When it comes to the impact on emerging markets, the Brexit Surprise (the surprise outcome of the UK’s EU-membership referendum) is in some ways analogous to the Taper Tantrum of May 2013 that occured when then-Fed Chair Bernanke’s suggested that the US central bank was contemplating reducing its rate of security purchases (see Neely 2014). In this note we take a first look at whether Brexit had analogous effects.

The answer in one sense is yes – a substantial number of emerging markets saw declines in their stock markets and dollar exchange rates in the first two post-Surprise days of trading, just as in the wake of Bernanke uttering ‘the t word’. If anything, declines following the Brexit Surprise were more widespread and larger.

In another sense the answer is no – where the Taper Tantrum mainly hit countries that had received large capital inflows in the preceding period and had large and liquid financial markets out of which international investors could easily rebalance, the Brexit Surprise mainly hit countries with trade links with the EU and, to a lesser extent, the UK itself. This is contrary to the early conventional wisdom: one respected international bank recently wrote how “Much of the near-term impact was expected to hit EMs via financial market channels…. It is too early to gauge the near-term impact on real activity through trade channels. Trade links of the UK with most EM economies are limited.”

Maybe so, but we are inclined to conclude otherwise. Where the Taper Tantrum was a mainly financial shock, investors in emerging markets are receiving the Brexit Surprise as a real shock that will be transmitted mainly via trade – trade with the EU more than with just Britain.

The early returns

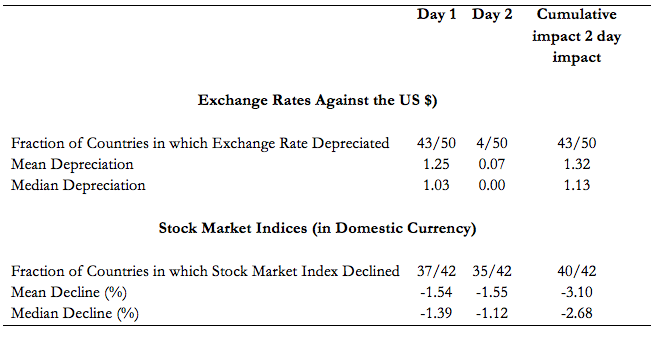

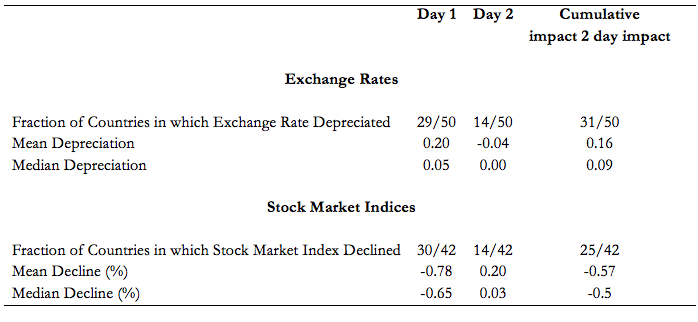

On impact, equity and foreign exchange markets in emerging economies were affected more strongly by the Brexit Surprise than the Taper Tantrum, as shown in Tables 1 and 2 (and contrary to some early press commentary).

Table 1 Emerging markets following the Brexit Surprise

Table 2 Emerging markets following the Taper Tantrum

Note: This is for the set of emerging markets included in Eichengreen and Gupta (2014). Data are from DataStream. Exchange rates are against the dollar; and stock market prices are in domestic currency.

