Even as the first Vox eCollection is going online, the global economy is being shaken by events ranging from a Chinese economic slowdown to the possibility of a delayed Greek Eurozone exit. The fact that such events can be viewed as dangerous for the world economy as a whole is a powerful testimony to how profoundly fragile are macroeconomies and financial sectors in the mature economies – four and half years after the eruption of the global crisis.

The current imbalances in the Eurozone as well as among advanced countries are not necessarily rooted in a lack of fiscal discipline. Yet the sharp increase in public debt (explicit and implicit) has progressively shifted policy priority to fiscal consolidation. A high stock of public liabilities is feared to be hampering investment and growth, and making an economy excessively vulnerable to market sentiments. Within the Eurozone, fiscal adjustment is held back by the additional constraint of a common monetary policy, and the lack of a common budget providing insurance across regions.

This eCollection provides a synthesis of the current debate, on whether the consolidation programs adopted by several countries since 2011, cut too much and too soon, thus creating an unnecessary contractionary bias and macroeconomic risk. In the Eurozone, the backlash from such policy mistakes could easily undermine social consensus towards the common currency and jeopardise progress towards integration.

It is important to clarify from the start that the debate is not about the need for fiscal discipline. In advanced countries, with an ageing population and rising healthcare costs, the large expansion of debt due to the crisis is an unwelcome addition to the fiscal burden that requires a convincing policy response. Rather, the debate is about the extent to which spending cuts and tax hikes in the short run are desirable and effective in containing the prospect of sovereign risk crisis.

The questions have different angles. To set the stage for the eCollection, it is useful to single out three of these.

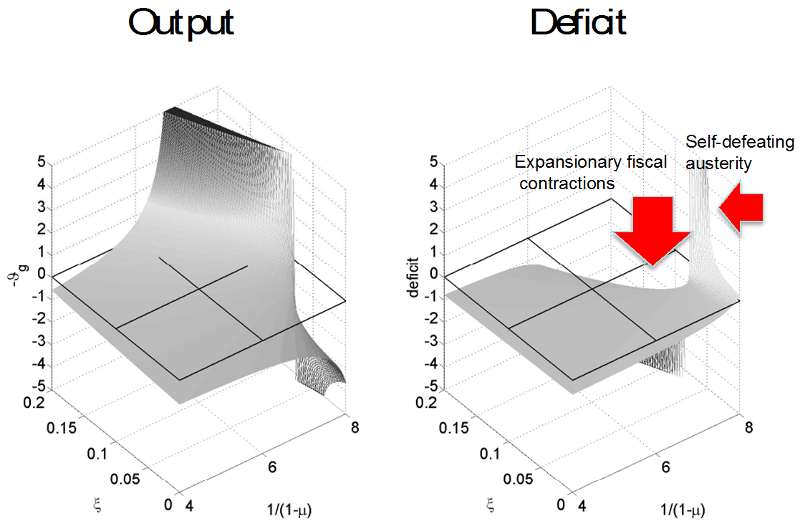

The first angle concerns the fiscal multiplier when markets charge a risk premium on government debt. This dimension can be illustrated by means of a Figure that I borrow from joint work with Keith Kuester, Andre Meier, and Gernot Mueller (Corsetti et al. 2012 ). The Figure is produced based on a standard new-Keynesian model, extended to encompass the possibility that (a) markets price sovereign risk based on expectations of future deficits and debt, and (b) sovereign risk spillover on private borrowing costs. In the model, (a) markets assess sovereign risk based on their expectations of future fiscal performance; and (b) rising risk premia on sovereign debt in turn creates jurisdiction risk, affecting all residents in the economy, via a deterioration of the balance sheets of banks and corporates, increasing taxation risk, rising tariffs and costs of utilities, falling internal demand, etc.. Because of these reasons, fiscal stress translates into higher interest rates for private agents.

The figure is drawn assuming a large recessionary shock that causes the monetary authorities to bring (nominal) policy rates to zero, and study the effect of an upfront cut in spending expected to last for the entire duration of the on-going recession. The model is calibrated in reference to the US economy (see Corsetti et al. 2012 for details).

