Financial institutions are connected to each other via bilateral contracts, such as loans and derivatives, and are thus exposed to counterparty risk. If one institution is insolvent and defaults on its agreements, their counterparties may become insolvent as well – problems in one financial institution spread to others in what is known as financial contagion. Large shocks can trigger a cascade of defaults with potentially devastating consequences for the economy, as was the case in the 2007–2008 financial crisis (Cecchetti and Schoenholtz 2017). To reduce the negative externalities imposed on their respective economies and the dire results from bankruptcy cascades, many governments have rescued systemically important financial institutions with government bailouts. Ben Bernanke, chairman of the Federal Reserve at the time, stated that the collapse of Bear Stearns in mid-March 2008 was so severe that creditors lost confidence they could recoup their loans by selling the collateral, forcing the government to intervene (Bernanke 2008).

Capital requirements and resolution policies

The use of taxpayer money for bailouts has been heavily criticised as it provides large banks with an implicit bailout protection: knowing that they are too large to fail, large banks have an incentive to engage in excessive risk-taking (such as over-investing in risky assets) because their downside is protected. To prevent excessive use of taxpayers’ money for bailouts, capital requirements such as Basel III have been put in place to reduce the default risk of each individual bank. Nevertheless, these regulations do not guarantee financial stability in the most extreme of events.

Academic research of the last decade (beginning with Allen and Gale 2000 and Stiglitz and Greenwald 2003) has aimed at better understanding the role of financial structure – that is, the structure of networks, including linkages through derivatives and other risk-sharing arrangements (see also Stiglitz 2010). What kinds of structures reduce the likelihood of systemic crises and the size of taxpayer contributions needed to prevent a financial crisis? Allen and Gale (2000) and Acemoglu et al. (2015) have shown that the structure of the financial network strongly affects the size of the externalities. The findings of this two-decade-old research programme indicate that instead of focusing only on individual banks, regulations should also be directed at the structure of the financial network and the size of the required buffers should take this structure into account.

In addition to capital requirements, recent policy discourse has also centred on resolution policies. Dodd-Frank required the production of living wills, i.e. contingency plans from systemically important financial institutions to resolve their operations at default. However, sceptics worried that they would either be irrelevant and/or scrapped when a crisis occurred because the commitment to implementing them was not credible.

An alternative to bailouts: Bail-ins

Since the East Asia crisis, critics of bailouts have suggested ‘bail-ins’ as an alternative, whereby the private sector makes a contribution to the rescue of a bank in distress. However, credibility and enforceability are again at issue. How can the government enforce private sector involvement when the private sector knows that in the absence of its cooperation, the government would nonetheless proceed with a bailout? Under such circumstances, banks seemingly have no incentive to contribute to a bail-in, as they always prefer a rescue through a public bailout. While a few bail-ins have been observed in practice, the conditions under which they exist has not been understood until recently. A prime example of a bail-in is the rescue of Long Term Capital Management (LTCM) in 1998. Under the supervision of the Federal Reserve Bank of New York, a total of 14 banks, including the primary creditors of LTCM, agreed to participate in a recapitalisation plan totalling $3.6 billion. The Financial Stability Board has since included bail-ins as one of its primary components of post-crisis resolution regimes (FSB 2011).

Credibility of the government’s threat and welfare losses

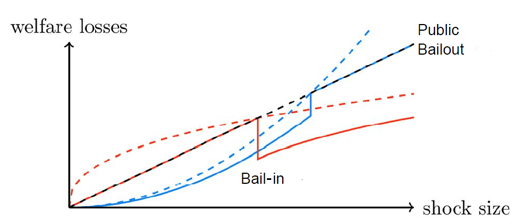

Do credible bail-in strategies actually exist? In a new paper, we argue that the answer is yes (Bernard et al. 2017). We show that the existence of credible bail-ins is related to the amplification of the shock through the financial system, which occurs through liquidation losses, bankruptcy costs, and negative feedback effects between highly interconnected banks in distress. Credible bail-in strategies exist if, and only if, this amplification lies below a certain threshold. If it exceeds this threshold, the losses to the real economy are too great for the government to idly stand by. The government thus cannot credibly threaten to not bail out the distressed banks. Since banks are aware of this fact, they refuse to contribute to a bail-in, which leaves a public bailout the only possible intervention option. If, in contrast, the amplification lies below the threshold, the ‘no intervention’ threat is credible and banks can be incentivised to contribute to a rescue in order to avoid a default cascade. A corollary to our result is that the network structure plays a fundamental role in deciding whether a rescue has to be paid for by taxpayer money or from sources within the financial sector.