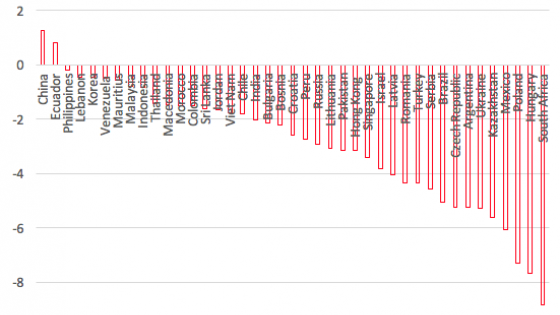

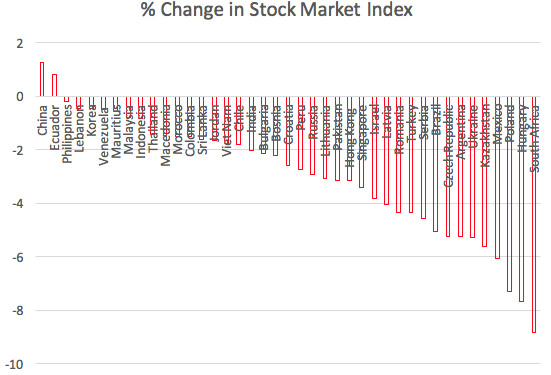

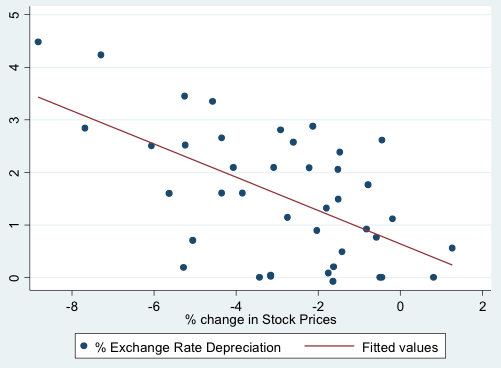

There is also significant heterogeneity in the impact across emerging markets, as shown in Figure 1. The impact of the Brexit Surprise ranges from slight positive to negative 9% for stock markets and from zero to 4.5% for exchange rate depreciation. Moreover, the impact on stock markets and foreign exchange markets is positively correlated. Countries with the largest valuation loss in their stock markets are also those suffering the largest exchange rate depreciation.

Figure 1 Percent change in stock prices following the Brexit Surprise (two days)

Note: Stock market prices are in domestic currency.

Source: Data are from DataStream.

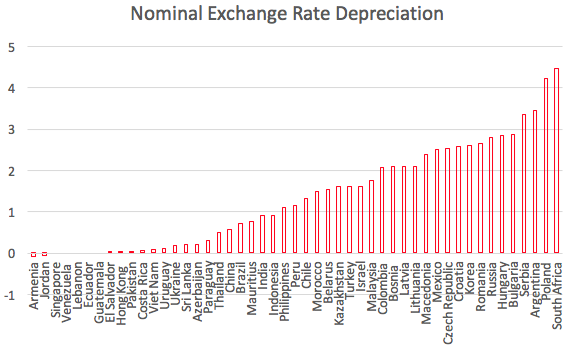

Figure 2 Percent exchange rate depreciation following the Brexit Surprise (two days)

Note: Exchange rates are against the dollar.

Source: Data are from DataStream.

Figure 3 Stock markets and exchange rates following the Brexit Surprise (two days)

Note: Exchange rates are against the dollar; and stock market prices are in domestic currency.

Source: Data are from DataStream.

Who was hit and why?

With what variables is the impact on emerging equity and foreign exchange markets correlated? Did countries with a recent deterioration in growth outlook experience larger exchange rate depreciation or stock market corrections? We drew data on the revision in growth forecast for 2016 for each country from the World Economic Outlook, comparing the April 2016 and October 2015 editions. It turns out that there is no evidence of a link between the change in the growth outlook and the impact of the Brexit Surprise.

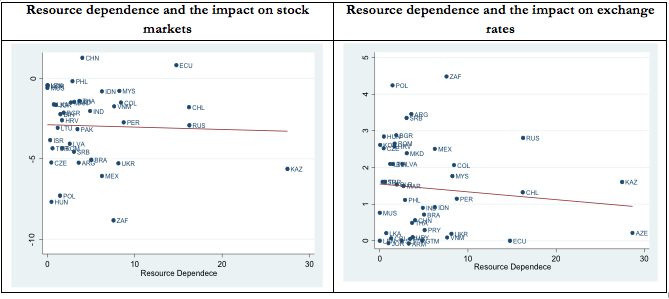

Since the Brexit Surprise was accompanied by a decline in the price of oil, did it affect financial markets in resource-dependent economies more strongly? Interestingly, it does not appear that countries with greater resource dependence felt a larger impact.