The figure plots the response of output (left graph) and the deficit to GDP ratio (right graph) to a spending cut by 1% of GDP, against two key features of the crisis. On the right axis is the expected duration of the recession, in quarters, running from 4 to 8 (two to four years). On the left axis is the sensitivity of risk premia to expected deficits, which is rising in the initial stock of debt.

The figure conveys a key message. If the recession is not expected to last very long (below four quarters), upfront spending cuts cause a moderate fall in output, and end up reducing the deficit. The contractionary impact of the Keynesian multiplier is attenuated by the positive effects of the cut on the interest rate on sovereign debt, reflected by private borrowing costs.

However, when the anticipated duration of the recession is longer – between one and two years in our simulations – the picture changes radically. With a low sensitivity of the sovereign risk premium to future deficits, the multiplier effect dominates and becomes quite large – this is the case recently stressed by Christiano et al. (2011). Because of a large multiplier, upfront cuts are self-defeating: the deficit-to-GDP ratio actually rises.

But with a high initial public debt and/or a higher sensitivity of the risk premium to future deficits (moving up on the left-hand axis), the macroeconomic impact of the cut changes sign: at some point, contractions become expansionary. In the simulations underlying the graph, the conditions for expansionary contractions are strict (the debt-to-GDP ratio exceeds 110%), and results are sensitive to assumptions. Most importantly, the borderline between self-defeating and expansionary contractions is quite thin: small differences in the state of expectations and market attitude may make a large difference on the outcome. Moreover, as the anticipate duration of the recession becomes longer and longer, the economy becomes highly vulnerable to self-fulfilling crises. These results are actually quite consequential for policy.

Despite the highly stylised nature of the analysis, there are two general lessons to be learnt:

- The best strategy for debt consolidation is not the same across countries. Early implementation of cuts to signal a government determination may work for countries with an already compromised fiscal stance, reflected in risk premia. There is little need for rushing into cuts for countries with a relatively strong fiscal position, currently benefitting from negative risk premia. More complex is the situation of countries that have faired well so far, often exploiting their monetary independence, but may still face the risk of deterioration of market sentiments because of underlying weaknesses.

- As expectations about output growth, and the sensitivity of risk premia to the future path of debt and deficits, can (and do) vary significantly over time, it is quite difficult to assess the impact of fiscal reform. Plans that are well designed under a certain scenario, may turn out to be counterproductive for small differences in it. This consideration calls for a cautious approach to debt consolidation, preferring, when possible, steady reforms with effect over time.

Indeed, according to the model, adopting measures that phase in cuts in the future in a credible way vastly improve the macroeconomic outcome.

The second angle of the question is the impact of fiscal reform on uncertainty. Namely, there is widespread consensus on the idea that, at the root of the global crisis, there is a significant increase in uncertainty that has motivated firms and households to adopt precautionary cuts in consumption and investment plans, causing the large recession and thus exacerbating the fiscal stance.

Successive rounds of budget plans of increasing severity may have in some circumstances created anxiety and confusion. This is so especially in countries where the sacrifice of tax hikes and cuts have so far not corresponded to any improvement in the macroeconomic conditions.

- A key criterion for the success of fiscal consolidation is as simple as this: measures that reduce uncertainty are likely to be more effective. Measures that raise uncertainty are likely to less effective, if not counterproductive.

The last dimension concerns what lies on top and beyond fiscal consolidation. While public solvency is a necessary condition for stabilising markets, much of the crisis has global roots. What is the new macroeconomic and financial framework for the Eurozone and the global economy as a whole? What is the main strategy for dealing with the consequences of imprudent over-lending and excessive risk taking by the surplus countries or sector within a country, which now focus on exploiting the advantage of their creditor status, corresponding to the excessive borrowing by countries and sectors now facing painful adjustment? What policy model can at once correct misalignment of relative prices, and minimise the problems created by debt overhang, before these erode and political consensus to reform? Experience and theory suggest that confidence crisis and fundamental weakness interact in a crisis. Can the international economy effectively guarantee liquidity and firewalls against contagion?

- Fiscal consolidation is not sufficient to restore macroeconomic stability. Worse, it may not be within the reach of governments without international policy design that provide a sense of directions.

The contributions of the eCollection shed light on these different dimensions.