The Global Crisis that started in 2007 shook the confidence in inflation targeting as a well performing monetary policy framework. The crisis resulted in policy interest rates being stuck near zero levels for a very long time in the US and Europe. An earlier crisis in Japan led to very low rates since the mid-1990s. The so-called zero lower bound (ZLB) constraint for policy interest rates led to new interest in ways to avoid or get out of the ZLB regime (also called the ‘liquidity trap’).

Some prominent central bankers have made calls to reform the monetary policy framework. One particular suggestion has been that price-level targeting could be a more appropriate framework for monetary policy rather than inflation targeting. Evans (2012) argued that price-level targeting might be used to combat the liquidity trap. Carney (2012) made a related suggestion that with policy rates at ZLB, "there could be a more favourable case for nominal GDP targeting" (nominal GDP targeting is related to price-level targeting).

More recently, Williams (2017) and Bernanke (2017) have expressed support for flexible price-level targeting. Bernanke advocates temporary price-level targeting as an alternative framework for monetary policy. Bullard (2018) recommends a further study of price-level targeting.

Interestingly, despite the strong advocacy mentioned above, there is in fact very little actual experience with price-level targeting. Historically, the closest example to our knowledge is Sweden, which a long time ago in the 1920s and 1930s briefly flirted with monetary policy somewhat akin to price-level targeting. Jonung (1979) and Berg and Jonung (1999) discuss two episodes of price-level stabilisation in Sweden in 1921-22 and in the 1930s.

Recent research on price-level targeting

Most of the academic literature on price-level targeting employs the rational expectations (RE) framework.1 A seminal paper, Eggertsson and Woodford (2003), considers optimal monetary policy and a modified form of price-level targeting under RE in a liquidity trap. Eggertsson and Woodford argue that price-level targeting gives guidance in terms of history-dependence of monetary policy and is a good policy under the ZLB constraint.

Rational expectations, however, implies a very strong assumption about agents' knowledge of the economy. This is so especially if the economy is in a recession and faces risks of deflation. The assumption of RE becomes informationally very demanding in such a scenario. Ambler (2009) and Hatcher and Minford (2014) comment on the role of the RE assumption and mention some alternatives, but do not systematically analyse the significance of imperfect knowledge.

In a recent paper, we relax the RE assumption and analyse price-level targeting as a monetary policy framework under conditions of imperfect knowledge and learning. They present a systematic analysis of its role for escaping the liquidity trap (Honkapohja and Mitra 2018).

Limited initial credibility suffices

Credibility of price-level targeting is likely to be fairly low upon its introduction when the ZLB prevails. We emphasise that the performance of price-level targeting should be assessed in the presence of endogenously evolving credibility of such monetary policy. The key question is whether this credibility can improve over time.2 Remarkably, it turns out that the economy can escape from the ZLB even if the initial credibility of a newly introduced price-level targeting regime is only slightly positive.

We employ a standard new Keynesian model and are careful with modelling nonlinearities and multiple equilibria. The key result is that the introduction of price-level targeting in the presence of the ZLB and sluggish economic activity induces the economy to escape from the recessionary scenario towards the target equilibrium.

