Green innovation is a key ingredient in the fight against climate change. It involves making new low-carbon technologies (LCTs) available and reducing the cost of existing ones, both crucial for the transition to a greener economy. While there has been significant progress over the last few decades, momentum in green innovation has slowed down in recent years (Popp et al. 2020, Cervantes et al. 2023). Green innovation peaked at around 10% of total patent filings in 2010 and has experienced a mild decline since.

In our recent paper (Hasna et al. 2023), we show that green innovation not only helps the environment but also increases economic activity in the short-to-medium term, thereby mitigating the costs of compliance with climate policies. The prospects of such positive effects are particularly appealing at a time of weak medium-term growth prospects and political economy constraints and heightened societal concerns about the adoption of a more vigorous climate agenda (Furceri et al. 2021). At the same time, we highlight the role of climate policies, international cooperation and multilateralism to advance green innovation and its diffusion across the global economy.

Green innovation yields economic benefits

Green innovation is expected to yield long-term economic dividends, by helping avoid natural disasters and reducing climate damages. Yet, its short-term effect is less obvious in a context where most installed capital and production processes are more attuned to nongreen innovation.

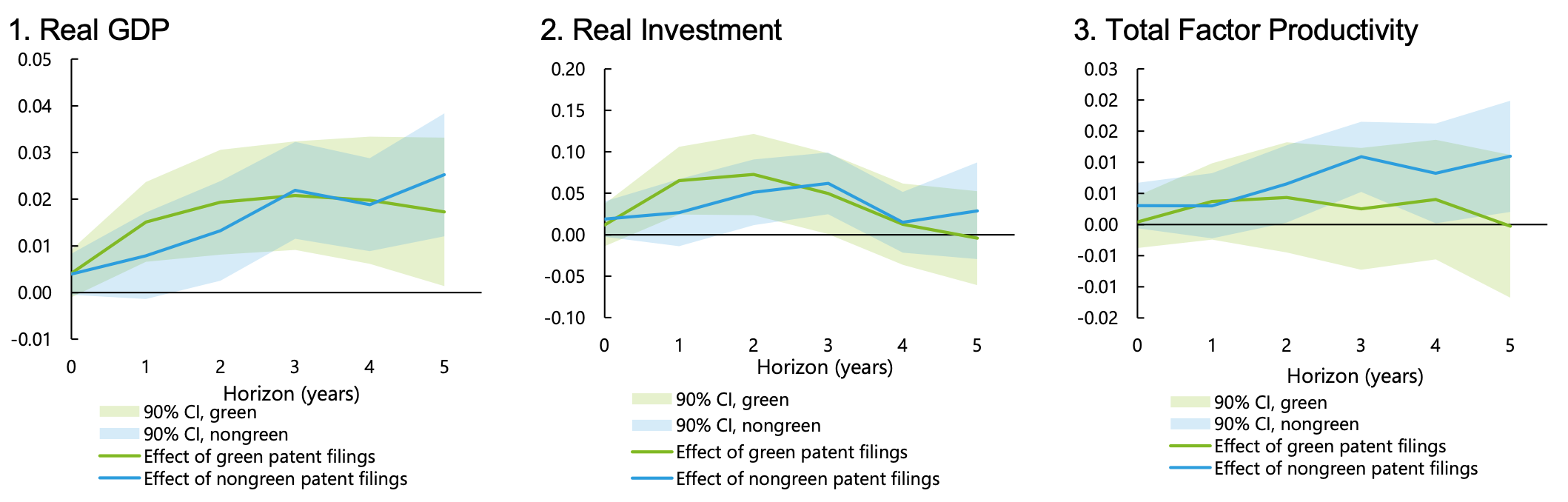

Our analysis shows that a doubling of annual green patent filings can boost gross domestic product by 1.7% after five years compared to the baseline scenario. And that’s under our most conservative estimate – other estimates show up to four times the effect. Moreover, the estimated increase in economic activity resulting from green innovation is similar to that resulting from nongreen innovation (Figure 1, panel 1).

Despite comparable economic benefits, green and nongreen innovation affect the economy in different ways. Green innovation affects growth by boosting investment but not productivity in the short run, while non-green innovation has a more immediate impact on productivity (Figure 1, panels 2 and 3). This is perhaps not surprising as the purpose of green technology is not necessarily to increase productivity, but rather to decarbonise. Similarly, the need to reorganise production processes around new green technologies could explain initially weak, or even negative, impacts on productivity. Part of green innovation, however, can be expected to boost productivity over time as it makes energy sources cheaper and increases energy efficiency. Additionally, we find that green innovation is associated with more innovation overall, not just a substitution of green technologies for other kinds. This may be because green technologies often require complementary innovation (Dechezleprêtre et al. 2014). As such, the effect of green innovation on total innovation could also generate more economic growth.

Figure 1 Gauging the impact of green and non-green patent filings on economic activity (percent)

Sources: European Patent Office Worldwide Patent Statistical Database (PATSTAT); and Hasna et al. (forthcoming).

