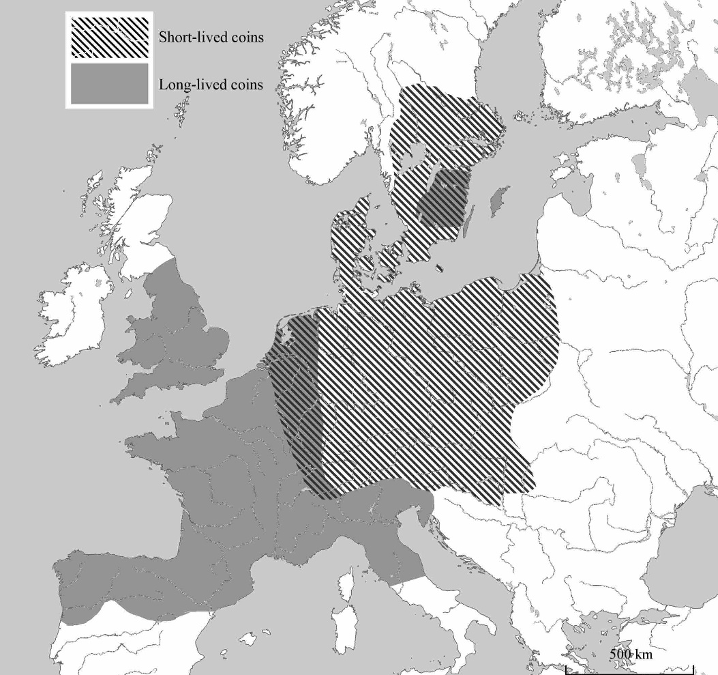

The Gesell (1906) tax1 is receiving increasing attention due to the empirical relevance of the zero lower bound. What most economists and economic historians do not know is that a Gesell tax – called periodic recoinage, or renovatio monetae in Latin – was applied for between 150 and 200 years in large parts of medieval Europe (England, Germany, Scandinavia, Central and Eastern Europe), as Figure 1 shows.

Figure 1 Periodic recoinage in medieval Europe, 1140–1290

Source: Svensson, and Westermark (2020).

Note: England had periodic recoinage 973–1125, and Normandy 930–1100.

In a system with periodic recoinage, old coins were declared invalid and had to be exchanged for new ones at exchange fees and dates that were known a priori. Renewals could occur as often as twice a year, and a common exchange fee was four old coins against three new ones. Thus, the tax level depended both on the exchange fee and the time between recoinage dates. Periodic recoinage was a transparent system with full information about dates and exchange fees.

The historical motivation for using the periodic recoinage tax was to tax inhabitants and local trade. It is functionally equivalent to a tax on money holdings, as proposed by Gesell (1906). Surprisingly, periodic recoinage has seldom, if ever, been mentioned or analysed in the literature of economics.

In this column, we focus on three questions:

- What conditions must be fulfilled for periodic recoinage to work

- How periodic recoinage worked in practice, and which policy tools the minting authority could use to enforce the system

- Why the system broke down.

Conditions for the system to work

Svensson (2016) sets up a theoretical framework for the basic conditions for periodic recoinage. Periodic recoinage requires a geographical currency constraint (foreign coins must be invalid), an exchange monopoly, and control of marketplaces. Only one coin type should circulate in the currency area, and the different issues need to be clearly distinguishable for the everyday users of the coins. Practically, this was accomplished by changing the main design of the coins, whereas the monetary standard remained unchanged (see Figure 2).

Figure 2 Three coin issues from the mint Hildesheim (Germany) c. 1240–60, where coins were annually renewed

Periodic recoinage could occur at high frequency (that is, annually or biannually) in small currency areas such as Central and Eastern Europe, in which the system was relatively easy to monitor. There are also some examples of periodic recoinage in larger areas, for example in England between the year 973 and 1125, but with less frequent renewals – in this case, every three or six years.

Periodic recoinage works particularly well in relatively undeveloped economies. These economies have a small volume of coins in circulation, which makes reminting easier. There are also few places in which coins are used for transactions in these areas, and few groups in society who use coins – in other words, low monetisation. These conditions make monitoring and enforcement of periodic recoinage easier.