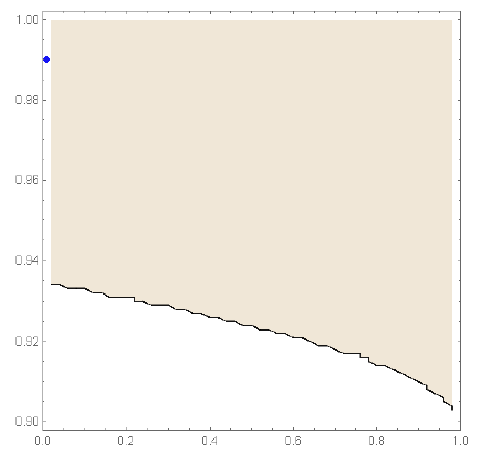

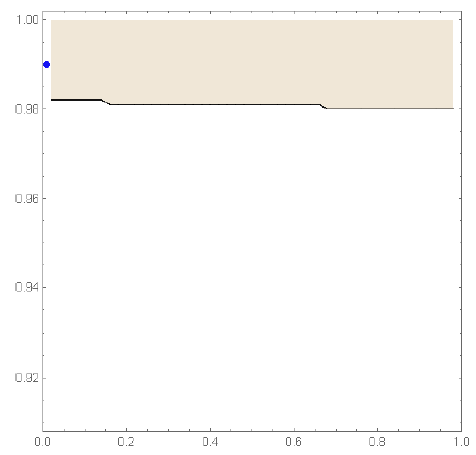

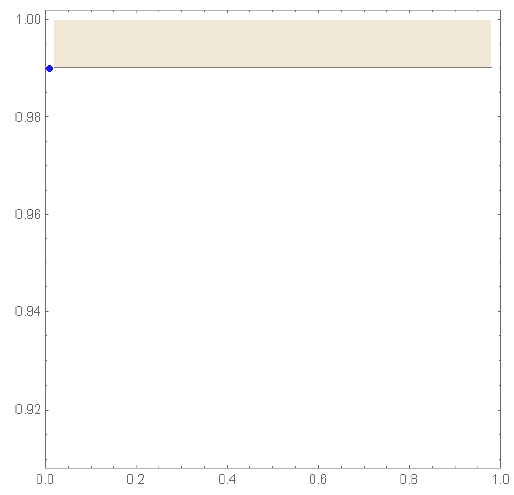

Figure 1 illustrates the result using three panels. Three current conditions – namely, the level of initial credibility, expectations of future output, and expectations of future inflation – are central to the issue of convergence back to target equilibrium.

We fix output expectations at three different values to get a two-dimensional graphic. The shaded area in each panel gives the set of initial credibility (measured on horizontal axis) and inflation expectations (measured on vertical axis) from which there is convergence back to the target equilibrium. The figure legends indicate the fixed value of output expectations in each case. The dot in the figure panels gives the level of inflation at the ZLB-constrained equilibrium.

Figure 1A Basin of attraction for PLT, initial output expectations set at slightly above the target steady state.

Note: Different degrees of initial credibility are plotted along the horizontal axis and initial inflation expectations along the vertical axis

Figure 1B Basin of attraction for PLT, initial output expectations set at the target equilibrium

Note: Different degrees of initial credibility are plotted along the horizontal axis and initial inflation expectations along the vertical axis.

Figure 1C Basin of attraction for PLT, initial output expectations set at liquidity trap level

Note: Different degrees of initial credibility are plotted along the horizontal axis and initial inflation expectations along the vertical axis.

It is apparent that the current conditions in output expectations, inflation expectations, and initial credibility are important for convergence back to target equilibrium. Higher output expectations and initial credibility can facilitate convergence back to target. Regarding inflation expectations, convergence back to the target obtains for all values of inflation expectations that are not too low, i.e. they are above the ZLB-constrained equilibrium.

The result about escaping the liquidity trap depends on several conditions besides the degree of initial credibility. The policymaker should obviously announce the future target path for the price level upon the move to price-level targeting. Opacity about the target price path yields no advantage in dynamic guidance in comparison to IT.

With knowledge about the target price path, the significance of additional guidance depends on the credibility of the newly introduced price-level targeting policy, i.e. how much weight the information about the target price path has in the agents' forecasts of inflation. Private agents can combine inflation forecasts based on the target price path with forecasts based purely on inflation statistics. We define credibility of price-level targeting in terms of the weight of the former forecasts relative to the latter. The weights evolve endogenously over time in accordance with a standard model of reinforcement learning.