The existence of credible bail-in strategies affects the socially desirable network structure. In earlier work without considering intervention, dense connections between financial institutions seemed to enhance financial stability, unless a shock was large enough to cause a systemic default (Allen and Gale 2000, Gai and Kapadia 2010, Acemoglu et al. 2015). Our findings reverse these presumptions and indicate that a more sparsely connected network may be beneficial for two reasons:

- sparser connections enlarge the range of shocks for which a credible bail-in strategy exists; and

- banks are willing to make larger contributions to a bail-in, thereby lowering the necessary taxpayer contributions from the government.

Figure 1 provides a graphical illustration, with the complete topology in representing densely connected networks, and the ring topology representing sparsely connected networks.

Figure 1

Notes: The figure compares equilibrium welfare losses in a complete (blue) and ring network (red) topology, in the presence (solid lines) and absence (dashed lines) of intervention. When the ‘no intervention’ losses exceed the costs of a public bailout (black dashed line), the government’s threat of no intervention is not credible and a public bailout is the only possible equilibrium rescue.

Structural policies, moral hazard, and optimal regulatory structure

Our framework paves the way for a full research agenda targeting the analysis of structural policies, which account for how the equilibrium bail-in procedure affects banks’ trading and investment decisions. This study characterises the equilibrium bail-in consortium that arises after the realisation of an exogenous shock. By assuming a prior distribution over shock sizes, the government can identify the ex-ante preferred network structure. In an extension of our work, banks anticipate which bail-in consortia are credible for which network structures, and hence choose their counterparties so that the resulting interbank network minimises their ex-ante expected contributions to the equilibrium bail-in plan. This adds an important layer to the moral hazard literature – in addition to maximising the value of their bailout option through excessive risk taking (Acharya and Yorulmazer 2007, and Farhi and Tirole 2012), banks can affect the likelihood of a government bailout in bad states of the world through their interbank lending decisions.

Concluding remarks

While the existing literature has investigated the moral hazard problem of banks being 'too correlated to fail' and the problem of finding the optimal regulatory structure individually (i.e. focusing on the behavior of each bank in isolation), our work suggests that these problems should not be solved in isolation because of crossover effects—the existence of externalities is at the core of the rationale for government intervention. An endogenous network formation model that takes into account banks' anticipation of credible bail-in strategies would lead to the informed design of structural policies aimed at preventing banks from reaching a network structure, in which the government's no-intervention threat fails to be credible. Such regulatory policies would maximize the likelihood that future crises can be resolved through bail-ins rather than bailouts.

References

Acemoglu, A, A Ozdaglar and A Tahbaz-Salehi (2015), “Systemic Risk and Stability in Financial Networks”, American Economic Review 105(2): 564-608.

Acharya, V and T Yorulmazer (2007), “Too many to fail—An analysis of time-inconsistency in bank closure policies”, Journal of Financial Intermediation 16(1): 1-31.

Allen, F and D Gale (2000), “Financial Contagion”, Journal of Political Economy 108(1): 1-33.

Bernanke, B (2008), Speech at the Federal Reserve Bank of Kansas City's Annual Economic Symposium, Jackson Hole, Wyoming, August 22, 2008.

Bernard, B, A Capponi and J Stiglitz (2017), “Bail-ins and Bail-outs: Incentives, Connectivity, and Systemic Stability”, NBER Working Paper No. 23747.

Cecchetti, S and K Schoenholtz (2017), "The financial crisis, ten years on", VoxEU.org, 29 August.

Farhi, E and J Tirole (2012), “Collective Moral Hazard, Maturity Mismatch, and Systemic Bailouts”, American Economic Review 202(1): 60–93.

Financial Stability Board (FSB) (2011), “Effective Resolution of Systemically Important Financial Institutions: Recommendations and Timelines”, FSB Consultative Document, 19 July 19.

Gai, P and S Kapadia (2010), “Contagion in Financial Networks”, Proceedings of the Royal Society A 466: 2401–2423.

Greenwald, B and J E Stiglitz (2003), Toward a new Paradigm in Monetary Economics, Cambridge University Press.

Stiglitz, J E (2010), “Risk and Global Economic Architecture: Why Full Financial Integration May be Undesirable”, American Economic Review 100(2): 388-392.