Typically, periodic recoinage was enforced only within a city’s borders, and any coins could be used outside the city. The authorities had several methods to monitor and enforce periodic recoinage. First, they used exchangers and other administrators at the city markets for monitoring. Second, the recoinage date was often just before an important annual fair, or the payment date of an annual tax. Third, the payment of any fees, taxes, rents, tithes, or fines had to be made in new coins. Empirical evidence from hoards shows that people were more willing to exchange their old coins for new ones when the interval between recoinage dates was longer. Thus, lower tax rates make periodic recoinage work better.

Policy tools and price fluctuations

In Svensson and Westermark (2020a), we set out a cash-in-advance model to capture the implications of periodic recoinage. Our model includes households, firms and a monetary authority. Households care about cash and credit goods and can hold both new and old (illegal) coins. The choice of which coins to hold is endogenous.

The government receives seigniorage from recoinage fees, which are used to finance government consumption. The government has three policy instruments to affect people’s willingness to use legal coins and hand-in old coins for recoinage: the exchange fee level between old and new coins; the period length between recoinage dates; and the effort of plaintiffs, who try to detect people using illegal coins.

The results of the model show that the system with Gesell taxes works and generates revenue:

- if the exchange fee is sufficiently low,

- if the period of time between two instances of re-coinage is sufficiently long, and

- if the probability of being penalised for using old illegal coins is sufficiently high.

Prices increase during an issue period and fall immediately after the recoinage date. This is because money supply increases during an issue and drops at the recoinage date. When the government has collected exchange fees, it starts to spend the revenues and coins are distributed in the private sector, increasing money holdings. The higher the Gesell tax, the greater the price increases (as long as the coins are surrendered for recoinage). Finally, an increase in the cost of non-cash alternatives like bartering tends to make periodic recoinage more viable. This is because more transactions are made in the market, leading to higher government revenues.

The breakdown

There are other conditions for periodic recoinage to work in practice: there should be a limited number of coins in circulation, and the minting authority must be able to enforce the geographical currency constraint. If either of these conditions is not fulfilled, there is a risk that the periodic recoinage system will fail (Svensson and Westermark 2020b).

Renewals should also work better in small currency areas, since it is easier to enforce the exchange monopoly and monitor the use of illegal coins. If currency areas become larger, renewals will be more difficult to undertake, or else the period between renewals has to increase.

Empirical observations have shown that the coin volume in circulation increased substantially in central, northern and eastern Europe in the second half of the 13th century. This was for two reasons: first, specialisation and labour division increased within cities, requiring more coins for transactions; second, authorities started collecting their taxes and fees in coins, rather than in naturals or services. When the coinage volume increased, it became more difficult to re-mint coins on a timely basis. And when coins were used everywhere, including outside the city walls, monitoring and enforcement became costlier.

Another reason for the system failure was the increased inter-regional trade and increased use of supra-regional coins, such as groschens and hellers. Trade between cities became more important when cities reached a certain level of specialisation. Goods were exported between regions, and these inter-regional goods were priced in terms of supra-regional coins. Eventually, transactions with inter-regional goods were also conducted with supra-regional coins and it became more difficult for local authorities to enforce their coin monopoly. Thus, the periodic recoinage system was abolished in the period 1290 to 1320 in large parts of Europe, and long-lived coins were introduced. Minting authorities had to use other means to raise revenue from coinage, such as coin debasements.

References

Gesell, S (1906), The Natural Economic Order, translated from German by Philip Pye (1958), Peter Owen.

Svensson, R (2016), “Periodic Recoinage as a Monetary Tax: Conditions for the Rise and Fall of the Bracteate Economy”, Economic History Review 69(4): 1108–31.

Svensson, R and A Westermark (2020a), “Renovatio Monetae: When Gesell Taxes Worked”, International Economic Review, forthcoming.

Svensson, R and A Westermark (2020b), “Economic Factors Explaining the Break-Down of Periodic Recoinage”, stencile.

Endnote

1 Silvio Gesell argued in favour of a stamp tax on money.