How does design and governance influence central banks’ role as lenders? Today, most advanced economy central banks have strict rules to prevent conflicts of interest. Yet, given their role in the economy, central bankers cannot be fully isolated from private sector influence. For example, they might be tempted to rely on their personal or professional relationships with bankers to obtain better information about who to lend to, especially during a crisis when informational problems are heightened. They might also be subject to political pressures about bank bailout (Ball 2018) or be influenced by their past experience in the private sector (Mishra and Reshef 2019). Moreover, many countries around the world lack rules on conflicts of interest for central bankers and suffer from weak rule of law and corruption. It is not obvious why central banks in these countries should be more immune to these problems than the governments who charter them.

While a growing literature on connected lending has emerged over the past two decades (e.g. Akin et al. 2020, Bussolo et al. 2020), little is known about whether central bankers draw on personal connections during lender of last resort (LOLR) operations and what the consequences of doing so are. In recent research (Mitchener and Monnet 2023), we shed new light on these issues by drawing on detailed and non-anonymous central bank lending data. Because of privacy concerns and commercial bankers’ fear of stigma, such data are impossible to obtain from recent lender of last resort operations. We thus turn to history and previously unknown archival data from the central bank of France, Banque de France (BdF), which contains the names and amounts borrowed by all the main French commercial banks that borrowed during a severe financial panic that shook France’s financial system in 1930-31. We combine these hand-collected lending data with new information on the relationships between the BdF’s board of directors and commercial banks to understand whether these connections were utilised during a banking panic and to examine what effect they might have had on the central bank’s role as a lender of last resort.

This historical setting is especially well suited to study how personal links and private interests can affect the lender of last resort policy of a central bank. Of the more than 40,000 shareholders, only the 200 largest shareholders had voting rights, and it was these shareholders that selected the Regents, the BdF’s directors. This governance structure had important implications for how the central bank reacted to two waves of banking panics in the autumn of 1930 and summer of 1931.

The value of connections during crises

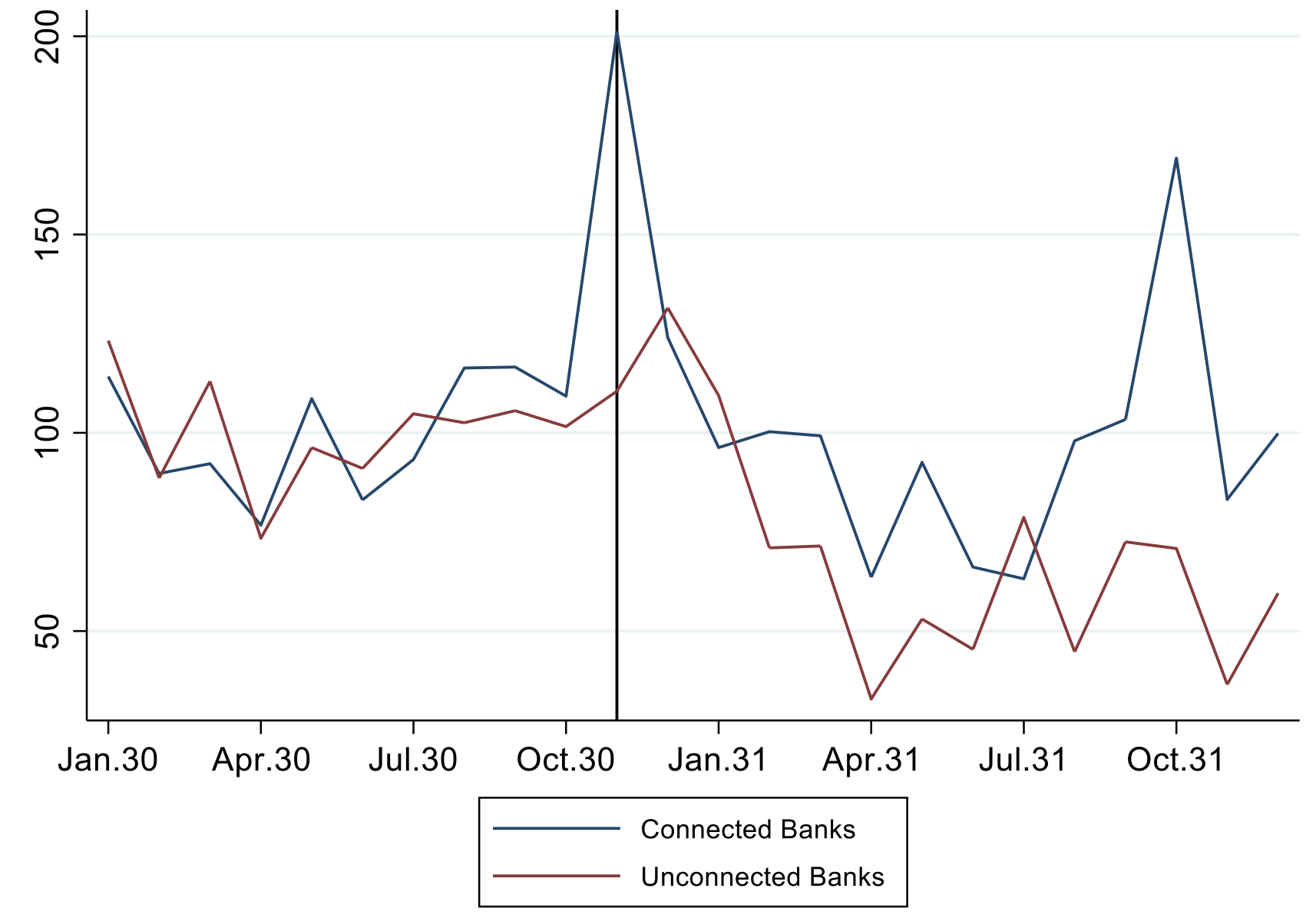

Once the banking panic began, the BdF’s lending policy assiduously relied on personal connections. Difference-in-differences regressions confirm the pattern shown in Figure 1. Once the panic commenced, the BdF lent disproportionately more to ‘connected banks’. (The BdF was directly connected to a commercial bank either because (1) a board member of a commercial bank was a voting shareholder of the BdF (including shareholders who were then elected as a board member of the BdF) or (2) the commercial bank itself was a corporate shareholder of the BdF.)