Figure 4 Resource dependence and the Brexit Surprise

Note: We extracted the resource dependence of the economies (share of value added of resource based industries in GDP) from the World Development Indicators. Linear relationships are insignificant at the conventional confidence levels.

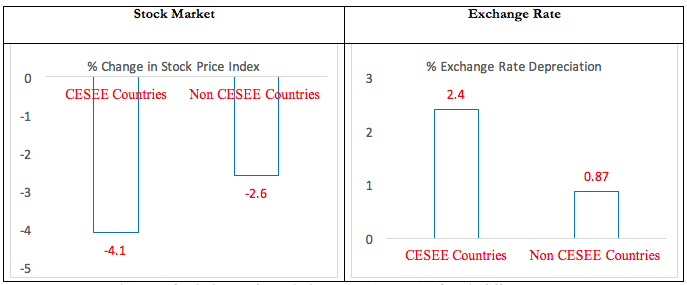

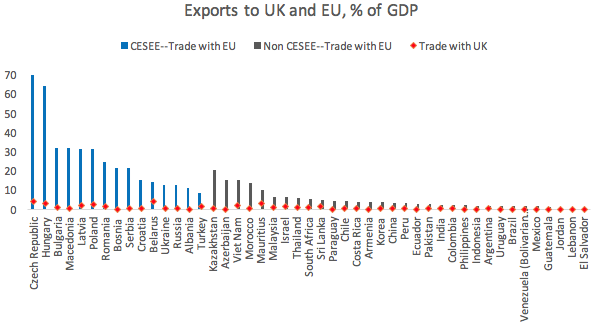

Were emerging European economies, with their relatively strong trade and financial ties with the UK and the EU, affected more strongly? Here there is supportive evidence (the Central, Eastern and South Eastern European (CESEE) economies in our sample are Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Latvia, Lithuania, Poland, Romania, Russia, Serbia, Macedonia, Turkey, and Ukraine). The average impact was -4.1% on stock markets and 2.4% on exchange rates for the CESEE countries, compared to -2.6% and 0.87% for non-CESEE countries in the sample.1 These differences are statistically significant at conventional confidence levels. They survive the inclusion of additional controls (as we show in Tables 3 and 4 below).

Figure 5 Impact on CESEE and non-CESEE economies

Note: Averages for CESEE and non CESEE countries are significantly different.

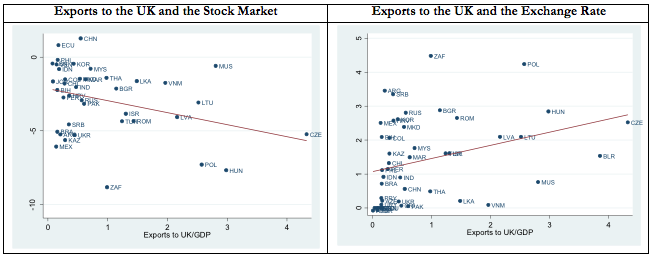

Were countries with larger trade, finance or growth links with UK and/or EU affected more strongly? We calculated the share of exports in GDP destined for the UK and EU.2 The results confirm that the countries trading more extensively with the UK and EU were affected more strongly.

Figure 6 Trade with the UK

Note: Data are from IMF’s Direction of Trade Statistics. Both relationships are significant at the 5% level.