Assessing robustness of monetary policy regimes

Figure 1 employs a novel way to assess robustness of a monetary policy regime. The concept of the basin of attraction of the targeted equilibrium is the set of all initial conditions that result in convergence back to the target equilibrium. A large basin of attraction means that the economy gets back to the equilibrium even after a large (say, deflationary) shock. The panels in Figure 1 show how the basin of attraction depends on the initial credibility of price-level targeting and initial inflation expectations, keeping initial output expectations fixed at the indicated levels.

Even a small positive degree of initial credibility of price-level targeting can have big benefits in the sense that the basin of attraction is significantly larger than in the case of price level targeting with opacity or inflation targeting. Less surprising is the result that a higher degree of initial credibility leads to a larger basin of attraction.

These results are also sensitive to the ratio of actual price level to its initial target value. The ratio should not be too high (see Figures 5A and 5B in Honkapohja and Mitra 2018). This observation is consistent with the historical evidence from Sweden cited above. The Swedish experience during the 1920s was unfavourable, whereas the experience in the 1930s episode was much more successful, and this was in part due to difference in the initial price level targeted by the authorities on the two occasions.

We conclude by stressing that the comparison of inflation targeting and price-level targeting depends on the current state of the economy: whether the economy is currently in a deflationary situation or in a ‘normal’ situation (i.e, near the target equilibrium). We show that inflation targeting is more robust than price-level targeting in terms of the basin of attraction in a ‘normal’ situation (see, fro example, Figure 4 in Honkapohja and Mitra 2018).

References

Ambler, S (2009), “Price-Level Targeting and Stabilization Policy: a Survey,” Journal of Economic Surveys 23: 974—997.

Berg, C and L Jonung (1999), “Pioneering Price Level Targeting: the Swedish Experience 1931-1937,” Journal of Monetary Economics 43: 525—551.

Bernanke, B (2017), “Monetary Policy in a New Era,” Peterson Institute Conference on Rethinking Macroeconomic Policy, October.

Bullard, J (2018), “A Primer on Price Level Targeting in the U.S.,” speech at the FRB of Saint Louis.

Carney, M (2012), “Guidance,” Speech, www.bankofcanada.ca.

Coenen, G and V Wieland (2004), “Exchange-rate Policy and the Zero Bound on Nominal Interest Rates”, American Economic Review, Papers and Proceedings, 94, 80-84.

Eggertsson, G B and M Woodford (2003), “The Zero Bound on Interest Rates and Optimal Monetary Policy”, Brookings Papers on Economic Activity (1): 139—233.

Evans, C L (2012), “Monetary Policy in a Low-Inflation Environment: Developing a State-Contingent Price-Level Target,” Journal of Money, Credit and Banking 44: 147—155.

Gibbs, C G and M Kulish (2017), “Disinflations in a Model of Imperfectly Anchored Expectations,” European Economic Review 100: 157—174.

Hatcher, M and P Minford (2014), “Stabilization Policy, Rational Expectations and Price-Level versus Inflation Targeting: A Survey,” CEPR Discussion Paper No. 9820.

Honkapohja, S and K Mitra (2018), “Price Level Targeting with Evolving Credibility”, CEPR Discussion Paper No. 12739.

Jonung, L (1979), “Knut Wicksell’s Norm of Price Stabilization and Swedish Monetary Policy in the 1930s,” Journal of Monetary Economics 5: 459—496.

Kryvtsov, O M, A Shukayev and A Ueberfeldt (2008), “Adopting Price-Level Targeting under Imperfect Credibility: An Update,” Working paper 2008-37, Bank of Canada.

Williams, J C (2017), “Preparing for the Next Storm: Reassessing Frameworks and Strategies in a Low R-star World,” FRB Economic Letter 2017-13: 1—8.

Endnotes

[1] See Ambler (2009) and Hatcher and Minford (2014) for recent surveys.

[2] The evolution of credibility is described as reinforcement learning from relative performance on the part of economic agents. A few earlier papers have allowed for exogenously fixed imperfect credibility, see Coenen and Wieland (2004), Gibbs and Kulish (2017), and Kryvtsov et al (2008).