Note: The measure of patents is based on the count of granted patents filed in two or more countries. Green patents are patents with the Y02 CPC code. The analysis in all panels is based on a local projection framework in which the dependent variable is the log difference in real GDP over the horizon considered and the independent variable is the logarithm of green patent filings. See Hasna and others (2023) for additional econometric exercises including additional controls and different specifications such as instrumental variation. CI = confidence interval.

In addition to domestic policies, international cooperation is key to incentivise green innovation and its diffusion

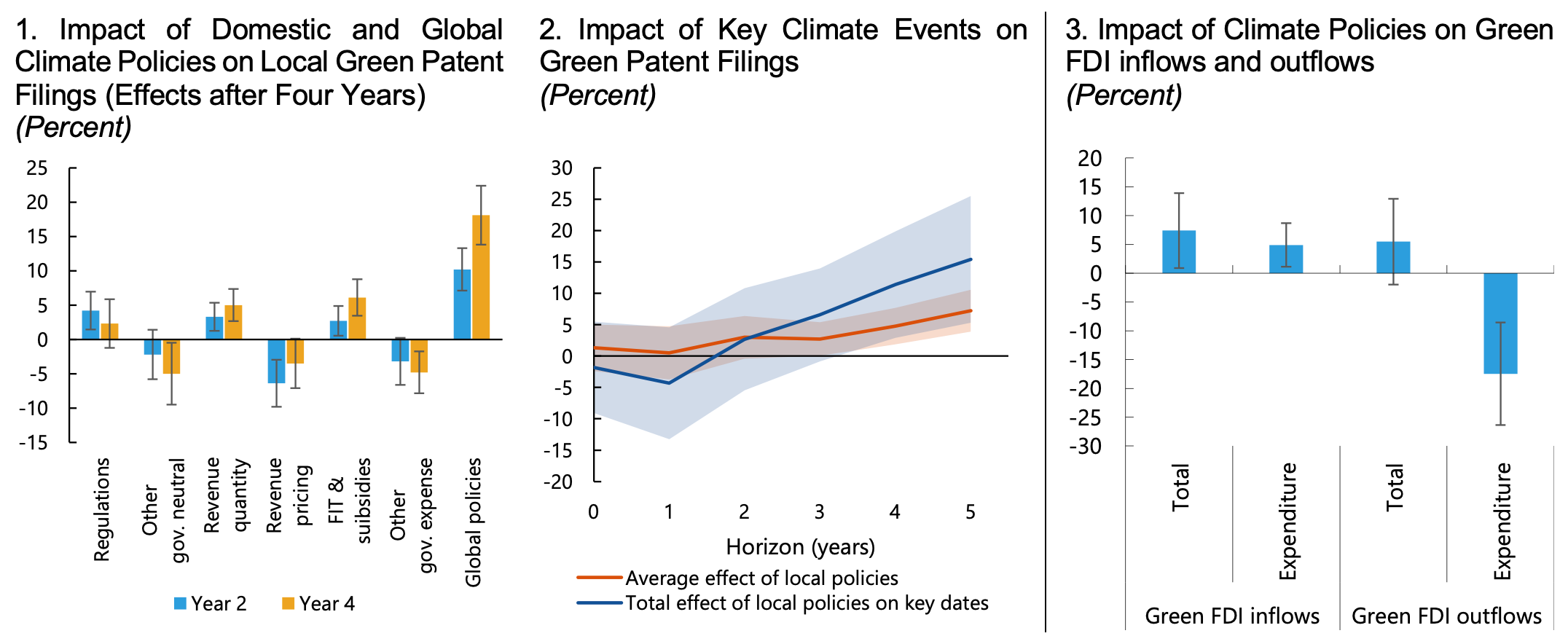

We also examine the role of policies in boosting green innovation and diffusion. Domestic climate policies are of course central to driving green innovation – the evidence is particularly strong for regulations, emissions-trading systems that put binding quantitative limits on emissions, and expenditure measures such as feed-in tariffs and R&D subsidies, a finding consistent with the model in Acemoglu et al. (2017). However, our research also highlights that global climate policies, measured as a distance-weighted sum of national policies in the rest of the world, have an even bigger impact on domestic green patent filings compared to domestic policies (Figure 2, panel 1). In addition, international climate agreements (such as the Kyoto Protocol and Paris Agreement) almost double the impact of domestic policies (Figure 2, panel 2).

There are three plausible explanations for the salience of global climate policies in terms of their impact on green innovation. First, given markets’ global nature, firms respond both to policies domestically and in large countries, as this is where technologies can be sold. This effect is reinforced in larger potential markets. An example is the automobile market, where the development and sales of electric vehicles rose sharply in tandem with recent governmental announcements of future bans on sales of internal combustion engine cars (see also Aghion et al. 2022). Second, as more countries are involved in the development of these new technologies, technological spillovers can be leveraged more strongly building on progress made in other countries. Third, global policy landmarks create more certainty about governments’ commitments towards a green transition, thereby strengthening the credibility of such policies and reinforcing their impact on innovation.

