Editors' note: This column is part of the Vox debate on the economic consequences of war.

Since 24 February 2022, Russia has waged a war of aggression against Ukraine. In response, a coalition of at least 40 Allies1 has formed to impose economic sanctions. Sanctions on Russia have been as diverse as the group of Allies, ranking from financial measures against Russia’s central bank and/or commercial banks to import restrictions and bans, export controls, investment bans, travel restrictions, seizure of international assets, and suspension of international cooperation.2 Some of the most severe sanctions have been imposed by G7 countries and the EU. In response, Russia has begun to impose its own countermeasures, or countersanctions, against nations it considers ‘unfriendly’.

With remarkable promptitude, a number of researchers and institutions have set out to analyse the economic effects of Russia’s war and the subsequent sanctions on the global economy. Some contributions chose computable general equilibrium (CGE) modelling (e.g. Evenett and Muendler 2022, Chepeliev et al. 2022, Felbermayr et al. 2022, Langot et al. 2022, WTO 2022), others applied global macroeconomic models (e.g. OECD 2022), econometric and partial-equilibrium techniques (e.g. Pestova et al. 2022, Ferrara et al 2022), while yet others focused on estimating economic effects on certain countries or sectors (e.g. Bachmann et al. 2022).

In the face of spiralling sanctions and escalating rhetoric, we explore a heightened conflict scenario in which Allies3 extend their current sanctions into a comprehensive trade embargo on Russia. We simulate the effects of this counterfactual using CGE modelling, more specifically the Global Trade Analysis Project (GTAP) framework. We define the Allied trade embargo as consisting of four cumulative components, each of which is implemented as a separate model shock:

1) An embargo on imports from Russia, modelled as prohibitive import tariffs by Allies.

2) An embargo of Allied exports into Russia, modelled as prohibitive export tariffs by Allies.

3) Partial withdrawal or suspension of FDI by companies headquartered in an Allied country; and

4) As a collateral consequence of the Allied trade embargo, higher trade costs at which Russia continues to trade with non-sanctioning countries.

The partial withdrawal of FDI by Allied-owned subsidiaries (component (3)) reflects that a growing share of foreign companies invested in Russia has been withdrawing or suspending operations since the beginning of Russia’s war,4 which will only accelerate with future rounds of sanctions.5 We assume conservatively that half of Allied subsidiaries in Russia close or suspend operations. The FDI withdrawal is modelled as negative shocks to sector-specific total factor productivity (TFP) and applied to those sectors with Allied-owned capital.6

The higher trade costs of doing business between Russia and non-Allies (component (4)) is motivated by reports that financing, insuring, and executing trade deals between Russia and non-sanctioning countries has become significantly more costly due to the existing Allied financial and trade sanctions. Once Allies pile on additional sanctions, Russia may well have to resort to barter trade with non-Allies (much like Iran does in the face of Western sanctions).7 Transportation costs will further increase since Russia’s infrastructure corridors into East Asia are underdeveloped, and since more and more shipping companies will discontinue service in and out of Russia.8 It appears reasonable to expect that non-Allied trading partners will aim to shift as much of these extra transaction costs onto Russia, and additionally will seek to exploit Russia’s weak negotiation position and demand sizable trade discounts.9 We model these additional trade costs as a combination of a bilateral increase in non-tariff barriers of 5% between Russia and non-Allied trading partners, and a 10% across-the-board export subsidy coupled with a 10% import tax by Russia on products traded with non-Allied countries.10

These four shocks, taken together, are compared to a pre-embargo baseline, which allows us to estimate the short- to medium term economic effects of the Allied trade embargo.11

Our analysis, described in more detail in Mahlstein et al. (2022), complements recent computable general equilibrium (CGE) analyses of the economic effects of Russia sanctions (e.g. Evenett and Muendler 2022, Chepeliev et al. 2022, Felbermayr et al. 2022, Langot et al. 2022, WTO 2022) in a number of ways: First, our counterfactual is a comprehensive trade embargo, compared to more limited sanctions modelled elsewhere. Second, our model permits decomposing the overall trade and economic effects of a trade embargo and to compare various constituent sanction components. Third, the results we present can be interpreted as short- to medium-term effects, rather than long-term effects, which may increase the relevance of our analysis to policymakers.

