The Covid-19 crisis has increased public debt to unprecedented levels. Yet falling demand and lower commodity prices have reduced inflation rates globally. But in recent months, inflationary pressures have re-emerged, driven by base effects, supply bottlenecks, and the recovery in demand – in some cases boosted by fiscal stimuli (Ball et al. 2021). While many advanced economies maintain a very accommodative policy stance, some central banks in emerging market economies are reversing the interest rates cuts of last year, to bring inflation back on target.

The question is how effective these moves will be. Standard open economy models predict that a higher interest rate will lift the exchange rate. A stronger currency, in turn, will reduce import prices and help to bring down domestic inflation. For emerging market economies, however, the empirical evidence does not support this prediction (Kohlscheen 2014, Hnatkovska et al. 2016).

While most of the research has focused on the unconditional response of the exchange rate, in a recent paper (Alberola et al. 2021) we emphasise its contingent behaviour. Our results suggest that the exchange rate responds to domestic policy shocks in a state-contingent way, depending on the backing of government bonds, or the lack thereof. In a ‘Ricardian’ fiscal regime, when debt is fully backed by future fiscal surpluses, monetary tightening strengthens the exchange rate. In a ‘non-Ricardian’ regime, by contrast, the fiscal authority cannot credibly commit to levy taxes for an amount equal to the outstanding value of its obligation. In this case, an increase in the policy rate leads to a depreciation of the currency.

Evidence from Brazil

If we wish to test the link between the exchange rate, monetary policy, and the fiscal regime, Brazil makes a good case study – thanks to the combination of a flexible exchange rate regime, its independent central bank, and a history of recurrent debt crises.

In the 1980s, fiscal profligacy led to recurrent debt crises, leading the Brazilian government to default four times on its domestic and/or foreign debt. Since the mid-1990s, Brazil has significantly improved its monetary and fiscal policies, adopting an inflation targeting framework with a flexible exchange rate regime. Nevertheless, fiscal concerns resurface from time to time.