Figure 2 Effect of climate policies on green patent filings and green FDI flows

Sources: Climate Policy Database; European Patent Office Worldwide Patent Statistical Database (PATSTAT); Hasna et al. (forthcoming), and Pienknagura (2024).

Note: The measure of patents is based on the count of granted patents filed in two or more countries. Green patents are patents with the Y02 CPC code. All panels estimate the impact of climate policies following the local projection framework, in which the dependent variable is the log of patents per capita over the horizon considered and the variable of interest is the change in the stock of climate policies. In panel 1, bars indicate the effect on patents 2 and 4 years after the shock. Other gov. neutral refers to non-regulatory, budget neutral policies. Revenue quantity refers to revenue-generating climate policies setting caps on emissions, such as cap-and-trade systems. Revenue pricing refers to revenue-generating policies that have a direct impact on carbon prices, such as carbon taxes. Other gov. expense refers to expenditure-generating policies except FIT and subsidies. Global policies is a distance-weighted sum of national climate policies in the rest of the world. In panel 2, key climate events include IPCC report issuance dates, Kyoto Protocol and Paris Agreement. In panel 3, Expenditure refers to expenditure-generating policies, such as FITs and subisidies. For more details on the econometric specification and additional controls in each panel, see Hasna and others (2023) and Pienknagura (2024). FIT = feed-in tariff.

The deployment of technologies across borders, especially to emerging market and developing economies (EMDEs), is essential to the success of the global mitigation effort. Production processes are typically much more emission-intensive in EMDEs, even within the same narrow sector (Capelle et al. 2023). This, combined with much more dynamic growth than in advanced economies, implies that EMDEs will become a key source of future emissions growth, absent any action.

Putting in place climate policies in EMDEs pays off in terms of technological diffusion by increasing LCT imports and especially green FDI inflows (Figure 2, panel 3). A major increase in climate policies (equivalent to one standard deviation of the distribution of changes in the number of climate policies) boosts green FDI inflows by 7%. FDI inflows are particularly important as, in addition to transferring technology, they can relax the financing constraint and, in some cases, the managerial constraint, which can be serious obstacles to technology diffusion in EMDEs. Lower tariffs on LCT imports – which remain relatively high in middle- and low-income countries – is the other policy that can boost significantly LCT imports and green FDI inflows, shedding light on the importance of reducing the cost of technologies that are key to the green transition.

Meanwhile, our analysis points to potential tensions between the objectives of developing green technologies at home and their international diffusion. Unilateral green subsidies in advanced economies – undertaken as part of green industrial policy – lead to reshoring of green investment to these countries and a substantial decline in other recipient economies, especially EMDEs. A one standard deviation increase in subsidies reduces green FDI outflows by over 10%. While such subsidies may be important for domestic pollical economy reasons and may in the longer term yield global benefits in terms of cheaper green technologies, they create important negative spillovers on other economies that cannot afford such subsidies. They also create the risk of escalating trade tensions. A fragmented world with smaller potential markets could stifle incentives for green innovation and slow the transfer of LCT goods to EMDEs. Advanced economies must thus carefully consider potential negative spillovers from subsidies, especially for EMDEs with lower fiscal space, and ensure that their policies comply with international rules including by avoiding local content requirements.

Authors’ note: The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

References

Acemoglu, D, U Akcigit, D Hanley and W Kerr (2017), “Transition to Clean Technology”, VoxEU.org, 5 July.

Aghion, P, A Bergeaud, M Lequien and M J Melitz (2022), “The heterogeneous impact of market size on innovation: evidence from French firm-level exports”, Review of Economics and Statistics, pp.1-56.

Capelle, D, D Kirti, G N Pierri and G Villegas-Bauer (2023), “Mitigating Climate Change at the Firm-Level: Mind the Laggards”, IMF Working Paper 2023/242.

Cervantes, M, C Criscuolo, A Dechezleprêtre and D Pilat (2023), “Fostering Innovation for Climate Neutrality”, VoxEU, 1 June.

Dechezleprêtre, A, R P Märtin and M Mohnen (2014), “Knowledge spillovers from clean and dirty technologies”, Centre for Economic Performance.

Furceri, D, M Ganslmeier and J Ostry (2021), “Design of climate change policies needs to internalise political realities”, VoxEU.org, 7 September.

Hasna, Z, F Jaumotte, J Kim, S Pienknagura and G and Schwerhoff (2023), “Green Innovation and Diffusion: Policies to Accelerate Them and Expected Impact on Macroeconomic and Firm-Level Performance”, IMF Staff Discussion Note SDN/2023/008.

Hasna, Z, H J Hatton, F Jaumotte, J Kim, K Mohaddes and S Pienknagura (forthcoming), “The Drivers and Macroeconomic Impacts of Green Innovation: A Cross-Country Exploration.”

Pienknagura, S (2024), “Climate Policies as a Catalyst for Green FDI”, IMF Working Paper 2024/46.

Popp, D, J Pless, I Haščič and N Johnstone (2020), “Innovation and Entrepreneurship in the Energy Sector”, NBER Working Paper No. c14375.