Simulated effects and interpretation

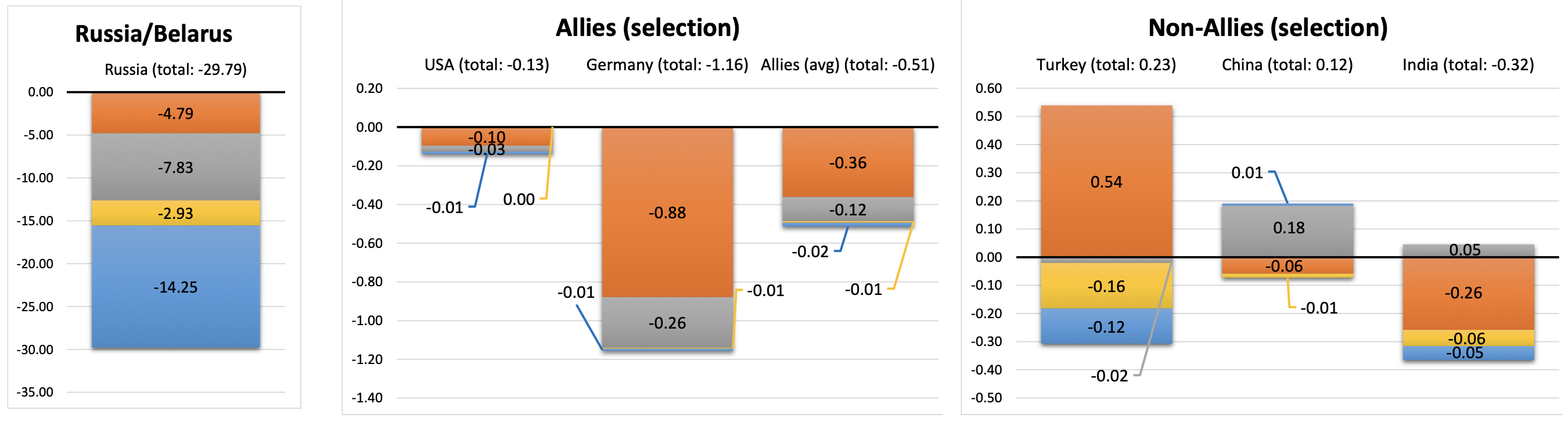

Figures 1 and 2 report the effects of an Allied trade embargo in terms of the percentage changes in real GDP (Figure 1) and economic welfare (i.e. real income; Figure 2). Each stacked bar decomposes the total effect in terms of the four components that characterise an Allied trade embargo.

Figure 1 Percent change in real GDP (Russia+, selected Allies, selected non-Allies)

Note: Scale does not match across panels.

Source: Mahlstein et al. (2022).

An Allied trade embargo is expected to decrease Russia’s real GDP by 14.80% (Figure 1). By far the largest contribution to Russia’s real GDP losses thereby results from partial withdrawal of FDI ( 12.53%). Allied countries are affected significantly less by their own trade embargo, with a 0.52% weighted average loss of real GDP. The economic pain is unevenly distributed, however: Allied countries that are (or used to be) more integrated into the Russian economy incur higher losses, while resource-rich Allies may even achieve marginal gains. Many non-sanctioning countries (notably China, India, and Turkey) also suffer real GDP losses from an Allied embargo since the additional trade costs from doing business with Russia dominate gains from trade diversion.

Figure 2 reports changes in real income (or welfare).12 Differences compared to real GDP effects (Figure 1) largely reflect the changes in terms of trade (the ratio of export price to import price). The economic welfare effect for Russia is 29.79%, nearly twice as high as real GDP losses, which attests to sizable terms-of-trade deterioration that Russia experiences as a result of the Allied trade embargo. Real income losses across Allies are 0.51%. Again, the effects for Allies vary across countries and regions. Among non-Allies, China and Turkey experience welfare gains, while India experiences a terms of trade deterioration, resulting in a welfare loss.