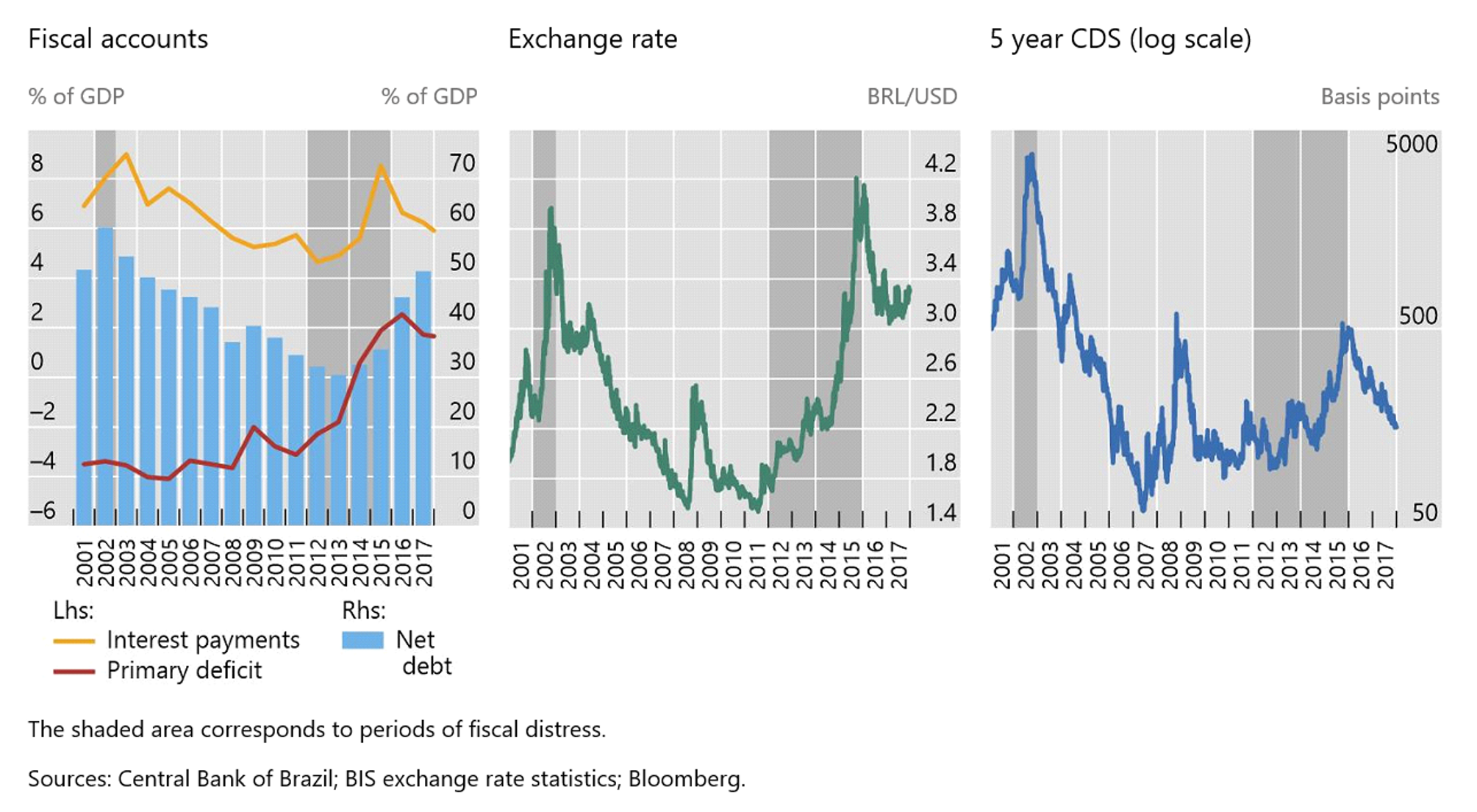

Figure 1 shows the evolution of fiscal variables, the exchange rate, and sovereign credit risk since 2001. Two episodes reflect the reawakening of fiscal concerns: the run-up to the 2002 general election and the period of economic weakness and political turbulence between 2012 and 2015. While differing in their duration and severity,1 the two episodes had some features in common: fiscal fundamentals were weak and market participants doubted whether fiscal policy could be sustainable – i.e. it was non-Ricardian.

Figure 1 Episodes of fiscal turbulence in Brazil

Did the exchange rate react differently to monetary policy during those periods? We look at daily movements of the Brazilian real around monetary policy decisions between 2001 and 2017 and their covariance with monetary policy surprises. We compute monetary surprises as the difference between the announced ‘Selic target rate’ (the policy rate) and its expected value the day before the announcement, as surveyed among professional forecasters.