Figure 1 Lending to connected and unconnected banks (pre-crisis average=100)

Sources: Authors calculations using ABF, Comptes principaux; see Mitchener and Monnet (2023) for details.

Note: The vertical line (November 1930) denotes the first month of banking panic

Banks that had ties to the BdF’s 200 largest shareholders on average received 30–40% more than banks that were unconnected to BdF shareholders. By contrast, no difference in the evolution of lending is observed between the two groups prior to the crisis, and nor did connected and unconnected banks differ in terms of risk or solvency. Excluding systemically important financial institutions (SIFIs) or banks that failed during the crisis increases the difference in crisis-period lending between connected and unconnected banks to more than 60%. That the results hold when the largest banks or systemically important financial institutions are excluded, and are in fact stronger, suggests that becoming a shareholder of the BdF was not a strategic choice by largest banks before the crisis (a point also confirmed by balance tests on pre-crisis bank characteristics). Indeed, since France had never experienced a systemic commercial banking crisis, the reaction of the central bank during a panic was unknown as was the potential link between BdF lending and BdF shareholders.

The absence of lending of last resort and its consequences

When the surge in demand for liquidity came in November 1930, the BdF chose not to lend broadly to all eligible banks that approached its discount window for liquid assets – the optimal policy response suggested by theory dating back to Thornton (1802) and Bagehot (1873). Unconnected banks had nowhere else to turn, given the BdF was the main source of short-term liquidity in the French economy (i.e. France lacked an active and accessible interbank market), and depositors had no knowledge to whom the BdF was lending. As a result, the financial panic morphed into a widespread banking crisis that ultimately required government interventions to save both the central bank and halt the panic from spreading to the largest banks in the French economy.

Bank runs continued in 1931, with market participants correctly surmising the Banque would not lend broadly. The second period of peak distress in autumn of 1931 only ended after the government intervened and bailed out a large failing commercial bank (BNC). We show that the decision to lend selectively during the panic represented a failure by policymakers to internalise a potential negative externality: since the panic was not arrested, it spilled over to connected banks.

Throughout the banking crisis, the BdF was overtly concerned with the welfare of its shareholders (i.e. connected banks) even as its non-performing loans ballooned, and protecting shareholder value meant paying dividends. In principle, selective lending was consistent with maximising shareholder value. In practice, lending to banks with personal connections was financially disastrous for the Banque (as it quickly accumulated non-performing loans on its books); it ultimately destroyed shareholder value since its lending policies during the autumn of 1930 allowed the banking crisis to grow into the largest in French history and spread to connected banks.

We provide new evidence that the Banque’s poor financial position largely resulted from massive discount window loans it had made in the first few weeks of the panic to connected banks, decisions that less than two months later led to a bailout from the French government during the last week of December 1930. This secret Christmas week agreement, undisclosed to the public at the time, removed non-performing discount window loans from the central bank’s balance sheet, with the French Treasury assuming these liabilities. The timing was particularly opportunistic as it provided ‘window dressing’ for the BdF’s year-end annual report, allowing its managers to state publicly that the bank had positive earnings and to pay its shareholders dividends. Indeed, despite the crisis, the bank’s ‘earnings management’ enabled it to pay a larger dividend at the end of 1930 than in any year immediately prior to the panic.

The importance of central bank governance

Lacking governance rules ensuring that each borrower was treated equally, the BdF engaged in selective lending and this lender of last resort policy proved to be ineffective at stopping the panic. The failure of the BdF's lender of last resort policies was a key factor in the transformation of the central bank into a public entity with explicit financial support from the Treasury and without shareholder voting rights. Politicians held the Banque responsible for failing to stop the banking crisis of 1930-31, and a political coalition led by Leon Blum completely overhauled the bank’s governance. It removed the significant influence the 200 largest shareholders had on policy by changing the voting structure to a ‘one share, one vote’ model, and reformed the selection of the board of directors and policy committees so that it operated in the public’s interest.

The governance reforms resolved two different problems that may have motivated selective lending: fear of losses and conflicts of interest. Evidence from history thus provides a potent illustration of the critical role that central bank governance and design plays in lender-of-last-resort operations; even practices that appear to be ex ante justifiable based on heightened asymmetric information during panics can end up jeopardising a central bank’s objective of stopping panics.

References

Akin, O, C Fons‐Rosen and J L Peydró (2020), “Political Connections and Informed Trading: Evidence from TARP”, VoxEU.org, 29 October.

Ball, L M (2018), The Fed and Lehman Brothers: Setting the Record Straight on a Financial Disaster, Cambridge University Press.

Bussolo, M, F De Nicola, U Panizza and R Varghese (2020), “Political Connections and Financial Constraints: Evidence from Central and Eastern Europe”, VoxEU.org, 23 February.

Mitchener, K J and E Monnet (2023), “Connected Lending of Last Resort”, CEPR Discussion Paper 17831.

Mishra, P and A Reshef (2019), “How do Central Bank Governors Matter? Regulation and the Financial Sector”, Journal of Money, Credit and Banking 51(2-3): 369-402.