Figure 2 Percent change in real income (Russia+, selected Allies, selected non-Allies)

Note: Scale does not match across panels.

Source: Mahlstein et al. (2022).

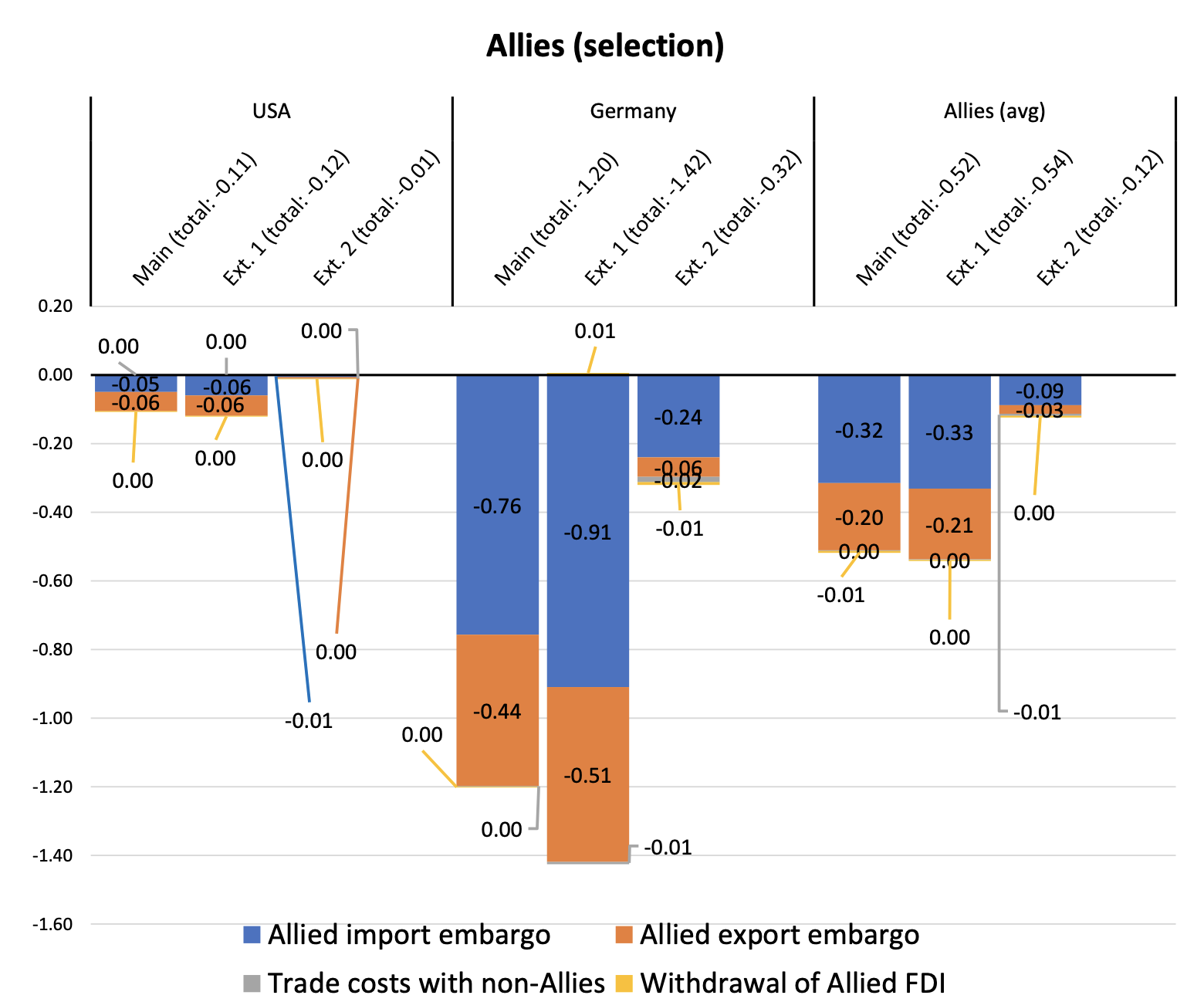

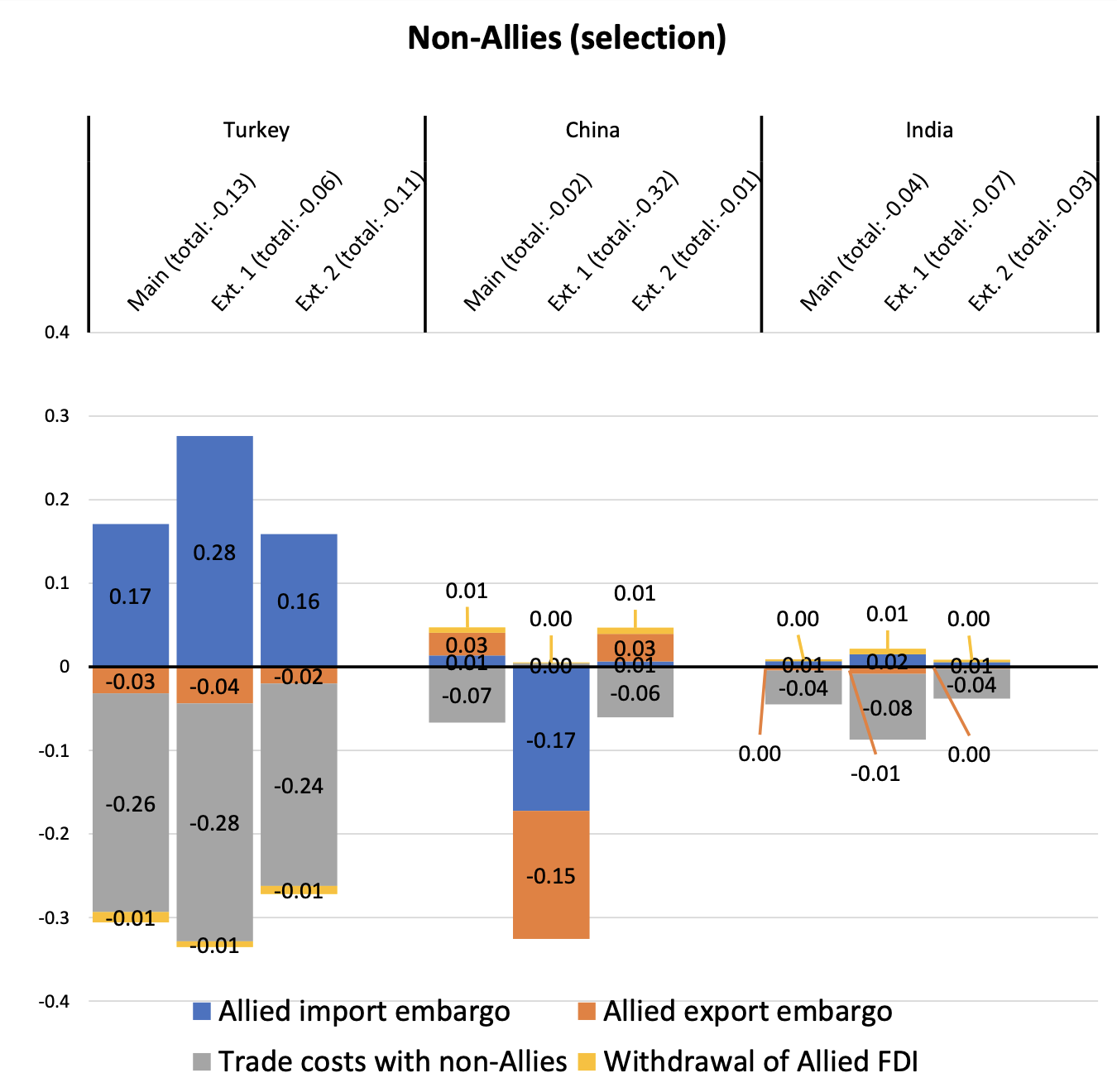

Model extensions

Our analysis in Mahlstein et al. (2022) includes two topical model extensions.

