There is ample evidence that protectionism responds to economic and political shocks (Bown and Crowley 2013). Moreover, tariff threats increase trade policy uncertainty and thus reduce trade (Crowley et al. 2016). Reductions in trade policy uncertainty through WTO commitments encourage firms to invest to enter new markets and expand exports (Handley 2014), which can lower prices and increase consumer welfare, as we find for the US after China’s WTO accession (Handley and Limão 2017a). Entry into credible preferential trade agreements can also further strengthen policy commitments, reducing trade policy uncertainty and increasing exports, as we find in Handley and Limão (2015) for Portugal’s accession to the EU.

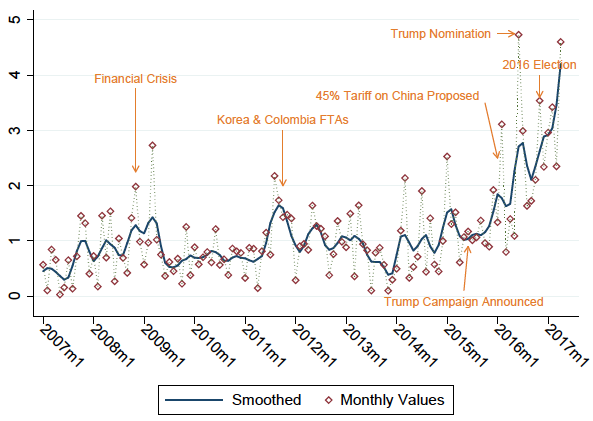

Threats to start trade wars and to renegotiate or ignore international commitments reduce the beneficial effects of trade agreements. Two events in 2016 increased trade policy uncertainty substantially: the British vote to leave the EU in June, and Donald Trump’s nomination as the GOP candidate in July. One index of the Trump trade policy uncertainty is shown in Figure 1 – the share of newspaper articles about international trade or trade policy that also mention “uncertain” or “uncertainty”. This index increased when the campaign was announced, upon his nomination, and upon his subsequent election – when he took office, trade policy uncertainty reached its highest level in a decade.1 In Handley and Limao (2017b), we note various potential actions of the incoming administration that were sources of trade policy uncertainty. Several of these have now occurred, including the US withdrawal from TPP, and renegotiations of its preferential trade agreements (PTAs). In March 2018, President Trump announced he planned to impose tariffs of 25% on steel and 10% on aluminium on all countries, and added that “trade wars are good… and easy to win” after other countries threatened retaliation (New York Times 2018).2 Notably, three of the four largest steel import source countries are US PTA partners, namely, Canada, South Korea, and Mexico. The exemptions for Canada and Mexico announced on 9 March are welcome. But they are conditional on unspecified concessions on NAFTA renegotiation and only temporary – two factors that could prolong a period of uncertainty and undermine the value and stability that NAFTA and other PTAs provide for US firms, especially if this tactic is normalised.

Figure 1 New-based index of trade policy uncertainty, 2006-2017

The possibility of a trade war initially translated into tangible stock market declines. But even if the US steps back from the brink, , the new trade cold war – defined by the higher probability of breaking up agreements and entering a 'hot' trade war – is already undermining the credibility of the world trade system.3 In this column, we focus on how US exporting firms (and thus their suppliers and workers) are hurt by uncertainty, especially during an economic crisis (Carballo et al. 2018). We find evidence that the interaction of economic and policy uncertainty exacerbated the reduction of trade in the 2008 Global Crisis.4 This was mitigated in part by US PTAs that provided insurance against adverse policy shocks when demand volatility increased.

