in the availability of granular data is needed to assess variations in corporate leverage. Common trends across countries, industries and size groups and their correlation with debt capacity should be monitored to detect early warning signs of distress. Second, the growing role of non-bank financial intermediaries in financing the real economy calls for a macroprudential framework that matches the existing framework for banks, to ensure spillover effects are avoided and risks addressed similarly across the financial system. Third, the ongoing process of credit reallocation away from corporate to household credit requires macroprudential authorities to focus more on the mortgage lending segment.

References

Beck, T, T Peltonen, E Perotti, A Sánchez Serrano and J Suarez (2023), Corporate credit and leverage in the EU: recent evolution, main drivers and financial stability implications, European Systemic Risk Board, Reports of the Advisory Scientific Committee, No 14.

De Jonghe, O, H Dewachter and S Ongena (2020), "Bank capital (requirements) and credit supply: evidence from Pillar 2 decisions", Journal of Corporate Finance (60): 101518.

Dell’Ariccia, G, D Igan, L Laeven, H Tong, B Bakker and J Vandenbussche (2012), “Policies for macrofinancial stability: how to deal with credit booms”, IMF Staff Discussion Note No. SDN/12/06.

Doettling, R, T Ladika and E Perotti (2022), “Creating Intangible Capital”, Amsterdam Business School, mimeo.

Dolbridge, C, E Gilje and A Whitten (2022), “The secular decline in private firm leverage”, NBER Working Paper No. 30034.

Falato, A, D Kadyrzhanova, J Sim and R Steri (2022), “Rising intangible capital, shrinking debt capacity and the U.S. corporate savings glut”, Journal of Finance 77(5): 2799-2852.

Gropp, R, T Mosk, S Ongena and C Wix (2019), “Banks response to higher capital requirements: evidence from a quasi-natural experiment”, Review of Financial Studies 32(1): 266-299.

Jordà, O, M Schularick and A Taylor (2016), “The great mortgaging: housing finance, crises and business cycles”, Economic Policy 31 (85): 107-152.

Kalemli-Ozcan, S, L Laeven and D Moreno (2022), “Debt overhang, rollover risk, and corporate investment: evidence from the European crisis”, Journal of European Economic Association 20(6): 2353–2395.

Modigliani, F and M Miller (1958), “The cost of capital, corporation finance and the theory of investment”, American Economic Review 48(3): 261–297.

Sánchez Serrano, A. (2022), “Market prices and the evolution of corporate leverage in the euro area”, Eurostat Working Paper Series No. KS-03-22-176.

Verner, E (2019), “Private debt booms and the real economy: do the benefits outweigh the costs?”, prepared for the INET Initiative on Private Debt.