Extension 1: China joins Allied embargo

Observers have wondered about the impact of enlarging the group of sanctioning countries to include, in particular, China, Russia’s largest non-Allied trading partner (e.g. Evenett and Muendler 2022). Extension 1 considers this scenario.

The first two bars of Figures 3 to 5 compare real GDP changes under our main case and under Extension 1. As expected, Russia would suffer higher economic losses from China imposing the same sanctions as Allies (real GDP losses of 14.80% in main case versus 18.77% in Extension 1). Hardly surprising, net negative effects on China would increase as well. Nearly all Allies stand to lose as well.13 Looking at non-sanctioning countries, most non-Allies (except for India) would record smaller losses or higher gains, respectively.

Extension 2: Russia pre-empts Allies and imposes its own trade embargo

From the moment the Allies began imposing sanctions, Russia has retorted with its own measures targeted at Allies, including capital, financial, import restrictions and export bans.14 Extension 2 estimates an alternative scenario in which Russia was the party imposing a trade embargo, pre-empting further Allied sanctions.

The first and third bars of Figures 3 to 5 compare real GDP changes under our main case and under Extension 2. As the party enacting a trade embargo, Russia would suffer significantly higher real GDP losses (losses of 14.80% in main case versus losses of 24.90% in with Extension 2).15 This result obtains because Russia would have to perform costly changes in resource allocation – away from efficient sectors – upon the imposition of its own import and export embargos. Real GDP losses to Allies would be substantially smaller in Extension 2. Non-Allies would also stand to gain from a trade embargo initiated by Russia.

Figure 3 Percent change in real GDP: Main case vs. extensions (Russia)

Source: Mahlstein et al. (2022).

Figure 4 Percent change in real GDP: Main case vs. extensions (selected Allies)

Source: Mahlstein et al. (2022).

Figure 5 Percent change in real GDP: Main case vs. extensions (selected non-Allies)

Source: Mahlstein et al. (2022).

Conclusion and policy implications

Our results here and in Mahlstein et al. (2022) suggest the following conclusions:

- Sanctions are costly for the Russian economy: Regardless of how economic harm is measured, Russia would sustain significant losses from an Allied trade embargo, even in the short run. An Allied import and export embargo leads to a deterioration of Russia’s terms of trade, as its relative export prices decline considerably. Moreover, Russia experiences inefficient reallocation of resources as it reorganises its economy towards autarky and away from relatively efficient and advanced trading partners, and less trade overall.

- Withdrawal of Allied FDI is a powerful sanction tool: Withdrawal of Allied FDI causes colossal damage to the Russian economy at little to no economic cost to Allied and non-Allied economies. In order to increase harm on Russia while minimising self-harm, Allies could take measures to further reduce FDI. To make that work, they might consider carrot-and-stick measures vis-à-vis domestic multinationals invested in Russia. The ‘stick’ could entail prohibiting all new FDI or pressuring the private sector to exit Russia. Whether such pressure is social, political, or fiscal is thereby secondary, as long as the withdrawal is swift and complete. In return for companies’ compliance, and as a ‘carrot’, Allies may wish to contemplate financial adjustment mechanisms for severely affected companies.

- For Allies, the economic pain resulting from their trade embargo is unevenly distributed: Countries that have been highly integrated into the Russian economy (e.g. Germany), and resource-poor East Asian economies stand to experience the greatest economic losses from an Allied trade embargo. A few resource-rich Allies even experience welfare gains. To prevent the coalition from breaking apart, and/or to avoid economic shockwaves throughout the world economy, the Allied coalition may wish to soften the economic blow to the most adversely affected countries. One way to do that would be further reductions in trade barriers among the Allies themselves. Another could be the development of international burden-sharing plans or adjustment assistance.