Export dynamics and the value of agreements

The recent challenges to the rules-based global trade system highlight why international trade is a fruitful avenue to explore the interaction of policy and economic uncertainty more broadly. Export entry into foreign markets requires sunk cost investments, which firms may not undertake if they perceive additional demand volatility and risk due to shocks that may discriminate against them, such as exchange rate or policy movements. The potential policy response in periods of high economic uncertainty and turmoil, even if well-intentioned, can often amplify risk for firms that export. This was a concern of G20 members during the Global Crisis and the rapid collapse in global trade. In response, they repeatedly pledged that “[w]e will not repeat the historic mistakes of protectionism of previous eras” in order to quell fears of a tit-for-tat trade war similar to the one triggered by the Depression. By 2016, the G20 was explicit about concerns with policy uncertainty and spillovers, stating “[w]e will […] clearly communicate our macroeconomic and structural policy actions to reduce policy uncertainty, minimize negative spillovers and promote transparency”.5 This language was notably absent from the 2017 Hamburg G20 Leaders’ declaration.

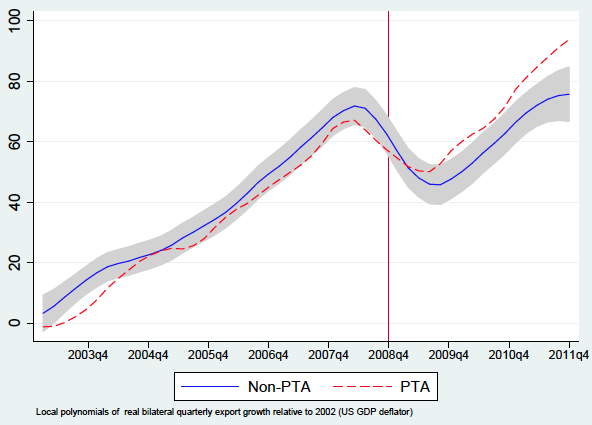

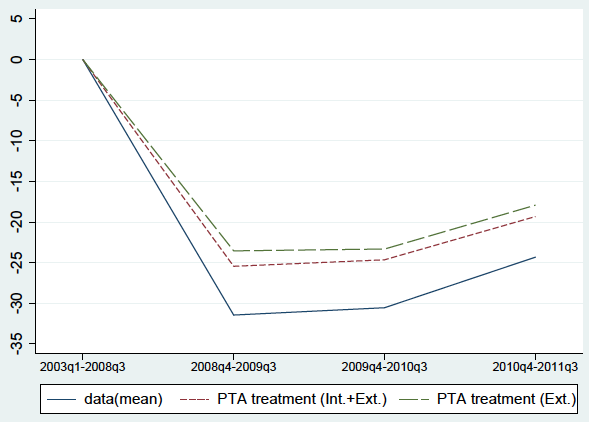

Figure 2 Export growth to PTA and non-PTA destinations, 2002-2011

US exports contracted by 22% from 2008Q3 to 2009Q2, but the severity of the collapse and speed of recovery varied across trade policy regimes. In Figure 2, we see that export growth toward US PTA partners declined less during the crisis and recovered more quickly. We estimate a growth differential during the crisis for PTA exports of about 10% after controlling for other standard supply and demand determinants of trade. More importantly, we find the PTA differential is largest in countries with higher GDP risk. We do not find a similar differential between PTA membership and risk prior to the crisis, from 2002-2008Q3, which suggests a role for PTAs in mitigating uncertainty during the crisis.

We develop a model consistent with this aggregate evidence and examine its predictions using detailed firm-level data. Reducing overall demand uncertainty always increases export market entry and exports in our framework. But if adverse trade policy shocks (i.e. protectionism) tend to arrive in tandem with negative income shocks, then the trade-reducing effects of increased volatility during a crisis can be amplified by an interaction between economic and policy uncertainty. If trade agreements constrain governments through their long-term and credible policy commitments to keep trade barriers low in good and bad times, then they should be valuable to exporters and their governments, especially during a downturn.

We estimate and quantify these effects using data from the US Census Bureau for the period 2003-2011, which includes a period of expansion prior to the crisis, the crisis itself, and its aftermath. The firm-level data allow us to estimate differential effects of income uncertainty for PTA and non-PTAs, and also across different margins – new products per firm (i.e. varieties) and value of existing ones – while controlling for various potential confounding factors. We highlight several key findings.

