The decline of the US manufacturing sector played such a prominent topic in the 2016 presidential election campaign that New York Times journalist Binyamin Appelbaum wondered in a headline “Why Are Politicians So Obsessed With Manufacturing?” (Appelbaum 2016). Much of the concern about the health of the manufacturing sector derives from the observation that its employment level is near historic lows. Ever since the end of the Great Recession, the sector has employed fewer than 12.5 million workers – the lowest job count in manufacturing since the US entered WWII in 1941. Manufacturing lost almost 6 million jobs during the 2000s alone, and strikingly, most of this decline came before the onset of the Great Recession.

Despite the poor employment performance in the 2000s, however, value added in manufacturing has been growing as fast as the overall US economy. Its share of US GDP remained stable, an achievement matched by few other high-income economies over the same period (Moran and Oldenski 2014). While the extraordinary growth of value added in the computer and semiconductor industries masks a more sluggish performance in other manufacturing industries (Houseman et al. 2014), the sector’s output growth clearly exceeds its employment growth.

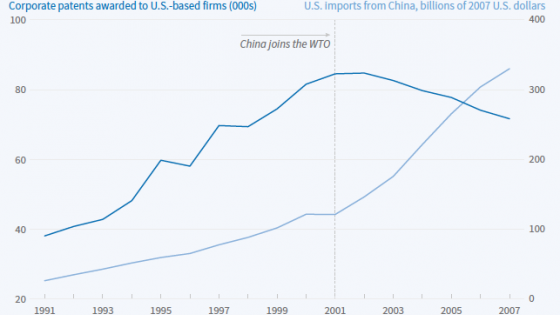

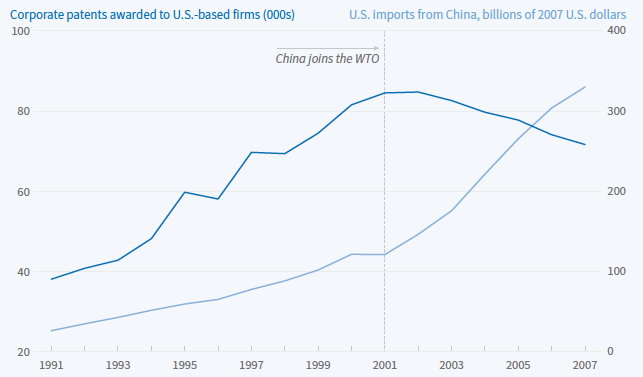

Another metric for the health of the US manufacturing sector, which has been less present in the recent debate, is its production of innovation as measured by patents. Manufacturing is the locus of US innovation and accounts for more than two thirds of US R&D spending (Helper et al. 2012) and for a similarly large share of US patents. Figure 1 shows that the annual number of patents awarded to US-based firms (dated by the year of patent application) doubled from less than 40,000 in 1991 to more than 80,000 in 2001, but subsequently declined through 2007.

Figure 1 US innovation and imports from China

Source: Maas (2017) based on authors’ calculations using the U.S. Patent and Inventor Database and the UN Comtrade Database.

During the 1990s, and especially the 2000s, the US manufacturing sector was exposed to a rapid surge in import competition from China. Figure 1 shows that imports from China increased more than tenfold between 1991 and 2007. Most of that growth occurred after China’s accession to the WTO in 2001, which coincides with the trend reversal in US patent production. The Chinese export boom was triggered by a series of economic reforms that included the establishment of Special Economic Zones for the production of export goods, and an easing of restrictions that had hindered firms’ access to labour, capital, and technology. The emergence of China as the world’s leading exporter of manufactured goods has been a major competitive shock for manufacturing firms in the US and elsewhere (Autor et al. 2016).

Although a now substantial literature evaluates the impact of China’s rise on labour market outcomes such as industry employment (Pierce and Schott 2015, Acemoglu et al. 2016) and workers’ earnings (Autor et al. 2014), far less is known about the impact of trade on innovative activities in US firms and industries. The effect of more intensive product-market competition on innovation is theoretically ambiguous. In standard oligopoly models, greater product market competition lowers profits and reduces incentives to invest in innovation. However, greater competition may also induce more innovation, either if pre-innovation rents fall relative to expected post-innovation rents (Agion et al. 2005), or if firms redeploy slack factors from goods production to innovation activities as competition depresses the demand for the firms’ products (Bloom et al. 2014). Indeed, a European study finds that firms in several European countries innovate more when Chinese imports increase in their industries, even as their employment level falls (Bloom et al. 2016).

In a recent paper, we analyse the impact of Chinese import competition on innovation in the US (Autor et al. 2016). Our analysis draws on all US corporate patents with application dates from 1975 to 2007 that are granted by March 2013. To obtain more information about the firms that applied for these patents, we use the firm names indicated on the patents to match them to firm data from Standard & Poor’s Compustat database. One challenge in this matching process is that patent records often contain different versions, abbreviations, and (mis-)spellings of a firm’s name, so that the names on patents do not correspond exactly to those in the firm database. We overcome this problem by constructing a novel matching algorithm that leverages the capabilities of an internet search engine. In a first step, we enter every firm name string that appears in the patent or Compustat data into the bing.com search engine, and we collect the URLs of the top five search results. We assign a patent to a Compustat firm if the corresponding firm name strings lead to at least two common URLs. This fully automated procedure builds on the web search engines’ capability to detect a company homepage or other webpages relating it even if the firm name’s is abbreviated or misspelled. Overall, we match almost three quarters of all corporate patents to Compustat, which covers companies listed on US stock markets.