- Non-Allies also stand to lose: Most non-Allies would likely suffer real GDP losses as a result of an Allied trade embargo. While non-Allies benefit from trade diversion effects, they experience higher losses from increased transaction costs of doing business with Russia. The spectre of economic losses may sway non-sanctioning countries to help the Allies persuade Russia to cease its aggression.

- Don’t wait for China: China imposing sanctions achieves mixed results. While it would cause greater harm to Russia, both China and the Allies would also be adversely affected by this move. This suggests that the economic case for convincing China to become an Ally may be less persuasive than previously thought, because (i) it results in more economic harm on Allies, while (ii) the incremental harm on Russia is limited. Also, (iii) given that China’s relative losses vis-à-vis the Allies would be considerable, its willingness to impose sanctions may be limited.

- Countersanctions by Russia would be self-defeating: If Russia were the party enacting countersanctions against Allies first, it would experience significantly higher economic losses, while losses to Allies would be far smaller. The Allies thus may consider holding back initially, waiting instead to see whether Russia retaliates with its own measures on Allies first.

References

Bachmann, R, D Baqaee, C Bayer, M Kuhn, A Löschel, B Moll, A Peichl, K Pittel and M Schularick (2022), “What if Germany is cut off from Russian energy?”, VoxEU.org, 25 March.

Chepeliev, M, T Hertel and D van der Mensbrugghe (2022), “Cutting Russia’s fossil fuel exports: Short-term pain for long-term gain”, VoxEU.org, 09 March.

Evenett, S and M-A Muendler (2022), “Making Moscow Pay - How Much Extra Bite Will G7 & EU Trade Sanctions have?”, UC San Diego cBrief1 number 1, 11 March.

Felbermayr, G, H Mahlkow and A Sandkamp (2022), “Cutting through the Value Chain: The Long-Run Effects of Decoupling the East from the West”, Kiel Institute for the World Economy Working Paper No. 2210, March.

Ferrara, L, M Mogliani and J-G Sahuc (2022), “High-frequency macroeconomic risk measures in the wake of the war in Ukraine”, VoxEU.org, 07 April.

Langot, F, F Malherbet, R Norbiato and F Tripier (2022), “Strength in unity: The economic cost of trade restrictions on Russia”, VoxEU.org, 22 April.

Mahlstein, K, C McDaniel, S Schropp and M Tsigas (2022), “Estimating the Economic Effects of Sanctions on Russia: an Allied Trade Embargo”, EUI Robert Schuman Centre Working Paper 2022/36, May.

Organisation for Economic Co-operation and Development (OECD) (2022), “Economic and Social Impacts and Policy Implications of the War in Ukraine”, OECD Publishing, March, Paris.

Pestova, A, M Mamonov and Steven Ongena (2022), “The price of war: Macroeconomic effects of the 2022 sanctions on Russia”, VoxEU.org, 15 April.

World Trade Organization (2022), “The Crisis in Ukraine - Implications of the war for global trade and development”, Secretariat Note, 11 April.

Endnotes

1 At the time of this writing, the sanctioning countries include US, UK, EU27, Montenegro, Albania, North Macedonia, Japan, Korea, Taiwan, Singapore, Canada, Australia, New Zealand, Switzerland, Norway, Iceland, Liechtenstein, and the Bahamas. The most up-to-date list of sanctioning countries is maintained by PIIE.

2 For an up-to-date overview of Allied sanctions, see, for example, resources by Sidley Austin LLP.

3 We define the group of Allies as consisting of US, UK, EU27, Japan, Korea, Taiwan, Singapore, Canada, Australia, Switzerland, and Norway. This appears to capture most countries that have imposed sanctions of Russia, except for smaller trading partners for Russia such as New Zealand, Iceland, Liechtenstein, a few ex-Warsaw Pact countries, and the Bahamas.

4 See, for example, Investment Monitor (2022). Yale University’s CELI website for an up-to-date list of corporations that have withdrawn from or suspended operations in Russia.