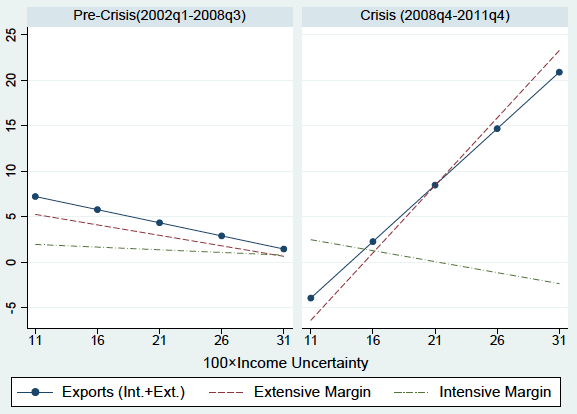

First, the net entry of US varieties was higher towards PTAs relative to non-PTA markets, particularly where income uncertainty was high. The right panel of Figure 3 shows that the higher overall export growth toward PTA countries from Figure 2 is driven by this extensive margin differential, which was not present before the financial crisis, as seen in the left panel.

Figure 3 PTA export growth differential, pre- and post-crisis

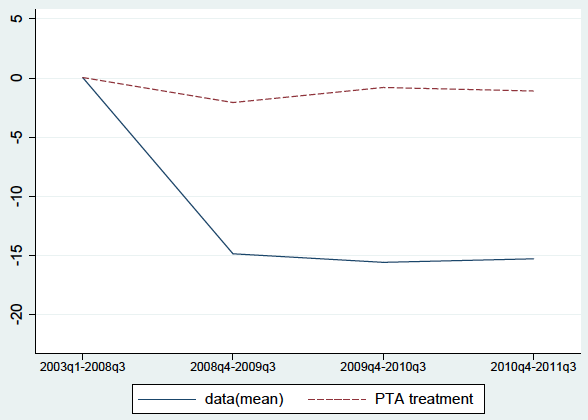

Second, using the non-PTA sample, we ask what its net entry and export growth path would have been without a crisis versus its path if those countries had a PTA in place. In Figure 4, we show that average net exit for non-PTA destinations was 15% below the ‘no crisis’ path by the fourth quarter of 2011 (the solid line). Most of this effect would be eliminated if those countries had a PTA (the counterfactual dashed line). The effect on exports is sizeable as well. In Figure 5, we see a large cumulative decline in aggregate exports (the solid line) to non-PTA countries in the data. If a PTA had been in place, that drop would have been cut by one third, or about 8% for the extensive margin.

Figure 4 Non-PTA average growth in firm varieties if treated as if PTA member

Figure 5 Non-PTA export growth margins if treated as if PTA member

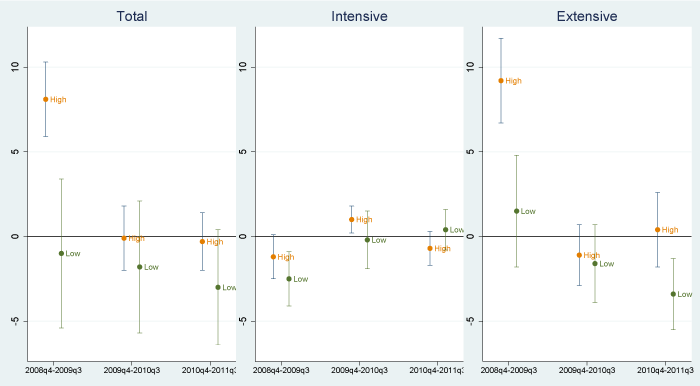

Going further, we then split our sample into industries that would face high or low tariffs in a trade war according to importer market power.6 In Figure 6, we find that the PTA export growth differentials were highest in the industries that faced high potential protection, whereas the differential is small if potential protection was low.

Figure 6 PTA export growth differential by high and low potential protection, measured by importer market power

A summary statistic that places the value of agreements into perspective is the foreign income growth differential required to offset the difference in US exports to non-PTA versus PTA markets from uncertainty. In 2011, closing the gap between the actual export growth and the PTA treatment counterfactual from Figure 5 is equivalent to cumulative foreign GDP growth from 2008-2011 of 5% for total exports, or 8% for the extensive margin.