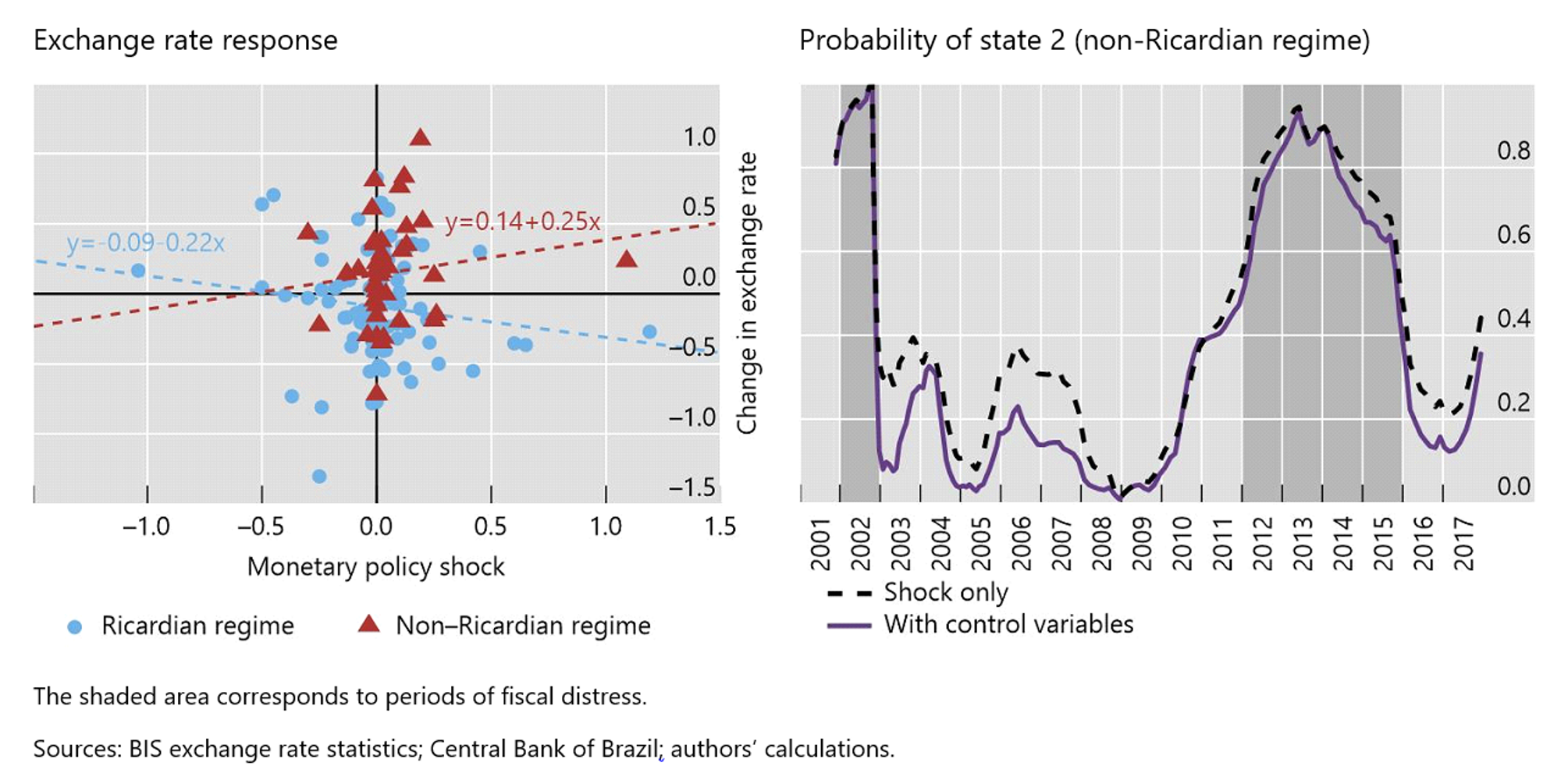

The scatter plot in the left-hand panel of Figure 2 shows that there is no clear relationship between exchange rate changes and monetary policy shocks across the whole sample. But once we treat the periods of fiscal distress separately, a different picture emerges. Simple regressions show that positive interest rate surprises lift the exchange rate in normal times but depress it during the periods of fiscal distress. Both results are statistically significant.

We corroborate these findings with a reverse exercise. Rather than determining the regime a priori, we assume that it is unobservable and evolves according to a ‘two-state Markov chain’. The estimation procedure determines the likelihood of the two regimes based on the changes in the exchange rate to monetary shocks.

The right-hand panel of Figure 2 plots the probability of the regime (state 2) in which the covariance between exchange rate changes and monetary policy surprises is positive – as we observe during non-Ricardian fiscal regimes. Consistent with our narrative identification, the probability is high in 2002, and between 2012 and 2015. This result supports our hypothesis that changes in the fiscal regime explain the differing responses of the exchange rate to monetary policy shocks.

Figure 2 Exchange rate response to monetary policy shocks depends on the fiscal regime

Sovereign risk and the exchange rate

To rationalise these findings and building on the idea of Blanchard (2004), we develop a model in which sovereign risk drives exchange rate movements, while fiscal policy switches between a Ricardian and non-Ricardian regime.

In the Ricardian regime, an increase in the domestic policy rate makes the local currency sovereign bond more attractive vis-à-vis foreign assets, increasing its demand and lifting the exchange rate. Conversely, in the non-Ricardian regime, an increase in the policy rate makes the bond less attractive, reducing demand for it and weakening the domestic currency. This occurs because the government does not adjust the primary surplus to offset the higher debt servicing cost. As a result, sovereign risk increases.