The overall growth in corporate patents shown in Figure 1 masks important heterogeneity in patenting trends for the two sectors that contribute the most to overall US patent output. The computer and electronics sector increased its share in overall US patents from 10% in 1975 to 35% in 2007, and accounted for almost all the growth during the 1990s seen in Figure 1. By contrast, the chemical and petroleum sector’s contribution to US patent output fell from 27% in 1975 to 10% in 2007, as the number of annual patents from this sector declined over time. Both the growth in computer patents and the decline in chemicals patents began well prior to the surge of Chinese exports in the 1990s. This observation is important because import competition from China hit the computer sector much more than the chemical industry, yet it would be erroneous to attribute the superior innovation performance of the computer sector to its greater import exposure, given that the acceleration in patenting in that sector predates the exposure to China trade.

The central finding of our regression analysis is that firms whose industries were exposed to a greater surge of Chinese import competition from 1991 to 2007 experienced a significant decline in their patent output. A one standard deviation larger increase in import penetration decreased a firm’s patent output by 15 percentage points. Using data from the 1975 to 1991 period and a regression setup that accounts for the diverging secular innovation trends in computers and chemical, we confirm that firms in China-exposed industries did not already have a weaker patent growth prior to the arrival of the competing imports.

The firm data allow us to embed the patent analysis in a wider context of other indicators for the activities of firms. Importantly, we find that import competition not only reduced patenting but also firms’ R&D expenditures. Import-competing firms further experienced declines in global sales, employment, capital stock, and stock market value. They were more likely to suffer a decline in operating profits.

The innovation activity of US firms did not merely shift from the US to other countries. We estimate similar negative effects of import competition on patents by US firms’ domestic employees and by their foreign employees. Instead, our results are most consistent with the notion that the rapid and large increase in competition squeezed firms’ profitability and forced them to downsize along many margins, including innovation. Consistent with that interpretation, we find that the adverse impact of import competition on patent output was concentrated in firms that were already initially more indebted and less profitable.

The decline of innovation in the face of Chinese import competition suggest that R&D and manufacturing tend to be complements rather than substitutes. That is, when faced with rapidly intensifying rivalry in the manufacturing stage of industry production, firms tend not to substitute effort from production to R&D. While politicians’ ‘obsession’ with manufacturing is primarily due to the sizable employment losses in the sector during recent decades, an accompanying reduction in innovation may well affect economic growth in the longer term.

References

Acemoglu, D, D Autor, D Dorn, G H Hanson and B Price (2014), “Import Competition and the Great US Employment Sag of the 2000s.” Journal of Labor Economics, 34: S141-S198.

Appelbaum, B (2016), “Why Are Politicians So Obsessed With Manufacturing?” New York Times Magazine, October 4.

Aghion, P, N Bloom, R Blundell, R Griffith and P Howitt (2005), “Competition and Innovation: An Inverted-U Relationship.” Quarterly Journal of Economics, 120: 701-728.

Autor, D, D Dorn and G H Hanson (2016), “The China Shock: Learning from Labor Market Adjustment to Large Changes in Trade.” Annual Reviews of Economics, 8: 2015-240.

Autor, D, D Dorn, G H Hanson, G Pisano and P Shu (2016), “Foreign Competition and Domestic Innovation: Evidence from U.S. Patents.” CEPR Discussion Paper No. 11664.

Autor, D, D Dorn, G H Hanson and J Song (2014), “Trade Adjustment: Worker-Level Evidence.” Quarterly Journal of Economics, 129: 1799-1860.

Bloom, N, M Draca and J Van Reenen (2016), “Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, IT and Productivity.” Review of Economic Studies, 83: 87-117.

Bloom, N, P M Romer, S J Terry and J Van Reenen (2014), “Trapped Factors and China’s Impact on Global Growth.” NBER Working Paper no. 19951.

Helper, S, T Krueger and H Wial (2012), “Why Does Manufacturing Matter? Which Manufacturing Matters? A Policy Framework.” Brookings Institution Policy Report.

Houseman, S, T J Bartik and T J Sturgeon (2014), “Measuring Manufacturing: How the Computer and Semiconductor Industries Affect the Numbers and Perceptions.” Upjohn Institute Working Paper no. 14-209.

Maas, S (2017), “Competition from China Reduced Domestic Innovation.” NBER Digest, February.

Moran, T H and L Oldenski (2014), “The US Manufacturing Base: Four Signs of Strength.” Petersen Institute for International Economics Policy Brief PB14-18.

Pierce, J R and P K Schott (2016), “The Surprisingly Swift Decline of U.S. Manufacturing Employment.” American Economic Review, 106: 1632-1662.