5 Current and future rounds of Allied sanctions, and retaliation by Russia against foreign businesses, will likely exacerbate the costs of doing business in Russia by way of transportation and logistics costs, costs of financing and underwriting, complications in purchasing intermediate goods abroad, restrictions on cross-border sales or repatriation of profits, etc.

6 To define the shock of partial withdrawal of Allied FDI on a sectoral level, we multiply the foreign FDI share in each sector (available from Rosstat, Russia’s statistical agency) with the share of ‘Allied’ FDI (available from the Central Bank of Russia), and divide by two (to capture a 50% withdrawal of Allied FDI). To illustrate: In the motor vehicles and parts sector (GSC 43), foreign subsidiaries owned an average of 63.0% of fixed assets between 2018 and 2020. Using an 85% Allied share of total FDI, this yields a share of 53.6% of total assets held by Allies. The effect of a withdrawal of half of Allied FDI is then simulated as a TFP shock of ‑53.6%/2 = ‑26.8%.

7 See https://www.files.ethz.ch/isn/137386/111011_ACUS_IranChina.pdf

8 Shipping giants Maersk, MSC and CMA CGM have already halted cargo bookings in and out of Russia.

9 According to various sources (including Reuters and CSNBC) Russia is already forced to sell its oil at a 20% discount to China and India.

10 The first element – a 5% increase in non-tariff barriers – hereby reflects the higher real trade costs of doing business with Russia (‘sand in the gears of trade’). The second element – export subsidies and import taxes by Russia – captures attempts by Russia’s remaining trading partners to shift as much of these extra transaction costs onto Russia, and to exploit Russia’s weak negotiation position by demanding steep trade discounts.

11 We interpret our results as short-term effects. This is so, because our simulations are run as comparative statics (i.e. we do not allow labour and capital adjustment for each economy as a whole). In addition, two of the four components of our counterfactual – withdrawal of Allied FDI (component (iii) and trade cost increases of doing business with Russia (component (iv)) – inherently imply shorter-term effects.

12 Real income is the income of countries after adjusting for relative price changes (such as terms-of-trade effects or inflation). Real income changes are typically interpreted as a useful indicator of changes in a country’s economic welfare since real income measures the amount of goods and services that a country can actually purchase.

13 Take Germany as an example: Our model shows that German real GDP losses increase from 1.20% in the main case to 1.42% in Extension 1. An accession would result in a deterioration of China’s real GDP and terms of trade, and consequently in slower economic growth. Since China is one of Germany’s most important export markets, a demand shock in China would have nontrivial knock-on effects for the German economy. Germany is thereby not an outlier: all Allies (except for Norway) would record steeper losses if China joined the group of Allies.

14 For example, in early April 2022 it was reported that Russia was threatening to ban exports of certain agricultural and food products, timber, pharmaceuticals, and electronics to nations it considers ‘unfriendly’.

15 Note, however, that the resource reallocation by Russia in Extension 2 would produce terms-of-trade gains, making real income losses slightly smaller, as compared to the main case.

16 This is different from the main case of an Allied embargo, in which Russia only reacts to global price changes, but can otherwise operate freely (e.g. through parallel imports/exports). This requires less inefficient reshuffling of domestic resources, as compared to Extension 2, where Russia acts to exclude important import and export markets.

17 In Mahlstein et al. (2022) we estimate the economic effects of a complete withdrawal of Allied FDI (rather than a 50% withdrawal, as modelled here). The results suggest nearly a doubling of real GDP effects, as compared to the main case.

18 See https://www.federalregister.gov/documents/2022/04/08/2022-07757/prohibiting-new-investment-in-and-certain-services-to-the-russian-federation-in-response-to

19 This statement only holds true as long as China abstains from actively undermining Allied sanctions (e.g. via parallel imports). Moreover, we are, of course, not making statements about the expediency of a potential accession by China for political, diplomatic, or national-security reasons. China joining the Allies in sanctioning Russia may be desirable for purely non-economic reasons.