Broader implications: That was then, this is now

Our findings suggest the current network of trade agreements lowered joint policy and economic uncertainty, particularly in high potential protection industries. Back in 2008, the WTO Director General argued the WTO provides “[…] the everyday economy, with a collective insurance policy against the disorder caused by unilateral actions, whether open or disguised; a guarantee of security for transactions in times of crisis, henceforth an element of resilience that is vital to the running of a globalized world. In short, a global insurance policy for a global real economy”. Our findings highlight the insurance value of PTAs during the last economic crisis – a benefit that can’t be ignored in light of recent US threats of protectionism, the renegotiation of NAFTA, and Brexit. The importance of WTO membership is less clear, but is also under threat. It may become increasingly important if some PTAs are weakened or dissolved. Renegotiation of agreements is not necessarily bad. But if negotiating international policy under duress or exiting first and hoping to work out the details later becomes more common, the value of these agreements in the next crisis may be greatly diminished.

References

Baker, S R, N Bloom, and S J Davis (2016), “Measuring Economic Policy Uncertainty”, The Quarterly Journal of Economics 131(4): 1593–1636.

Bown, C P, and M A Crowley (2013), “Import protection, business cycles, and exchange rates: Evidence from the Great Recession”, Journal of International Economics 90(1): 50–64.

Bown, C (2018), “Trump’s Steel and Aluminum Tariffs: How WTO Retaliation Typically Works”, PIIE Blog, 5th March.

Broda, C, N Limão, and D E Weinstein (2008), “Optimal Tariffs and Market Power: The Evidence”, American Economic Review 98(5): 2032–65.

Carballo, J, K Handley, and N Limão (2018), “Economic and Policy Uncertainty: Export Dynamics and the Value of Agreements”, NBER Working Paper 24368.

Crowley, M, H Song, and N Meng (2016), “Tariff Scares: Trade policy uncertainty and foreign market entry by Chinese firms”, CEPR Discussion Paper no. 11722.

Handley, K (2014), “Exporting under trade policy uncertainty: Theory and evidence”, Journal of International Economics 94(1): 50–66.

Handley, K, and N Limão (2015), “Trade and Investment under Policy Uncertainty: Theory and Firm Evidence”, American Economic Journal: Economic Policy (4).

Handley, K, and N Limão (2017a), “Policy Uncertainty, Trade, and Welfare: Theory and Evidence for China and the United States”, American Economic Review 107(9): 2731–83.

Handley, K, and N Limão (2017b), “Trade under T.R.U.M.P. policies”, in C P Bown (ed.), Economics and Policy in the Age of Trump, chapter 13, CEPR Press, London.

New York Times (2018), “E.U. Leader Threatens to Retaliate with Tariffs on Bourbon and Bluejeans”, 2 March.

Endnotes

[1] The index applies the basic methodology in Baker et al. (2016) who focus on domestic policy uncertainty.

[2] Such tariffs can reduce US imports by over $14 billion and lead to unprecedented levels of retaliation (see Bown 2018).

[3] In Handley and Limão (2017a), we show that US TPU has high costs for its consumers’ welfare – a modest increase in the probability of high protection against all its partners is equivalent to 1/3 of the cost US consumers would face if imports were banned.

[4] This research was conducted while the authors were Special Sworn Status researchers at the Census HQ and Michigan Research Data Centers. Any opinions and conclusions expressed herein are those of the authors and do not necessarily represent the views of the U.S. Census Bureau. All results have been reviewed to ensure that no confidential information is disclosed.

[5] G20 Communique, April 2, 2009, see here, and G20 Leaders' Communique from the Hangzhou Summit, September 5, 2016, see here.

[6] Some goods are more responsive to trade barriers than others and a foreign government would increase tariffs more on the least responsive goods, i.e. those where its market power is high. See Broda et al. (2008) for some empirical evidence.