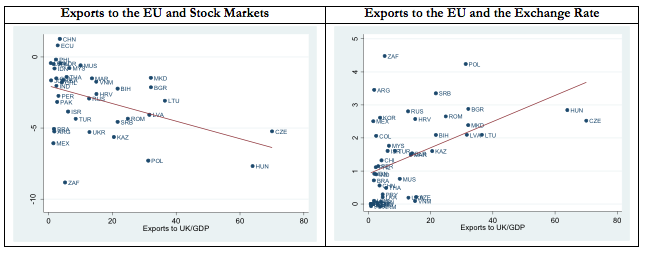

Interestingly, trade with the EU matters more than trade with the UK. When we include both in regressions, it is trade with the EU that has significant coefficients. When it came to emerging markets, evidently, fears were for the economic prospects of Europe as much as just the UK. The EU is a more important market than the UK for CESEE economies and other emerging markets, by virtue of its sheer size. Even if the EU deceleration or downturn was mild relative to that in the UK, evidently investors anticipate that the impact on emerging-market exports will still be relatively large.

Figure 7 Trade with the UK and the EU

Figure 8 Trade with the EU

Note: Data are from the IMF’s Direction of Trade Statistics. Both relationships are significant at 5% level.

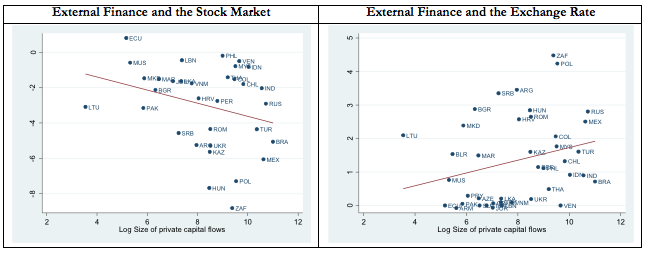

Finally, were emerging markets with larger capital inflows or larger financial markets affected more strongly? We do find some evidence for this, albeit of a weaker sort than in our earlier analysis of the Taper Tantrum.

Figure 9 Private external finance

Note: Private external financing includes loans, bonds and equities received during 2012-2014, data are from the Global Financial Stability report of the IMF (2015). Following Eichengreen and Gupta (2014) it is considered here as a proxy for the size of financial markets. Coefficients are significant in both panels at 10 percent level.

Our regression results (available from the authors) show that export exposure – to the EU more than just the UK – consistently helps to explain which emerging markets reacted most negatively to the Brexit Surprise. For exchange rate depreciation, the dummy variable for Central and Eastern European countries continues to matter, as if new questions about the future of the EU and UK weighed on these countries for reasons in addition to export exposure pure and simple. In addition, external financial exposure, as measured by capital inflows in the prior period or the stock of external liabilities, also helps to explain which emerging stock and foreign exchange markets declined most sharply, although these results are less robust than in our earlier analysis of the Tapering episode.

Conclusion

Emerging economies felt a strong negative impact from the Brexit Surprise, judged from the reaction of equity and foreign exchange rate markets. That impact was actually larger and more widespread than in the case of the Taper Tantrum, an episode that is widely viewed as a paradigmatic emerging-market shock, or more precisely as a paradigmatic shock transmitted from the advanced to the emerging world.

Where the Brexit Surprise has had financial consequences in the short run, as evidenced by the impact not just on emerging market equity and foreign exchange markets but also on measures of global risk aversion like the VIX, the emerging markets most strongly affected have been those that depend on the EU as an export market. Where the Taper Tantrum was mainly a financial shock (it raised questions about the terms and availability of dollar funding), the Brexit Surprise is evidently perceived as having real as well as financial consequences. This is contrary to the early post-Surprise consensus among investment banks and financial advisors. But, then, the story is not over. Stay tuned.

References

Eichengreen, Barry and Poonam Gupta (2013), “Tapering Talk: The Impact of Expectations of Reduced Federal Reserve Security Purchase on Emerging Markets,” VoxEU.org, 19 December.

Neely, Christopher (2014). Lessons from the Taper Tantrum, Economic Synopses, St Louis Fed https://research.stlouisfed.org/publications/economic-synopses/2014/01/28/lessons-from-the-taper-tantrum/

Endnotes

[1] These variables are strongly correlated: countries exporting more to the UK typically also export more to the EU.

[2] These are means. Relative medians are of similar magnitudes.