The model’s key feature is that foreign investors fear they will be subject to higher ‘haircuts’ than domestic investors if sovereign debt is restructured. There are different reasons why non-residents may expect to suffer higher losses: plain discrimination, the imposition of capital controls, or the use of ‘sweeteners’ that are particularly attractive to domestic investors (see Gelpern and Setser 2004 and Sturzenegger and Zettelmeyer 2008 for examples). Sovereigns might attempt to treat residents more favourably in order to soften the impact of the restructuring on the domestic economy or to avoid measures that domestic constituents will find unpalatable (Erce 2013).

If the expected losses for domestic and foreign investors are different, the premia investors will demand for holding the debt will differ too. When sovereign risk rises, the increase in the local currency bond yield will not suffice to compensate foreign investors. The resulting fall in demand weakens the exchange rate, giving rise to an expected appreciation that increases the expected return for foreign investors.2 This mechanism is consistent with the recent empirical evidence on the link between currency premia and sovereign risk (Della Corte et al. 2021).

Concluding remarks

Given the critical importance of the exchange rate for emerging market economies’ internal and external stability (BIS 2019), understanding its response to domestic policies is fundamental for policymakers. For all the progress made during the last decades, our work underlines the importance of fiscal sustainability for monetary policy to operate effectively. In the post-pandemic context, where fiscal fundamentals have worsened and inflationary concerns are on the rise, a virtuous interaction between monetary and fiscal policies will be central for macroeconomic stability.

Authors note: The views, opinions, findings, and conclusions or recommendations expressed in this column are strictly those of the authors. They do not necessarily reflect the views of the Bank of International Settlements (BIS) nor the Swiss National Bank (SNB). The BIS and the SNB take no responsibility for any errors or omissions in, or for the correctness of, the information contained in this article.

References

Alberola, E, C Cantu, P Cavallino and N Mirkov (2021), “Fiscal regimes and the exchange rate”, BIS Working Paper 950.

Ball, L, G Gopinath, D Leigh, P Mishra and A Spilimbergo (2021), “US inflation: Set for take-off?”, VoxEU.org, 7 May.

Blanchard, O (2004), “Fiscal Dominance and Inflation Targeting: Lessons from Brazil”, NBER Working Paper 10389.

BIS (2019), Monetary policy frameworks in EMEs: inflation targeting, the exchange rate and financial stability, BIS Annual Economic Report, Chapter 2.

Della Corte, P, L Sarno, M Schmeling and C Wagner (2021), “Default expectations and currency movements”, VoxEU.org, 17 May.

Erce, A (2013), “Sovereign debt restructurings and the IMF: implications for future official interventions”, Globalization Institute Working Paper 143.

Gelpern, A and B W Setser (2004), “Domestic and External Debt: The Doomed Quest for Equal Treatment”, Georgetown Journal of International Law 35: 795-814

Hnatkovska, V, A Lahiri, and C A Vegh (2016), “The Exchange Rate Response to Monetary Policy Innovations”, American Economic Journal: Macroeconomics 8: 137–81.

Kohlscheen, E (2014), “The impact of monetary policy on the exchange rate: A high frequency exchange rate puzzle in emerging economies”, Journal of International Money and Finance 44: 69-96.

Sturzenegger, F and J Zettelmeyer (2008), “Haircuts: Estimating investor losses in sovereign debt restructurings, 1998-2005”, Journal of International Money and Finance 27: 780-805.

Endnotes

1 From 2003 to 2011, thanks to a favourable external scenario characterized by a worldwide boom in commodity prices, Brazil managed to reduce its external vulnerability. The external debt to GDP ratio fell from 45% in 2002 to 20% in 2011, while foreign exchange reserves increased from US$38 billion to US$350 billion.

2 Similarly, when sovereign risk rises, the increase in the foreign currency bond yield makes foreign currency debt more attractive for domestic investors. The increase in demand leads to a depreciation of the domestic currency.